Fundamental

Overview

The USD got a boost across

the board yesterday on positive expectations about the first trade deal that

eventually was revealed to be with the UK. Trump announced

that tariffs on cars and steel will be lowered but the most important part was

that the 10% “global tariff” will remain in place.

The US officials

highlighted that the 10% is going to be the floor and the trade deal with the

UK is going to be the baseline for all other deals. There’s a risk now that we

reached the peak in de-escalation and other countries might not like the 10%

floor, especially the EU. For now, the Federal Reserve Governor Waller’s scenario

#2 is playing out.

Recall, that he said 10% or

lower tariffs would make him less inclined to cut rates faster. This is now triggering

a repricing in interest rates as the market scaled back the easing expectations

to 68 bps by year-end. We were at more than 80 bps at the start of the week. It

gave also the greenback a boost as the market unwound the crowded dollar

shorts.

On the JPY side, the

currency has been driven mainly by global events rather than domestic

fundamentals. Alongside the Swiss Franc, it’s been the favoured safe haven in

the currencies space amid the swings in risk sentiment. On the monetary policy

front, the BoJ kept interest rates unchanged as expected and

delivered a dovish message.

This was then echoed by BoJ

Governor Ueda which placed a great deal on trade developments. In summary, the

central bank is likely to go faster on rate hikes in case we get a good trade

deal and delay rate adjustments in case the trade deal disappoints.

USDJPY

Technical Analysis – Daily Timeframe

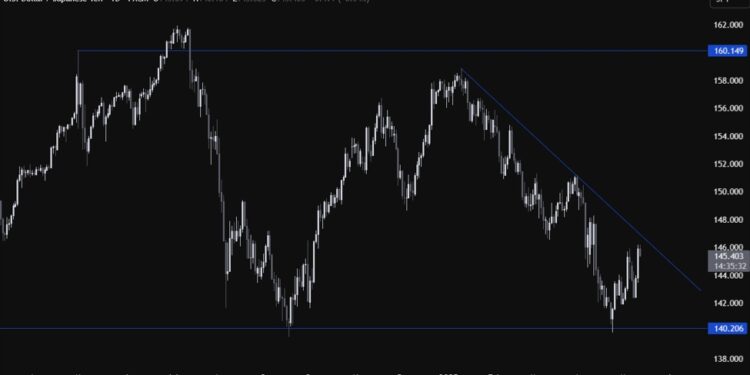

USDJPY Daily

On the daily chart, we can

see that USDJPY continues to erase the April losses and it’s now approaching

the major trendline. The sellers will likely lean on the trendline with a defined risk above it to

position for a drop back into the 140.00 handle, while the buyers will look for

a break higher to increase the bullish bets into the 151.00 handle next.

USDJPY Technical

Analysis – 4 hour Timeframe

USDJPY 4 hour

On the 4 hour chart, we can

see that we have now an upward trendline defining the bullish structure on this

timeframe. From a risk management perspective, the buyers will have a better

risk to reward setup around the trendline, while the sellers will look for a

break lower to increase the bearish bets into new lows.

USDJPY Technical

Analysis – 1 hour Timeframe

USDJPY 1 hour

On the 1 hour chart, we can

see that we have a minor upward trendline defining the bullish momentum on this

timeframe. The buyers will likely continue to lean on the trendline to keep pushing

into new highs, while the sellers will look for a break lower to extend the

pullback into the next trendline. The red lines define the average daily range for today.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.