The USD is mixed vs the 3 major currency pairs – the EUR (-0.13), the JPY (+0.37%), and the GBP (+0.19%) to kickstart the US/North American session. The pair is higher vs the AUD after RBA held its policy rate steady at 3.85%, defying the expectations of a 25 basis point cut, citing the need for more data to confirm that inflation is sustainably tracking toward its 2.5% target.

IN the video above, I take a technical look at the EURUSD, USDJPY and GBPUSD, and also a look at the AUDUSD.

Despite inflation easing to 2.1% in May—its lowest since October 2024—the RBA noted that recent data was slightly stronger than anticipated.

RBA Governor Michele Bullock emphasized a cautious and gradual approach to rate easing, stating that while recent inflation data was interpreted differently by the market, the RBA prefers to wait for more comprehensive data—especially the upcoming quarterly CPI on July 30. She noted that monthly inflation figures are too volatile, and the central bank wants confirmation that inflation is still on track before acting. Bullock downplayed prior market excitement over a potential 50 bps cut discussed in May, clarifying it was only considered as an option but quickly dismissed in favor of a more measured 25 bps move. She also highlighted that policy discussions reflected only minor differences, mainly about timing rather than direction, and that international risks played a role in the cautious stance. Ultimately, Bullock reaffirmed that the current pause doesn’t signal an extended hold, but rather a decision to play it safe until stronger data justifies a cut.

Treasurer Jim Chalmers called the decision disappointing, emphasizing the government’s efforts to ease cost-of-living pressures.

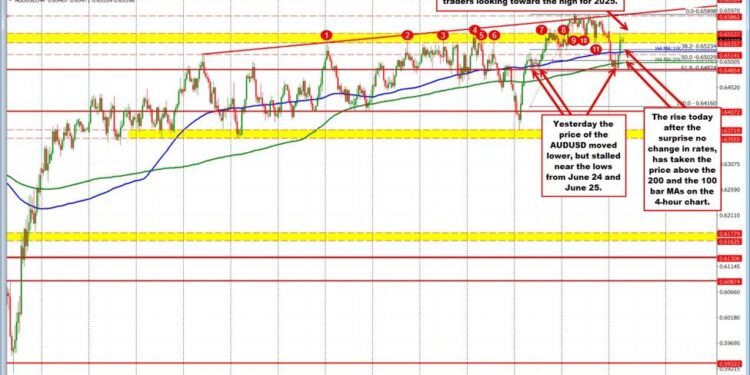

The AUDUSD is higher by 0.83% off of the decision and retracing much of the declines seen in trading yesterday. The pair is back above the 200 and 100 bar MAs on the 4-hour chart after dipping below each yesterday to test the lows from June 24 and June 25. The pair is back testing a swing area between 0.65357 to 0.65537. Move above and traders will be eying the highs from last week and the year at 0.6590.

On Monday tariffs returned to the spotlight as Trump sent warning letters to 14 nations, including Japan and South Korea, about higher duties set to take effect August 1. While less severe than those proposed in April, the new tariffs exceed the current 10% baseline. Trump described the deadline as “firm, but not 100% firm,” leaving room for negotiation. The new duties exclude previously announced sector-specific tariffs, and the omission of India and the EU from the letters has fueled speculation of pending trade deals. Japan and South Korea signaled willingness to negotiate, with both nations seeking exemptions or adjustments.

Meanwhile, China warned Trump against reigniting their tariff dispute, highlighting the fragility of a recent trade truce between the two nations. A vague “framework” deal was reached in June, but details remain unclear. China now faces an August 12 deadline to strike a deal and avoid the return of steep tariffs, which could exceed 100% if reinstated.

The major US indices are mixed after declines yesterday Dow industrial average is lower while the S&P and NASDAQ today. Both the S&P and NASDAQ came off record closing levels on Thursday of last week. The S&P fell -0.79% and the NASDAQ felt -0.92%. A snapshot of the market currently shows that futures are implying:

- Dow industrial average -31.35 points

- S&P index +8.25 points.

- NASDAQ index 74.43 points

In the US debt market, yields are higher after yesterday’s move to the upside:

- 2 year yield 3.907%, +0.8 basis points

- 5-year yield 3.981%, +1.5 basis points

- 10 year yield 4.415%, +2.0 basis points

- 30 year yield 4.954%, +2.4 basis points

in other markets:

- Crude oil is down marginally by $0.10 at $67.83.

- Gold is down $12 at $3326.22.

- Bitcoin is up $430 at $108,717. The high price today reached $109,000. The high price last week extended up to $110,557 about $1500 short of the $112,000 all-time high

The economic calendar is light with the Canada Ivey purchasing managers index for June as the only release. It came in at 53.8 not seasonally adjusted and 48.9 seasonally adjusted last month.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.