Editor’s note: “Stay Ahead of Stock Market Volatility With An Outperforming Strategy” was previously published in May 2025. It has since been updated to include the most relevant information available.

For the past several months, since it became clear that Donald Trump won the U.S. presidential election, the stock market has been highly volatile.

In that time, we’ve seen:

- One of the fastest 10% drops in market history

- Following the announcement of the “Liberation Day” tariffs on April 2, the S&P 500 sharply declined, dropping over 12.1% in the subsequent four sessions.

- One of the worst two-day crashes

- On April 3-4, the market suffered a 10.5% setback, marking the fourth-worst two-day stretch since 1950.

- One of the best single-day rallies

- Following President Trump’s announcement of a 90-day pause on recently implemented tariffs, the S&P surged 9.5% on April 9, marking its strongest one-day performance since October 2008.

- One of the best win streaks

- On May 2, the S&P locked in its ninth straight day of gains – the longest winning streak in more than 20 years – rising roughly 10% over that stretch

- One of the highest readings for the volatility index

- The CBOE Volatility Index (VIX), often referred to as the market’s “fear gauge,” nearly doubled over six months, reaching a reading of 27.86.

With all this volatility, investors are dying to know what the next four years will look like for stocks under “Trump 2.0.” Is this unpredictability the new normal?

Possibly…

I have six words of advice for this era: embrace the boom, beware the bust.

Embrace the Boom; Beware the Bust

Thanks in large part to the AI investment megatrend, the U.S. stock market has been booming for the past two years.

That is, the craze around artificial intelligence has sparked an exceptional surge in investment. Companies have been racing to create the infrastructure necessary to support next-gen AI. Indeed, Meta (META), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL) – pretty much all the world’s major tech companies continue to spend billions upon billions of dollars to build new AI data centers, create new applications, hire more engineers, etc. And all that investment has created a major economic boom.

The result? Stocks have been soaring for two years.

From its lows in October 2022 to its peak in early February, the S&P 500 surged more than 70% higher. That is a stellar rally. And it was powered by two consecutive years of greater than 20% gains across the market.

The S&P rose 24% in 2023. It popped another 23% in ’24. That is just the fourth time since the Great Depression – nearly 100 years ago – that the index rallied more than 20% in back-to-back years.

We were unequivocally in a stock market boom.

And in our view, this boom is about to get even ‘boomier.’

Why the Stock Market Rally May Be Just Getting Restarted

We understand that stocks are off to a very rough start in Trump’s second term. One could argue that the stock market boom is already done. But we don’t think that’s the case.

Instead, we believe that the stock market boom of 2023 and ‘24 is restarting here in May 2025 for several reasons:

- The AI Boom that powered the stock market rally of the last two years remains strong.

- Inflation pressures are contained, with the U.S. inflation rate easing to 2.4% for the 12 months ending March 2025, down from 2.8% in February.

- The labor market remains healthy. As of April 2025, the unemployment rate stood at 4.2%, maintaining the narrow range (between 4.0% and 4.2%) it has held since May 2024.

- Consumers are still spending, albeit more conservatively.

- Tariff threats are evolving into trade deals, as the U.S. just secured an agreement with the U.K., removing tariffs on U.K. steel, aluminum, and car exports, while the U.K. eased tariffs on U.S. ethanol and beef.

- Rate cuts are coming. Economists from JPMorgan Chase and Goldman Sachs expect the Fed to begin cutting rates later in 2025. We anticipate the first arriving by June.

- Tax cuts and regulatory reductions are also on the horizon. Extending the expiring 2017 Tax Cuts and Jobs Act is projected to decrease federal tax revenue by $4.5 trillion from 2025 through 2034, with a long-run GDP increase of 1.1%.

All that tells us that stocks could be on the launching pad right now and should soar over the next few months, maybe even years.

Sounds great, doesn’t it?

Sure does – so long as you remember that all market booms inevitably end with busts. It is not a question of “if.” It is simply a question of “when.”

What History Says About Big Stock Market Booms (and Busts)

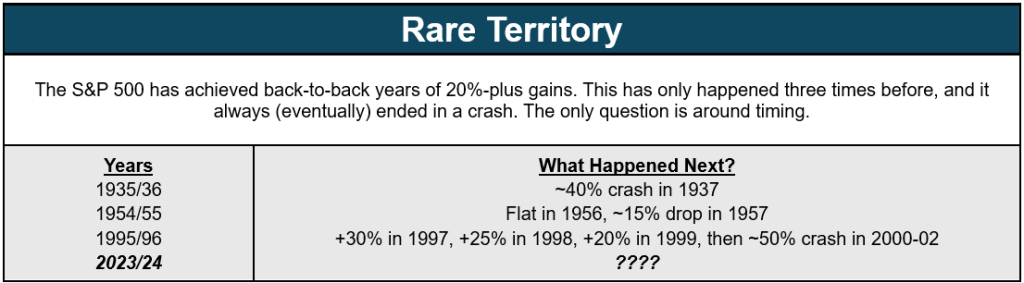

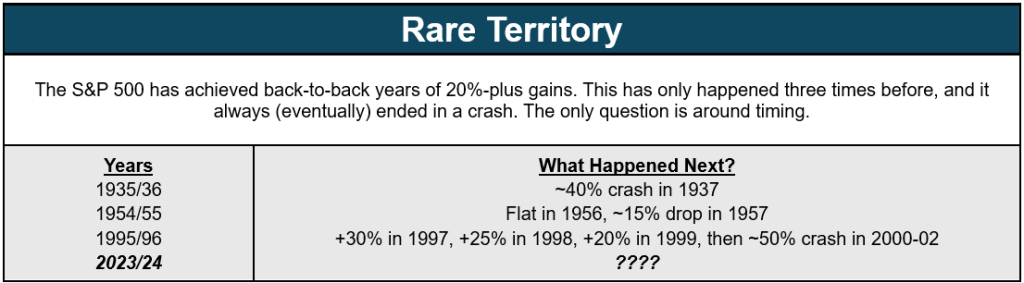

As we mentioned before, the stock market just notched back-to-back years of 20%-plus gains. It has only done that three times before: in 1935/36, 1954/55, and 1995/96.

After the two boom years in 1935 and ‘36, stocks immediately crashed about 40% in 1937. That boom turned into a bust almost immediately.

Following the market boom in 1954 and ‘55, stocks went flat in ‘56, then dropped 15% in 1957. The boom turned into a bust after about a year.

Similarly, post-1995/96, stocks kept partying throughout 1997, ‘98, and ‘99 – only to crash about 50% throughout 2000, ‘01, and ‘02. After about three years, that era’s big boom turned into a big bust as well.

All booms of this nature turn into busts. It is simply a matter of timing.

Does that mean you should get out of stocks and run for the hills now to avoid the inevitable meltdown?

Absolutely not…

The Final Word on Gaining a Stock Market Edge

Usually, the last 30 minutes of a movie is the best part of the film. The last episode of a TV show is almost always the best one, just as the last few minutes of a ballgame are normally the most exciting.

Similarly, the last few years of a stock market boom can often be the most profitable.

Just consider the Dot Com Boom of the 1990s.

Tech stocks had some amazing years therein. The Nasdaq Composite rallied 40% in 1995, about 20% in ‘96, another 20% in ‘97, and then 40% again in ‘98. But tech stocks saved their best for last, with the Nasdaq soaring almost 90% for its best year ever in 1999.

Then the bust started in 2000.

Point being: The best year for tech stocks in the ‘90s was the final year of the Dot Com Boom.

That’s why you don’t want to leave a stock market party early. But you also don’t want to leave too late.

So, what’s an investor to do?

Embrace the boom. Beware the bust. Ride stocks higher, then head for the exits when the warning signs appear.

Of course, that’s much easier said than done, I know.

That’s exactly why we created Auspex: an algorithmic stock screener that analyzes thousands of stocks each month to help us uncover those most likely to rise over the next 30 days.

It adheres to strict parameters so that it highlights only those with the most favorable fundamental, technical, and sentimental setups. And typically, only a few make each final cut.

Following a final manual evaluation from my team, those stocks go on to become our “Auspex picks” for the month. And after 30 days, we do it all over again.

This tool is designed to help you truly embrace the boom while remaining protected from the bust.

Find out how to make the most of this era of gains while you still can.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at [email protected].