Palantir Technologies (PLTR) will release its Q1 2025 earnings today, right after the stock market closes, and investor expectations are sky-high. The stock is up 64% year-to-date, continuing a stunning run that has turned this once-controversial government contractor into one of the most-watched AI firms in the world.

Analysts are projecting 62% adjusted EPS growth and a 36% revenue jump, which would be impressive under any circumstances, let alone in a choppy tech market. But Palantir hasn’t just been riding hype; it has been executing a clear, aggressive strategy to become the AI operating system for mission-critical industries.

NATO Deal: A Global Endorsement

The crown jewel of Palantir’s recent deals is its newly signed contract with NATO. The company will provide its Maven Smart System, an advanced AI-driven warfighting platform, to NATO’s Allied Command Operations. The system fuses intelligence, improves targeting and planning, and enhances battlefield awareness across all 32 member nations.

Moreover, the deal was closed in just six months – lightning speed for a multilateral defense procurement. That says two things: NATO sees AI as essential to modern defense, and Palantir is trusted to deliver it.

The NATO contract adds a possible recurring, high-margin revenue stream and gives Palantir global validation. This isn’t just U.S. military adoption anymore; it’s multinational, alliance-level tech integration.

Palantir’s Quiet Empire of Deals

Since the start of the year, Palantir has been on a tear, signing deals across sectors that share one thing in common: the need to make fast, complex decisions with high-quality data.

Here’s a quick breakdown of Palantir’s recent deals:

- Everfox (Defense): Teaming up to enhance secure battlefield operations with real-time data fusion.

- SAUR Group (Utilities): Automating water infrastructure compliance using AI-powered contract and process management.

- Parexel (Healthcare): Managing clinical trials and compliance more efficiently, speeding up drug development with zero shortcuts.

- Archer Aviation (ACHR) (Aviation): Helping scale electric aircraft production while optimizing air traffic logistics with Foundry and AIP.

- Databricks (Enterprise AI): Creating a seamless AI ecosystem by integrating Palantir’s platform with Databricks’ data stack.

These deals may look scattered on the surface, but they point to a common goal: embedding Palantir deeply into essential workflows where real-time decision-making is non-negotiable. Palantir’s software is becoming a core infrastructure layer for defense, water plants, and hospitals.

Strategic Clarity Over Flash

Palantir isn’t chasing the consumer AI buzz, building chatbots, or dabbling in social media. It’s focusing on industrial, institutional, and infrastructural AI – places where uptime, compliance, and real-time accuracy matter most.

That strategy is also what makes Palantir so hard to disrupt. Switching becomes expensive and risky once the software is embedded into a client’s operational backbone. This makes Palantir a classic “sticky” platform, precisely the kind investors love.

Most of the new deals have multi-year terms, which means recurring revenue and stronger forecasting. As more clients rely on Palantir to manage increasingly complex data environments, the company’s value proposition only grows.

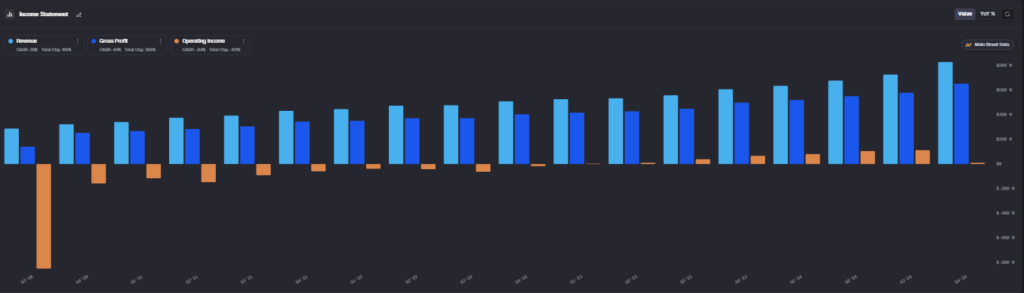

The following Main Street Data (MSD) chart examines how Palantir has steadily increased its revenue and income over recent quarters.

Valuation: The Elephant in the War Room

That said, valuation remains a concern. Palantir trades at eye-popping multiples – P/E north of 380, P/S around 78 based on 2025 estimates. Naturally, many analysts who rate PLTR as a “Hold” cite those metrics.

Still, the bullish thesis for long-term believers is this: Palantir is building a moat in high-stakes sectors that few others can penetrate. It has successfully increased its cash flow, revenue, and margin over the quarters, and if execution stays strong and margins stay high, the premium may well be worth it.

What’s Next

In conclusion, Palantir’s Q1 earnings call will be a litmus test. Can Palantir show that its explosion of deals is feeding into sustainable top-and-bottom-line growth? Can it prove that it’s not just collecting headlines, but building an empire of real utility?

So far, the momentum says yes. Now the numbers need to follow.

What Is the Price Target for PLTR Stock?

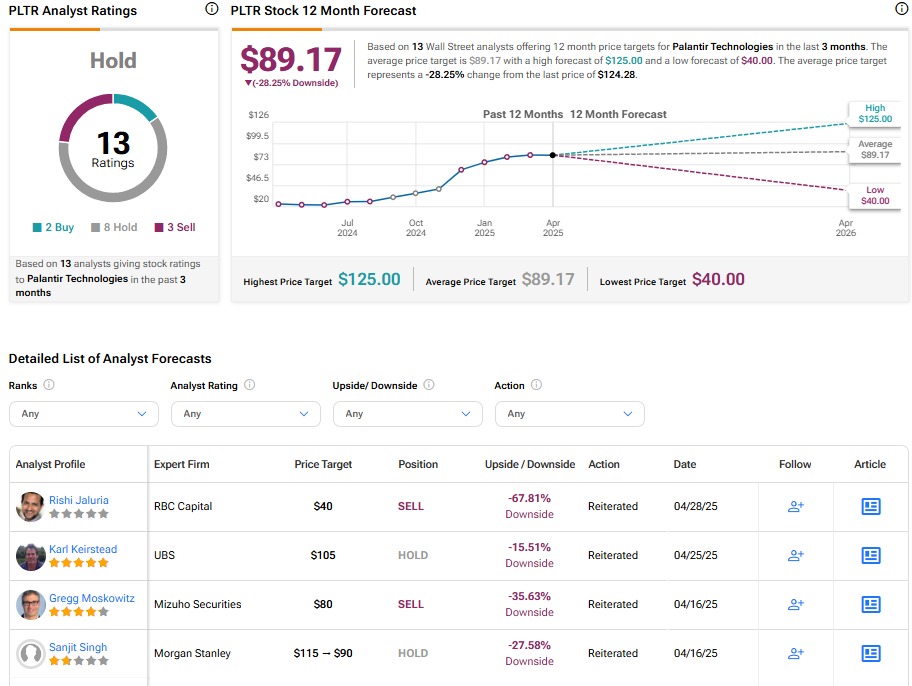

Turning to Wall Street, Palantir is considered a Hold based on 13 analysts’ ratings. The average price target for PLTR stock is $89.17. This implies a 28.25% downside potential.

See more PLTR analyst ratings

Disclaimer & DisclosureReport an Issue