In Q1 FY2025, Metaplanet posted the strongest financial results in its 20-year corporate history—driven by a Bitcoin treasury strategy that is now operating at scale.

Metaplanet isn’t just aligning with Bitcoin. It’s compounding shareholder value through it—by using capital markets infrastructure, BTC-native KPIs, and recurring income strategies to systematically increase Bitcoin per share.

With 6,976 BTC on its balance sheet, a 170% BTC Yield year-to-date, and a growing global footprint, Metaplanet is no longer a signal — It’s a system.

A Breakout Quarter for Japan’s Bitcoin Treasury Leader

Metaplanet’s Q1 FY2025 results marked a turning point—not only in terms of scale, but in consistency. For the first time, both core operating metrics and Bitcoin treasury KPIs broke company records.

Quarterly Financials:

- Revenue: ¥877M (+8% QoQ)

- Operating Profit: ¥593M (+11% QoQ)

- Total Assets: ¥55.0B (+81%)

- Net Assets: ¥50.4B (+197%)

- Unrealized BTC Gains (as of May 12): ¥13.5B

While the company reported a ¥7.4B valuation loss on its Bitcoin position as of the March quarter-end due to market prices, it noted that those losses had fully reversed—and then some—by mid-May.

This context matters: valuation volatility is expected in a BTC-denominated capital model. What matters more is BTC per share growth, operational profitability, and capital efficiency—all of which trended strongly upward.

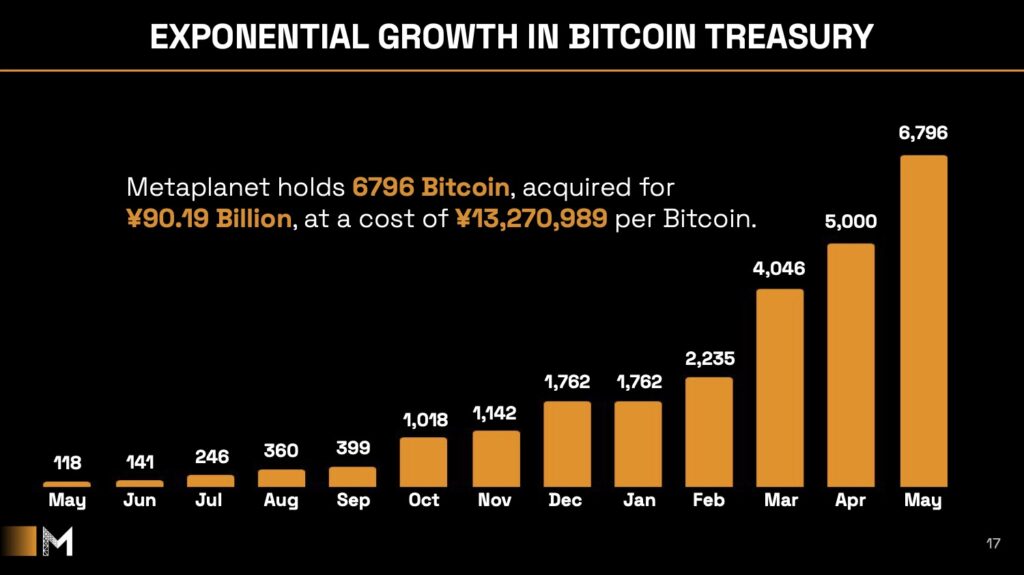

BTC Holdings Surge to 6,976—Up 3.9x Year-to-Date

Metaplanet added 5,034 BTC in Q1 alone, growing its Bitcoin holdings to 6,976 BTC—a 3.9x increase since January 1.

It now holds:

- ~68% of its near-term 10,000 BTC target

- A cost basis of ¥13.27M per BTC

- A top 11 position globally and #1 in Asia among public companies by Bitcoin held

This accumulation was funded via Japan’s largest moving-strike warrant program, which allows the company to issue equity into market strength without setting a fixed discount or strike. As of May 10:

- 87% of the 210M-share program has been executed

- ¥76.6B has been raised

- The program enabled continuous BTC purchases without disrupting share price stability

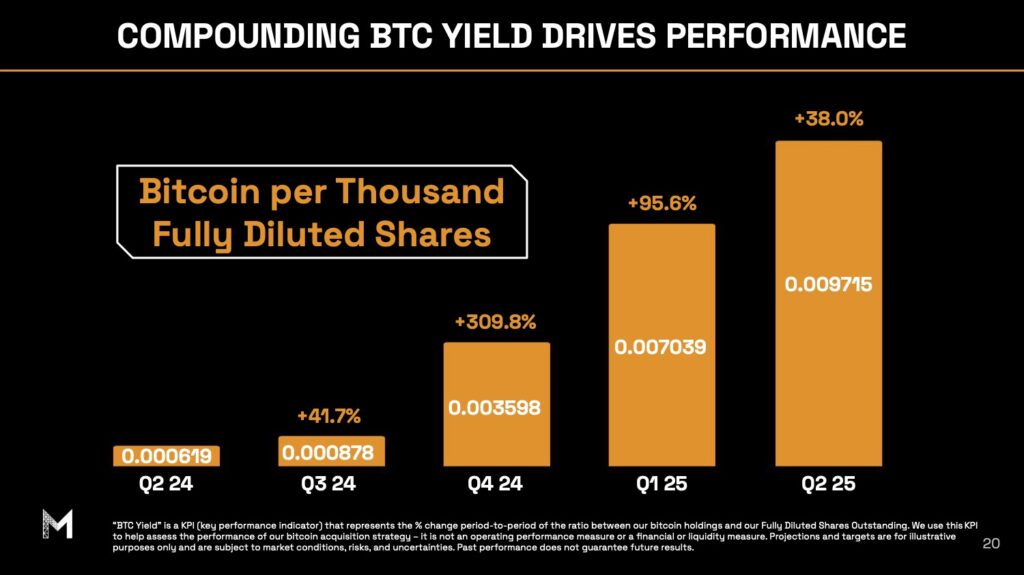

BTC Yield Hits 170%—A Defining KPI

Metaplanet tracks a unique Bitcoin-native KPI: BTC Yield, which measures the growth in Bitcoin per diluted share. In Q1:

- BTC Yield: 170.0%

- BTC Gain: 2,996 BTC

- BTC ¥ Gain: ¥45.4B

This metric is central to how Metaplanet evaluates treasury performance—not in fiat returns, but in how effectively it grows BTC per shareholder unit.

BTC Yield reflects not just accumulation, but capital strategy. Equity raised must result in BTC that outpaces dilution. If that happens, BTC Yield goes up. If not, it drops. It’s a precision tool for treasury discipline.

This mirrors the innovations pioneered by Strategy (formerly MicroStrategy), but with a distinctly Asia-Pacific capital markets model.

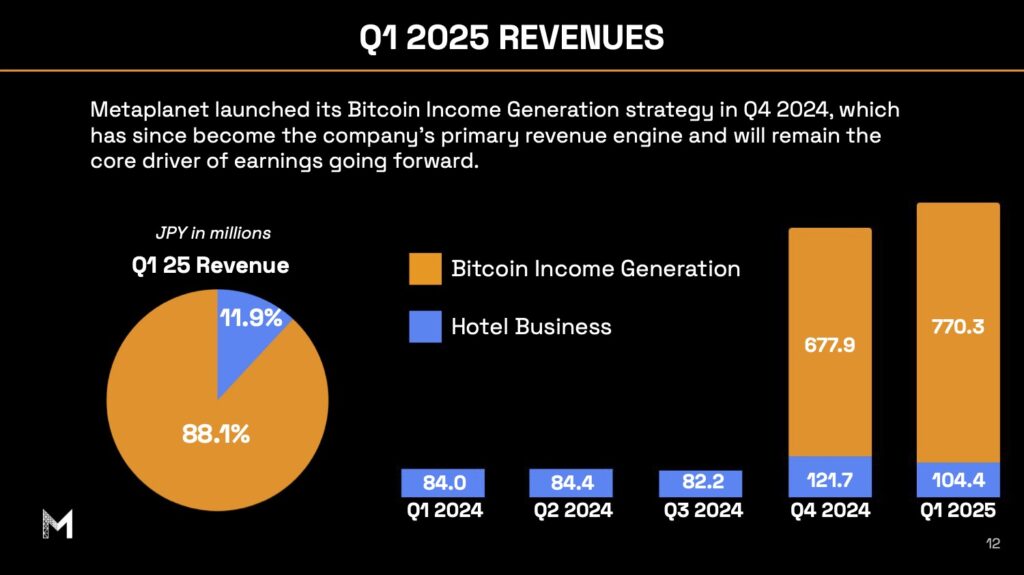

Operating Profit Hits New Record—Driven by Bitcoin Income

Unlike many Bitcoin-focused firms, Metaplanet isn’t just raising capital and buying Bitcoin—it’s also generating recurring profit.

Q1 operating income was ¥592M, a new company record.

Breakdown:

- ¥770M from Bitcoin Income Generation (primarily from writing BTC cash-secured puts)

- ¥104M from its legacy hotel business

- Operating margin: 67.6%

Why it matters: this income model reduces dependence on equity issuance and improves capital flexibility. It also means new capital can go directly into BTC—not to fund operations. This reinforces Metaplanet’s ability to grow both BTC and BTC per share.

The company has now monetized 30 out of 58 days in 2025 via its BTC volatility strategies, while maintaining strict downside protection. This turns balance sheet volatility into a revenue source.

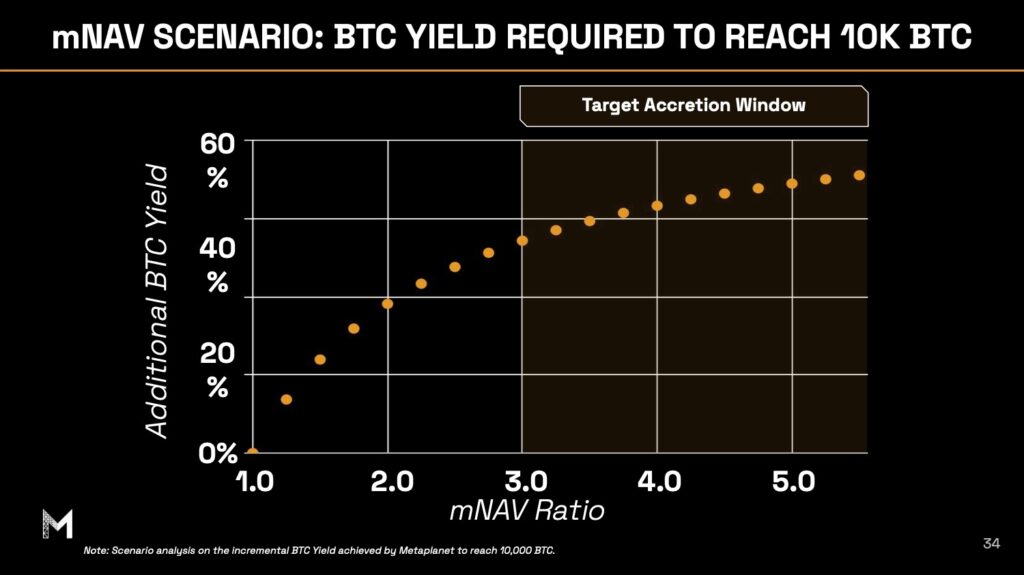

Metaplanet’s Premium to NAV and Global Liquidity Edge

One of the defining features of Metaplanet’s public market presence is its ability to maintain a premium to NAV—a rare feat among Bitcoin treasury companies.

At current levels, its equity trades well above the mark-to-market value of its BTC holdings, adjusted for dilution. This premium isn’t a speculative fluke—it’s a reflection of how the company is structurally positioned to outperform Bitcoin per share, and how global investors are beginning to understand and price in that capability.

Drivers of this premium include:

- Consistent BTC Yield growth that reinforces long-term per-share value

- A clean cap table with no preferred equity and no debt

- Deep domestic liquidity on the Tokyo Stock Exchange, where Metaplanet has become one of the top 3 most actively traded stocks by volume in 2025

- Broad ETF inclusion and algorithmic index participation, due to its high volatility, sector neutrality, and tradability

- Global exposure through MTPLF (U.S. OTC listing) and DN3 (Germany), providing accessibility to retail and institutional capital across time zones

- Transparent, BTC-native treasury reporting that aligns with modern investor expectations

Metaplanet has also attracted cross-border capital flows from Bitcoin-aligned investors seeking jurisdictional diversification and treasury growth, not just raw BTC exposure. The firm’s consistently positive BTC Yield and operating margin has helped reinforce this shareholder base, leading to organic demand-driven equity issuance at accretive prices.

A Scalable Bitcoin Treasury Model for Asia

As a Premiere Member of Bitcoin For Corporations, Metaplanet is playing a vital role in shaping the global Bitcoin treasury movement—particularly within the Asia-Pacific region.

While most Bitcoin treasury companies to date have emerged from the U.S., Metaplanet’s model proves that Bitcoin-native capital strategy can scale within different regulatory frameworks, capital markets, and investor cultures.

The company’s design is purpose-built to maximize Bitcoin per share without relying on fixed debt instruments or opportunistic “buy-the-dip” moments. Instead, it leverages:

- Moving-strike equity programs that allow it to issue shares only when market demand supports it

- A programmable treasury acquisition framework, enabling daily BTC purchases without timing discretion or manual trading

- BTC Income Generation strategies that turn volatility into operating profit

- Integrated liquidity infrastructure spanning three regions and currencies (JPY, USD, EUR)

As a Premiere Member of BFC, Metaplanet actively shares learnings, metrics, and execution insights with other public companies exploring Bitcoin treasury adoption. Its structure is not only repeatable—it’s exportable.

For corporates in Japan, Korea, Taiwan, Hong Kong, and Southeast Asia, Metaplanet offers more than proof of concept. It offers a blueprint.

And as BFC continues to expand its international footprint, Metaplanet’s role will be central to how the playbook for Bitcoin-native capital design evolves across global markets.

Conclusion: Metaplanet Moves From Signal to System

Metaplanet is no longer just Japan’s first public Bitcoin treasury company. It’s becoming the first in Asia to build an operational model that proves Bitcoin treasury strategy can deliver:

- High operating margins

- Capital-efficient BTC accumulation

- Scalable, transparent shareholder performance metrics

- Public market outperformance

With 6,976 BTC on the balance sheet, 170% BTC Yield, and a premium valuation supported by execution—not hype—Metaplanet is setting a new standard.

It’s not just holding Bitcoin. It’s showing what a Bitcoin-first capital structure can really do.