Market snapshot

- S&P/ASX 200: +0.2% to 7,780 points

- Australian dollar: flat at 63.44 US cents

- Dow Jones: -0.4% to 40,368 points

- S&P 500: -0.2% to 5,396 points

- Nasdaq: -0.1% to 16,823 points

- FTSE: +1.4% to 8,249 points

- EuroStoxx: +1.6% to 508 points

- Spot gold: +1.2% to $US3,266/ounce

- Brent crude: -0.1% to $US64.64/barrel

- Iron ore: -0.4% to $US99.60/tonne

- Bitcoin: -0.5% to $US83,595

Prices current around 11:55pm AEST.

Live updates on the major ASX indices:

Term deposit rates tumble

The big four banks have started cutting their term deposit rates.

Out of the big four banks, Westpac is currently offering the highest term deposit rate at 4.30 per cent for a term of 11 months, provided customers open the term deposit online, Canstar data shows.

|

Highest term deposit rates: big four banks |

|

|---|---|

|

Highest rate |

|

|

CBA |

4.20% for 10 months |

|

Westpac |

4.30%* for 11 months |

|

NAB |

4.25% for 7 months |

|

ANZ |

4.25% for 8 months |

(Source: Canstar. Note: deposit amounts and other conditions apply. *Westpac rate requires customers to open or renew online.)

But as Canstar’s data insights director, Sally Tindall notes, the big four banks’ highest term deposit rates are well behind others.

The highest term deposit rate is currently 4.90 per cent for a term of four months from MOVE Bank.

|

Highest term deposit rates |

||

|---|---|---|

|

Term |

Bank |

Rate |

|

4 month |

MOVE Bank |

4.90% |

|

6 month |

Gateway, Credit Union SA |

4.85% |

|

1-year |

G&C Mutual, Unity Bank |

4.65% |

|

2-year |

Judo Bank, Qudos Bank |

4.30% |

|

3-year |

Judo Bank |

4.20% |

“Term deposit rates have hit the skids and are likely to keep on sliding in the lead-up to the next RBA meeting,” Ms Tindall said.

“In the last nine days alone we’ve seen 35 banks cut at least one term deposit rate, including all four big banks.

“The banks are responding to growing global volatility created by the Trump tariff negotiations and the increasing likelihood of an RBA rate cut in May.”

Nvidia in firing line as tech battle between US and China escalates

Nvidia will take a quarterly charge of about $US5.5 billion after the US government limited exports of its H20 artificial intelligence chip to China, a key market for one of its most popular chips.

The news sent its stock price sliding about 6 per cent in after-hours trading.

The H20 is currently Nvidia’s most advanced chip for sale in China.

Nvidia said the US government informed it on April 9 that the H20 chip would require a license to be exported to China, and on April 14 told Nvidia those rules would be in place indefinitely.

It’s a big hurdle for Nvidia, which earlier in the week said it was planning to build AI servers worth as much as $US500 billion in the US over the next four years.

Tech stock analyst Daniel Ives from Wedbush said Nvidia now faced “massive restrictions and hurdles in selling to China”, which had been building during the Biden Administration.

“The Trump administration knows there is one chip and company fueling the AI Revolution and its Nvidia … and put a ‘Do Not Enter’ sign in front of China for Nvidia and Jensen (Huang CEO of Nvidia) with this restriction,” Mr Ives said.

“The financial impact is small relatively, but the strategic blow is the focus of the market as Nvidia now has massive blockades going after the China market in the middle of this raging US/China tariff battle.”

Mr Ives notes Nvidia is a “key strategic asset” for the US and the Trump Administration during this very tense period with China.

“And the White House is going to make sure Jensen and Nvidia’s chips do not land in China for now and help Beijing in the AI Revolution,” he added.

“The Street will take this news with clear nervousness worried these are the first shots fired in the tech battle between the US and China and Beijing/Xi are not just going to take this news and walk away.”

Mr Ives said there would likely be “a major back and forth between the US and China as the market and the economy is caught in the middle with this tariff battle royale.”

“While the Nvidia news is concerning it’s not a shock as we are in the middle of a trade war between the US and China and expect more punches thrown by both sides before cooler heads prevail and negotiations in some form can start to get these 145 per cent reciprocal tariffs down to a digestible level,” he said.

China halts orders of US-made Boeing jets

China has reportedly ordered its airlines to pause all incoming deliveries of American Boeing aircraft in response to Donald Trump’s 145 per cent tariffs on Chinese goods.

Read ABC coverage on this breaking story here:

ACCC busts wholesaler for telling buyers what it can sell the products for

Hard Rock sells blank apparel to retailers on a wholesale basis and directly to consumers via its online store.

But… they made false or misleading representations about consumers’ rights to return faulty or incorrect products and tried to rig what retailers could sell the gear for.

The ACCC has a court-enforceable undertaking from it where it admits breaking the Competition and Consumer Act and the Australian Consumer Law, commits to issue corrective notices to resellers and remove misleading representations about consumer guarantees from its website, and implement a compliance program.

What’s it about?

Hard Rock has admitted that between 20 June 2024 and 11 September 2024 it required certain resellers to sell Hard Rock products within a specific price range.

No way, says ACCC Chair Gina Cass-Gottlieb.

“Hard Rock has admitted that it sent written communications to ten resellers requiring them not to sell their products below 10 per cent of Hard Rock’s recommended retail price.

“In addition, Hard Rock told resellers that if they did not agree, it may adjust pricing or cease supplying its products to them.

“Suppliers cannot maintain price premiums in an anti-competitive way by setting minimum prices for resellers.”

Hard Rock’s undertaking, which the ACCC has accepted, is in effect for three years.

Election calls increase as pre-polls prepare to open

Does it seem like everyone is “calling for” something at the moment?

It’s a febrile moment, with almost a huge proportion of Australians set to cast their vote early at this election, and those pre-poll facilities about to open on April 22.

Peak body ASFA, which advocates on behalf of superannuation funds, is asking the next government for “certainty and stability in superannuation policy” as its key ask.

ASFA CEO Mary Delahunty says it wants to build on the stability that has helped superannuation become one of the biggest pools of capital in the world.

(My recent report on this is tagged at the bottom).

“Our superannuation system is working well for the 17 million Australians with superannuation accounts by delivering strong retirement outcomes: it builds our prosperity, and delivers greater financial security for retirees, stable capital for investment, and economic resilience for the country”

But it doesn’t want stasis either, calling for expanding the Low Income Superannuation Tax Offset to improve retirement outcomes for working Australians, implementing ‘payday super’ (getting paid it at the same time, something that has passed into law) without delay so that all Australians get their superannuation entitlements on time and protecting people from scams, among other items.

Flip and go: the rental/investment problem bedeviling Australia

Half of all investment properties are being resold within two years of tenants living in them, according to new data from the Australian Housing and Urban Research Institute (AHURI).

The research, based on data from a large and long-running survey by the Melbourne Institute, shows people aged 25-34 years are more likely to buy a rental property compared to other age groups, but also more likely to sell quickly.

This article from my colleagues Adelaide Miller and Emilia Terzon puts some bones on the vibe we’ve had around instability for the one-in-three Australians who rent – and why the housing crisis has such substantial and broad impact in society.

BOQ up +4.5% on $171M net profit after tax

Who says the minors can’t make it?

Bank of Queensland shares are up +4.4% at the time of writing on the release of strong half-yearly profits.

It holds 210,000 mortgages and has 500,000 deposit customers, the report says.

It has closed a substantial amount of branches, detailing the “early conversion of 34 branches” and the “consolidation of 20 branches” in its network.

As of now, shares are up +4.4% to $6.78.

ICYMI: Is a home deposit now worth thousands in lost super?

With home ownership further out of reach than ever for younger Australians, some are pondering whether their locked-away retirement funds would be better off used now, to buy a house.

Jordan Davies is one young person who views home ownership as out of reach, despite the 28-year-old feeling that he is relatively well-off, with a decent job and stable salary.

“It’s still difficult to obtain finance in the amount that is needed to purchase a property,” he told ABC News.

Loading…

Yet Mr Davies is on the fence about a policy being put forward by the Coalition, ahead of the federal election on May 3.

The scheme proposes that Australians should be allowed to take up to $50,000, or 40 per cent, of their superannuation fund to buy their first home.

The response from economists has been mixed.

Read more on the debate from Nadia Daly:

Ampol’s pump slump

Our top fuel retailer Ampol has reported a 49% drop in first-quarter refining margins for its Lytton refinery in Queensland on Wednesday.

It has cited weakness in refining profits in Singapore — a bellwether for Asia.

The company said its Lytton refinery margin decreased to $6.07 per barrel in the first quarter, down from $11.80 last year.

Meanwhile, the Lytton refinery’s quarterly output dropped 5.7% to 1.30 billion litres, as ten days of production were lost to prepare for Cyclone Alfred’s landfall.

Oil refiners have been facing a slump in profitability as slowing economic growth and rising penetration of electric vehicles in China. Additionally, new refineries coming online across Africa, the Middle East and Asia have put downward pressure on margins.

If the slump in refinery margins continues for the full second quarter, Ampol would be eligible for payment under Australia’s Fuel Security Service Payment program, “providing downside protection in a period of global refining market weakness”, the firm said.

In March, the fuel retailer flagged damage to a crude storage tank from heavy winds and rain as a result of the cyclone. That also weighed on the margin.

Star shares rallied on return to trade

The suspension on Star Entertainment shares has lifted and the stock is back trading on the ASX, after it finally lodged its half-year financial results yesterday, revealing a $300 million loss.

At the open, the stock jumped as much as 13.6 per cent — but that left it at just 12.5 cents.

It’s currently flat at 11 cents.

If we zoom out, here’s the one-year chart:

Don’t tax me for money I haven’t made yet, SMSF holders and others plead

An interesting group – The SMSF (self managed superannuation fund) Association, the National Farmers Federation, the Council of Small Business Organisations Australia (COSBOA) and the Family Business Association have come together to call on both major parties to rule out taxes on unrealised gains.

Or, as they put it, underlined and italicised in their press release:

to immediately and unequivocally rule out any move to tax unrealised investment gains in any part of the tax system.

Hold on, what now?

At issue is a proposal called Division 296 where the Albanese government put forward (but failed to pass through parliament into law) a tax on unrealised superannuation earnings.

In a joint statement, the industry coalition put it out there:

“Let’s be clear: taxing someone on paper gains they haven’t received a cent from is not reform – it’s confiscation.

“It punishes aspiration, destroys liquidity, and turns volatile market movements into tax bills.”

What it calls the “absurdity of taxing paper gains” has been shown somewhat with the recent tariff turmoil in investment markets.

“It shows just how easy it is for a paper gain in one period to be wiped out in the next, leaving the investor with a tax bill for an investment gain they never received,” it notes.

“The industry coalition is calling on both major parties to follow the precedent they’ve set on negative gearing: rule out any tax on unrealised gains, in any form, for any asset class.”

ASX 200 opens lower

The flagship index covering the 200 largest listed companies in Australia is in negative territory in the opening minute of trade.

The index is -0.1% lower at 7,754.9 points

Want a home? Maybe skip this post

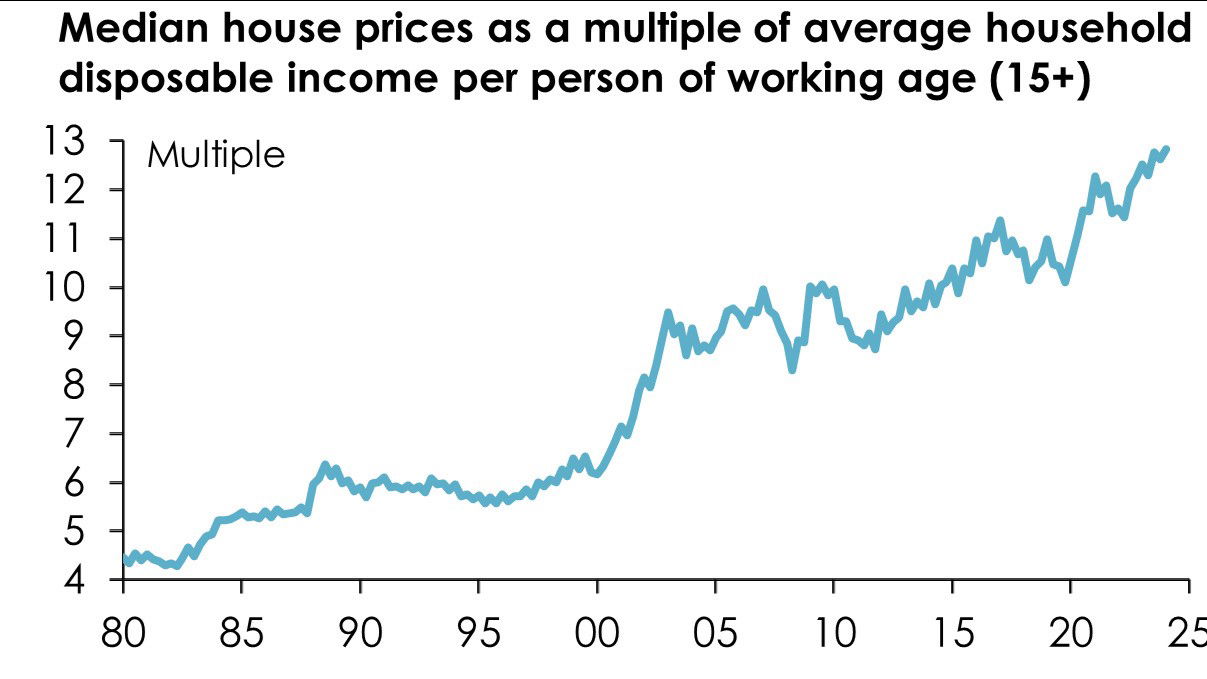

With housing one of the key issues of the looming election, independent economist Saul Eslake has put together a graph I’ve seen many times that never gets less deflating.

In case it’s not clear enough, this is an index of two things for the period from 1980 to 2025 … what’s happened to median house prices, compared to what’s happened to household disposable income for working people.

Saul has a cynical view of why most schemes seem to simply boost demand, in a post I’ve linked to below:

“One is left to wonder, why do parties of both major political persuasions keep doing things which they know will put upward pressure on house prices, and thus exacerbate the problem which they say they are trying to solve?

“It’s hard to avoid the conclusion that the reason is that they know that there are only about 110,000 people who each year succeed in becoming first home buyers: and even if you assume that for every one who does, there are five or six who don’t, that’s still only 700,000 or so votes, tops, for policies that might restrain the rate of house price inflation, or halt it altogether.

Whereas politicians also know that at any point in time there are more than 11 million voters who own their own home, and more than 2¼ million who own at least one investment property: and the last thing those 11-13 million voters want is anything that might restrain (let alone halt) the rate of property price inflation.

“So on the one hand, 700,000 votes, on the other, something north of 11 million – even the dumbest of our politicians can “do that math” (as the Americans say).

“And they do.”

The main tariff we will pay is confidence

Interesting note from ANZ economists Adelaide Timbrell and Aaron Luk, who have modelled consumer sentiment, using domestic factors and economic growth in US and China to determine the “sensitivity of Australian consumers” to the uncertain global backdrop.

“Recent US tariff announcements have heightened global uncertainty and led to a downgrade in expectations of US and global growth. While the proposed 10% tariffs on Australian goods is expected to have limited direct impact on the Australian macroeconomy, the uncertain global backdrop is likely to influence consumer and business decision-making locally.

“This, we expect, will be the main impact of tariffs in Australia.

Interestingly, despite our much closer economic ties with China – a slowdown there won’t affect our consumers as one in the US, perhaps reflecting stronger cultural ties to the Land of the Free.

“We added US and China economic growth variables into our consumer sentiment model in order to assess the impacts of the global backdrop on Australian consumer sentiment. While sentiment is more sensitive to domestic factors, including the price level and changes in the cash rate, the model suggests US economic growth has a substantial impact. This is despite relatively modest trade flows with the US. The effect of China’s economic growth on sentiment is less pronounced.”

Job heat: applications per ad “only this high during the height of the pandemic” according to Seek

Job ad website Seek always has interesting data about jobs, because they’re at the end that shows movement (up/down) much earlier than labour and employment statistics.

Here’s some of their latest key points

- Job ad volumes dropped for a second month, down 3.0% from February.

- Applications per ad, which rose 2.0% month on month (m/m) have only been this high during the height of the pandemic.

- Queensland job ad volumes dropped 6.9% m/m, the sharpest monthly decline in the state since 2020.

- Advertised salary growth rose by 0.3% m/m in March, continuing the stable growth seen in recent months.

- Annual advertised salary growth has inched up to 3.7% since late last year but has slowed by 0.6 percentage points since March last year.

Seek’s senior economist Dr Blair Chapman says demand continues to cool.

“March (marks) the second consecutive month of falling ad volume. However the quarterly view suggests demand is a little more robust with only a small decline and an increasing number of industries experiencing growth”

Financial analyst warns trade war risks depression-scale downturn

A former banker and financial analyst has warned Donald Trump’s determination to remake the US financial system could result in an economic downturn comparable to the 1930s Gret Depression.

Financial risk analyst and author Satyajit Das told The Business the impact is already playing out on financial markets.

“I think we’ve seen a lot of pressure on, certainly, the bond market, the equity markets — particularly the more frothy ends of it — have seen some damage, but I don’t think we really know what’s going to happen until we see the actual real economies, in terms of jobs and incomes and corporate profits, start to react. And that takes time,” he said.

Loading…

Mr Das says the Global Financial Crisis of 2008 was “fundamentally different” to the current situation, as it flowed from the financial sector, mainly the US sub-prime market.

“[The current trade war] is a combination of economic problems and things which are flowing through into financial problems.

“To be honest, we haven’t seen a reordering of the global economic system on this scale since the 1930s and that was the Smoot Hawley tariffs, which certainly didn’t cause the Great Depression, but were contributors to that.

“On the other side, on the financial side, the excesses that have built up over the last 20 years are far greater than I’ve ever seen before.

“I think the critical thing there is there’s a complete disconnect between cash and earnings and valuations, so the difference between valuations and everything else has become stretched.

“So I don’t know how bad it could be, but all I know looking at history is it could be very bad.”

And a quick note, if you want to catch The Business with Kirsten Aiken tonight, it will be on at a later time of 10:15pm AEST on ABC News Channel due to the leaders’ debate.

Special late-night edition of The Business

The Business will be on the ABC News Channel slightly later tonight, because our next prospective PMs are holding a debate hosted by the ABC.

The program will be on at 10.15pm AEST— and always on iView.

China pauses deliveries of American-made Boeing jets

Billions of dollars’ worth of plane sales have been grounded, as China tells its biggest airlines to pause deliveries of American-made Boeing jets, according to reports from Bloomberg News, as the trade dispute between the two economic superpowers continues.

However, international aviation consultant Neil Hansford believes China will be the biggest loser from the move.

“China will still have to pay interest, in the end China is cutting of its nose to spite its face because China has a shortage of aircraft after COVID, its aviation industry isn’t recovering in passenger terms,” Mr Hansford told AM.

“It’s emotive but when it gets to the cut and thrust, it’s China who will pay the price.”

The three main Chinese airlines were expected to take delivery of 179 Boeing planes between now and 2027 — that’s more planes than the entire Qantas main fleet.

The larger trade war between China and the United States shows no sign of cooling.

US tariffs on China stand at 145 per cent, and in return China has imposed 125 per cent tariffs on American goods coming into the country.

Listen to the full report from Angus Randall on today’s episode of AM:

The rare earths question the US might have asked before sparking a global trade war

Hi Daniel. It’s all a bit complicated isn’t it. If Chinese companies absolutely need Nvidia chips and the USA absolutely needs China’s rare earth minerals you would think there’s a simple deal to be done or am I a bit naive?

– Phillip

Morning Phillip, it’s a good question.

Increasingly the tariff turmoil looks like a series of deals in the making.

There’s a great explainer from US think tank the Center for Strategic and International Studies about the consequences of China’s new rare earths export restrictions.

Here’s the key bit for me:

“The restrictions apply to seven medium and heavy rare earths: samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium. The United States is particularly vulnerable for these supply chains. Until 2023, China accounted for 99 per cent of global heavy rare earth element processing, with only minimal output from a refinery in Vietnam.

“However, that facility has been shut down for the past year due to a tax dispute, effectively giving China a monopoly over supply. China did not impose restrictions on light rare earths, for which a more diverse set of countries undertake processing.”