Market snapshot

- ASX 200: -0.2% to 8,545.8 points (live values below)

- Australian dollar: -0.8% to 65 US cents

- Wall Street: S&P 500 +0.4% Nasdaq +0.3% Dow +0.2%

- Europe: FTSE +0.2% EuroStoxx -0.3%

- Spot gold: +1.2% to $US3,426/ounce

- Brent crude: +9% to $US75.60/barrel

- Iron ore: Flat at $US95.40/tonne

- Bitcoin: -1.5% to $US104,261.2

Prices current around 1:25pm AEST.

Live updates on the major ASX indices:

Members to give feedback on FINSIA ‘partnership’ with CISI

The Financial Services Institute of Australasia (FINSIA) — the professional institute for financial industry practitioners across Australia and New Zealand says it wants to enter a “strategic alliance that would lead to all of its current members joining the Chartered Institute for Securities & Investment (CISI) later in the year.

It has invited feedback from members on the proposed partnership, saying that the move “represents a unique opportunity for FINSIA members to expand their global recognition and networks, and to access world-class thought leadership and professional development opportunities”.

Some concerned members have reached out to ABC News over the partnership and the organisation’s financial performance.

“My analysis of FINSIA’s financial statements suggests a consistent pattern of substantial losses for over 18 years, accumulating to more than $30 million since 2008,” says one member Neville Watkins.

“This includes losses exceeding $5 million in just the past two years alone. The FINSIA Board has ostensibly been undertaking reviews over this period, which they have cited as a reason for these considerable losses.”

Mr Watkins said he was now worried that CISI will effectively take over FINSIA’s membership, leading to the cessation of FINSIA as an independent entity, with an expected joining date from November 2025.

“This move represents a deeply disappointing end for an organisation that once boasted over 20,000 members in 2006, now reportedly reduced to fewer than 7,500 in 2024,” he said.

Feedback from members to FINSIA’s board closes on Friday June 27.

Do you know more?

If you have more information about this story please contact Nassim Khademat [email protected] or [email protected]

Aussie share market closes lower

The S&P/ASX 200 closed 0.2 per cent lower at 8547.4 on Friday after Israel’s military strikes against Iran’s nuclear program sites.

Energy stocks rallied as Brent prices surged as much as 13 per cent to above $US78 a barrel.

Woodside Energy closed 7.4 per cent higher at $25.20, while Santos lifted 3.7 per cent to $6.90.

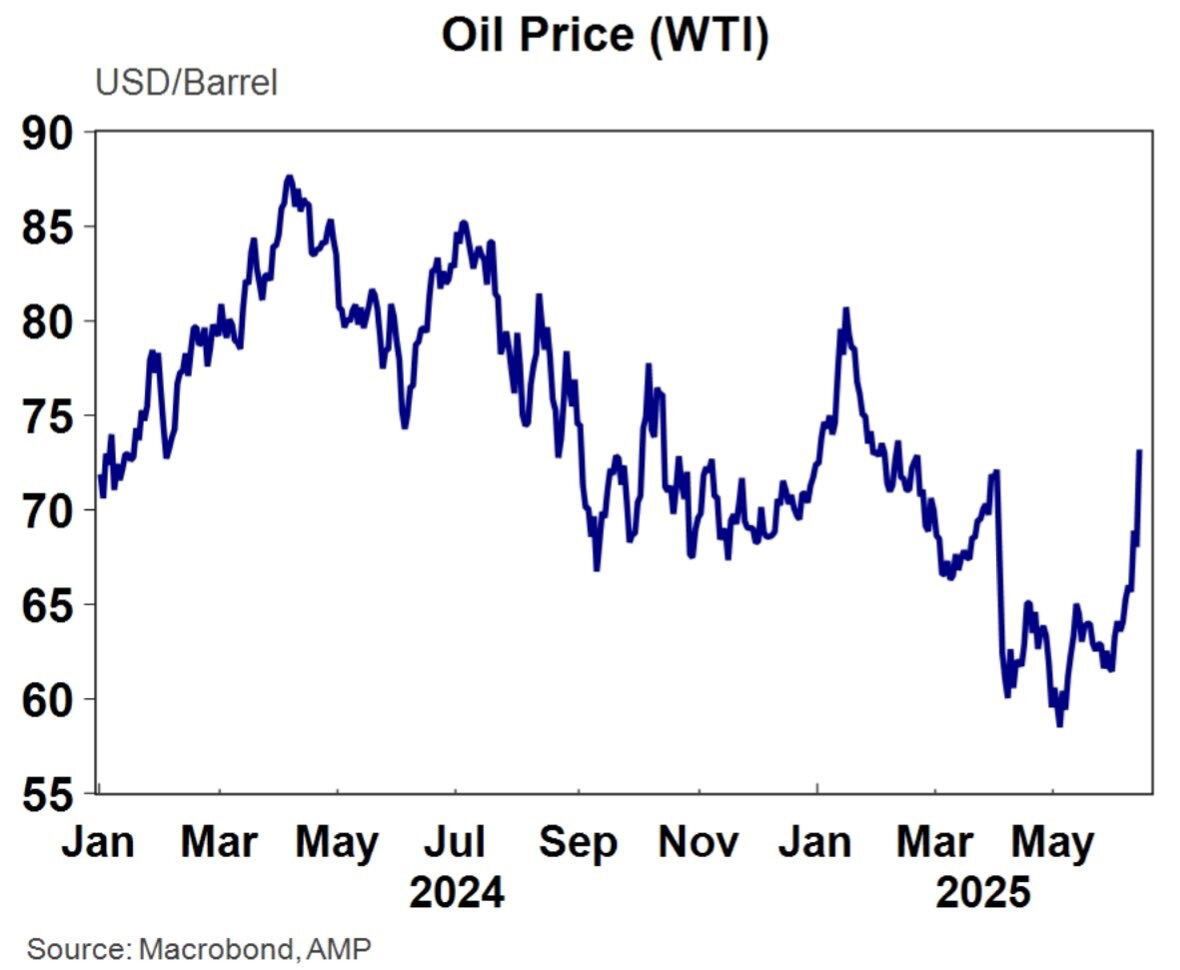

Ipek Ozkardeskaya, Senior Analyst with Swissquote Bank, says a “broader escalation” in the conflict in the Middle East could soon push oil prices toward US$100 per barrel.

AMP’s head of investment strategy and chief economist Shane Oliver says the latest spike in the oil price will flow through to higher petrol prices.

He said the spike this month points to a 12 cents a litre increase flow on to Australian petrol prices if sustained.

Gold prices also rose as investors fled to safe haven assets, with the gold price trading 1.2 per cent higher at $3424.6 on Friday afternoon.

What geopolitical escalation versus de-escalation means for oil prices

Ipek Ozkardeskaya, Senior Analyst with Swissquote Bank, says a de-escalation in tensions between Israel and Iran could bring oil back below $70 per barrel, around the 200-day moving average.

But the other scenario is “broader escalation”, potentially pushing oil prices toward US$90–$100 per barrel.

The price of US crude jumped as much as 13 per cent, trading past US$77 per barrel on Friday, while Brent also surged past US$76 per barrel.

“Prices have since pulled back slightly, but tensions are far from over,” she noted.

“Beyond oil, if tensions disrupt transit through the Strait of Hormuz, LNG flows could also be hit—as roughly one-fifth of global LNG passes through the strait.

“So far, there’s no major price action on that front. Let’s hope tensions ease before broader disruptions emerge.”

She noted the US and Iran are expected to meet in Oman this Sunday to discuss Iran’s nuclear program, “so this weekend could bring fresh developments”.

Qantas ‘closely monitors’ Air India crash probe

A spokesman for Qantas and Jetstar says the airline will “closely monitor” the findings of the investigation into the Air India plane that crashed in Ahmedabad shortly after takeoff.

The Air India crash of a Boeing 787-8 is the same type of aircraft used by Jetstar on international routes, and a variant of Qantas’ 787-9 fleet.

“We extend our deepest condolences to the families and loved ones of all of those affected by this devastating accident in Ahmedabad,” a Qantas spokeswoman said.

“Aviation authorities are in the process of thoroughly investigating the cause of this incident and we will closely monitor their findings.”

Viswashkumar Ramesh, the only known survivor out of the 242 people onboard the Air India plane on Thursday, had been sitting near an emergency exit of the London-bound flight and managed to jump out, police said. Read that story here:

More ASIC action around the Shield and First Guardian collapses

Corporate watchdog ASIC has permanently banned Financial Services Group Australia responsible manager Graham Holmes and is continuing its investigations into Ferras Merhi in connection with its probe into the Shield and First Guardian collapses.

In a statement on Friday ASIC said that “Mr Holmes had been involved in the contravention of a financial services law by FSGA, including FSGA’s failure to take reasonable steps to ensures its representatives acted in the best interests of clients and to give appropriate advice to clients”.

“ASIC also found that Mr Holmes had accepted to be FSGA’s RM (responsible manager) ‘on paper’ only and to receive RM fees, when he knew he was not fulfilling his duties as an RM,” ASIC said.

“ASIC therefore had reason to believe Mr Holmes is not a fit and proper person to participate in the financial services industry.”

ASIC added that individuals who are nominated by AFS licensees as responsible managers must have direct responsibility for significant day-to-day decisions about the financial services the licensee provides.

FSGA and Holmes have the right to apply to the Administrative Review Tribunal for a review of ASIC’s decisions.

ASIC also has turned its focus to Ferras Merhi and various entities associated with him, in connection with its investigations into the Shield Master Fund and the First Guardian Master Fund, which both collapsed.

Despite being the sole director of FSGA, Merhi and his advice firm Venture Egg Financial Services were both authorised representatives of InterPrac Financial Planning until the end of last month.

Do you know more?

If you have more information about this story please contact Nassim Khademat [email protected] or [email protected]

Israel attack on Iran could have ‘dire consequences’

The scope of Israel’s attack on Iran is more severe than anticipated, says MST Financial senior energy analyst Saul Kavonic, and that could have “dire consequences for energy prices and economic growth”.

“The attack we’ve seen today is on the far more severe range than anyone expected,” he told ABC News.

Mr Kavonic said unless there was a rapid de-escalation in tensions, which he fears may not be the case, this spelled troubled for financial markets and the wider economy.

“The scope for this Iranian counter attack is now all but assured and the conflict could go out of control,” he said.

“If escalation continues, it will be significant disruption to oil and markets.

“That has dire ecosneuwnces for global energy prices and therefore economic growth.”

Iran’s Supreme Leader Ayatollah Ali Khamenei is alive and is being continuously briefed about the situation, a security source told Reuters.

Iran’s leader posted on social media platform X (formerly Twitter) that Israel “has prepared for itself a bitter, painful fate, which it will definitely see” and that the “Islamic Republic’s Armed Forces won’t let them go unpunished”.

Energy, gold stocks limit losses on ASX

A rally for energy stock and gold miners are helping to limit the falls on the ASX this afternoon, with the benchmark index down 0.4 per cent.

Despite the losses, it’s outperforming other indices around the region:

- Nikkei 225 -1.3%

- Shanghai Composite -0.7%

- Shenzen Component -1.2%

- Kospi 200 -1.2%

- Hang Seng -0.7%

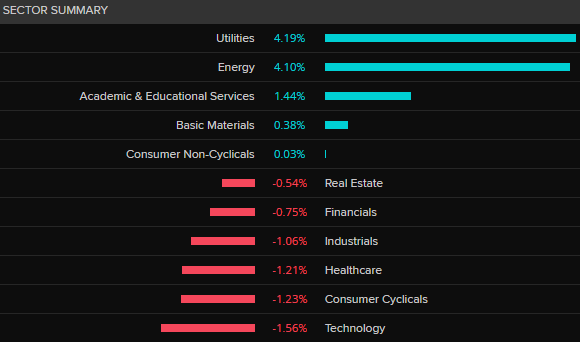

Here’s how the ASX 200 sectors are faring in afternoon trade:

The biggest gains for individual stocks:

- Karoon Energy +10%

- Woodside Energy +7%

- Capricorn Metals +6.4%

- Origin Energy +6.1%

- Evolution Mining +5.5%

And the steepest falls:

- Polynovo -7.3%

- Clarity Pharmaceuticals -7.1%

- Credit Corp -6.7%

- Neuren Pharmaceuticals -6.6%

- Qantas -5%

🎥 Oil and gold prices soar after Israeli strikes on Iran

Markets have had an anxious response to Israeli strikes on Iran with oil and gold prices spiking dramatically.

Local shares in oil and gas companies have gone up, while Wall Street is forecast for a steep sell-off. The Aussie dollar has fallen sharply as investors flock towards safe haven assets.

Watch this report from finance presenter David Chau:

You can read more on the market response from business correspondent David Taylor:

‘The risks are very high right now’: What analysts say about Israel’s strikes on Iran

Financial news service Bloomberg has done a quick call around to gauge financial analyst reactions to Israel’s strikes on Iran.

Here’s a few highlights:

Matt Maley, a chief market strategist at Miller Tabak + Co:

“My question is what happens with the Strait of Hormuz? Iran can shut that down and that’s 13 million barrels of oil everyday, not to mention natural gas, and they have the ability to shut that down. Will they want to do that or limit what can go through? I don’t know.

“The assumption that this will be a quick affair is a risky one … If this turns into something lengthy and the Strait of Hormuz gets impacted oil can go above $US100 very quickly and that puts pressure on global growth. I don’t want to overstate it because we simply don’t know if things will get worse or not. The real risks are very high right now.”

Charu Chanana, chief investment strategist in Singapore at Saxo Markets:

“Whether this risk-off tone sticks now depends on the next 24-48 hours. If Tehran’s response is limited and energy flows remain uninterrupted, experience suggests the premium can bleed out fairly quickly. But any sign of retaliation or supply disruption would keep volatility elevated and push oil and safe-haven assets higher.”

Rodrigo Catril, a Sydney-based strategist at National Australia Bank:

“One theme to watch is whether the dollar’s safe haven attributes are being diluted by the US administration’s trade policy (tariffs), fiscal profligacy and its challenge to the rule of law. Evidence to date suggests that is the case.

“Israel’s unilateral move, if confirmed, also highlights how the world order is potentially changing. The US is seemingly stepping away from a leading geopolitical role, opening the door for others to pursue their own agenda. The concern here would be that Israel is just one and others could follow in the belief that the US won’t be there to stop them.

“Geopolitics is becoming a more disruptive force for markets, adding another layer of uncertainty. Safe havens will go bid but the dollar may not.”

Woodside gets more time to respond to North West Shelf conditions

Gas giant Woodside has been given more time to assess the impact of conditions the Albanese government imposed on the future operations of its North West Shelf facility.

The project, located in the Burrup peninsula in Western Australia, was given conditional clearance last month.

It is the country’s oldest and largest LNG plant and a key supplier to Asian markets.

But environmental groups have long opposed its extension based on concerns that the emissions could impact rock art that is culturally and spiritually significant to Indigenous Australians.

More on that story here:

‘Aussie not a haven in times of market stress’

The Australian dollar has been on the receiving end of selling across financial markets, despite Israel’s strikes on Iran pushing up oil (and therefore gas) prices, making one of Australia’s key exports (LNG) more valuable.

By 1:30pm AEST, the Australian dollar was trading down 0.8% at 64.76 US cents.

The ABC’s business correspondent David Taylor explains why in the piece you can access via the link below:

Where the markets stand halfway through ASX trade

Israel’s air strikes on Iran have had an immediate and dramatic effect on financial markets.

Most notably, the global benchmark Brent crude oil futures contract had surged 11.3% to $US75.75 a barrel by 1pm AEST.

That’s on top of a rise of about 5% yesterday.

Crude oil prices are up about $US10 a barrel over the past two days which, if sustained, will feed through to higher petrol and diesel prices over the next few weeks.

Higher energy costs, if sustained over coming months, could see an unwelcome jump in inflation across the globe, much as we saw after Russia’s invasion of Ukraine.

The reason in this case is not only Iran’s own production of crude, but also its ability to effectively shut off the Strait of Hormuz, through which roughly 30% of seaborne trade in crude oil passes.

Aside from energy prices, gold also rose 1.7% to $US3,441 — just short of recent record highs — as traders looked for safe havens.

The Australian dollar is seen as a “risk” asset, so it fell about 1% after the Israeli strikes, to 64.76 US cents.

The Australian share market also fell, but only 0.2% for the ASX 200 index, as huge gains for energy and gold stocks offset broader declines.

Woodside was up 6.9%, Origin 7.1%, Santos 4.1% and Ampol 2.6%.

Gold miner Northern Star was 4.7% higher, with Gold Road Resources up 1.9% and Newmont surging 5.4%.

However, Japan’s Nikkei is off 1.3%, Shanghai is down 0.7% and US share market futures are 1.8% lower.

Petrol prices to rise, shares in for renewed ‘uncertainty ‘

AMP’s head of investment strategy and chief economist Shane Oliver says the latest spike in the oil price will flow through to higher petrol prices.

He said the spike this month points to a 12 cents a litre increase flow on to Australian petrol prices if sustained.

“Much will depend on Iran’s retaliation and whether it returns to US nuke talks, which Israel may be trying to force,” Mr Oliver said.

“It will almost certainly fire missiles back at Israel, but the main risk would be if it attacks US bases in the region,” he said, noting that is “possible but likely to be limited”.

He said neighbouring oil producers could also disrupt or block the Strait of Hormuz through which roughly 20 to 30 per cent of global oil consumption and 25 per cent of global LNG trade flows daily.

This posed the biggest upside risk to oil prices, but central banks including the RBA would likely look through any near-term boost to inflation from higher petrol prices, he said.

Beyond the near term, he said the key will be if Iran returns to the nuclear talks with the US.

“It’s possible that Israel by its attacks (and the US behind it) is trying to force Iran to do this by sending a warning that if it doesn’t comply it faces an even worse attack from the US,” he said.

“So maximum pressure is back. But for shares it likely means a renewed period of uncertainty given the risk of even higher oil prices in the near term.”

How might Iran respond to Israel’s strikes?

Aside from what further action Israel might take, there is also the key question of how Iran will respond to the latest Israeli strikes on its territory.

Middle East analyst Rodger Shanahan says it is certain Iran will respond, but he believes its options are limited.

Loading…

You can read more of the ABC’s broader live coverage of what’s happening in the Middle East in the live blog.

Gold climbs after Israel attacks Iran’s nuclear program

Safe haven asset gold climbed after Israel conducted military strikes against Iran early on Friday, local time.

Spot gold prices have jumped over 1.4 per cent to trade at $US3,432 per ounce at 12.23pm AEST.

Gold has rallied 30 per cent this year, with investors increasingly seeking safety in the asset due to geopolitical tensions, including in the war in Ukraine.

Even before Israel’s strike on Iran, JP Morgan had forecast that gold prices would continue to hit all-time highs in 2025.

Gold prices peaked at $US3,500 in April, with JP Morgan saying prices would average $US3,675 an ounce by the final quarter of 2025 and $US4,000 an ounce by the second quarter 2026 based on ongoing trade and tariff risks.

Why war affects the market

Why does war affect stocks & shares, gold & silver?

– Michelle Baruffi

Great question, Michelle.

War often brings about greater uncertainty and instability which markets typically dislike.

It can lead to a big sell-off in stocks and it can cause investors to move towards what’s viewed as safer assets like gold, bonds, or currencies.

And as explained in an earlier in post, war in regions where big oil producers are located (like in Iran) can also impact the price of oil because it disrupts world oil production.

Oil prices jump 7.6pc after Israel air strikes on Iran

The latest update on Brent crude oil prices — a key global benchmark.

Brent futures are up 7.6% to $US74.64 a barrel so far today, having followed up a roughly 5% jump yesterday.

As my colleague Nassim Khadem explained earlier in today’s blog, traders are concerned that an escalating conflict in the region might close the Strait of Hormuz, through which around 30% of seaborne oil is shipped.

Market snapshot

- ASX 200: -0.5% to 8,526 points (live values below)

- Australian dollar: -1% to 64.65 US cents

- Wall Street: S&P 500 +0.4% Nasdaq +0.3% Dow +0.2%

- Europe: FTSE +0.2% EuroStoxx -0.3%

- Spot gold: +1.2% to $US3,426/ounce

- Brent crude: +7.3% to $US74.41/barrel

- Iron ore: -0.4% to $US95.05/tonne

- Bitcoin: -2.5% to $US103,338

Prices current around 11:35am AEST.

Live updates on the major ASX indices:

How soon could Israel’s attack on Iran send oil prices above $US100?

JP Morgan thinks a worst-case scenario — such as a closure of the Strait of Hormuz through which global oil flows or major retaliatory attacks from Iran — could disrupt supply and send oil prices dramatically higher.

Iran’s defence minister had warned of attacks on United States bases if nuclear talks collapse, and now Israel has carried out strikes on Iran, according to multiple media reports.

In a note published overnight the investment bank flagged $US120–$US130 per barrel as a potential range for crude oil prices in the event of military conflict and a closure of the Strait of Hormuz.

That would be roughly double the level of oil prices earlier this week, before speculation around potential Israeli strikes ramped up.

About 30 per cent of the world’s seaborne oil trade moves through the Strait.

The International Atomic Energy Agency (IAEA) on Thursday formally declared Iran in breach of nuclear non-proliferation obligations — for the first time in almost 20 years — after uncovering undeclared nuclear activity at multiple sites.

While Iran continues to insist its nuclear program is peaceful, US President Donald Trump said that Iran would not be allowed to obtain a nuclear weapon. The US has relocated personnel due to rising risks in the region.

The price of Brent crude shot up more than 8 per cent to $US75.18 on Friday morning local time, following an increase of around 5% yesterday as speculation around future Israeli strikes on Iran mounted.

Watch more about how important the Strait of Hormuz is to oil supply in this video I did in 2023 when Middle East tensions began rising: