A trader is comforted by a coworker as they work on the floor of the New York Stock Exchange.

Eduardo Munoz Alvarez / Getty Images

The Magnificent Seven stocks collectively lost more than $800 billion in Thursday trading, the latest milestone underscoring how President Donald Trump’s tariff rollout has crippled financial markets.

Taken together, the seven megacap technology stocks that comprise the closely followed index lost around $840 billion in market cap, according to a CNBC analysis as of Thursday afternoon. As a whole, CNBC’s Magnificent Seven index tumbled more than 5% in the session.

Technology stocks led a broad and severe market sell-off as the unveiling of Trump’s long-awaited tariff policy created a risk-off atmosphere. The tech-heavy Nasdaq Composite tumbled nearly 5%, poised for its worst session since 2022.

Trump’s plan includes levies of 46% on Vietnam and 32% on Taiwan, two of several countries now facing special duties on exports to the U.S.

Magnificent 7 market caps

| Ticker | Company | Market cap prior (in millions of dollars) | Market cap current (in millions of dollars) | Change (in millions of dollars) | %chg |

|---|---|---|---|---|---|

| NVDA | Nvidia | 2,694,248.0 | 2,514,420.0 | (179,828.0) | -6.7% |

| AAPL | Apple | 3,363,292.0 | 3,089,439.8 | (273,852.2) | -8.1% |

| GOOGL | Alphabet | 1,924,322.1 | 1,865,085.9 | (59,236.2) | -3.1% |

| MSFT | Microsoft | 2,840,822.0 | 2,795,772.0 | (45,050.0) | -1.6% |

| META | Meta Platforms | 1,479,479.7 | 1,389,370.1 | (90,109.6) | -6.1% |

| AMZN | Amazon | 2,077,260.7 | 1,930,058.5 | (147,202.2) | -7.1% |

| TSLA | Tesla | 909,502.4 | 864,428.9 | (45,073.5) | -5.0% |

| Total | (840,351.6) |

Source: CNBC, FactSet

Apple led the megacap cohort’s charge downward, sliding more than 8% amid concerns that Trump’s broad plan for levies would hurt the personal technology giant given its production abroad. Apple is on track to record its worst day in more than half a decade.

Amazon dropped more than 7% after Trump also signed an executive order ending the de minimis trade loophole next month, which has allowed shipments worth less than $800 into the U.S. duty-free.

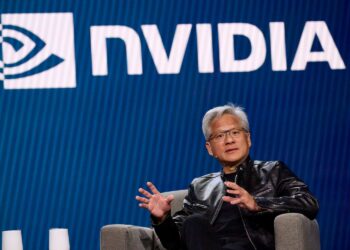

Nvidia, the artificial intelligence giant and retail investor favorite, sank nearly 7%. Trump has previously floated tariffs on semiconductors and other industries.

Also on the AI front, Microsoft pulled back more than 1% after Bloomberg News reported that the company was rolling back data center projects worldwide.

CNBC’s Magnificent 7 index, 1-day

Dan Ives, a well-known technology analyst at Wedbush, called Trump’s tariff plan “worse than the worst case scenario” in a note to clients. He said to expect countries to quickly be able to make deals to reduce their respective taxes, but warned that the U.S. would face a “self-inflected economic Armageddon” if the tariffs stay as originally presented.

But White House officials have largely brushed off concerns that Trump’s economic policies were roiling the stock market. Treasury Secretary Scott Bessent said on Wednesday that large market decline seen recently should be attributed instead to poor performance from technology companies following the launch of an AI model from Chinese startup DeepSeek earlier this year that took Wall Street and Silicon Valley by storm.

“I’m trying to be Secretary of Treasury, not a market commentator,” Bessent said on Bloomberg TV Wednesday night. “What I would point out is that especially the Nasdaq peaked on DeepSeek day, so that’s a Mag 7 problem, not a MAGA problem.”

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!|Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange. In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles, and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!