Market snapshot

- ASX 200: -0.3% to 8,211 points (live values below)

- Australian dollar: -0.1% to 64.36 US cents

- Wall Street (Friday): Dow +1.4%, S&P 500 +1.5%, Nasdaq +1.6%

- Europe (Friday): DAX +2.6%, FTSE +1.2%, Eurostoxx +2.1%

- Spot gold: +0.2% to $US3,244/ounce

- Brent crude: -3.5% to US$59.18/barrel

- Iron ore (Friday): +0.3% to $US97.15/tonne

- Bitcoin: -1.2% to $US94,577

Prices current around 10:20am AEST

Live updates on major ASX indices:

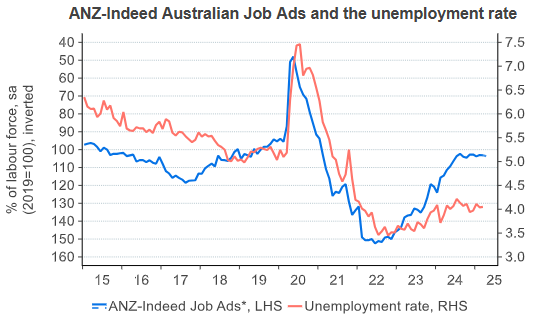

Job ads stable, supporting labour market

The latest job ads survey shows there was a slight pick in positions available in April, pointing to on-going stability in the employment market.

ANZ-Indeed Job Advertisements rose 0.5% in April — remaining quite stable since September — to be down 5.1% over the past year.

Indeed economist Callam Pickering noted job creation across Australia remains healthy given prevailing economic headwinds.

“That continues to support employment growth, helping contain unemployment and also helping households deal with cost-of-living pressures and other economic challenges,” Mr Pickering said.

“Job advertisements are a forward-looking measure of labour demand and right now it’s painting a clear picture of a job market that should remain tight in the near-term.

“Nevertheless, the global economic outlook is suddenly much weaker, owing to unpredictable trade policies from the United States, which may weigh on the Australian job market going forward.”

Job Ads growth was mixed across regions, with a large drop in New South Wales offset by stronger results in the other mainland states, led by South Australia and Western Australia.

Queensland though has been the biggest underperformer this year, after last’s big hiring spree.

Choc horror! Chocoholics suffering the bitter taste of soaring prices

If you think you are paying too much for your chocolate fix, beware it is about to become even more expensive.

Our commodities-minded colleague Clint Jasper has been sampling the views of the big-multinationals that dominate the chocolate market, and all say their prices will follow global cocoa prices higher.

But will prices rises kill the chocolate egg? It’s an interesting read.

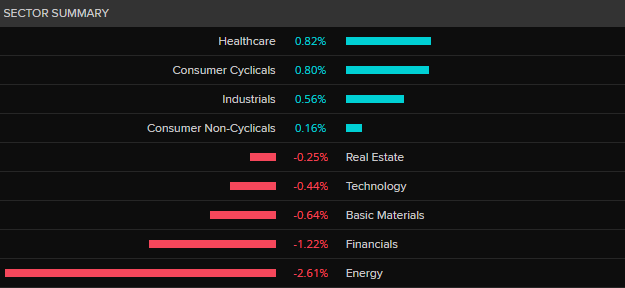

ASX down 0.5%, hit by bank and energy sell-off

The ASX 200 has opened lower following a disappointing first-half profit announcement from Westpac and tumbling oil prices hitting the likes of Woodside and Santos.

At 10:40am AEST, the ASX 200 was down 0.5% to 4,609 points and the broader All Ordinaries was down a more modest 0.2%.

The gains in healthcare and consumer stocks were more than outweighed by heavy selling in the financial and energy sectors.

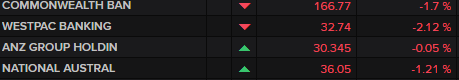

The big four banks are all lower after Westpac unveiled a disappointing first-half cash profit of $3.3 billion this morning.

Westpac is down more than 2% and CBA has slipped 1.7%,

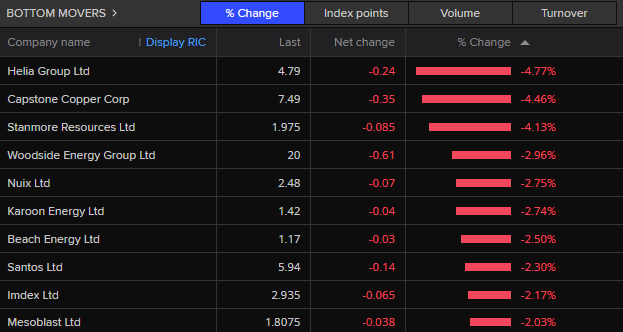

The oil and gas producers have all been hit hard by OPEC+’s decision over the weekend to increase production quotas.

The oil price is down around 3.5%, below $US60/barrel this morning. Woodside is down 3% and Santos is down 2.6%.

The biggest mover this morning is, not surprisingly, Gold Road Resources (+9.4%) after accepting an improved $3.7 billion takeover offer from a South African rival.

Oil and gas producers all feature prominently amongst the morning’s big losers.

Gold Road Resources to be taken over in $3.7b deal

South African gold miner Gold Fields will acquire Gold Road Resources in a deal valuing the Australian miner in a $3.7 billion deal.

The deal equates to a 14.5% premium on Gold Road’s closing price on Friday.

The deal comes after Gold Road rejected Gold Fields’s $3.3 billion buyout bid in March because it believed the offer materially undervalued the company and was “highly opportunistic”.

Under the deal, Gold Road shareholder will receive a fixed cash consideration of $2.52 per share, minus any special dividends, and a variable cash component equal to the full value of the shareholders’ proportion of stake in Northern Star Resources.

The buyout would help the South African miner to consolidate ownership over the low-cost, long-life Gruyere gold mine in Western Australia, which it operates under a joint venture with Gold Road, at a time of sky-high bullion prices.

With Reuters

ASX opens lower

The ASX is off to a disappointing start.

On opening, at 10:10 AEST, the ASX 200 was down 0.2% after futures trading pointed to a 0.4% rise.

Westpac has opened 1.9% lower on a disappointing first-half result and will likely drag other banks down ahead of their results later this week.

Westpac facing earnings downgrade after profit miss

The first analyst reviews of Westpac’s first-half results are rolling in and, so far, they’re not glowing.

JP Morgan’s experienced bank analyst Andrew Triggs said the bank’s $3.3 cash profit (the preferred metric of the banking community that strips out one-off impacts in a result) was 1% below his estimate and 2% below that of his peers.

Mr Triggs said the lower cash net profit after tax (NPAT) was driven by weaker revenues, specifically non-interest income.

Trading income was particularly weak, down 7% on consensus estimates.

Core net interest margins (the difference between lending rates and deposit rates, and a key measure of bank profitability) were also softer than expected.

On the positive side of the ledger, Mr Triggs noted provision expenses for bad debts were lower, operating costs were in line with expectations and the bank’s capital ratio strength was better than expected.

Mr Triggs said the result was expected to trigger small downgrades to the consensus pre-provision operating profits, mainly driven by lower revenue trends.

Government spending will continue to support the economy: Morgan Stanley

Investment bank Morgan Stanley says Labor’s “meaningful” majority win should continue to deliver fiscal support for the Australian economy.

In a note to clients this morning, Morgan Stanley’s equity strategy team led by Chris Nichol said ALP messaging shows government spending will remain a significant economic backstop.

“Government spending contributed the entirety of Australia’s economic growth in 2024, so the trajectory of fiscal policy is clearly consequential to the outlook,” Mr Nichol wrote.

“The fiscal backstop looks set to remain as a surprise meaningful majority outcome underpins the case for voter-mandated pursuit of key policy pledges.”

The policy pledges highlighted by Morgan Stanley include housing supply, income tax cuts, cost of living relief and an expanded Medicare.

Mr Nichol says energy, immigration and industrial relations/wages policies are other key policy planks the market will watch carefully.

He says the likely improved ALP position in the Senate is likely to be significant, as is the poorer showing from the Greens.

“We believe a swing against the Greens party could see that voting block more malleable to negotiate passing of legislation in the upper house.

“Our key macro call has been for the RBA to find a faster path to Neutral with 3 further cuts this year (the next in May).

“How a galvanized fiscal pledge influences this path will rise in debate.

“For equity markets, Australia’s case for regional resilience is bolstered in the short term with domestic settings supported against what will likely be more caution shown in outlook by C suite (CEO suite) narrative in relation to the global backdrop and trade policy uncertainty.”

Trump says he won’t remove Fed chair early

Donald Trump may be no fan of Federal Reserve chair Jerome Powell, but he says he won’t remove the man he appointed during his first term as US president before his time in the position ends in May next year.

The Trump administration’s recent musings about looking for ways to fire Powell sent markets into a tailspin last month.

Backing away from that stance saw an immediate recovery in the market’s fortunes.

However, in an interview on NBC’s Meet the Press, Trump couldn’t help himself making the usual character assessment of people he doesn’t like, calling the respected Powell “a total stiff”.

Asked if he would remove Powell before his term as chair ended in 2026, Trump issued his most definitive denial, saying: “No, no, no. That was a total — why would I do that? I get to replace the person in another short period of time.”

However, Trump did continue to push the Fed chief to cut interest rates.

“Well, he should lower them. And at some point, he will. He’d rather not because he’s not a fan of mine. You know, he just doesn’t like me because I think he’s a total stiff,” the president complained.

Trump is unlikely to get an immediate satisfaction on his wish.

The market is betting a cut after this week’s meeting is unlikely because fears about stoking inflation remain the Fed’s paramount concern at the moment.

OPEC+ agrees to raise production despite falling prices

A meeting of the OPEC+ oil cartel has agreed to further open the valves on production despite falling prices and a forecast slowdown in the global economy and demand.

It’s the second consecutive month the powerful group has raised output, agreeing to increase production in June by 411,000 barrels a day.

Oil prices fell about 1% on Friday in anticipation of the meeting, which had been brought forward from Monday to Saturday.

OPEC+ official communication said the increase was driven by the healthy fundamentals of the oil market and low inventories.

However, reports from the meeting’s sidelines noted Saudi Arabia is pushing OPEC+ to accelerate the unwinding of earlier output cuts to punish fellow members Iraq and Kazakhstan for poor compliance with their production quotas.

As ANZ’s commodities team noted this morning, reports emerged last week that Saudi Arabian officials had been telling allies that the kingdom could endure a sustained period of depressed prices.

“This comes after its recent decision to raise output by 411kb/d in May, compared with its planned increase of 138kb/d,” the ANZ note said.

“The higher production hikes appear to be in response to a lack of compliance by some members of the group.”

The hikes also follow US President Donald Trump calling on OPEC+ to raise output. The president will visit Saudi Arabia later this month.

The June increase will take the total production increase since April to almost 1 million barrels/day, unwinding the most recent 2.2 million b/d production cuts by more than 40%.

This week: Bank results, Fed and BoE rates decisions

Australia:

Mon: Westpac interim results, Inflation gauge (Apr), Job ads (Apr)

Tue: Household spending indicator (Mar), Building approvals (Mar)

Wed: NAB interim results

Thu: ANZ interim results

Fri: Macquarie FY results

International:

Mon: US — ISM and S&P services indexes (Apr)

Tue: CN — Services index

US — Trade balance (Mar)

Wed: US — Fed rates decision, Consumer credit (Mar)

Thu: UK — BoE rates decision

US — Consumer inflation expectations

Fri: CN — Trade balance

With little in way of macro releases this week, the banks’ mini reporting season will hold the market’s attention this week.

Westpac leads off this morning and is expected to report a cash profit of about $3.4 billion.

NAB (forecast cash profit $3.5 billion) reports on Wednesday and ANZ (forecast cash profit $3.5 billion) will on Thursday.

CBA, which marches to a different beat, has already reported a $5.1 billion cash profit, meaning all up, the retail bank’s first six months profit will be likely some loose change under $16 billion.

Investment bank Macquarie releases it full-year results on Friday.

The consensus call is for a $3.7 billion profit, up from last year’s $3.5 billion effort, but it has endured an usual spate of softer-than-expected quarters in recent times, so another disappointment is possible.

On the global front, rates decisions from the US Federal Reserve and the Bank of England are the key set-piece events.

The consensus forecast is the Fed will leave its rates target parked at the current 4.25 to 4.5% range after Wednesday’s meeting despite the much weaker-than-expected and contractionary first quarter GDP result.

The Bank of England is expected to cut its rate by 25bp to 4.25% when it meets on Thursday.

Election result unlikely to be market mover: AMP

Anyone looking for a significant post-election bounce on the ASX may well be disappointed, according to AMP’s head of investment strategy, Shane Oliver.

“As Labor’s return to government was flagged by opinion polls, it won’t come as a big surprise for most investors,” Dr Oliver said.

“And, as it won’t be needing support from the Greens as some had feared could have led to a less business-friendly outcome, its return likely just means more of the same and so is unlikely to have much impact on the share market or the $A.

“With the budget trajectory looking little different to that announced in the March budget, there are no significant implications for the RBA, although all the extra spending announced since January does mean that interest rates will likely be higher than would otherwise have been the case.”

Dr Oliver also doesn’t believe there isn’t much likelihood of Australia losing its AAA credit rating, despite Standard and Poor’s floating the idea last week.

“Our assessment is that the risk is low as deficit and debt projections look little different from that outlined in the March budget.”

“… anyway, after all that local fun, it’s now back to Trump, who will likely remain the main driver of investment markets for a while yet,” Dr Oliver said.

Westpac boss says customers ‘resilient’ as mortgage delinquencies remain low

In his first results outing as Westpac’s CEO, Anthony Miller said the bank remained in a strong position in “uncertain times”.

“Westpac’s very strong balance sheet is important given global uncertainty,” Mr Miller said

“Our capital, liquidity and deposit-based funding enable us to support our customers and our community.”

Mr Miller also lauded his customers’ resilience and said RBA rate cuts were now providing welcome relief.

“The resilience of customers who have navigated significant cost of living challenges over the past few years is impressive.

“This resilience is reflected in the improvement in credit quality metrics indicating we may have passed the low point in the cycle.

“Mortgage delinquencies and impairment charges remain low. We are ready to assist customers who need help.”

Wall St rebound rolls on, ASX set to rise

Wall Street’s ninth-straight session of rises has effectively erased the losses accrued after the “tariff tantrum” of April 2.

The S&P 500 gained 1.5% to 5,687 points, 0.3% above its April 1 close.

The Dow and Nasdaq gained 1.4% and 1.5% respectively.

The overall positive mood looks likely to flow through to the ASX this morning, with futures trading pointing to 0.4% rise.

While the S&P 500 rose almost 3% over the week, Friday’s rally was supported by positive news on the US jobs front and a belief that trade tensions with China might be easing.

The US economy added an unexpectedly strong 177,000 jobs in April and unemployment held steady at 4.2% despite a clearly slowing economy.

The jobs data saw US Treasury bond yields rise as it eased pressure on the Federal Reserve, most likely allowing it to hold rates where they were and not cut, at least for time being.

The US dollar fell against most currencies, with Australian dollar up 0.9% to be solidly above the 64 US cent level.

The bigger market mover was perhaps a statement from China’s Commerce Ministry on Friday that it was “evaluating” an offer from Washington to hold talks over US President Donald Trump’s 145% tariffs.

However, the ministry warned: “Attempting to use talks as a pretext to engage in coercion and extortion would not work.”

The news from China was welcomed in Europe, with all key bourses rising and the pan-European Eurostoxx index gaining more than 2%.

Oil fell ahead the weekend OPEC+ meeting to discuss production output for June.

The global benchmark, Brent crude, slipped 1.4% to $US61.29/barrel. Over the week it was down 8%.

Gold traded sideways on Friday, having fallen 2.6% over the week.

Westpac posts $3.46b first-half profit

Westpac has posted a $3.5 billion first-half profit, a 1% decrease on the result a year ago.

The company’s cash profit, its preferred measure which strips out one-off issues, was $3.3 billion, slightly lower than consensus estimates.

The bank increased its total loans by 5% over the year and customer deposits by 7%, while its margins remained flat.

The interim dividend increased slightly to 76 cents per share, but below the analyst consensus for an 80 cps payout.

Market snapshot

- ASX 200 futures: +0.4% to 8,280 points

- Australian dollar: +0.9% to 64.42 US cents

- Wall Street (Friday): Dow +1.4%, S&P 500 +1.5%, Nasdaq +1.6%

- Europe (Friday): DAX +2.6%, FTSE +1.2%, Eurostoxx +2.1%

- Spot gold (Friday): flat at $US3,240/ounce

- Brent crude (Friday): -1.4% to US$61.29/barrel

- Iron ore (Friday): +0.3% to $US97.15/tonne

- Bitcoin: -0.4% to $US95,927

Prices current around 7:15am AEST

Good morning

Good morning and welcome to another week on the ABC markets and finance blog.

It’s Stephen Letts from the ABC business team here, limbering up for a blow-by-blow coverage of the day’s events, where every post is hopefully a winner, but none should be construed as financial advice.

In short, it looks like a positive start on the local market after Wall St finished the week with a strong rally, finally recouping the ground lost since the April 2 Liberation Day tariff announcements.

Futures trading points to the ASX gaining 0.4% on opening.

Today’s key event will be Westpac’s first-half results, which will be carefully scrutinised for any change in loan impairments and the bank’s margins, as well as commentary from new CEO Anthony Miller.

As always, the game’s afoot, so let’s get blogging.

Loading