Market snapshot

- ASX 200: +0.27% to 7,946 points

- All Ords: +0.24% to 8,146

- Australian dollar: flat at 62.77 US cents

- S&P 500: +0.4% to 5,633 points

- Nasdaq: +0.9% to 17,449 points

- FTSE: +0.6% to 8,635 points

- EuroStoxx: +1.3% to 549 points

- Spot gold: +0.36% to $US3,121/ounce

- Brent crude: flat at $US74.44/barrel

- Iron ore: +1.7% to $US102.70 a tonne

- Bitcoin: -0.2% to $US85,063

Price current around 11.40am AEDT

Live updates on the major ASX indices:

ICYMI: Bally Corporation talks about Star Entertainment

With Star Entertainment’s refinancing deal with Salter Brothers Capital falling over, it’s now exploring a solution with US casino group Bally Corporation.

In March, the gaming giant offered at least $250 million in funding for a controlling stake in Star Entertainment.

It’s worth looking back at Kirsten Aiken’s chat with Bally Chair Soo Kim about the deal on The Business:

Loading…

Midday share market update

Not much happening in local share markets today.

The ASX200 is up slightly, +0.2 per cent, to 7,943 points as at 12.40pm AEDT.

The All Ordinaries is also up +0.2 per cent, to 8,144 points.

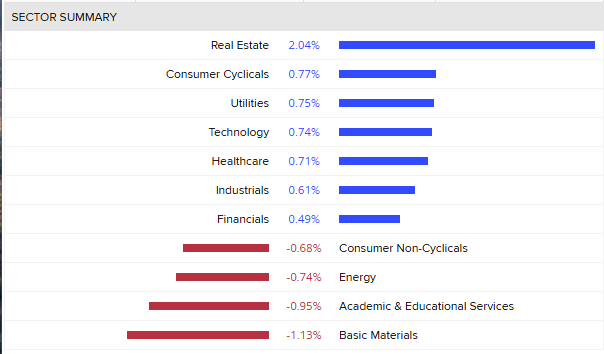

We’ve got 7 of the 11 sectors in positive territory today, led by real estate.

Basic materials and academic services are down.

Here’s a summary:

Taking a look at individual stocks, the top movers are Megaport, Fisher and Paykel Healthcare and Goodman Group.

Zip Co, Telix Pharmaceuticals and Liontown Resources are leading the losses.

Millions of Australians hit by card fraud

Another interesting set of data put out by the Australian Bureau of Statistics today is around scams and card fraud.

The Personal Fraud Survey shows over two million Australians experienced card fraud and 675,000 responded to a scam in 2023-24.

“We found that 9.9 per cent of Australians aged 15 years and over were victims of card fraud in 2023-24. This is up from 8.7 per cent in the previous year,” said William Milne, ABS head of crime statistics.

The good news out of the survey is many card victims got their money back.

“We found 72 per cent of card fraud victims were fully reimbursed by their card issuer,” he said.

However, the net loss to all victims after reimbursements were paid out was $477 million.

When it comes to scams, buying or selling scams (which include things like false billing and online shopping scams) were the most common.

More than 300,000 Australians were victims of this type of scam.

Australian home building approvals dip

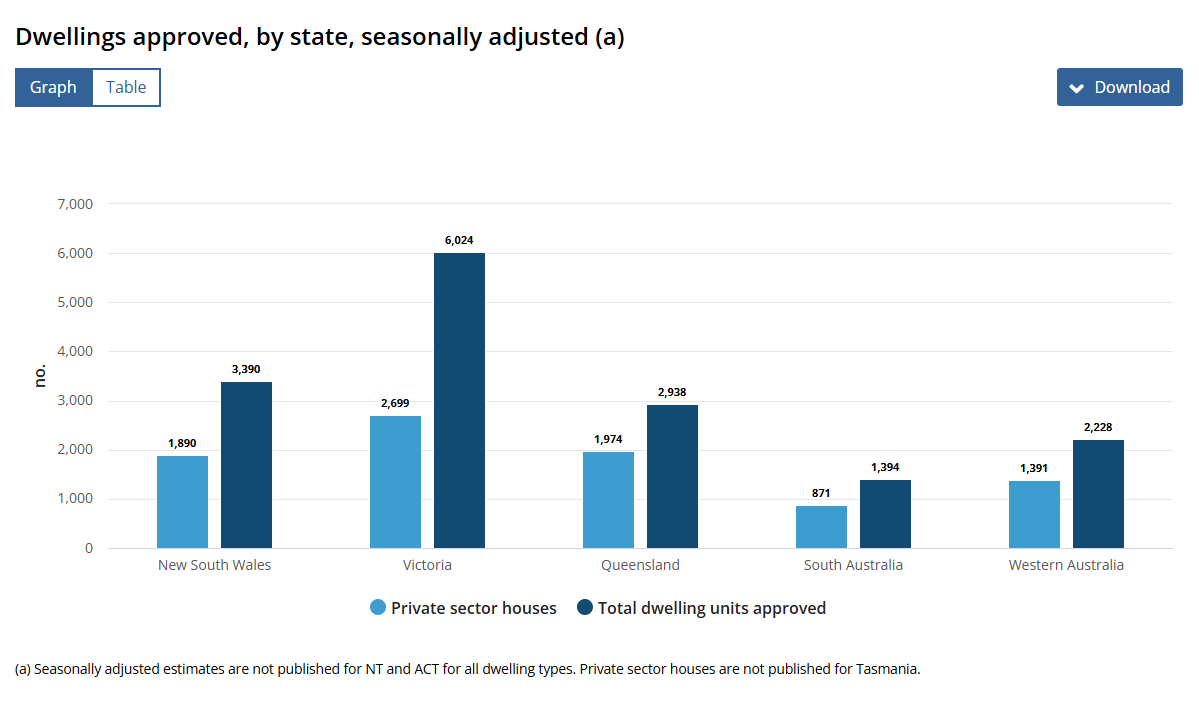

The total number of dwellings approved fell 0.3 per cent in February, according to the Australian Bureau of Statistics.

It comes after the total number of approvals rose 6.9 per cent in January.

“Approvals were varied across building types. Private dwellings excluding houses fell 1.5 per cent, while private sector house approvals were up 1.0 per cent,” said Brock Hermans ABS head of construction statistics.

There were more than 9,000 private sector houses approved, which is more than 5 per cent higher than the same time last year.

It was driven by demand in New South Wales.

Take a look at this chart, which shows dwelling approvals by state.

There was a fall in the number of what’s called ‘private sector dwellings excluding houses’ which includes apartments, townhouses, terrace houses or semi-detached. There were only 7,113 of this type of approval this February, after reaching a two-year high in January.

Despite the falls, the number of approvals is still up more than 70 per cent since February last year.

Looking at the big picture: the value of total buildings approved was $14.34 billion, which was down just over 3 per cent.

RBA raises new open market operations repurchase agreements by 5bps

The Reserve Bank will increase the price of all new open market operations (OMO) repurchase agreements by 5 basis points to 10 basis points over the cash rate target, effective from April 9, 2025.

At the same time, OMO will continue to be offered at a floating rate repurchase agreement.

The RBA transacts in financial markets on a daily basis to maintain the actual cash rate as close as possible to the target rate. These transactions are commonly known as open market operations.

OMOs involve the purchase and sale of securities in the domestic financial market to manage liquidity and influence the cash rate, ultimately implementing monetary policy decisions and ensuring a smooth payments system.

In March last year, the RBA board endorsed a system for implementing monetary policy.

Banks’ demand for reserves would be satisfied in full at the RBA’s OMOs, at a price near the cash rate target, using full allotment repurchase agreement auctions.

The RBA calls this system ‘ample reserves with full allotment’ because it supplies as many reserves as banks demand at its OMOs.

The central bank will introduce a seven-day term, in addition to the existing 28-day term, at each weekly OMO.

WiseTech ex-director explains why she left

Former WiseTech director Christine Holman says she won’t talk about the circumstances of her exit. ABC radio star Ali Moore asks a killer question: What makes you leave a board?

“I think I’ve over-estimated my ability in the circumstances to influence change and underestimated the ability of the CEO to influence the independent board.”

She tells an anecdote of running for prefect at school and about an “invisible line of integrity” that people have.

“I’m just not prepared to cross that line of integrity ever, and if there’s a price to pay… I’ll live with that.”

Star fails to secure Salter Brothers loan

Australian casino operator Star Entertainment said on Wednesday that its refinancing proposal with investment group Salter Brothers Capital worth up to $940 million had been withdrawn.

The cash-strapped firm continues to be unable to lodge its half-year results and says it is now exploring a previously made refinancing solution with US casino group Bally’s.

ASX opens higher

The Australian share market has posted modest gains at the open.

The ASX 200 index rose 42 points or 0.5% to 7,964, by 10:15am AEDT.

Here are the top and bottom movers in the first 15 minutes of trade.

Plain English guidance and more super scrutiny, ASIC chair promises

Chair of corporate regulator ASIC, Joe Longo, has raised a substantial issue with law reform: complexity.

“Australia has a real problem with complexity… we don’t seem to be able to get away from it.

“Directors duties provisions are my favourite provisions… short sentences.”

He’s promising that ASIC is doing that.

There’s discussion at this ACSI (Australian Council of Superannuation Investors) conference about super, about the interaction with financial stability regulator APRA.

Joe Longo makes a final observation:

“The superannuation sector is huge… in every way. A major player in the economy, affects almost everybody. I say to the industry welcome the accountability, stay focussed [on that]. The sector has achieved very good investment returns, but that’s not a complete [view] of what needs to be done”

I’ve written about our burgeoning super industry — the trillions in play — and how it’s impacting our budget, retirement and overall financial system.

Super good morning!

Hi team,

Just jumping in from the ACSI conference in Melbourne.

Just me and the billions.

Currently ASIC chair Joe Longo is being questioned by my ABC colleague Ali Moore on stage. And he’s getting stuck into the “unique entity” that is our stockmarket operator the ASX – a company that is listed on its own bourse.

He called the ASX a “problematic entity” with some “very significant problems” that ASIC alleges has “misled the market” (and they’re dragging them to court at the moment about that).

His main concern is that the ASX is “just not moving quickly enough” to deal with its problems.

Joe Longo also harks back to a market outage, and how it could have been much worse.

“The ASX is lucky that outage occurred on a Friday afternoon on a quiet trading day… we’re conducting a wide-ranging investigation at the moment”.

More to come…

Shell responds to Dutton’s gas policy

Shell Australia Chair Cecile Wake says more gas supply is needed, instead of a reservation policy, to sustainably reduce Australian power prices.

She’s called for governments to remove hurdles to investment, rather than intervene in the gas market.

You can watch this interview by Business Host Kirsten Aiken.

Foreign companies could sue over Dutton gas plan

Peter Dutton’s plans for a national gas reservation could see Australian taxpayers effectively subsidising ongoing use of the energy, says a top legal expert.

Companies from allied countries including Japan, the US and UK could sue the Australian government for “lost profits” under the opposition’s plan, using treaty law.

Mr Dutton has promised to “soon” publish modelling and details of his gas plan, which has faced a barrage of industry condemnation.

Read more from chief digital political correspondent Jacob Greber, political reporter Nicole Hegarty and Sarah Gerathy.

Kalgoorlie celebrates as gold hits record price

The price of gold has hit a record, topping $5,000 an ounce.

Australia’s gold mining city, Kalgoorlie, is celebrating the news but with some trepidation over how long it might last.

The mayor and leading local figures say more money should be invested in the town as a result.

Read more from Jarrod Lucas in Kalgoorlie.

How local market reacted to RBA rates decision

RBA leaves interest rates on hold at 4.1pc

The RBA has left rates on hold at 4.1% and revealed a rate cut wasn’t even discussed in yesterday’s meeting.

RBA governor Michele Bullock’s tone at her press conference cast doubt on when the RBA would next cut rates.

That’s not good news for some mortgage borrowers, who would have been hoping for a rate cut to ease repayment pressures.

Michele Bullock says the economy is in a good position amid global uncertainty.

But she says we have to be careful not to get ahead of ourselves, that inflation pressures remain and cost-of-living pressures are still very real for many Australians.

The rates decision comes as house prices hit fresh highs in March, thanks to a confidence boost following February’s interest rate cut.

You can watch this story from Business Reporter Nadia Daly or read the story on the RBA rates decision from Business Reporter Stephanie Chalmers by clicking the link below.

Wall Street endures topsy-turvy day

The S&P 500 and the Nasdaq Composite both closed higher on Tuesday, after a topsy-turvy day on Wall Street dominated by investor angst ahead of the impending tariff announcements from the Trump administration.

Financial markets have been volatile in recent weeks as investors assessed the economic fallout of US President Donald Trump’s extensive tariff plans, which have sparked worries about a US economic slowdown and higher inflation.

Some of the uncertainty that has gripped markets is expected to dissipate after Trump unveils his tariff plan on Wednesday during an event in the Rose Garden, currently scheduled for 7am AEDT on Thursday.

However, while clarity on the specific tariff measures will be welcomed by investors, the overall backdrop is set to remain highly uncertain, making it difficult for markets to agree on directionality.

“The fact of the matter is sentiment is washed out and positioning is still fairly light,” said Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions.

“I don’t think we’re going to get the type of clarity that investors and business leaders want,” he added. “And at the end of the day, we spend a lot of time talking about tariffs, but the bigger story is we are dealing with an economy that is not firing on all cylinders.”

For now, according to Melson, this means investors are “sitting on their hands, biding their time.”

This attitude was reflected in the three Wall Street benchmarks on Tuesday, which swung between positive and negative territory throughout much of the day, before finishing the afternoon with some decent momentum.

Good morning

Welcome to Wednesday’s markets live blog, where we’ll bring you the latest price action and news on the ASX and beyond.

A mixed session on Wall Street overnight sets the tone for local market action today.

The Dow Jones index was flat, the S&P 500 rose 0.4 per cent and the Nasdaq Composite up 0.9 per cent.

ASX futures were up 28 points or 0.4 per cent to 8,001 at 7:00am AEDT.

At the same time, the Australian dollar was up 0.5 per cent to 62.74 US cents.

Brent crude oil was down 0.4 per cent, trading at $US74.47 a barrel.

Spot gold dropped 0.2 per cent to $US3,118.44.

Iron ore rose 1.7% to $US102.70 a tonne.