Market snapshot

- ASX 200: -0.1% to 8,549 points

- Australian dollar: Flat at 65.13 US cents

- S&P 500: Flat at 6,092 points

- Nasdaq: +0.3% to 19,973 points

- FTSE: -0.5% to 8,718 points

- EuroStoxx: +0.7% to 469 points

- Spot gold: Flat at $US3,333/ounce

- Brent crude: +0.3% to $US67.9/barrel

- Iron ore: -0.3% to $US92.70/tonne

- Bitcoin: -0.5% to $US107,279

Price current around 7:50am AEST

Live updates on the major ASX indices:

CBA is the world’s most expensive bank: explained

By what measure is CBA the world’s most expensive bank? From what I can see JP Morgan has a bigger market cap and higher price per share

– Roman

Hi Roman, I’m glad you asked. Ian has this to say in response:

“It is based upon its valuation.

The comparisons are based on both a price to earnings multiple and price to loan book valuation. On those measures, it is the most expensive bank in history.

Investors need to compare oranges with apples. Obviously, a bigger bank will cost more because of its scale. But the simple price doesn’t measure value.”

Possum pizza?

Pizza chain Dominos is facing allegations around the use of timber for cooking its “smokehouse” pizzas and its proximity to possum habitats.

As the Specialist Reporting Team’s Angela Heathcote reports:

“A Victorian sawmill harvested wood from endangered mountain ash forests and sold it to Domino’s as woodchips to smoke meat for pizzas.

The pizzas were marketed with Forest Stewardship Council (FSC) certification, but an investigation has now found seven breaches of FSC standards.

The sawmill responsible says its timber harvesting is in full compliance with all relevant environmental regulations and forestry legislation.”

Read more:

Why is CBA the world’s most expensive bank?

Reporting by chief business correspondent Ian Verrender

It has become one of the great mysteries of life.

Along with age old anomalies like, why does sour cream have a use-by date or, how does the snow plough man get to work, big professional investors are grappling with the incredible Commonwealth Bank conundrum.

Why is the Commonwealth the world’s most expensive bank? And why does the share price keep rising?

The big institutional investors are angry. And with good reason. For much of the past year, they’ve resisted buying more CBA shares because all their models are unanimous. As a stock, it’s horribly overvalued.

By refusing to jump aboard, many are now underperforming the market, which has largely been driven by the incredible run from CBA, now the biggest stock on the Australian Securities Exchange and leaving all others in the dust.

While it’s off a touch this morning, it breached $180 a share in the past week and yesterday passed through $190, as it canters towards a double ton.

The gains have been spectacular. It’s added 55 per cent in the past year and more than 30 per cent since mid-March. Retail investors, ordinary punters, love it and appear to be the biggest cohort of buyers.

CBA appears to be in the happy position of doing well when markets turn sour and doing well when markets are running hot.

It’s been identified as a safe haven by foreign investors looking to lighten their exposure to Wall Street, especially with the US dollar in decline. That’s because it isn’t exposed to Trump’s tariff war or the China trade.

And when markets are going up, it does too.

No-one is happier than CBA boss Matt Comyn who is on track to haul in a massive bonus this year given CBA’s outperformance. On some estimates, he could be in line for a $40 million payday.

ACCC sues Australian Gas Networks over alleged ‘greenwashing’

The consumer watchdog has launched Federal Court action against gas distributor Australian Gas Networks Limited, accusing the company of “greenwashing” and misleading millions of Australians.

The ACCC alleges that the company made false and misleading representations in its TV and online advertising campaign aired in 2022 and 2023.

“We allege that Australian Gas Networks engaged in greenwashing in its ‘Love Gas’ ad campaign,” ACCC chair Gina Cass-Gottlieb said.

“We allege that the ads overstated the likelihood of Australian Gas Networks overcoming significant technical and economic barriers to distribute renewable gas to households within a generation.

“It is not currently possible to distribute renewable gas at scale and at an economically viable price, and throughout 2022 and 2023 it was highly uncertain whether, and if so when, this would be possible.”

The ACCC said the claims by Australian Gas Networks were contained in four advertisements which all featured a young girl and her father using gas appliances in the home for cooking, bathing or heating.

Neuren jumps 10% on US patent

Pharmaceutical company Neuren has soared on news that the United States

Patent and Trademark Office has allowed Neuren’s patent application covering the use of NNZ-2591 to

treat Pitt Hopkins syndrome (PTHS) for issuance as a patent.

Shares jumped more than 10% to $13.85.

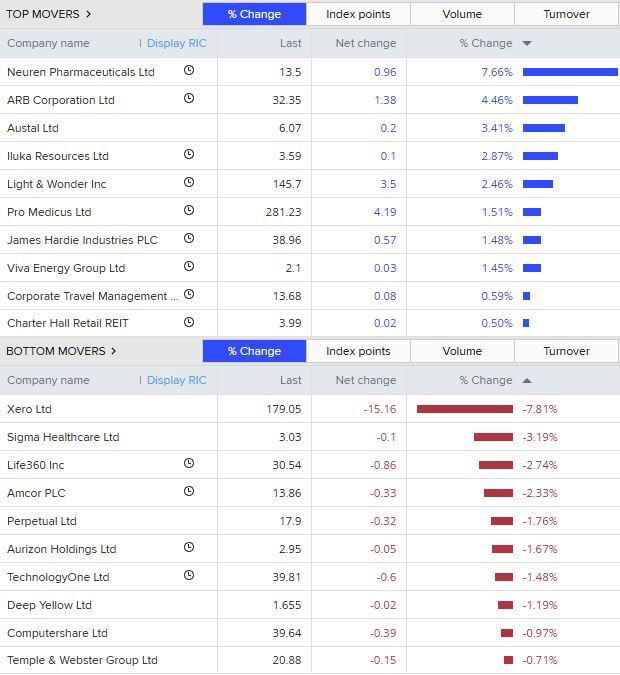

Top and bottom movers at open

ASX opens lower

The Australian share market has opened lower after a mixed session on Wall Street.

The ASX 200 lost 18 points, or 0.2% to 8,542, by 10:15am AEST.

Kylie Moore-Gilbert says Iranians fear they’re about to pay the price from a vengeful regime

As markets continue to weigh developments in the Middle East, US media is citing a preliminary US intelligence assessment that casts doubt over Donald Trump’s claim that US strikes have obliterated Iran’s nuclear facilities.

The reports say the strikes have set back the nuclear program by only a few months.

Kylie Moore-Gilbert, who was incarcerated in Iran’s prison system for two years, says Iranians are “just hoping like hell that this doesn’t escalate further and that the ceasefire will actually hold”.

She tells The Business Host Kirsten Aiken there is a lot of concern that the regime, which is not trusted by the vast majority of its population, might seek to race toward a bomb, using the 400 kilograms of enriched uranium that Tehran is purported to have taken out of its Fordow facility.

Shell denies BP takeover talks after WSJ report

Shell denied that it was in talks to buy BP after The Wall Street Journal reported on Wednesday that the oil major was in early discussions over a takeover of its British rival.

“No talks are taking place. As we have said many times before, we are sharply focused on capturing the value in Shell through continuing to focus on performance, discipline and simplification,” a Shell spokesperson said.

A BP spokesperson declined to comment on the WSJ report.

The latest in a series of rebuttals by Shell follows recent repeated assertions by CEO Wael Sawan that Shell had a very high bar for big acquisitions and that buying back shares was a better allocation of money than the possibility of buying BP.

BP has been the subject of takeover talks for several years because of its stock’s relative underperformance, but analysis of its disclosures shows that the British energy group may not be as cheap as its market valuation would suggest.

The company was valued at nearly $US80 billion on Wednesday with net debt of $US27 billion while Shell’s market capitalisation stood at more than $US208 billion.

Reporting by Reuters

The rise of drone warfare

DroneShield chief executive Oleg Vornik says the recent spectacular Ukrainian drone attack on Russia’s strategic bomber fleet has underscored how asymmetric warfare is a new battlefield.

The ASX-listed company has announced its biggest single order yet — a $62 million contract for Australian-made counter-drone equipment destined for deployment within a European defence program.

He says the rise of drone warfare is a lesson for military planners, who need to understand security no longer ends at a country’s national borders.

At a time when Australia’s involvement in the trilateral AUKUS submarine program has been questioned, Mr Vornik says it’s important Australia seeks to be a part of a global coalition of democracies amid geopolitical turbulence.

He also told The Business Host Kirsten Aiken DroneShield was already participating in the AUKUS program to the extent that it was involved in protecting submarine yards in the US and UK from drone incursions.

Shuttered bakery All Are Welcome owes suppliers thousands

Suppliers involved with former bakery All Are Welcome say they are also owed thousands of dollars, after the ABC revealed staff are owed almost $250,000 in superannuation.

A government scheme covers employee entitlements when a business goes under, but it does not cover superannuation.

Payday super — which means super is paid at the same time as wages — will be introduced by the middle of next year, and some in the industry believe it will help reduce unpaid contributions.

Read more from business reporter Adelaide Miller.

Wall Street mixed, Nvidia resets record high, Powell in focus

US stocks took a breather on Wednesday, pausing a two-day rally as the tenuous Israel-Iran cease fire continued to hold and investors pored over a second day of congressional testimony from Federal Reserve chair Jerome Powell.

Tech shares lifted the Nasdaq, while the S&P 500 ended flat. The benchmark index remained within striking distance of its record closing high reached on February 19.

The blue-chip Dow ended in negative territory.

“It almost feels like back to your regularly scheduled bull market,” said Ryan Detrick, chief market strategist at Carson Group in Omaha.

“We’ve dealt with the tariffs, we’ve dealt with the Middle East drama, but stocks continue to defy the odds by moving higher with the realisation that the US economy remains quite resilient.

“But today it’s almost like watching paint dry as we’re all waiting for the S&P 500 to make new highs,” Detrick added.

Nvidia shares touched a record high, lifting its market value to $US3.75 trillion and making it the world’s most valuable company.

A ceasefire between Israel and Iran appeared to be holding, reducing the risks of disruptions to the global oil trade. At a NATO summit on Wednesday, US President Donald Trump hailed the swift end to the 12-day conflict, saying that talks next week would seek a commitment from Iran to end its nuclear ambitions.

Powell resumed two days of congressional testimony on Wednesday, appearing before the Senate Banking Committee following scrutiny before a House panel on Tuesday.

“It looks like we’ve got a bit of a tug of war as to everything from Middle East tensions to how that’s going to impact inflation, and then you’ve got oil prices firming up a little bit,” said Sandy Villere, portfolio manager at Villere & Co in New Orleans.

“It would be interesting if oil gets weaker and inflation stays at bay and then you wrap all that into what Powell has been saying. It feels like the market is being pretty resilient.”

Brent crude futures settled up 0.8% to $US67.68 a barrel, while US West Texas Intermediate crude (WTI) settled up 0.9% to $US64.92, both contracts paring some of the 13% losses made earlier in the week.

Market snapshot

- ASX 200 futures: -0.4% to 8,500 points

- Australian dollar: -0.1% at 65.05 US cents

- S&P 500: Flat at 6,092 points

- Nasdaq: +0.3% to 19,973 points

- FTSE: -0.5% to 8,718 points

- EuroStoxx: +0.7% to 469 points

- Spot gold: +0.3% to $US3,332/ounce

- Brent crude: +0.1% to $US75.64/barrel

- Iron ore: -0.3% to $US92.70/tonne

- Bitcoin: -0.3% to $US107,551

Price current around 7:50am AEST

Live updates on the major ASX indices:

ASX to fall

Good morning and welcome to Thursday’s markets live blog, where we’ll bring you the latest price action and news on the ASX and beyond.

A mixed session on Wall Street overnight sets the tone for local market action today.

The Dow Jones index dropped 0.3 per cent, the S&P 500 was flat and the Nasdaq Composite gained 0.3 per cent.

ASX futures were down 37 points or 0.4 per cent to 8,500 at 7:30am AEST.

At the same time, the Australian dollar was down 0.1 per cent to 65.08 US cents.

Brent crude oil was up 0.8 per cent, trading at $US67.67 a barrel.

Spot gold settled 0.3 per cent higher to $US3,332.06.

Iron ore lost 0.3 per cent to $US92.70 a tonne.