Intel Stock Current Technical Setup:

Intel Corporation’s stock (NASDAQ: INTC) exhibits compelling bullish momentum. Since early 2024, a key descending resistance line has defined price action, recently decisively broken to the upside, validated by a successful retest.

Following a significant earnings-related decline in August 2024, INTC stock entered an extended consolidation phase, primarily trading within a range between approximately $17.70 and $27.50. A volume profile analysis indicates most trading activity occurred between the Value Area Low (VAL) near $19 and the Value Area High (VAH) at around $22.85, with the Point of Control (POC) positioned around $20.35.

Intel Stock Analysis Video

As the above video shows, among other “hints”, the recent technical action has produced higher lows and higher highs within an ascending channel, signifying growing bullish sentiment. The stock has successfully crossed critical technical levels, including the longstanding red resistance and the key VAH at $22.85.

Upcoming Earnings Catalyst for INTC:

Intel’s earnings report scheduled for July 24, 2025, introduces potential volatility and could significantly reinforce the bullish breakout. Investors should closely monitor stock performance leading up to this catalyst.

INTC Stock Price Movement and Stability

From early April to late June 2025, INTC exhibited primarily range-bound trading behavior, fluctuating between approximately $18 and $23. Early April volatility peaked with prices briefly dipping to $17.67, followed by a sharp rebound above $21. Subsequently, the stock consolidated steadily, indicative of investor accumulation and equilibrium between buying and selling pressures.

INTC Stock Volume Weighted Average Price (VWAP) Insights

The VWAP consistently averaged around $20.50, reflecting stable institutional activity and consensus on fair market valuation. This consistency suggests limited speculative volatility, reinforcing investor confidence in price stability.

Technical Observations of INTC Stock

-

Key Support Levels: Repeatedly tested support around $20.00-$20.50 demonstrates robust buyer interest, marking this area as strategic for potential entries.

-

Resistance Levels: Initial resistance around $21.50 converted into support after a bullish breakout, signaling increased market confidence and buyer conviction.

-

Recent Highs: An upward breakout reaching a peak of $23.38 at the end of June underscores renewed bullish momentum, with the potential for continuation should this resistance be decisively surpassed.

Detailed Trade Idea and Risk Management for INTC Stock

-

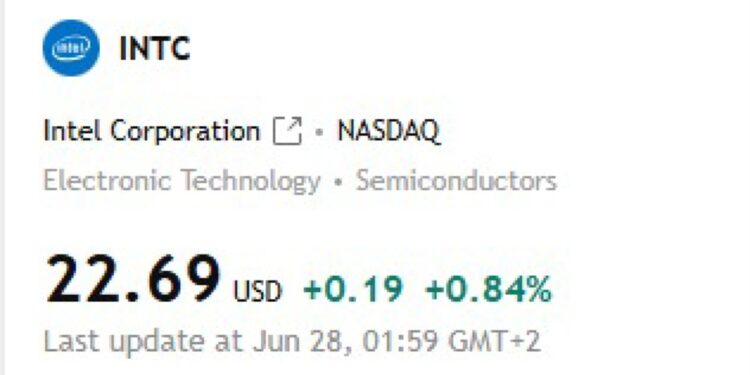

Suggested Entry: Around $22.88, just above the critical VAH at $22.85. But buyers can also scale into the Long and buy in premarket at apx. $23-$23.15. Price in pre-market now is:

-

Initial Stop-Loss: Approximately $21.61, below recent swing lows, representing about a 6% potential downside.

-

Partial Profit Targets:

-

Long-Term Target: Potentially approaching historical highs around $50, offering substantial upside.

INTC stock price now in pre-market is $23.11

Investment Implications

The recent price action and breakout dynamics suggest a bullish continuation scenario. Investors may find value in accumulating shares on controlled pullbacks towards recent support levels in the range of $22-$23, at their consideration.

Risk Management and Positioning for Intel Stock Buyers

Prudent investors are advised to:

-

Implement disciplined stop-loss strategies around established support levels ($20.50-$21.50).

-

Employ partial profit-taking at near-term resistance ($23.38) while potentially maintaining runner positions for extended gains.

Relative Strength Analysis (OrderFlow Intel):

-

Relative Prediction Score: +8 out of 10 (Very Strong Bullish Bias, High Confidence)

INTC demonstrates significantly stronger volumetric and delta metrics compared to the broader NASDAQ market, reflecting strong underlying bullish conviction.

INTC Stock Trader & Investor Strategic Update

Why This Matters:

Stocks exhibiting strength independent of broader market trends indicate substantial buyer conviction, potentially translating into sustained upward movements.

Actionable Insights:

-

Monitor Key Resistance: Closely watch the recent pivot high at $23.38 for breakout confirmation.

-

Evaluate Pullbacks: Utilize minor market pullbacks as strategic opportunities to accumulate shares.

-

Position Management: The stock’s robust independent strength justifies holding positions for longer durations, targeting ambitious profit objectives.

In Summary, Intel Stock Seems Bullish

Intel Corporation (INTC) shows promising bullish momentum following a stable consolidation phase. Investors adopting a balanced strategy—accumulating near critical supports and actively managing positions—could capitalize on significant upside potential, particularly if the stock decisively surpasses the key resistance at $23.38. Continued vigilance regarding price action and volume around pivotal levels will be essential for informed investment decisions. This is not financial advice and you must always do your own research and trade/invest at your sole risk only.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.