MUMBAI: In April, as US President Donald Trump rattled global markets with his tariff hike proposals for almost all its trading partners, Indians investing in equities listed abroad, especially in the US, showed their smart acumen. They doubled down on investments abroad through the month, mostly buying US stocks as markets crashed, a strategy popularly called ‘buying the dip’ in market parlance.

“April was a record-breaking month for us, with both new and existing investors showing strong conviction in building exposure to US and global equities,” said Nikhil Behl, co-founder & CEO – stocks, INDMoney, a tech-driven platform for Indians to invest in stocks, both locally and globally.

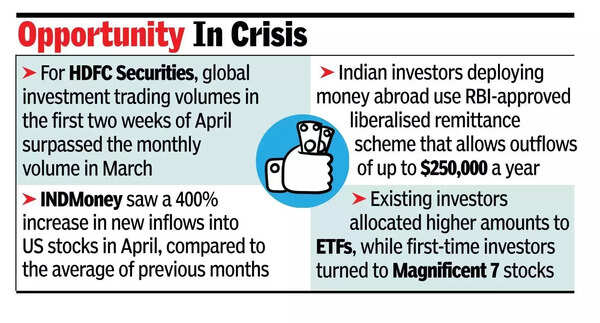

The platform saw a 400% increase in new inflows into US stocks in April, compared to the average of the previous several months, Behl said. “This month, the platform added almost as many new US stock investors as Indian stock investors – a trend we have never seen before!” said Behl.

Although no industry-wide data for Indians investing in stocks listed abroad are available, the trend across platforms that facilitate domestic investors to invest abroad was similar. For HDFC Securities, in the first two weeks itself, trading volumes in global investing surpassed the monthly volume in March. “We have seen a significant uptick in both user activity and investment volumes following the recent tariff announcements,” said Abhishek Mehrotra, Head Equities & Investment Products, HDFC Securities.

For Appreciate, another platform in the same segment, “there was a 2.5x increase in average stock purchases and a 2x increase in average stock purchase value per user in the period following tariff announcements compared to the previous period,” said Shlok Srivastav, COO & co-founder of the platform.

Indian investors use the RBI-approved liberalised remittance scheme(LRS) that allows each resident Indian to invest up to $250,000 per annum to put money in equities listed in foreign exchanges. Such enthusiasm by domestic investors, according to Behl, was mainly because they saw the market volatility as a prime buying opportunity, especially in innovation-led sectors like AI, semiconductors, and large-cap tech. “Well-known names like Apple, Google, and Meta are now available at far more attractive valuations.With capital still on the sidelines, many retail investors viewed this as the right moment to deploy.”

Such investments by Indians were not concentrated, which is another sign of a matured investing approach. While some bought into the Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla), there was substantial buying interest for exchange-traded funds. Most existing US stock investors were seen spreading their risks by allocating higher amounts to ETFs, while first-time investors mostly bought stocks from the Magnificent 7 pack, Behl of INDMoney said.