Bitcoin has bounced back in recent weeks, surging as serious U.S. dollar collapse fears drive billionaire interest in bitcoin.

Front-run Donald Trump, the White House and Wall Street by subscribing now to Forbes’ CryptoAsset & Blockchain Advisor where you can “uncover blockchain blockbusters poised for 1,000% plus gains!”

The bitcoin price has soared toward its all-time high of $112,000 per bitcoin, with traders betting a looming Federal Reserve flip will turbo-charge the crypto market.

Now, as U.S. president Donald Trump issues a surprise crypto prediction, bitcoin and crypto are braced for a “huge” BlackRock crypto market bombshell that has suddenly appeared on the “horizon.”

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

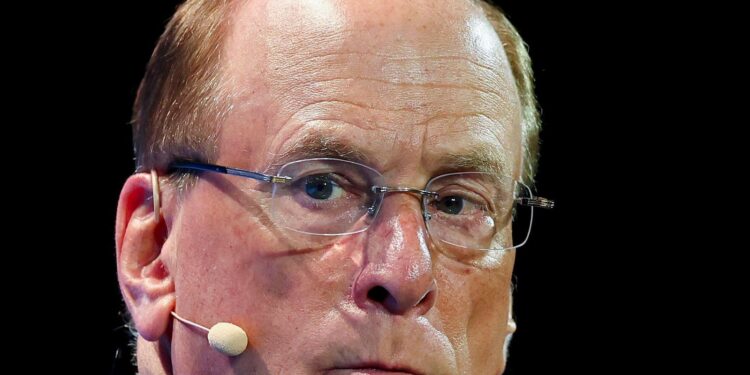

BlackRock chief executive Larry Fink has become one of the most bullish bitcoin price voices on Wall … More

In-kind redemptions for the bitcoin and crypto exchange-traded funds (ETFs) that have taken Wall Street by storm over the last 18 months could be coming soon, according to U.S. Securities and Exchange Commission (SEC) commissioner Hester Peirce.

“I can’t prejudge, but we hear that there’s a lot of interest,” Peirce, who heads up the SEC’s crypto task force, said on stage at a Bitcoin Policy Institute event, adding that in kind bitcoin and crypto ETFs are now “on the horizon.”

In-kind redemptions allow investors to exchange ETF shares directly for the underlying asset rather than receiving cash, which is currently the case for the spot bitcoin and crypto ETFs approved by the SEC in early 2024—a change described as “huge” by Bloomberg Intelligence ETF analyst Eric Balchunas.

In-kind redemptions for bitcoin and crypto funds would make it cheaper and quicker for traders to buy and sell ETF shares, potentially making them more attractive to institutional investors on Wall Street.

Earlier this year, BlackRock, which has dominated the spot bitcoin ETF market with its $75 billion IBIT fund, asked the SEC to permit in-kind creations and redemptions for bitcoin ETFs, instead of having to use cash, with the likes of Fidelity and other smaller bitcoin and crypto ETF providers following suit.

“Those (forms) are going through the process now,” Peirce said.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

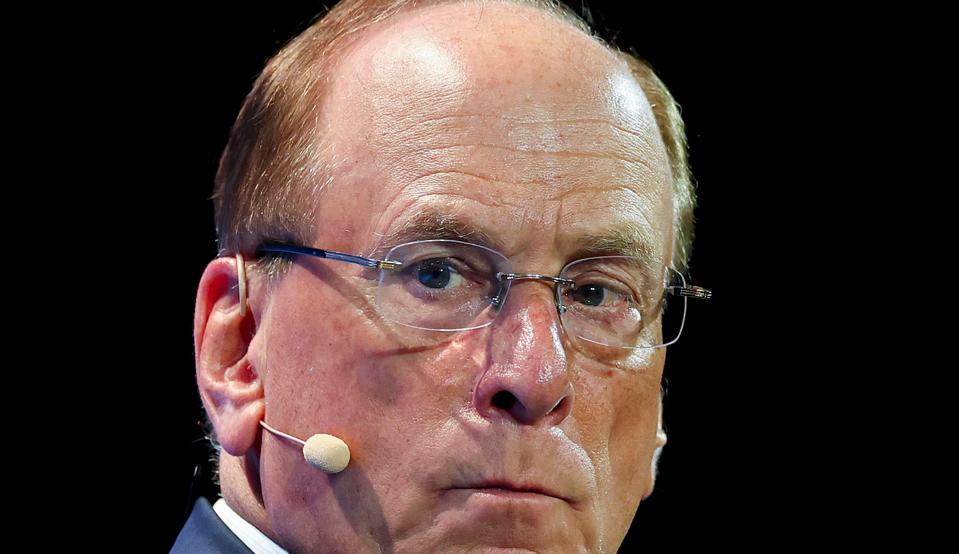

The bitcoin price has rocketed to an all-time high this year, helped by BlackRock’s massive $75 … More

BlackRock, which manages after around $10 trillion worth of assets for investors, spearheaded Wall Street’s campaign to bring a long-awaited spot bitcoin ETF to market in 2023, with a fleet of funds debuting in January 2024 that now hold 1.4 million bitcoin worth $152 billion.

BlackRock’s fund alone holds around 3% of the 21 million bitcoin that will ever exist, worth almost $75 billion at the current bitcoin price, which some have warned could be giving BlackRock outsized control over the network.

Meanwhile, the combined bitcoin price and crypto market is on the verge of a “turning point” as it hits $3.4 trillion, according to one analyst.

“The $3.4 trillion to 3.55 trillion range is a turning point, which has activated sellers and prevented the market from consolidating higher,” Alex Kuptsikevich, FxPro chief market analyst, said in emailed comments.

“Since the end of Wednesday, bitcoin has been testing the $108,000 mark, but it will sell off when it touches this level. Over the past couple of days, we have seen a smooth but steady intraday uptrend, accompanied by heavy buying from medium—and long-term investors. We see this as a sign of buying by professional market participants and link it to strengthening stocks, which increases the likelihood of reaching $110,000 or even $112,000 as early as this week.”