The U.S. Supreme Court is preparing to release its tariff ruling, potentially as soon as this week. Depending on the outcome, investors could see wildly different reactions in the stock market. Here’s what JPMorgan’s trading desk predicts could happen. Tariffs struck down and immediately replaced, 64% chance: The S & P 500 could close up 0.1% to 0.2%, after initially rallying 0.75% to 1% on the announcement Tariffs upheld, 26% chance: The S & P 500 could decline 0.3% to 0.5%, with bigger moves in the yield curve Tariffs struck down and replaced after the midterms, 9% chance: The S & P 500 could rise 1.25% to 1.5%, with the Russell 2000 significantly outperforming Tariffs struck down with no replacement, 1% chance: The S & P500 could rise 1.5% to 2%, with the Russell 2000 outperforming The high court heard oral arguments in November challenging the rationale the Trump administration used to put the levies in place. Many expected a decision could have been reached by January. On Thursday, the U.S. government said it has collected $124 billion in customs duties through tariffs in the fiscal year through January, up 304% from the same period in 2025. JPMorgan is predicting that the most likely scenario from the Supreme Court decision, with a 64% chance of occurring, is that the duties will be struck down by the court and then immediately replaced. The firm said this situation could lead to an initial burst of euphoria in the stock market before the Trump administration steps in to put into place other levies that limit any gains. Indeed, Treasury Secretary Scott Bessent has repeatedly made assertions that several sections of the 1962 Trade Act gives the president sweeping powers over import duties. “We can recreate the exact tariff structure with [sections] 301, with 232, with 122,” Bessent told host Andrew Ross Sorkin during an onstage interview at The New York Times DealBook Summit. JPMorgan’s trading desk said any new levies will mean the future realized effective tariff rate will be about the same as what was paid in 2025. The second-most likely scenario, with a 26% chance of playing out, is that the tariffs are upheld, they said. JPMorgan expects this situation could mean drastic moves in the yield curve as inflation concerns come to the fore. The S & P 500 is expected to drop with this outcome. The scenario it expects is least likely to occur, with a 1% chance, is that tariffs are struck down with no replacement. The trading desk said that could push the Trump administration to an “incrementally more dovish Fed candidate,” which would be welcomed positively by markets.

How the stock market may move on the Supreme Court’s tariff decision

Recent Posts

- Profit Taking Expected For South Korea Stock Market

- How the stock market may move on the Supreme Court’s tariff decision

- Klarna Group Shares Plunge After Q4 Results Miss Forecasts

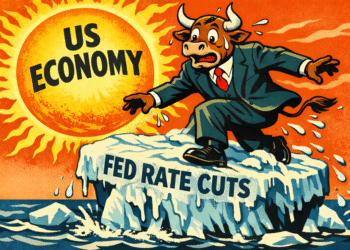

- Will the Stock Market Melt Down if the US Economy Heats Up?

- Super Micro Computer Surges After $40B Revenue Outlook Reignites AI Momentum

© 2025 - Market News Board