The US market opened the North American session with high levels of anxiety from the threat of Pres. Trump tariffs. Those tariffs or expected to be announced – and go into effect – on April 2. The news weighed on the global stock markets in the Asian Pacific sessions and the European indices as well. In the US, the pre-market futures implied a sharply lower opening as well.

In the early hours, the S&P trading down as much as -92.21 points or -1.65%. The NASDAQ index traded down as much as -468 points or -2.7%. The Dow fell -435 points.

However, as the day wore on, there were some hints from Washington that if countries made an effort toward fixing trading inequalities, the tariffs would be less. The losses started to be chipped away.

Later in the US session, Fed’s Williams and Barkin spoke and although both kinda cancelled each other out (Williams a little more dovish and Barkin a little more hawkish), the markets were encouraged.

- Williams a cautiously dovish tone, with a strong emphasis on uncertainty and data dependence. He repeatedly notes the unclear impact of tariffs and highlights the need to monitor both inflation and growth risks. He avoids firm predictions—particularly around recession odds—and underscores the importance of waiting for more data before making policy moves. While his comments lean toward patience and flexibility, he also signals vigilance on inflation, emphasizing the importance of keeping long-run expectations anchored. Overall, his stance favors a wait-and-see approach, leaning dovish but leaving room to adjust as the outlook evolves

- In contrast, Fed Barkin strikes a cautiously hawkish tone, emphasizing inflation vigilance and a patient, data-dependent approach. He highlights supplier price pressures and makes clear that rate cuts would require strong confidence that inflation is under control. While he acknowledges consumer fatigue and some risk in the labor market, his focus remains on inflation risks. Barkin avoids committing to any specific policy path, underscoring uncertainty and the importance of waiting to see how conditions evolve. Overall, he signals no urgency to cut rates and a preference to hold steady until the inflation outlook becomes clearer.

The indices had already turned mixed with Dow higher, but the markets seemed to be comforted and by the end of the day, the S&P closed higher, and the Nasdaq was near unchanged.

IN the US interest rate market, as a stocks rose, yields started to chip away at the declines in reaction to less risk off flows. A further decline in rates in the last 30 or so minutes have led to lower yields. A snapshot of the market the end of day shows:

- 2 year yield 3.891%, -1.9 basis points

- 5-year yield 3.956%, -2.3 basis points

- 10 year yield 4.212%, -4.2 basis points

- 30 year yield 4.580%, -5.2 basis points

For the first quarter of the year, yields were sharply lower:

- 2-year yield, -35.3 basis points

- 5-year yield -42.2 basis points

- 10 year yield -36.2 basis points

- 30 year yield -20.6 basis points

In the forex market, the USD was more bid today on risk-off sentiment, and although it is still closing higher on the day, it is also off the highs. Nevertheless, the biggest gains for the greenback came against the CAD, AUD and NZD (0.48%, 0.62% and 0.65% respectively) as risk off and fears of tariffs hurt those currencies.

In Australia, the Reserve Bank of Australia interest rate decision in the new trading days also a risk event. The central bank is expected to keep rates unchanged. Traders will be focused on the comments and hints for policy going forward.

Looking at the USDs changes were all positive vs the major currencies:

- EUR +0.10%

- JPY +0.06%

- GBP +0.14%

- CHF +0.43%

- CAD +0.48%

- AUD +0.62%

- NZD +0.65%

A snapshot of the other markets at/near the end of day shows mixed US stocks:

- Dow industrial average rose 417.86 points or 1.00% at 42001.76

- S&P index rose 30.91 point toward 0.55% at 5611.85.

- NASDAQ index fell -23.70 points or -0.14% at 17295.29.

- Russell 2000 fell -11.36 points or -0.56% in 2011.91.

The first three months of the year ended with the major indices all down.

For the year (1Q):

- Dow -1.28%

- S&P -4.59%

- Nasdaq -10.42%

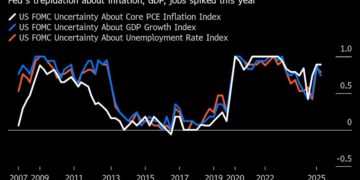

So the 1st quarter is in the books and there not a lot to write home about as fears weigh on the market including:

- Stagflation

- Higher inflation from tariffs

- Slower job market

- Q1 earnings coming lower

Tomorrow is a new day, and quarter.