This report was written by Tiger Research, analyzing Ethereum’s current dominance in the real-world asset tokenization market, examining the structural challenges it faces, and exploring which blockchain platforms are positioned to lead the next phase of RWA growth.

-

Ethereum currently leads the RWA market, supported by its first-mover advantage, past institutional experiments, deep on-chain liquidity, and decentralized architecture.

-

However, general-purpose blockchains with faster and cheaper transactions, along with RWA-specialized chains designed for regulatory compliance, are addressing Ethereum’s limitations in cost and performance. These emerging platforms are positioning themselves as next-generation infrastructure by offering either superior technical scalability or built-in compliance features.

-

The next phase of RWA growth will be led by a chain that successfully integrates three elements: on-chain regulatory compatibility, a service ecosystem built around real-world assets, and meaningful on-chain liquidity.

The tokenization of real-world assets (RWA) has become one of the most prominent themes in the blockchain industry. Global consulting firms such as BCG have released extensive market projections, and Tiger Research has conducted in-depth analyses of emerging markets like Indonesia—underscoring the sector’s growing significance.

So, what exactly is RWA? They refer to tangible assets—such as real estate, bonds, and commodities—that are converted into digital tokens. This tokenization process requires a blockchain infrastructure. Currently, Ethereum is the leading infrastructure supporting these transactions.

Despite growing competition, Ethereum has maintained its dominant position in the RWA market. Specialized RWA blockchains have emerged, and platforms like Solana, well-established in the DeFi space, are expanding into RWA. Even so, Ethereum continues to account for over 50% of market activity, underscoring the strength of its incumbent position.

This report examines the key factors behind Ethereum’s current dominance in the RWA market and explores the evolving conditions that may shape the next phase of growth and competition.

There are clear reasons why Ethereum has become the default platform for institutional tokenization. It was the first to introduce smart contracts and proactively prepared for the RWA market.

Supported by a highly active developer community, Ethereum established critical tokenization standards, such as ERC-1400 and ERC-3643, well before competing platforms emerged. This early foundation provided the technical and regulatory groundwork necessary for pilot projects.

As a result, many institutions began evaluating Ethereum before considering alternatives. Several notable initiatives during the late 2010s helped validate Ethereum’s role in institutional finance:

-

JPMorgan’s Quorum and JPM Coin (2016–2017): To support enterprise use cases, JPMorgan developed Quorum, a permissioned fork of Ethereum. The launch of JPM Coin for interbank transfers demonstrated that Ethereum’s architecture—even in a private form—could meet regulatory demands around data protection and compliance.

-

Société Générale Bond Issuance (2019): SocGen FORGE issued €100 million in covered bonds on the Ethereum public mainnet. This showed that regulated securities could be issued and settled on a public blockchain while minimizing intermediary involvement.

-

European Investment Bank Digital Bond (2021): In collaboration with Goldman Sachs, Santander, and Société Générale, the EIB issued a €100 million digital bond on Ethereum. The bond was settled using a central bank digital currency (CBDC) issued by the Banque de France, highlighting Ethereum’s potential in fully integrated capital markets.

These successful pilot cases strengthened Ethereum’s credibility. For institutions, trust is based on proven use cases and references from other regulated players. Ethereum’s track record continues to attract interest, creating a reinforcing cycle of adoption.

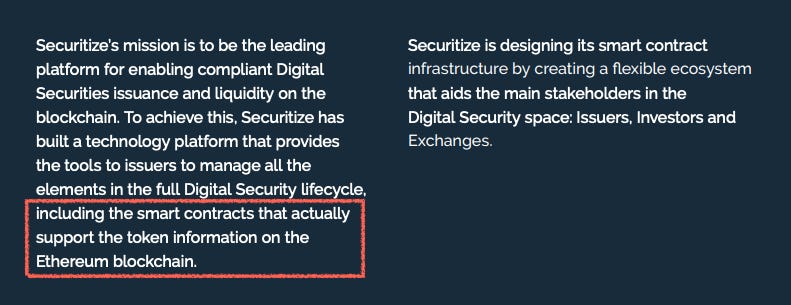

For example, in 2018, Securitize announced in official documents that it would build tools on Ethereum to manage the full lifecycle of digital securities. This initiative laid the foundation for the eventual launch of BlackRock’s BUIDL, the largest tokenized fund currently issued on Ethereum.

Another key reason for Ethereum’s continued dominance in the RWA market is its ability to convert on-chain liquidity into actual purchasing power. Tokenizing real-world assets is not merely a technical process. A functional market requires capital that can actively invest in and trade these assets. In this regard, Ethereum stands out as the only platform with deep and deployable on-chain liquidity.

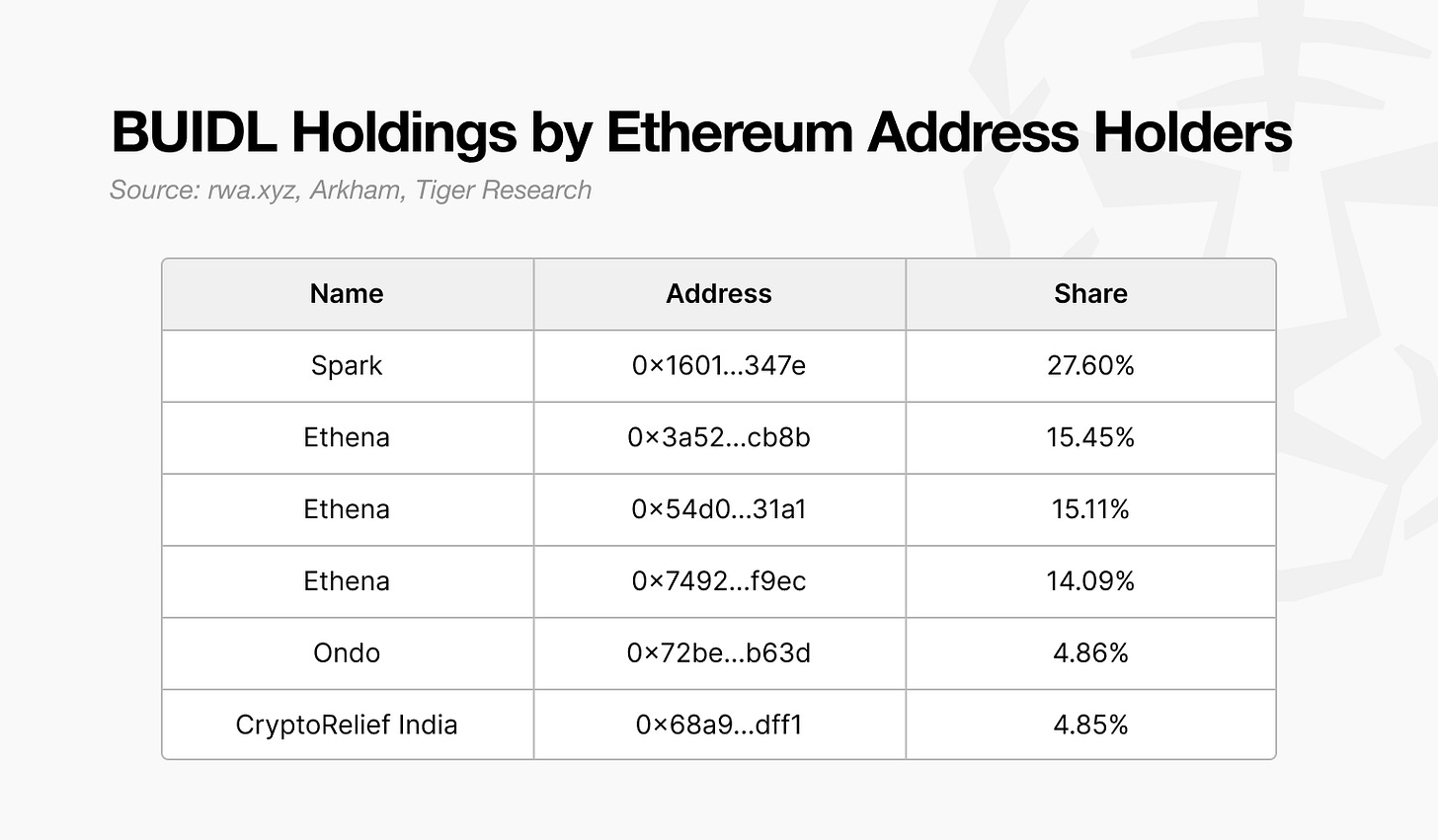

This is evident in platforms such as Ondo, Spark, and Ethena, all of which hold substantial amounts of the tokenized BUIDL fund on Ethereum. These platforms have attracted hundreds of millions of dollars by offering products based on tokenized U.S. Treasuries, stablecoin-based lending, and synthetic yield-bearing dollar instruments.

-

Ondo Finance has accumulated over $600 million in total value locked (TVL) through its treasury-backed products, USDY and OUSG.

-

Spark Protocol, leveraging DAI liquidity from MakerDAO, has purchased real-world Treasuries worth over $2.4 billion.

-

Ethena has built a bankless yield infrastructure on Ethereum using its synthetic stablecoins USDe and sUSDe, attracting both institutional demand and DeFi liquidity.

These examples show that Ethereum is not merely a platform for asset tokenization. It offers a robust liquidity base that enables real investment and asset management. In contrast, many emerging RWA platforms struggle to secure capital inflows or secondary market activity beyond the initial token issuance phase.

The reason for this divergence is clear. Ethereum already integrates stablecoins, DeFi protocols, and compliance-ready infrastructure. This creates a comprehensive financial environment where issuance, trading, and settlement can all take place on-chain.

As a result, Ethereum functions as the most efficient environment for converting tokenized assets into actual purchasing activity. This gives it a structural advantage that goes beyond simple market share.

Decentralization plays a critical role in building trust. Tokenizing real-world assets involves transferring ownership and transaction records of high-value assets to a digital system. In this process, institutional concerns center on system reliability and transparency. This is where Ethereum’s decentralized architecture offers a distinct advantage.

Ethereum operates as a public blockchain supported by thousands of independently run nodes worldwide. The network is open to anyone, and changes are determined through participant consensus rather than centralized control. As a result, it avoids single points of failure, ensures resilience against hacks and censorship, and maintains uninterrupted uptime.

In the RWA market, this structure creates tangible value. Transactions are recorded on an immutable ledger, reducing fraud risk. Smart contracts enable trustless transactions without intermediaries. Users can access services, execute agreements, and engage in financial activity without requiring central approval.

These attributes—transparency, security, and accessibility—make Ethereum a compelling choice for institutions exploring asset tokenization. Its decentralized system aligns with the key requirements for operating in high-stakes financial environments.

Ethereum’s mainnet demonstrated the feasibility of tokenized finance. However, along with its success, it also exposed structural limitations that hinder broader institutional adoption. Key barriers include limited transaction throughput, latency issues, and an unpredictable fee structure.

To address these challenges, Layer 2 rollup solutions such as Arbitrum, Optimism, and Polygon zkEVM have emerged. Major upgrades—including the Merge (2022), Dencun (2024), and the upcoming Pectra (2025)—have brought improvements in scalability. Still, the network falls short of matching traditional financial infrastructure. For example, Visa processes over 65,000 transactions per second, a level Ethereum has yet to achieve. For institutions that require high-frequency trading or real-time settlement, these performance gaps remain a critical constraint.

Latency and finality also pose challenges. Block production averages 12 seconds, and with the additional confirmations required for secure settlement, finality typically takes up to three minutes. Under network congestion, this delay can increase further—posing difficulties for time-sensitive financial operations.

More significantly, the volatility of gas fees continues to be a concern. During peak periods, transaction fees have exceeded $50, and even under normal conditions, costs frequently rise above $20. This level of fee uncertainty complicates business planning and can weaken the competitiveness of Ethereum-based services.

Securitize illustrates this dynamic. After encountering Ethereum’s limitations, the company expanded to other platforms such as Solana and Polygon while also developing its own chain, Converage. While Ethereum played a vital role in enabling early institutional experimentation, it now faces mounting pressure to meet the demands of a more mature and performance-sensitive market.

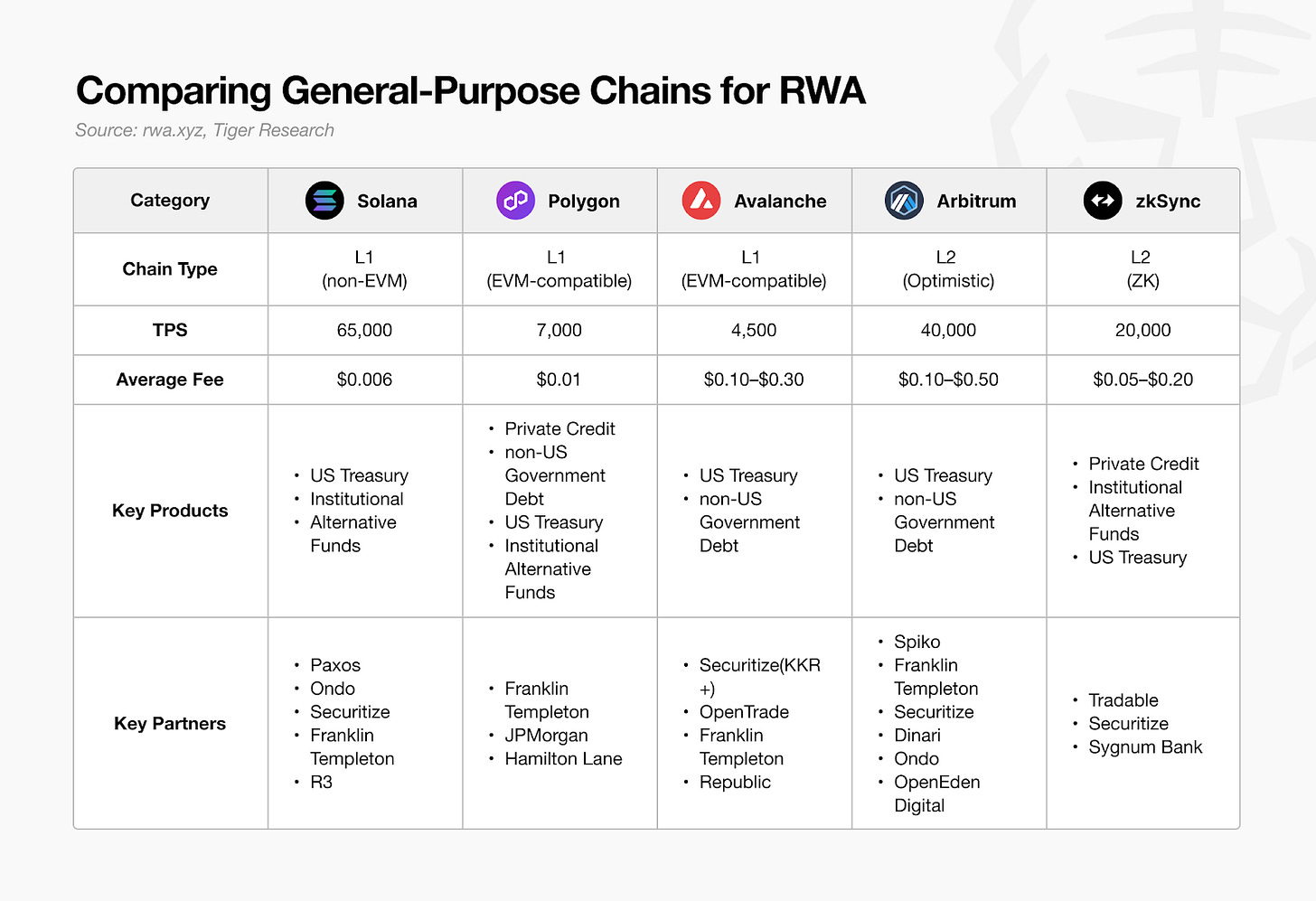

As Ethereum’s limitations become more apparent, institutions are increasingly exploring general-purpose blockchains that offer alternative strengths to Ethereum. These platforms complement Ethereum by addressing key performance bottlenecks—particularly in transaction speed, fee stability, and time to finality.

However, despite ongoing collaboration with institutional players, the actual volume of tokenized assets—excluding stablecoins—remains far lower on these platforms compared to Ethereum. In many cases, tokenized assets launched on general-purpose chains are still part of a multi-chain deployment strategy led by Ethereum.

Even so, there are signs of meaningful progress. In the private credit segment, new tokenization initiatives are emerging. On zkSync, for instance, the platform Tradable has gained traction, accounting for over 18% of activity in this sector—second only to Ethereum.

At this stage, general-purpose blockchains are just beginning to establish a foothold. Platforms like Solana, which have seen rapid growth in their DeFi ecosystems, now face a strategic question: how to translate this momentum into a sustainable position in the RWA space. Superior technical performance alone is not sufficient. Competing with Ethereum will require infrastructure and services that meet the trust and compliance expectations of institutional investors.

Ultimately, the success of these blockchains in the RWA market will depend less on raw throughput and more on their ability to deliver tangible value. Differentiated ecosystems—built around each chain’s unique strengths—will determine their long-term positioning in this emerging sector.

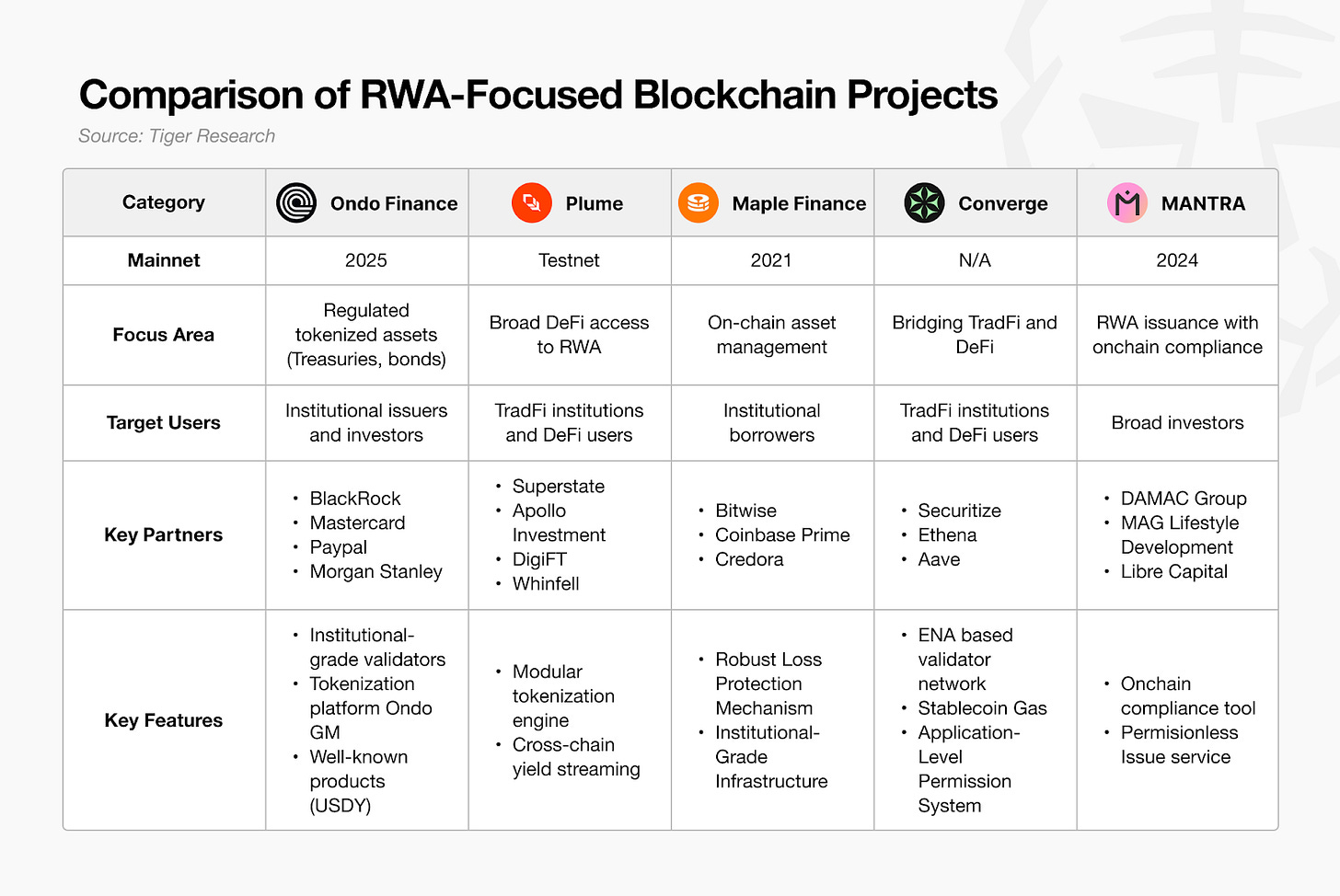

A growing number of blockchain platforms are moving away from general-purpose designs in favor of domain-specific specialization. This trend is also evident in the RWA space, where a new wave of purpose-built chains is emerging, optimized specifically for the tokenization of real-world assets.

The rationale for RWA specialized blockchains is clear. Tokenizing real-world assets requires direct integration with existing financial regulations, making the use of general blockchain infrastructure insufficient in many cases. Specialized technical requirements—particularly around regulatory compliance—must be addressed from the ground up.

One critical area is compliance processing. KYC and AML procedures are essential to the tokenization workflow, yet these have traditionally been handled off-chain. This approach limits innovation, as it merely wraps traditional financial assets in a blockchain format without redesigning the underlying compliance logic.

The shift now lies in bringing these compliance functions fully on-chain. Demand is growing for blockchain networks that can not only record ownership but also enforce regulatory requirements natively at the protocol level.

In response, several RWA-focused chains have started to offer on-chain compliance modules. For instance, MANTRA includes decentralized identity (DID) features that support compliance enforcement at the infrastructure layer. Other specialized chains are expected to follow similar paths.

In addition to compliance, many of these platforms are targeting specific asset classes with deep domain expertise. Maple Finance focuses on institutional lending with asset management, Centrifuge on trade finance, Polymesh on regulated securities. Rather than tokenizing broadly held assets like sovereign bonds or stablecoins, these chains are pursuing vertical specialization as a competitive strategy.

That said, many of these platforms are still in early stages. Some have yet to launch their mainnet, and most remain limited in terms of scale and adoption. If general-purpose chains are just starting to gain traction in the RWA space, specialized chains are still at the starting line.

Ethereum’s dominance in the RWA market is unlikely to persist in its current form. Today, the size of the tokenized asset market accounts for less than 2% of its projected potential, indicating that the sector remains in an early stage. Ethereum’s advantage to date has largely stemmed from its early discovery of product-market fit (PMF). However, as the market matures and scales, the competitive landscape is expected to shift significantly.

Signs of this transition are already evident. Institutions are no longer exclusively focused on Ethereum. Both general-purpose and RWA-specialized blockchains are being evaluated, and an increasing number of services are exploring custom chain deployments. Tokenized assets originally issued on Ethereum are now expanding into multichain ecosystems, breaking down the previous monopoly structure.

A critical turning point will be the utilization of on-chain compliance. For blockchain-based finance to represent genuine innovation, regulatory processes such as KYC and AML must occur directly on-chain. If specialized chains succeed in offering scalable, protocol-level compliance and drive industry-wide adoption, the current market hierarchy could be significantly disrupted.

Equally important is the presence of real purchasing power. Tokenized assets only become investable once there is active capital willing to acquire them. Regardless of the technology, without meaningful liquidity, tokenization has limited utility. As a result, next-generation RWA platforms must cultivate a robust ecosystem of services built on tokenized assets and ensure strong liquidity participation from users.

In short, the conditions for success are becoming clearer. The next leading RWA platform will likely be one that achieves all three of the following:

-

A fully integrated on-chain compliance framework

-

A service ecosystem built on tokenized assets

-

Deep and sustainable liquidity enabling real investment

The RWA market is still in its infancy. Ethereum has proven the concept. The opportunity now lies with platforms that can offer superior solutions—those that meet institutional requirements while unlocking new value in the tokenization economy.

Read more reports related to this research.This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.