Key Insights:

- Whale buys $100M ETH near cycle lows, signaling accumulation phase.

- ETH ETFs post $170M outflows in April amid market uncertainty.

- Ethereum trades in a tight range; breakout expected soon, direction unclear.

Ethereum (ETH) traded at $1,604 on April 19, climbing just over 1% from the previous day. Despite modest gains, ETH remained down 21% this month and continues to hover near bear market lows.

A $100 Million whale purchase has reignited discussions about the second-largest cryptocurrency’s future. Analysts are debating whether it is establishing a base or preparing for further declines.

Whale Moves In as Ethereum Price Nears Historical Lows

Crypto Rover reported that a single whale accumulated 46,577 ETH, worth roughly $100 Million, over the past two months. The buying spree came as Ethereum dipped below $1,600, marking levels not seen since the 2022 cycle low.

Analyst Heisenberg said he had “aped” into ETH near $1,400 and was watching for a sweep of 2022’s bottom. He maintained a bullish bias on long-term Ethereum recovery, contingent on retesting that key level.

“Buy at 2022 Cycle’s low sweep and SLEEP!” he posted on X. The whale accumulation coincided with a reversal from the $1,500 support zone. Ethereum reclaimed the $1,600 handle during Friday’s session. However, the broader sentiment remains fragile.

Ethereum ETFs Log Heavy Outflows

According to SoSoValue, Ethereum spot exchange-traded funds in the U.S. saw $32.17 Million in outflows over the past week. That brought April’s total to $170.99 million. Some days even recorded neutral flows, suggesting indecision among market participants.

Since January 2025, ETH ETFs have hemorrhaged over $900 million. Outflows accelerated after President Donald Trump’s administration reintroduced tariffs.

This impacted investor appetite across risk-on assets. The prolonged selling pressure has kept ETH well below its 2025 high of $3,500.

Market sentiment mirrored the trend. Over the past 24 hours, Ethereum’s trading volume dropped 23% to $10.5 Billion. This lack of momentum and capital inflow signals broader hesitation.

RSI Weak, Compression Signals Imminent Move

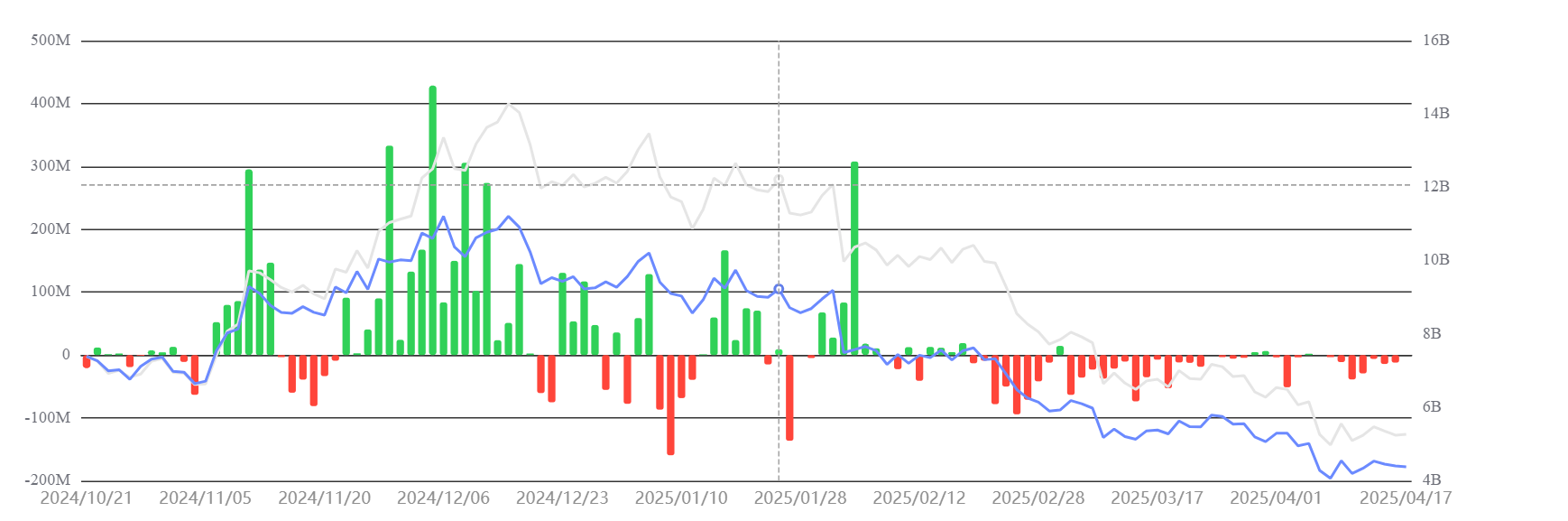

The daily chart of Ethereum showed a descending channel stretching from early February to mid-April. The RSI remained below 42, hinting at lingering bearish pressure. However, the price recently bounced from the lower bound of this falling channel.

Technical trader Daan noted that ETH had entered “extremely compressed” territory, with price action remaining flat for over two days. “This usually precedes a major move,” Daan posted. He did not speculate on direction.

The compression setup has historically led to extensive breakouts in either direction. ETH’s inability to reclaim the $1,700 resistance or sustain a move above the 200-day EMA suggests bulls remain cautious. The real test lies above $1,850, a level that would confirm a shift in short-term sentiment.

Macro Pressure Weighs on Market Structure

Global macro conditions have exacerbated Ethereum’s volatility. The ongoing trade war between the U.S. and China continues to drag on investor confidence.

China remains excluded despite the Trump administration’s 90-day tariff pause for most countries. This has added uncertainty to global markets, affecting crypto assets like ETH.

Market expert Ted Pillows emphasized that Ethereum’s fundamentals remain intact. He noted that 95% of stablecoin activity and the highest total value locked in decentralized finance still occur on Ethereum.

Pillows also highlighted the role of Ethereum in the real-world asset narrative and the network’s spot ETF status in the U.S.

Bulls Watch Key Levels as Liquidity Dries Up

ETH bulls continue to monitor $1,550 as critical short-term support. Altcoin Gordon says a drop below that level could open the door to $1,100. Meanwhile, analysts like CryptoGoos maintain a bullish long-term view, projecting a return to $2,800 if macro conditions improve.

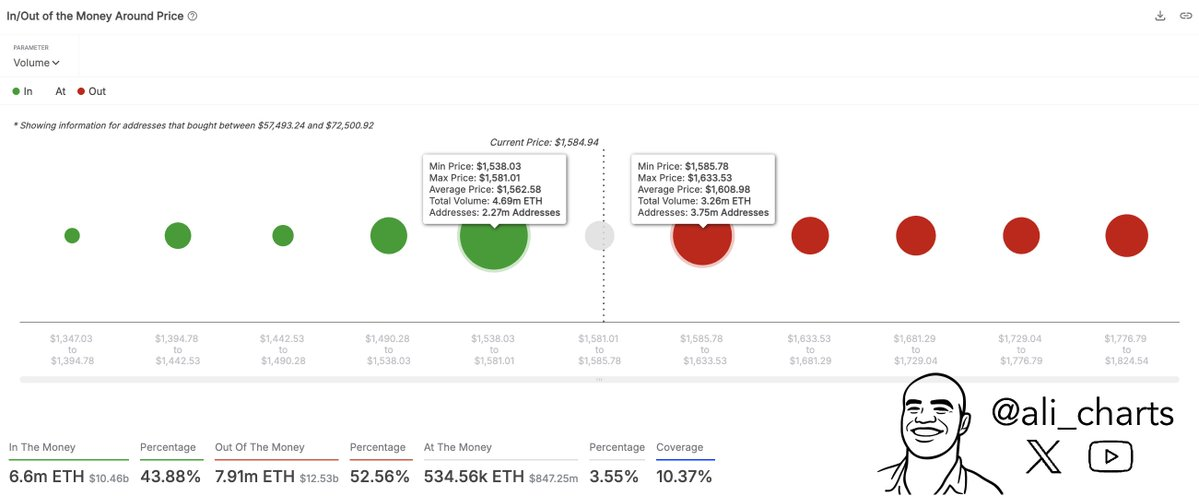

On-chain data from Ali Martinez showed whales offloaded 143,000 ETH last week, further complicating the outlook. Martinez said Ethereum traded between two supply zones at $1,540 and $1,630. He called it a make-or-break level for the trend.

ETH remained caught between weak fundamentals and bullish expectations. The significance of the $100 million whale purchase hinges on Ethereum maintaining levels above $1,500. Sustained support could suggest a bottom, while a failure might point to a dead-cat bounce.

Disclaimer

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.