Ethereum is trading above $2,600 despite the Bitcoin dip. ETF inflows top $91 million as ETH eyes a breakout toward $3,000.

Despite a steep correction in Bitcoin, Ethereum continues to hold its ground above $2,600. As Ethereum’s price trend diverges from Bitcoin’s, the market is anticipating the start of a new altcoin season.

Ethereum Price Analysis

On the daily chart, Ethereum maintains a sideways trend, testing its upper ceiling near the 50% Fibonacci retracement level at $2,699. Currently, Ethereum is trading at $2,625 after a pullback of nearly 1.88% on Thursday.

As Ethereum hints at a potential range breakout, the Fibonacci levels indicate immediate resistance at the 61.8% level, close to the psychological barrier of $3,000.

Supporting the upside potential, the Supertrend indicator signals a continuing uptrend, while the RSI hovers near the overbought zone, suggesting strong bullish momentum.

On the downside, key support remains at the 38.2% Fibonacci level, around $2,395.

Institutional Support Grows for Ethereum

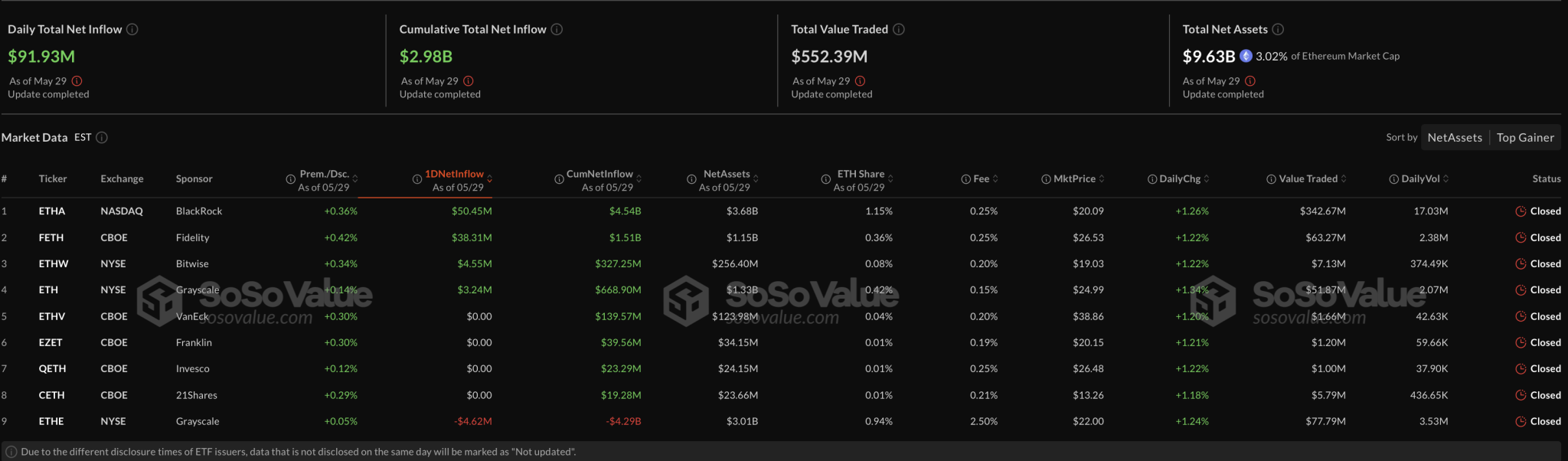

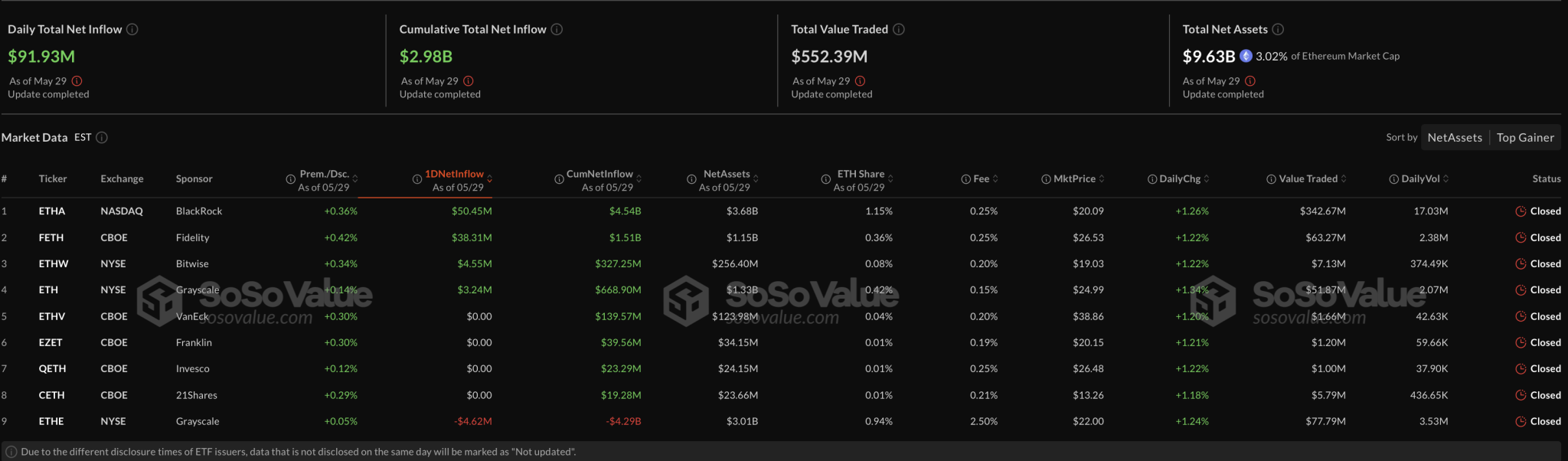

Amid the increasing likelihood of a bullish recovery, institutional support for Ethereum is growing. On May 29, Ethereum ETFs recorded a total daily net inflow of $91.93 million.

This marks the ninth consecutive day of positive inflows, bringing total net assets to $9.63 billion. On May 29, BlackRock led the inflows with $50.45 million, followed by Fidelity with $38.31 million.

Analyst Shares $3,000 Price Target

Sharing an optimistic outlook, Income Sharks recently tweeted about Ethereum’s strong upside potential. The analyst noted that a slight pullback was expected following the breakout of key resistance near $2,400.

As Ethereum fluctuates below the $2,700 level, the analyst maintains an upside target of $3,000, with a longer-term estimate extending to $4,000 as the bull run continues.

Bullish Sentiment Holds in Derivatives Market

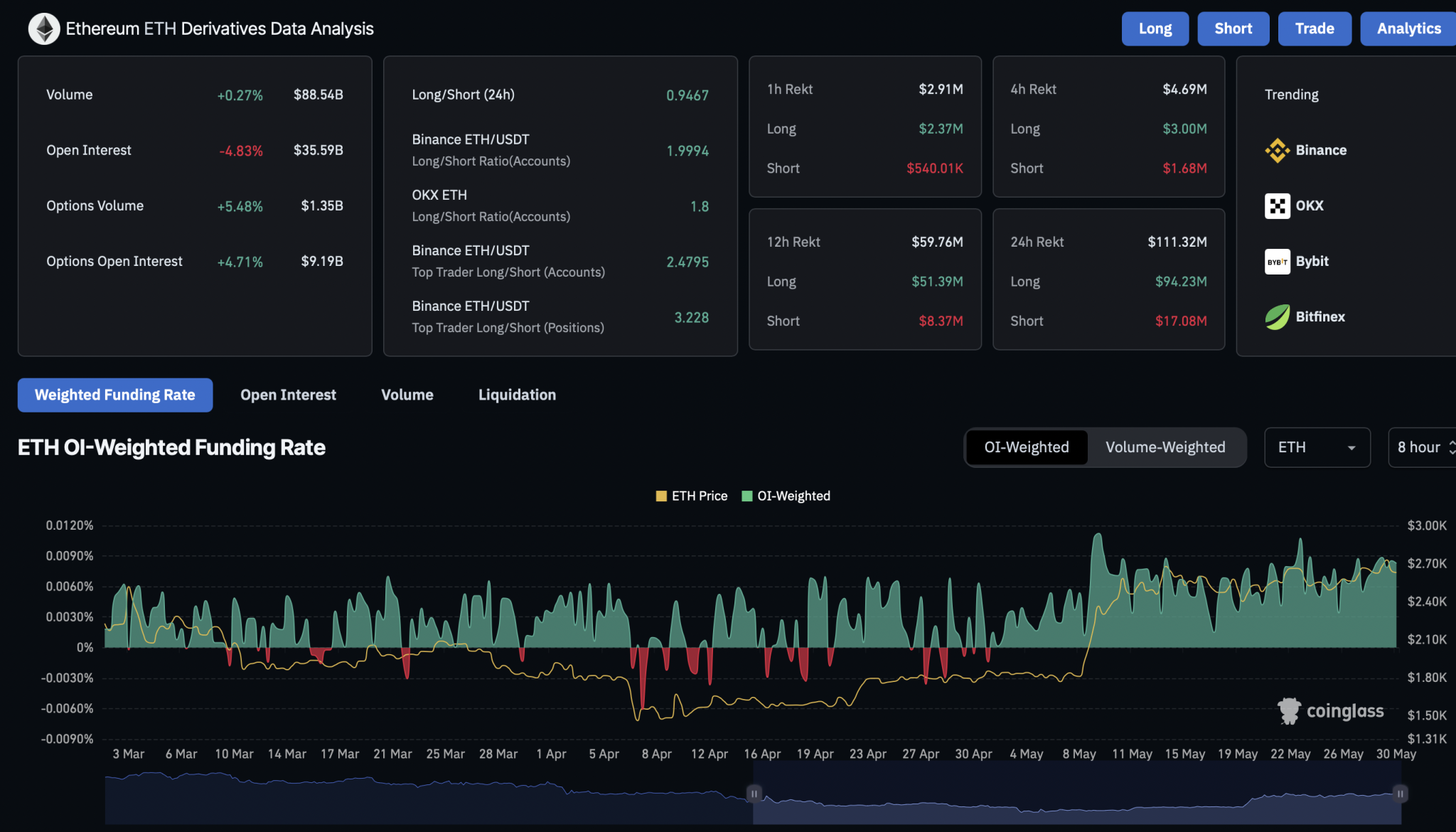

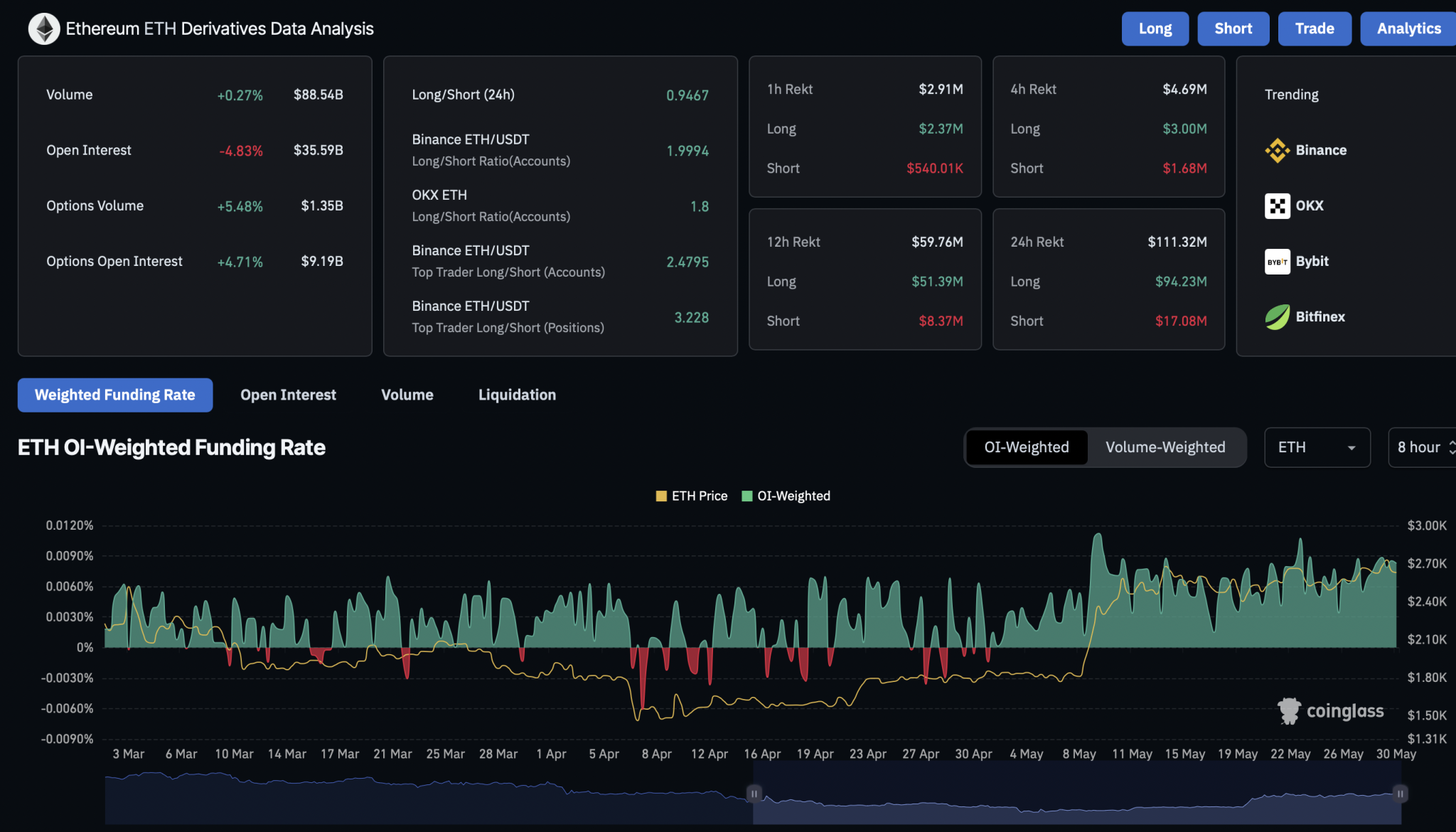

As Ethereum sustains the potential for a breakout, short-term volatility has triggered a spike in bearish sentiment within the derivatives market. Ethereum’s open interest is down 4.83% over the past 24 hours, reaching $35.59 billion.

In the same period, long liquidations surged to $94.23 million, significantly outweighing short liquidations of $17.08 million. Despite this large-scale unwinding of bullish positions, the funding rate remains elevated at 0.0083%.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.