Key Insights:

- Ethereum sellers are getting exhausted, signaling a potential price recovery.

- Whales are accumulating large amounts of ETH, indicating bullish sentiment.

- A bullish cross on ETH/BTC chart supports Ethereum’s upward momentum.

Ethereum is showing signs of a potential price rally as market conditions shift. Recent data and technical signals indicate a bullish outlook for $ETH, with sellers becoming exhausted and whales stepping in to accumulate large amounts of the cryptocurrency.

Additionally, key technical indicators suggest that Ethereum’s price could surge toward the $5,000 mark in the coming months.

Exhaustion of Sellers Signals Potential Rebound

The current market for Ethereum shows a clear sign of waning selling pressure. According to the chart, the net taker volume, which tracks buying and selling pressure, reveals that selling momentum is weakening.

As this pressure fades, it creates a favorable environment for buyers to take control, potentially driving the price upward. The weakening of sellers indicates that the market could be nearing a bottom, setting the stage for a rebound.

Market analysts suggest that the exhaustion of sellers is often a precursor to upward price movement. As sellers exit the market, buyers begin to step in, pushing prices higher. With Ethereum nearing its support levels and a decrease in selling activity, the outlook for $ETH is turning more positive. Analysts predict that if these conditions continue, Ethereum could head toward $5,000.

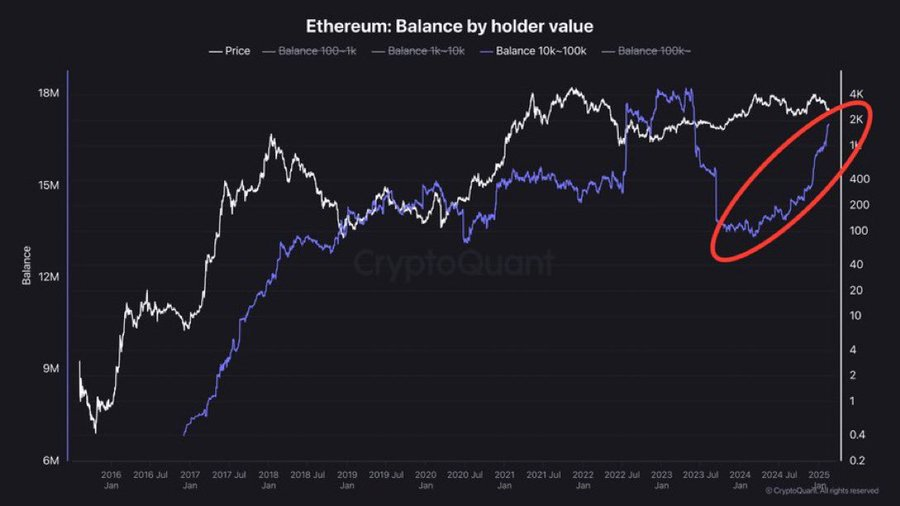

Whale Accumulation Indicates Growing Confidence

Other than the exhaustion of Ethereum, we are noticing a remarkable increase in whale activity in Ethereum. $ETH holders with large wallets are accumulating tokens indicating confidence in the coin’s longer term value. It seems wallets holding more than 100 ETH have increased balances in recent days and this has been a bullish sign with data.

Whales actions can have a tremendous impact on the price of Ethereum. Once the market pops this demand it has a tendency to transform into higher prices. The truth is that even with the current market and price movement, whales are still buying ETH which means they see a great future for the price. If whales continue to build up Ethereum, more of these larger holders can help demand for the cryptocurrency, which could fire the price.

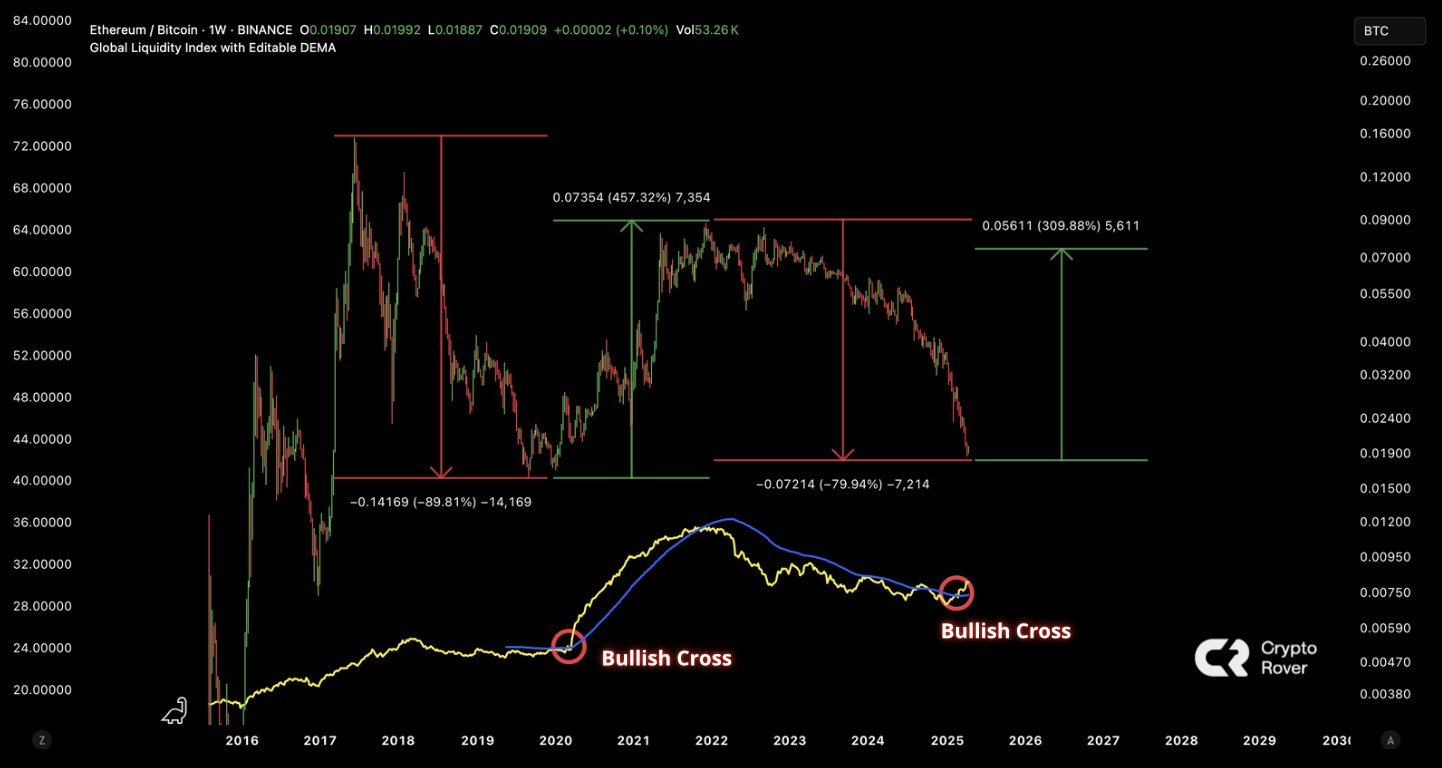

Ethereum Bullish Cross Supports Upward Momentum

Technically, Ethereum’s price against Bitcoin shows a strong bullish momentum. As you can see from the chart, Ethereum is displaying a bullish cross between two key moving averages, a read that the currency is about to breakout. A r bulls cross when a smaller MA crosses above a larger MA indicating there is a buying momentum.

The consolidation for Ethereum has lasted for quite a while, which is followed by a current bullish cross. Historically, this pattern preceded significant rallies, and there’s a good chance Ethereum is about to bounce soon with a high percentage unconditioned move.

Ethereum could rise to higher price levels tethered to a bullish cross on the market analysts and a drop in selling pressure with an increase in whale accumulation.

Ethereum Network Fees Hit 4-Year Low

On-chain fundamentals are also improving. According to Santiment, Ethereum transaction fees have dropped to $0.168—the lowest since May 2020. Lower fees typically signal better network scalability and broader accessibility for users.

The decline in gas fees coincides with improved Ethereum scalability, likely driven by Ethereum 2.0 upgrades and growing Layer 2 adoption. Reduced transaction costs make the network more attractive to users and developers, potentially increasing activity and, by extension, demand for ETH.

If this uptick in network usage persists, it may serve as another catalyst for a price recovery.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Olivia Stephanie is a FinTech enthusiast with a keen understanding of financial markets. Her passion for economics and finance has led her to explore emerging blockchain technology and cryptocurrency markets.