Ethereum is nearing a breakout above $1,850 as rising open interest, increasing long positions, and on-chain volume trends suggest a bottom may be forming.

As Bitcoin climbs above the $97,000 mark, Ethereum struggles around the $1,800 level. However, the daily chart reflects a short-term recovery trend, nearing a potential breakout rally. Will a post-retest reversal push Ethereum past the $2,000 mark?

Ethereum Price Analysis

In the daily chart, Ethereum’s price reversal has breached a long-standing resistance trendline, confirming a bullish breakout from a falling channel pattern.

Ethereum is currently trading at $1,821 after a 2.51% surge last night. However, the bullish trend still faces strong resistance near the high-supply zone around the $1,850 level.

This resistance constrains the breakout rally and may lead to a potential retest. Still, the ongoing recovery has triggered a positive cycle in the MACD and signal lines.

The declining 50-day EMA aligns with the supply zone, acting as a dynamic resistance. A breakout above the 50-day EMA and the supply zone would likely generate a buy signal for price action traders.

Based on Fibonacci retracement levels, the next immediate resistance lies at the 23.60% level near the psychological $2,000 mark. Beyond that, the 200-day EMA near the 38.20% level at approximately $2,400 will serve as a critical resistance.

On the downside, key support remains near the $1,600 level.

Near-Zero Rates Fuel Surge in Long Positions

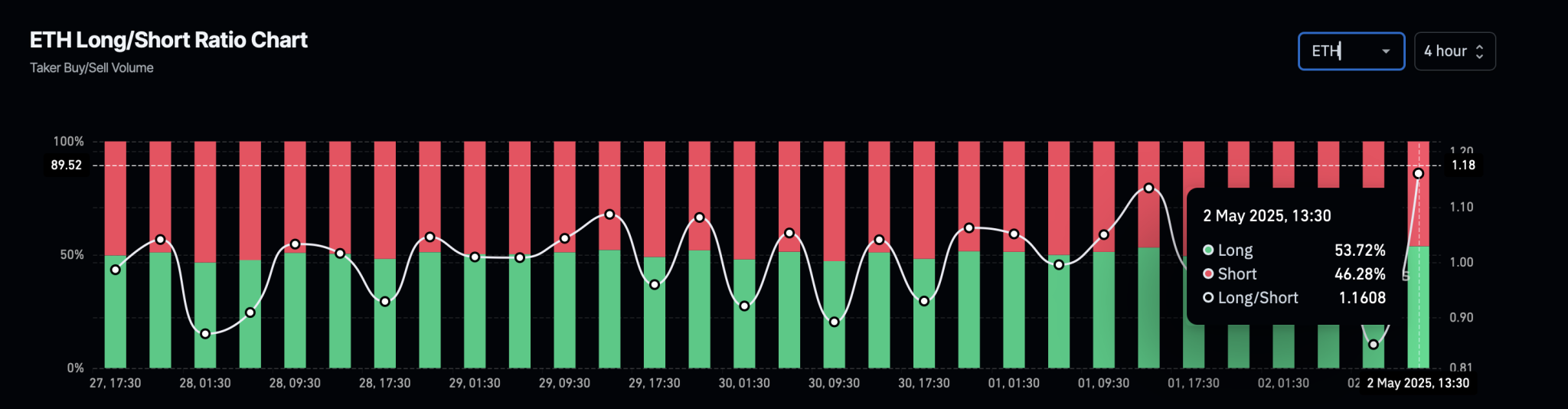

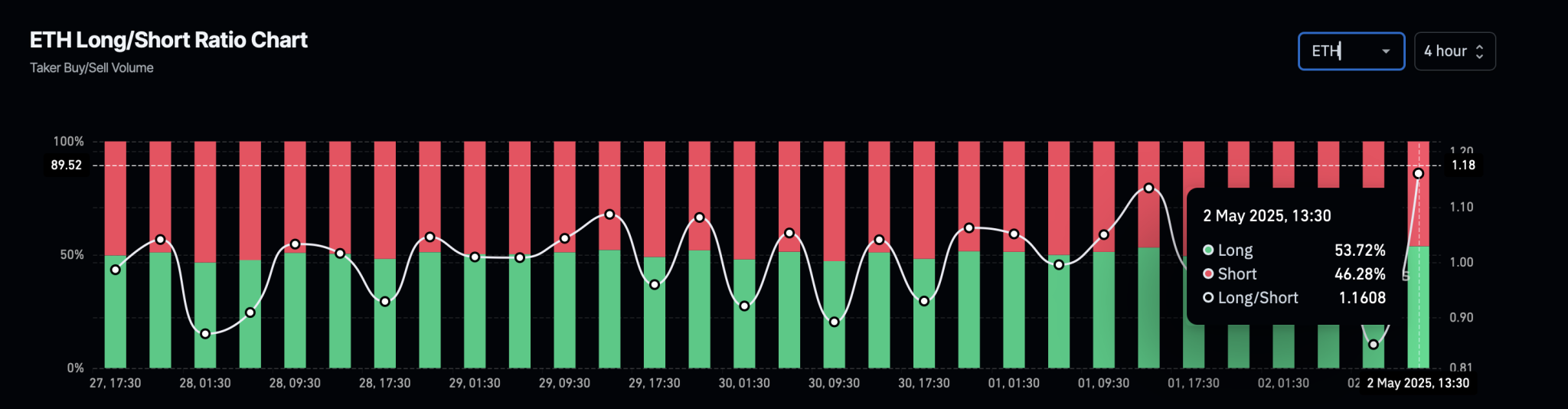

In the derivatives market, traders anticipate a major breakout rally in Ethereum. The Ethereum Long-to-Short Ratio chart shows 53.72% long positions accumulated over the past four hours.

This puts the Long-to-Short Ratio at 1.1608, indicating a bullish dominance. Additionally, open interest has increased by more than 3%, reaching $21.60 billion, while the overall market funding rate remains near 0%.

A near-zero funding rate lowers the cost of holding long positions, which is likely reinforcing bullish sentiment.

Historic Returns Suggest Bullish Reversal

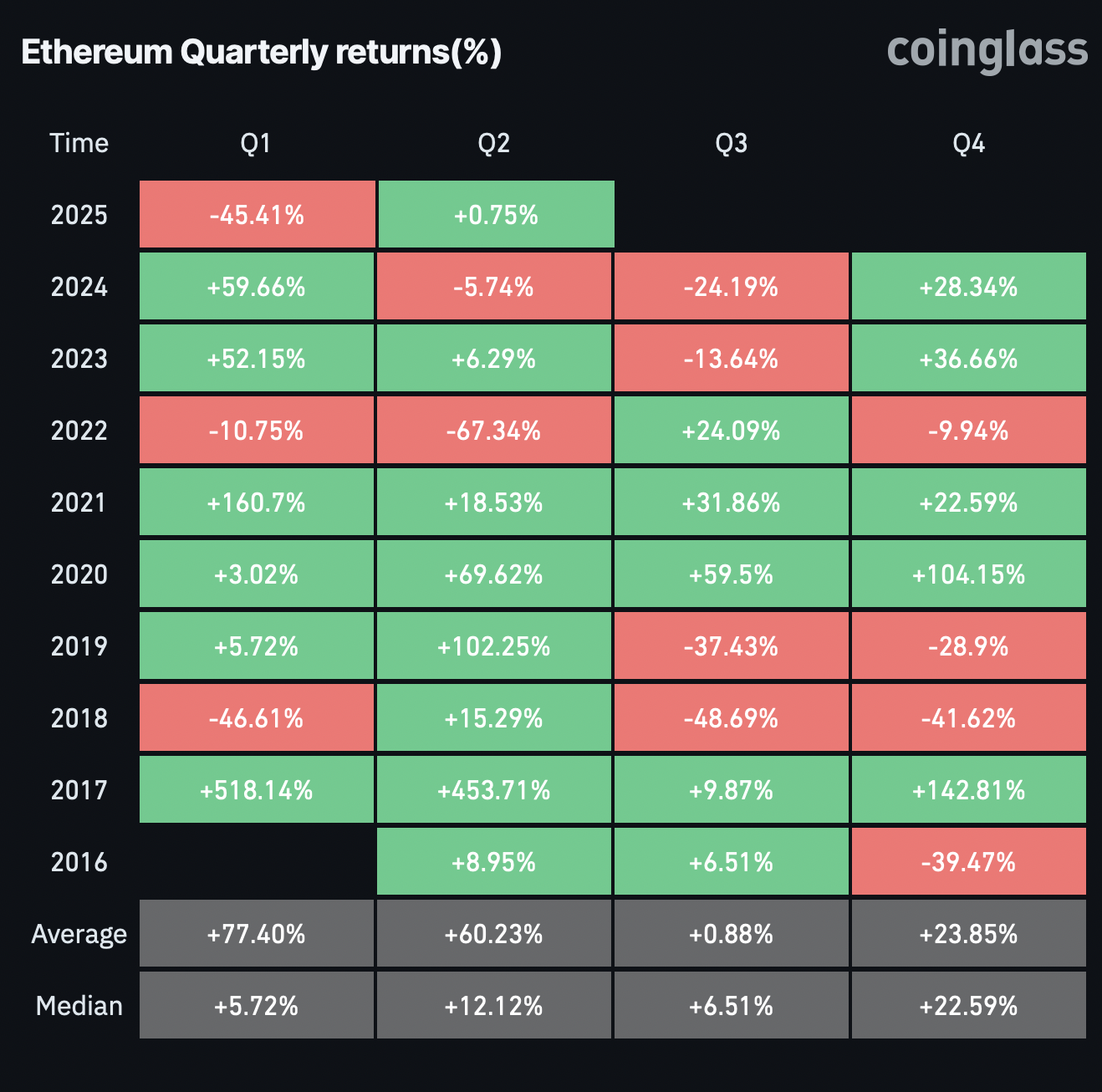

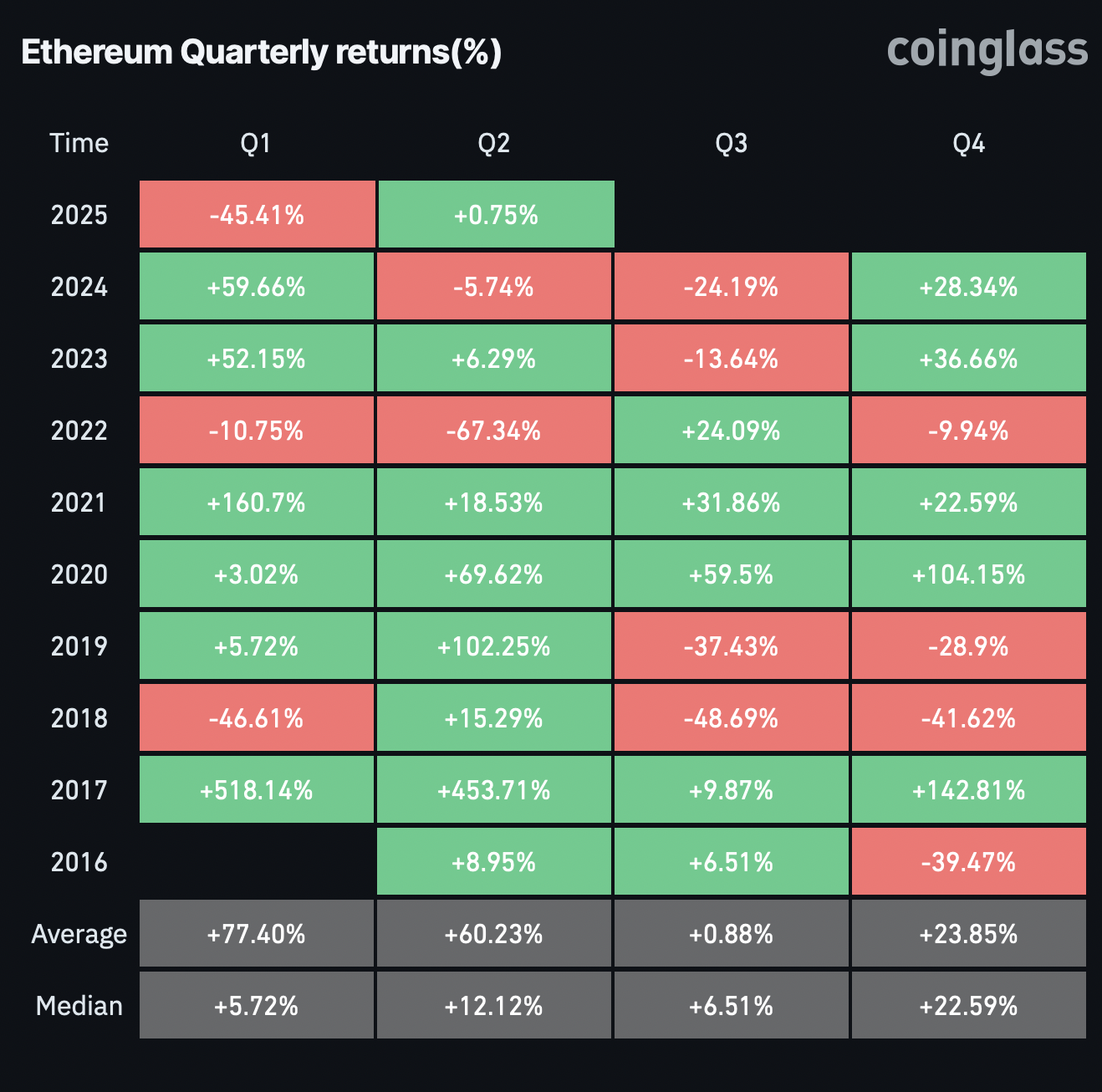

The historical price returns in Ethereum support the possibility of a breakout rally. Based on the data from CoinGlass, the Ethereum quarterly returns highlight a possibility of a bullish comeback.

Since 2016, Ethereum has posted positive Q2 results in seven out of nine years—excluding 2022 and 2024. The average Q2 return stands at nearly 60%, with a median return of 12.12%.

Ethereum Selling Pressure Waning

According to data from CryptoQuant, selling pressure in the derivatives market is gradually easing. The net taker volume turned positive on April 23 and 24 — a sign of growing buyer aggression.

As of May 1, the 30-day moving average stood at $311,406, reflecting a notable improvement. If this trend persists, Ethereum could be in the process of establishing a real bottom.

This shift may support a bullish recovery and increase the likelihood of a broader trend reversal in the coming weeks.

ETH Net Taker Volume

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.