Ethereum has suffered yet another blow this week, sliding to a fresh low of around $1,380 — a level not seen since March 2023. The ongoing downtrend has left investors increasingly concerned, with many now questioning whether ETH’s long-term bullish structure is still intact. Market conditions remain harsh, driven by persistent macroeconomic tensions, rising global instability, and uncertainty stemming from U.S. trade and fiscal policies.

Sentiment across the crypto space continues to deteriorate, and Ethereum’s price action reflects that unease. After months of struggling to hold key support levels, the breakdown below $1,500 has added to fears that a deeper correction may be unfolding.

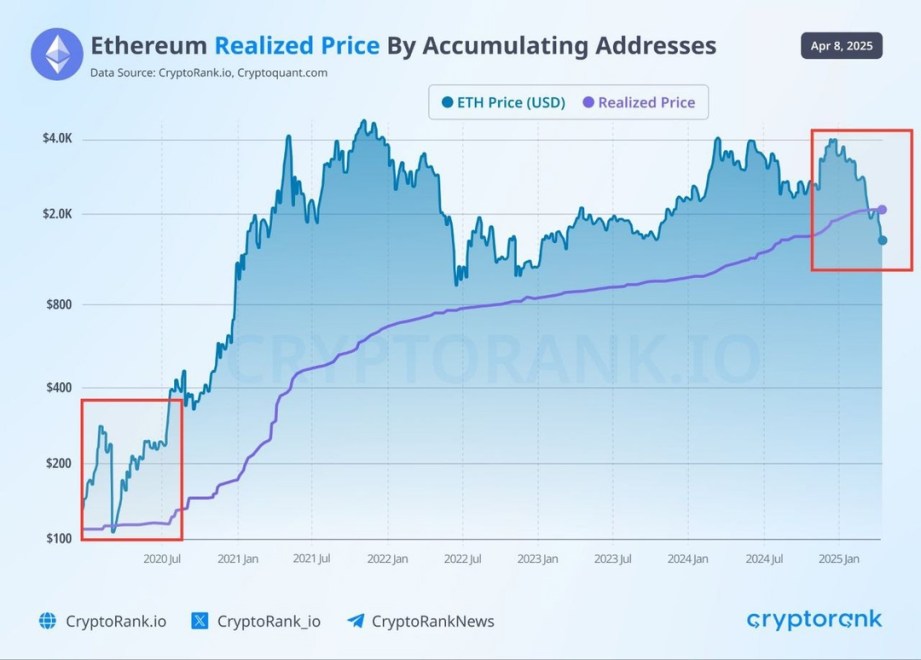

However, amidst the gloom, there may be a silver lining. According to CryptoRank data, Ethereum is now trading below its realized price — a rare occurrence historically associated with market bottoms and strong recovery phases.

While the near-term outlook remains uncertain, such rare on-chain signals could indicate that Ethereum is entering a key accumulation zone. The coming days and weeks will be critical in determining whether this is just another leg down — or the beginning of a long-term reversal.

Ethereum Sinks Below Realized Price As Fear Takes Over The Market

Ethereum has now lost over 33% of its value since late March, triggering deep concern among investors and analysts alike. The price plunge has brought ETH down to levels not seen in over two years, sparking panic and despair among holders who once expected 2025 to be a breakout year for altcoins. Instead, Ethereum has become a symbol of market fragility as the broader macroeconomic landscape continues to worsen.

Trade war fears, inflationary pressure, and a potential global recession are shaking financial markets to their core. In this climate, high-risk assets like Ethereum are among the first to suffer. As capital exits speculative assets in favor of safer havens, ETH’s selloff has only accelerated — and investor confidence has taken a serious hit.

However, there may be a glimmer of hope in the data. Top crypto analyst Carl Runefelt recently pointed out on X that Ethereum is now trading below its realized price of $2,000 — a rare occurrence that has historically signaled major turning points in ETH’s price trajectory.

Runefelt emphasized that the last time ETH dipped below its realized price was in March 2020, when it crashed from $283 to $109 — only to recover strongly in the following months. While the current environment is full of uncertainty, such on-chain metrics hint at the possibility that ETH is entering an accumulation phase once again.

Still, confidence remains fragile, and price action must stabilize before any real bullish narrative can return. Ethereum’s next moves will be critical in determining whether this level marks a true bottom — or just another stop on the way down.

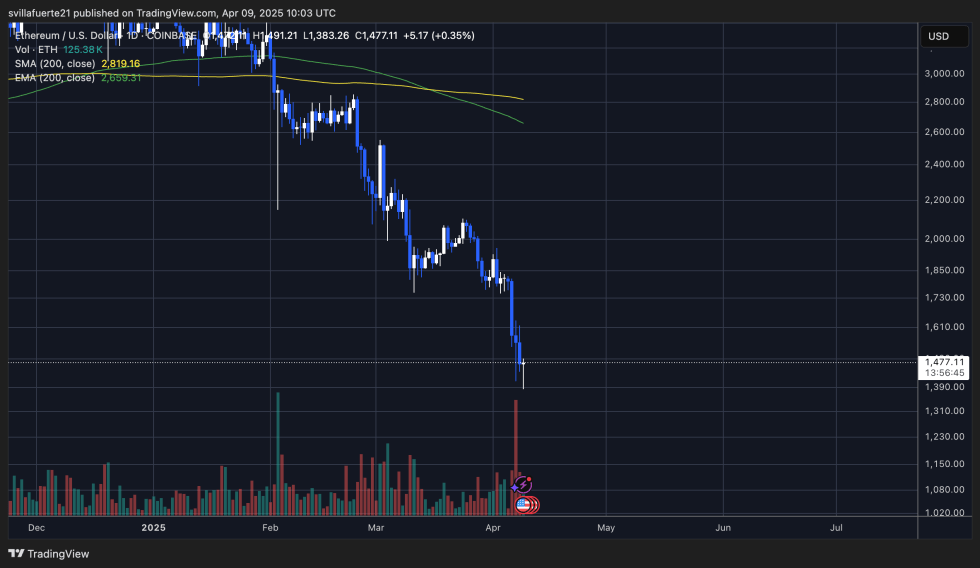

ETH Struggles Below $1,500 With No Clear Support in Sight

Ethereum is currently trading below the $1,500 level after suffering a brutal 50% decline since late February. The aggressive selloff has erased months of gains and left investors in a state of uncertainty, as ETH shows no signs of recovery. Market sentiment remains overwhelmingly bearish, and there is little indication that a bottom has been reached.

At this stage, Ethereum lacks a clearly defined support zone. Bulls have lost control, and price action continues to drift lower with weak demand and increasing fear. For a meaningful reversal to begin, ETH must first reclaim the $1,850 level — a zone that previously served as a key support and now stands as major resistance.

Until that happens, any upside attempt is likely to be met with strong selling pressure. The situation becomes even more precarious if Ethereum loses the $1,380 level, which has so far acted as a psychological threshold. Falling below this area could open the door to a deeper correction toward the $1,100–$1,200 range.

With macroeconomic tensions still high and volatility expected to persist, traders and investors will be watching closely to see whether Ethereum can stabilize — or continue its sharp decline.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.