(Reuters) – U.S. health insurer Elevance Health spent less than expected on medical care in the first quarter and said on Tuesday that demand for healthcare services among older adults was inline with expectations, allaying some concerns over elevated medical costs.

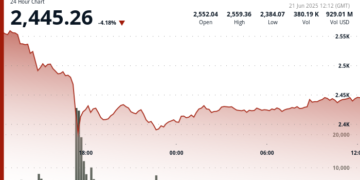

Rival UnitedHealth last week cut its full-year profit forecast and missed quarterly profit estimates for the first time since the 2008 financial crisis, due in part to high spending related to its Medicare Advantage plans for older adults and those with disabilities.

That sparked a brief selloff in shares across the sector on Thursday, but shares of other rivals pared some of their losses after Elevance pre-announced first-quarter earnings that came in ahead of expectations.

Costs related to Medicare Advantage remained elevated but manageable to start the year, Elevance Chief Financial Officer Mark Kaye said on the company’s post-earnings call on Tuesday.

“UnitedHealth is suffering from a double whammy of exposure in Medicare Advantage and in its value-based care Optum Health operations. Elevance just isn’t very big in either of those,” said Julie Utterback, an analyst at Morningstar.

UnitedHealth’s Medicare plans captured patients exiting rival Medicare businesses, but the company underestimated the use of medical services by this demographic. Higher premiums for people enrolled in Group Medicare plans prompted patients to take advantage of the medical services, said Kevin Gade, chief operating officer at Bahl & Gaynor, which owns shares of UnitedHealth.

Shares of Elevance rose 2% to $414 in early trading, while Cigna Group, CVS Health and UnitedHealth were up between 0.7% and 2.4%.

On a weekly basis, shares of UnitedHealth were down nearly 28%.

UnitedHealth also cited “unanticipated changes” in its Optum health services subsidiary as a reason for its disappointing results.

Elevance’s results “could be indicative that the recently discussed Medicare Advantage pressures may be limited to specific companies or sub-segments” said UBS analyst AJ Rice.

“On the Optum health side, which was where they had a significant earnings revision at UnitedHealth, Elevance really doesn’t have an equivalent business like that,” Rice said.

Optum’s emphasis on value-based care, where insurers are paid based on patient outcomes instead of quantity, presents a challenge as profit growth for this model has slowed, said Gade.

CFO Kaye said that group Medicare Advantage plans account for 15% of its total MA enrollment and added that the company has not seen “changes in utilization patterns from what we expected.”

Elevance also reiterated its full-year profit forecast of $34.15 to $34.85 per share, and confirmed first-quarter adjusted shareholders’ net income of $11.97 per share on Tuesday. Analysts had expected a quarterly profit of $11.38 per share.

For the quarter, the company’s medical loss ratio, a closely watched ratio to track costs, was 86.4%, below analysts’ average estimate of 86.8%. Companies aim for a ratio close to 80%.

(Reporting by Sneha S K and Manas Mishra in Bengaluru and Amina Niasse in New York; Editing by Shinjini Ganguli and Marguerita Choy)

By Sneha S K and Amina Niasse