The official PMIs, from China’s National Bureau of Statistics (NBS) are published today, for June 2025. later in the week we’ll get the unofficial, Caixin, PMIs, which are also informative. I’ve added some info below on the similarities and differences between the two series. I’ve posted this before, but ICYLMI.

As for today’s release, the official manufacturing PMI is expected to improve a touch but remain in contraction. Steady in expansion is the expectation for the non-manufacturing PMI. On Friday we had data from China. The sharp fall in profits at China’s industrial firms in May comes amidst ongoing weakness in an economy grappling with elevated US tariffs and persistent deflationary pressures.

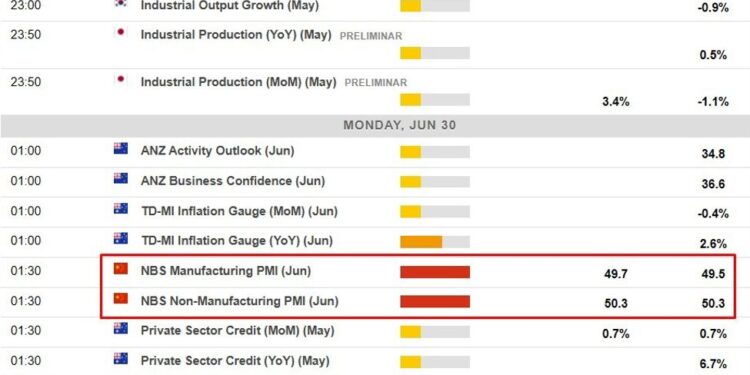

- This snapshot from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

*****

The two PMIs are quite different. If you are unfamiliar with this, the following will set you up for next year!

The PMIs (Purchasing Managers’ Indexes) from China’s National Bureau of Statistics (NBS) and Caixin/S&P Global differ primarily in survey scope, methodology, and focus. Here’s a breakdown of the key differences:

1. Provider and Affiliation

-

NBS PMI:

- Compiled by the National Bureau of Statistics of China, a government agency.

- Seen as the official PMI, closely aligned with government policies and priorities.

-

Caixin/S&P Global PMI:

- Compiled by Caixin Media in collaboration with S&P Global.

- A private-sector index, often considered more market-driven.

2. Survey Scope

-

NBS PMI:

- Focuses on large and state-owned enterprises.

- Covers a broader range of industries, including manufacturing and non-manufacturing sectors (e.g., construction and services).

- Reflects conditions in sectors heavily influenced by government policies and infrastructure spending.

-

Caixin PMI:

- Focuses on small to medium-sized enterprises (SMEs), particularly in the private sector.

- Captures the performance of companies that are more exposed to market-driven forces and less influenced by state interventions.

3. Sample Size and Composition

-

NBS PMI:

- Larger sample size, with about 3,000 enterprises surveyed for the manufacturing PMI.

- Emphasizes state-owned enterprises and larger companies, which tend to dominate traditional industries.

-

Caixin PMI:

- Smaller sample size, surveying around 500 enterprises, with a stronger focus on export-oriented and technology-driven firms.

- Provides insights into the private sector and its responsiveness to global economic conditions.

4. Release Dates

-

NBS PMI:

- Released monthly, typically on the last day of the month.

- Provides separate PMIs for manufacturing and non-manufacturing sectors.

-

Caixin PMI:

- Released a few days later, usually on the first business day of the following month.

- Includes only the manufacturing PMI and services PMI, with no equivalent for non-manufacturing activities like construction.

5. Interpretation and Use

-

NBS PMI:

- Reflects the overall economic landscape, especially trends in industries influenced by government policy.

- Analysts use it to gauge the impact of fiscal and monetary policies on the broader economy.

-

Caixin PMI:

- Viewed as a better indicator of the health of the private sector and market-driven segments of the economy.

- Considered more sensitive to external shocks (e.g., global trade conditions).

6. Key Insights and Differences in Results

- The NBS PMI often reflects policy-driven stability, showing less volatility because it covers sectors cushioned by government support.

- The Caixin PMI can be more volatile, as SMEs are more sensitive to real-time changes in market demand, supply chain disruptions, and global economic shifts.

Why Both Matter:

- NBS PMI offers a macroeconomic view of China’s state-influenced economy.

- Caixin PMI provides a microeconomic perspective of the more market-driven and globally competitive sectors.

By analyzing both, investors and policymakers can obtain a more comprehensive picture of China’s economic health and its underlying dynamics.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.