- Illicit activities primarily occur on the Ethereum and TRON networks, according to Bitrace’s crypto crime report.

- High-risk addresses that transfer and store stablecoins collectively received $649 billion in 2024.

- Blockchain addresses associated with fraudulent activities saw a dramatic surge in stablecoin inflows, totaling $52.5 billion.

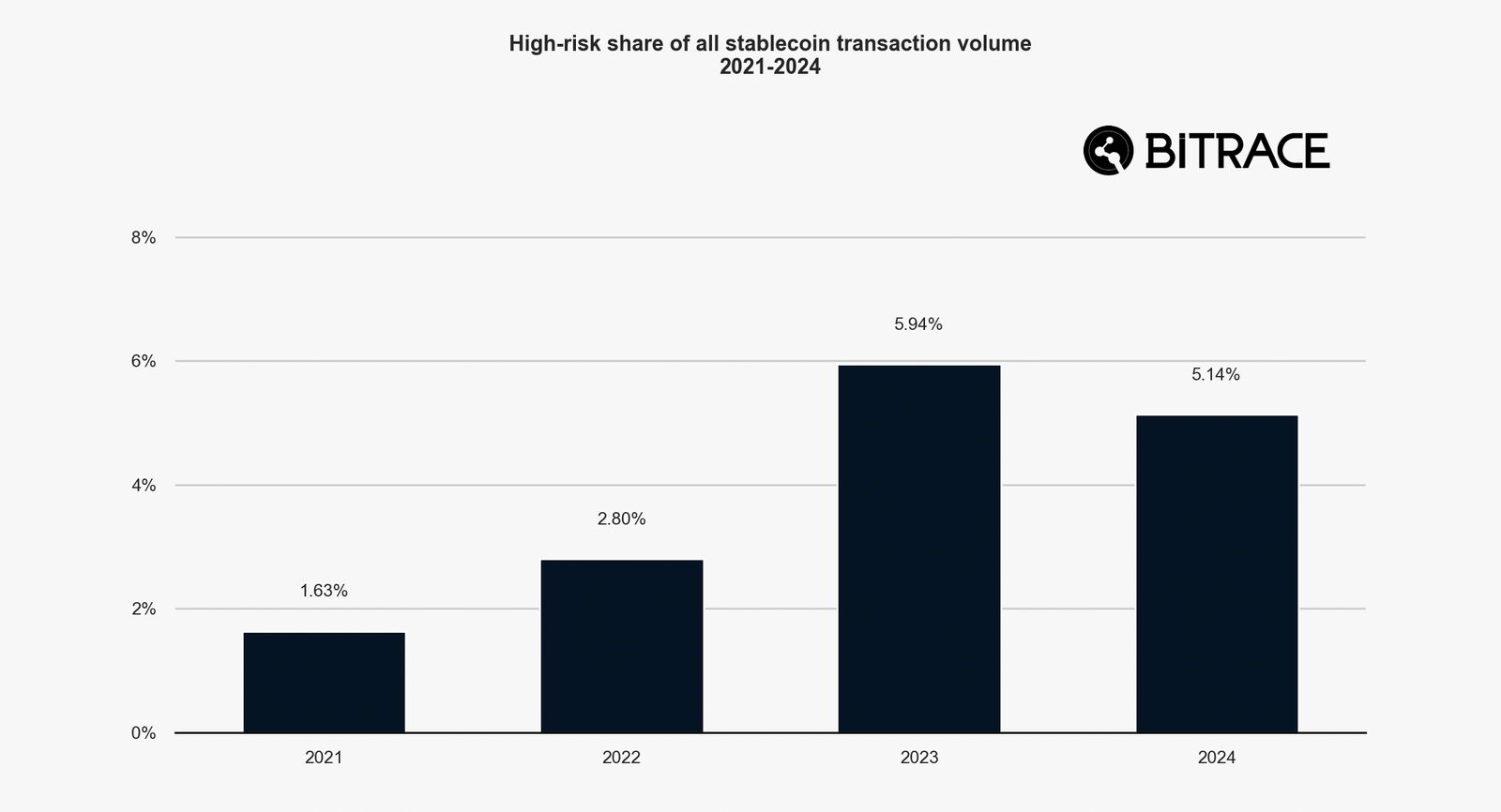

- High-risk addresses accounted for 5.14% of the total stablecoin transactions in 2024.

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets (RWA), futures and spot Exchange Traded Funds (ETFs), stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector. Increased market capitalization and the continued adoption of the blockchain infrastructure are commendable milestones. At the same time, criminal enterprises are seeing a parallel boom, as they increasingly leverage the crypto infrastructure, morphing their activities into complex systems that make it harder for law enforcement authorities to trace.

According to Bitrace’s 2025 Crypto Crime Report, most illicit activities are primarily found on Ethereum and TRON networks. However, addresses marked as “high-risk” collectively received more than $649 billion in 2024, surpassing the amount received in the previous year.

Illicit activities concentrate on Ethereum and TRON networks

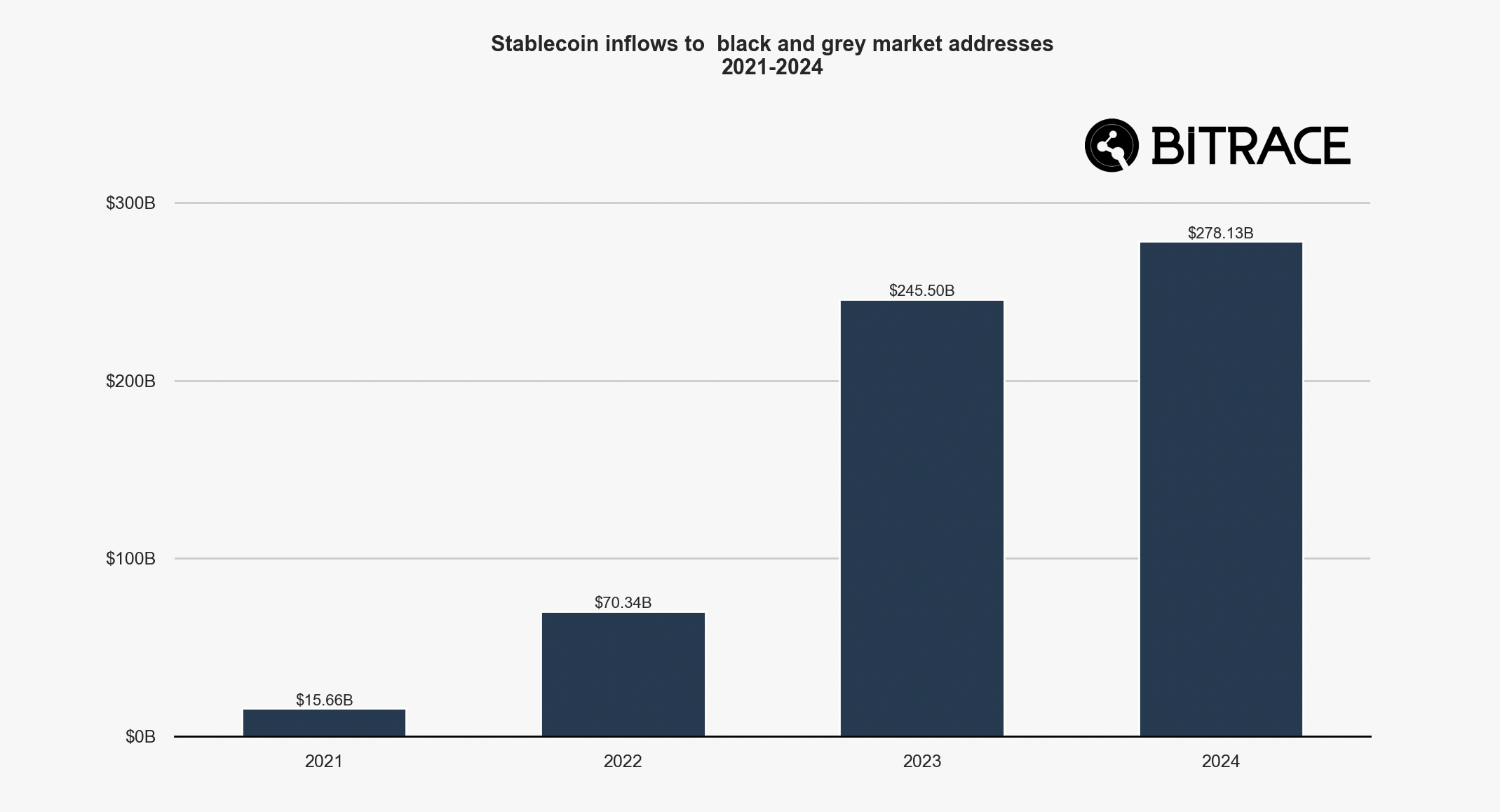

The 2025 Crypto Crime Report reveals that illicit trade was rampant on Ethereum, the largest smart contracts protocol, and the TRON blockchain, with high-risk addresses associated with black and gray markets receiving more than $278.1 billion in 2024. This figure is up slightly from 2023, but it is also significantly higher than in 2021 and 2022.

Bitrace highlighted several stablecoin versions that facilitate illicit transfers, including ERC20-USDT, ERC20-USDC, TRC20-USDT, and TRC20-USDC. High-risk addresses used by illicit entities for receiving, transferring, or storing stablecoins collectively received approximately $649 billion, marginally higher than the previous year.

Stablecoin inflows to high-risk addresses | Source: Bitrace

Regarding transaction volume, high-risk activities in the cryptocurrency industry accounted for 5.14% of the total stablecoin transactions in 2024. This represents a 0.8% decline compared to 2023. However, it remains significantly higher than the figures recorded in 2022 and 2021.

Proportion of high-risk activities in total stablecoin transactions | Source: Bitrace

Looking at the volume of illicit activities by stablecoin type, “TRON-based USDT dominated from 2021 to 2024. However, in 2024, the share of USDT and USDC on Ethereum increased,” Bitrace highlighted in the report.

Crypto fraud is on the rise

There is a growing positive correlation between escrow service platforms and illicit activities. Escrow services, such as Huione Guarantee, which facilitate transactions across illicit supply chains, saw transaction volumes surge to $2.64 billion by the fourth quarter of 2024, reflecting the growing demand for stablecoins in real-world economies, including Southeast Asia.

Online gambling platforms and their associated payment processors were not left behind, as the report indicates $217.8 billion in transactions in 2024, a 17.5% increase from 2023.

Stablecoin inflows to black and gray market addresses | Source: Bitrace

Interestingly, USDC’s share of stablecoins in these transactions surged to 13.36% from 5.22% the previous year. This uptick highlights the growing adoption of USDC in the gambling sector, despite the stablecoin being issued by Circle, a reputable organization.

“In 2024, blockchain addresses linked to fraud activities experienced an explosive growth in stablecoin inflows, reaching USD 52.5 billion – exceeding the total of previous years combined,” according to Bitrace’s report.

It is worth mentioning that the sharp increase in illicit activities may not entirely mirror reality, as security firms rely on current detection techniques amid an evolving and complex fraud system. Therefore, as more blockchains are monitored, previously undetected crypto crimes are reported, seemingly inflating statistics.

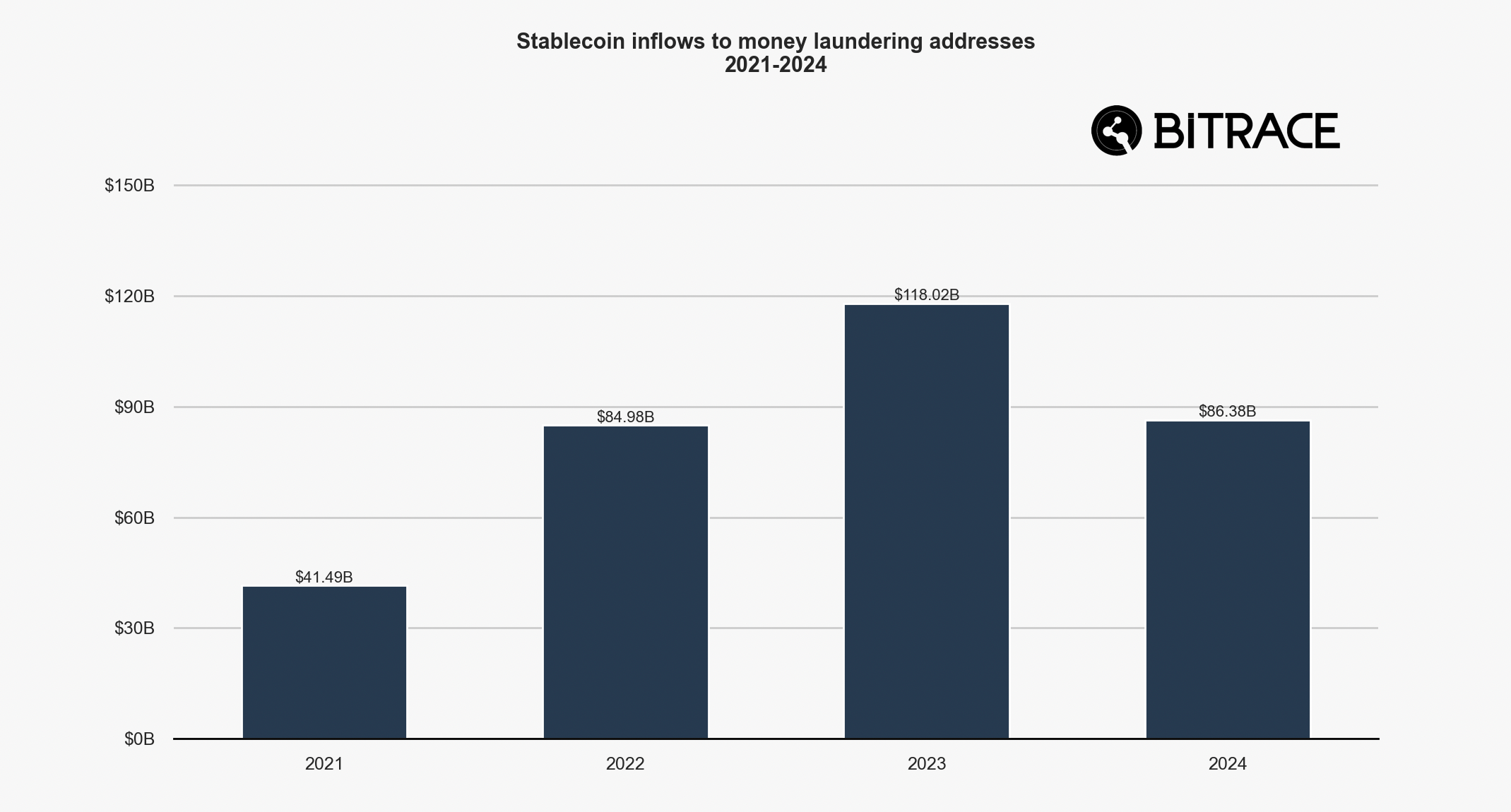

Money laundering activities show signs of decline

On the positive side, money laundering activities showed signs of easing, with the report highlighting addresses linked to associated activities receiving $86.3 billion, marginally lower than in 2023 and at the same level as 2022.

Stablecoin inflows to money laundering addresses | Source: Bitrace

The contraction in money laundering activities suggests that regulatory initiatives and enforcement actions in the last two years have had a noticeable and measurable impact.

Stablecoin issuers, including Tether and Circle, intensified their efforts, resulting in $1.3 billion worth of stablecoins being frozen on the Ethereum and TRON networks in 2024. This is double the amount frozen over the last three years combined.

The report attributes the milestone to regulations being developed globally, particularly in Hong Kong, where clear legal frameworks and enforcement actions have significantly reduced the proportion of risky stablecoin inflows since the third quarter of 2023.

Cryptocurrency metrics FAQs

intensified their efforts, resulting in $1.3 billion worth of stablecoins being frozen on the