China’s finance think tank gently pushes Bitcoin into reserve asset spotlight

The International Monetary Institution (IMI), China’s state-backed finance think tank, has republished an article that quietly elevates Bitcoin in the reserve asset debate.

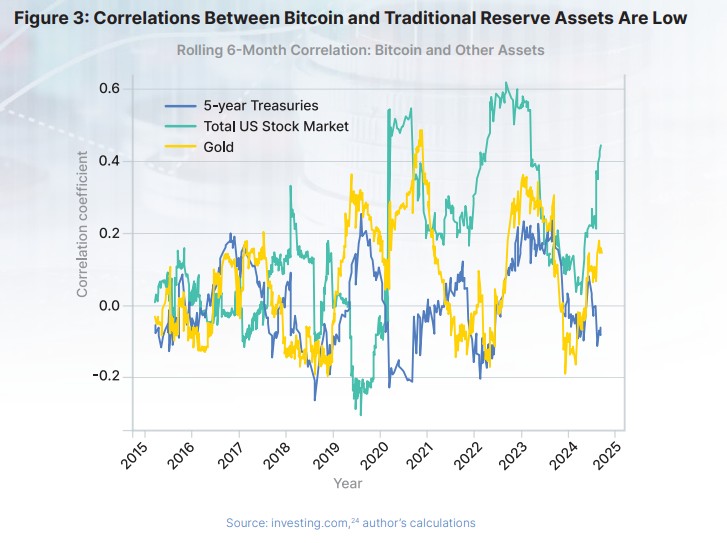

The report by former White House economist Matthew Ferranti, originally published in October 2024 by the Bitcoin Policy Institute, argues that Bitcoin can serve as a hedge for central banks in developing economies, particularly those exposed to US dollar weaponization. It was republished by the IMI on its official WeChat account on May 28 with an editorial note stating Bitcoin’s rise as a reserve asset “deserves continued attention.”

The IMI’s editorial note lays out that the appeal of US dollar assets is waning due to deficits, inflation and falling real yields. As a result, gold faces new challenges and Bitcoin is emerging as a serious contender for strategic reserves.

“Bitcoin is transitioning from a speculative asset to a strategic reserve asset,” IMI wrote.

IMI was established in 2009 to focus on research in monetary finance theory, policy and strategy. It operates as a non-profit institution within the Renmin University of China, a state-owned school co-founded by the Ministry of Education and the Beijing Municipal Government. IMI’s leadership includes senior academics and policy advisers.

Unlike central bank statements or legislative changes, the IMI’s commentary acts as a policy-side whisper that subtly introduces Bitcoin as a credible player in global reserve strategy. While stopping short of formal endorsement, it signals a growing institutional curiosity about Bitcoin’s role.

While Chinese regulators continue to enforce a sweeping ban on crypto activities like trading and mining, it’s notable that one of its most prominent financial think tanks is publicly discussing Bitcoin’s role as a hedge against the problems China has long warned about — US dollar hegemony and monetary risk.

China has banned cryptocurrency trading and mining, but continues to develop its own central bank digital currency, the e-CNY, and it remains highly engaged in global fintech debates.

Longest-serving South Korean crypto exchange CEO resigns

Lee Sirgoo, CEO of Upbit operator Dunamu and South Korea’s longest-serving crypto exchange chief, has stepped down.

“I made this decision based on the belief that new challenges and changes are necessary for Dunamu’s continued growth, as well as due to personal health issues,” said Lee Seok-woo in a statement.

His resignation will take effect on July 1, after which he will remain with the company as an adviser.

Lee’s departure came as a surprise to many in the local crypto industry, as he had been expected to lead the nation’s largest crypto trading platform through December 2026.

In February, South Korea’s Financial Intelligence Unit (FIU) imposed a three-month partial suspension on Upbit for alleged violations related to customer verification and failure to report suspicious activity. Dunamu challenged the order in court, which later temporarily lifted the ban.

Despite the timing, a Dunamu spokesperson said that Lee’s resignation is “due to personal reasons and is unrelated to the FIU sanctions.”

“The health concerns aren’t serious. He’s simply been fatigued from overwork and felt this was the right moment to step back and recover,” the spokesperson told Magazine.

Dunamu has nominated Oh Kyung-seok, CEO of apparel company Panko and a former judge, as Lee’s successor. Oh is expected to be officially appointed following approval at a shareholders’ meeting and board meeting on June 27.

Read also

Features

Are You Independent Yet? Financial Self-Sovereignty and the Decentralized Exchange

Features

‘Elegant and ass-backward’: Jameson Lopp’s first impression of Bitcoin

Even Sony’s banking unit gets into the blockchain business

Sony Bank, a subsidiary of Sony Group Corporation, has announced the establishment of a new wholly owned company focused on Web3 business.

Sony Bank cited the growing importance of blockchain-integrated services, such as cryptocurrency wallets, NFT infrastructure and exchanges as core reasons behind the new venture.

The move was approved at a Sony Bank board meeting held on May 27. The new subsidiary’s formal establishment is expected in June, and business operations are set to begin in the fall.

The company will operate in close coordination with Sony Bank’s existing Web3 initiative, the mobile app Sony Bank CONNECT, which offers entertainment-oriented financial services. In 2024, Sony Bank tested Japanese yen-backed stablecoins for gaming.

Sony Group also operates Soneium, the Ethereum layer-2 blockchain.

Read also

Features

ZK-rollups are ‘the endgame’ for scaling blockchains: Polygon Miden founder

Features

Lines in the sand: US Congress is bringing partisan politics to crypto

Thailand slashes payments and speculation for upcoming G-token

Thailand’s Securities and Exchange Commission has ruled out payments and speculative trading for the nation’s upcoming G-token initiative, the Bangkok Post reported.

Thailand’s G-token is a new digital financial instrument aimed at helping fund the national budget. The Ministry of Finance will reportedly distribute $150 million worth of digital investment tokens through an initial coin offering portal (ICO) scheduled to go live in July.

Finance Minister Pichai Chunhavajira said the G-Token initiative will allow retail investors greater access to government bonds. He added that the digital nature of G-Token is expected to yield better returns than bank deposits.

While G-Token’s use will be tightly controlled, transfers outside or across exchanges will be prohibited and enforced through smart contract mechanisms. The SEC said that G-Token should be viewed as a savings-oriented investment rather than a typical cryptocurrency, with secondary market trading permitted under regulatory oversight.

Details such as interest rates, collateral, and maturity periods will be announced by the Finance Ministry. Investors with digital wallets can purchase tokens directly, while those investing via securities firms will have their tokens held in custody. The SEC is requiring exchanges to implement safeguards like market surveillance, indicative pricing, and optional market makers to ensure transparency and investor protection.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan Yun is a multimedia journalist covering blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has covered Asian tech stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.