The first quarter of 2025 completely erased the effect of the US Presidential Elections. Bitcoin (BTC) retained its positions and market depth, while Ethereum (ETH) and altcoins saw an outflow of liquidity.

The first quarter of 2025 erased the price gains and liquidity from the last months of 2024. In three months, the market deflated to the levels of September 2024, losing both price action and liquidity.

On the positive side, Q1 arrived with a trend of improved policy climate for crypto, especially for the US market. The past three months saw the end of long-running lawsuits from the US Securities and Exchange Commission against several high-profile crypto companies. Despite the improved regulatory climate, most assets did not revisit their all-time highs.

Bitcoin liquidity held strong

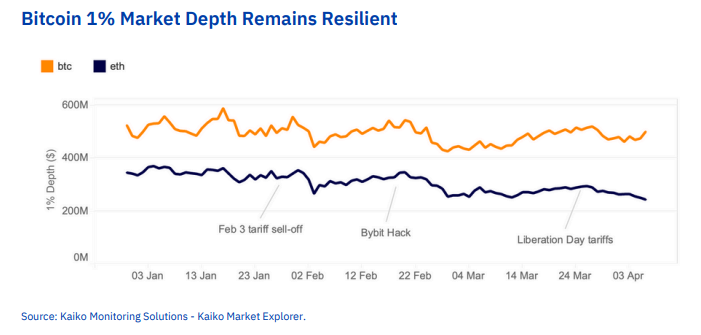

Bitcoin retained its 1% market depth liquidity for the entire quarter, even ending the period slightly higher at $500M. BTC liquidity remained unaffected by the biggest events of the quarter, including the February crash, the Bybit hack, and the announcement of aggressive US tariffs.

The Bitcoin market earned its support from US-based platforms. US-based exchanges made up to 58% of available BTC liquidity, with the rest spread among global exchanges. Cex.IO, Kraken, and Coinbase made up to 60% of available BTC liquidity.

Ethereum (ETH) liquidity lost 27% for the same period, reacting more to negative events. As of April 6, 1% ETH liquidity had fallen to $243M, with ongoing selling from whales.

The altcoin market also shrank significantly, losing 30% of its 1% market depth. During the first three months of the year, the hopes of an altcoin market were lost, as those assets abandoned hopes of rallying as a whole. A basket of some of the most active altcoins and tokens, made up of the top 50 assets based on market cap, erased 300M in liquidity.

Those top 50 assets started the year with $1B in available liquidity, losing 30% on average. Some sectors and narratives saw a more significant outflow. The market depth for SHIB, PEPE, RNDR, and FIL decreased by nearly 50%, while some funds flowed into TAO, ONDO, and XRP. The outflow from the altcoin markets came from US-based traders, who also focused more closely on BTC.

Meme tokens saw the biggest outflow of liquidity, caused by a general outflow from risky assets, as well as from negative events linked to highly volatile tokens. The crash of LIBRA and the volatility of Official Trump (TRUMP) also erased confidence in the meme token market.

The crypto market reacts quickly and tracks closely any statements coming from the US administration. As a result, volatility increased, and traders quickly repriced risk. Announcements on tariffs were one of the strongest factors for market shifts. The market in 2025 has no markers such as the halving of the block reward, or an election season. For that reason, the market may continue to react to short-term news linked to the global trade war.

Trade policy, ETF, and stablecoins to define Q2

According to Kaiko analysts, the market will keep tracking the new batch of ETF applications. As of April 2025, around 40 applications for new products are in various stages of revision by the SEC.

The slowdown of the altcoin market did not affect the trend for institutional attempts to offer legacy altcoins. The most awaited ETF are for Solana (SOL) and XRP, but new products have been proposed for LTC, DOGE, as well as legacy networks like Avalanche (AVAX).

Stablecoins may continue growing in Q2, on track to expand to their predicted level of $400B by the end of the year. Stablecoins are expanding liquidity, but mostly serve as a way to quickly lock in gains.

The uncertainties of trade policies may also revive the narrative of BTC as a store of value and digital gold. So far, BTC has lagged behind actual gold, but a weakening US dollar may boost the digital gold narrative.

Cryptopolitan Academy: Coming Soon – A New Way to Earn Passive Income with DeFi in 2025. Learn More

Disclaimer: For information purposes only. Past performance is not indicative of future results.