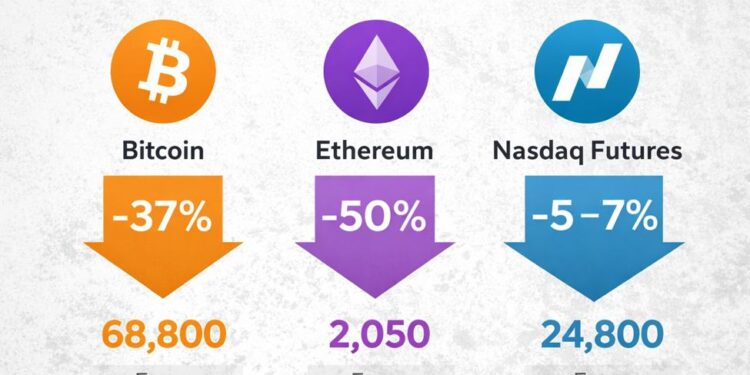

Bitcoin Futures are hovering near $68,800 in mid-February 2026, attempting to stabilize after a sharp retracement from last year’s surge above $110,000. At the same time, Ethereum Futures are trading close to $2,050, nearly 50% below their prior highs above $4,000. While crypto appears to be “holding,” the broader backdrop tells a more complex story.

Nasdaq Futures, which climbed above 26,000 during the late-2025 expansion phase, have cooled materially and are now trading closer to the 24,800 region. The index is no longer delivering clean upside momentum, and recent weeks show more rotational behavior than sustained expansion. That shift in macro tone matters because crypto’s recent stabilization is occurring within a softer risk environment.

The key question for investors right now is whether Bitcoin’s consolidation near $68K represents early accumulation, or simply a pause within a broader distribution phase. Ethereum’s deeper retracement and weaker relative structure add another layer of caution. When cross-asset positioning is examined together rather than in isolation, the message is clear: crypto is not yet leading the next risk-on cycle.

Nasdaq Futures: Cooling Momentum Without Capitulation

The broader macro backdrop is critical here.

Since peaking above 26,000 in late 2025, Nasdaq Futures have pulled back roughly 5–7 percent. That may not sound dramatic, but the internal structure has shifted. Upside attempts over the past several weeks have required more effort and delivered less follow-through. Downside weeks, by contrast, have produced cleaner directional movement.

This matters because crypto does not operate in isolation. When equities enter a rotational or cooling phase, high-beta assets typically require strong independent leadership to outperform. That leadership is currently missing.

Importantly, this is not a panic environment. There is no evidence of forced liquidation across equities. Instead, participation has cooled. That subtle distinction changes the probability of what comes next.

Rotation tends to produce choppy rallies, not sustained breakouts.

Bitcoin: Stabilization After a 37% Reset

Bitcoin’s move from above $110,000 to the current $68,800 region represents a reset of roughly 37 percent. Historically, Bitcoin has experienced similar retracements within broader cycles, but what makes this phase notable is the nature of the rebound.

Over the last several weeks:

-

Bounce attempts have been moderate rather than explosive.

-

Price has not reclaimed prior breakdown zones above $75,000–$80,000.

-

Upside sessions have lacked sustained follow-through.

The key structural detail many overlook is this: stabilization alone does not equal accumulation.

True accumulation phases tend to show expanding participation alongside improving upward efficiency. What we are currently observing is compression — price holding, but not aggressively reclaiming lost ground.

That distinction may determine whether Bitcoin forms a base in the coming months or drifts lower in alignment with broader macro softness.

Ethereum: The 50% Drawdown Tells a Different Story

Ethereum’s situation is more fragile.

From highs above $4,000 to current levels near $2,050, ETH is down nearly 50 percent. That magnitude of drawdown exceeds Bitcoin’s retracement and reinforces Ethereum’s role as the higher-beta component of the crypto complex.

More importantly, Ethereum has not demonstrated relative leadership during this stabilization period.

In recent weeks:

-

ETH has underperformed Bitcoin on rebound attempts.

-

Upside moves have stalled below prior structural resistance.

-

The asset remains closer to breakdown territory than breakout territory.

This relative weakness is new information that often goes unnoticed. While headlines focus on “crypto holding,” the internal hierarchy shows Ethereum acting as the pressure point.

Historically, when Ethereum underperforms Bitcoin during stabilization phases, it suggests caution rather than imminent upside acceleration.

Relative Strength Hierarchy: The Market’s Hidden Signal

When we rank the assets by structural strength as of February 2026:

-

Nasdaq Futures – cooling but structurally intact

-

Bitcoin Futures – stabilizing but not leading

-

Ethereum Futures – weakest and most fragile

This ranking is not based on price alone. It reflects directional efficiency, recovery quality, and relative performance across multiple timeframes.

The absence of a leader is the key takeaway.

In strong risk-on environments, one asset typically pulls ahead decisively. That is not happening right now. Instead, we see synchronized stabilization within a cooling macro regime.

That combination reduces the probability of immediate upside acceleration.

Ether Weaker than Bitcoin

What Would Change the Narrative?

For sentiment to shift meaningfully:

-

Nasdaq Futures would need to regain sustained upside momentum and hold above recent consolidation levels.

-

Bitcoin would need to reclaim the $75,000–$80,000 region with follow-through.

-

Ethereum would need to outperform Bitcoin on a weekly basis, not just bounce alongside it.

Until those developments occur, rallies may represent rotational rebounds rather than confirmed trend reversals.

Why This Phase Is Different From Prior Crypto Corrections

In previous cycles, Bitcoin often decoupled from equities during critical turning points. In early 2026, that decoupling has not materialized.

Instead:

-

Crypto is stabilizing within a cooling macro regime.

-

Ethereum is showing disproportionate weakness.

-

Bitcoin is acting defensive rather than aggressive.

This suggests the current environment is not one of panic liquidation, but neither is it one of renewed expansion.

It is transitional.

Transitional markets demand patience.

Final Outlook: Rotation Before Expansion

As of mid-February 2026:

-

Bitcoin holds near $68,800 after a major reset.

-

Ethereum trades near $2,050, down nearly 50 percent from highs.

-

Nasdaq Futures remain below prior peaks, reflecting macro cooling.

The data does not yet confirm accumulation across crypto. Instead, it points to stabilization within a broader rotational phase.

For investors, that means monitoring relative strength and leadership, not just price bounces.

For traders, it means recognizing that in cooling regimes, upside follow-through must prove itself.

The next major move will likely begin with one asset breaking this hierarchy, not by bouncing, but by leading.

Until then, the crypto market remains in reset mode rather than expansion mode.