The discussions about the US-China trade deal and the US-UK agreement have turned sentiment from US President Donald Trump’s muddled trade agenda to enhanced global trade conditions, boosting cryptos over the last week.

Ether led a significant rally in the cryptocurrency market last week, driven by trade deal hopes and expectations of a network upgrade. It marked its biggest gains since 2021.

On Friday, Ether surged 14% to $2,490, resulting in a weekly gain of almost 33% for the second-largest digital currency by market capitalization. The last time the token saw something similar was in 2021, during the pandemic’s crypto bubble.

Speculative excesses and low interest rates drove the surge back then.

Bitcoin wasn’t too far behind. The OG token rose 1.7% to $104,336, which was fueled by improved confidence in the digital asset market after the US and UK announced a new trade agreement.

After a period of increasing tariffs under Trump’s administration rattled risk markets, the US has engaged in trade deals with the UK, and now China indicates that international economic relations are improving.

The resurgence in Ether’s value can be attributed to investors’ heightened focus on Ethereum’s ongoing technological advancements.

The recent implementation of the Pectra upgrade on the network is widely regarded as a fundamental enhancement for cryptocurrency’s commercial infrastructure.

Ethereum’s Pectra Upgrade: What These Changes Mean for Your Business

Slated for next week, this dual-pronged update promises tangible improvements that warrant the attention of any enterprise exploring or already leveraging blockchain technology.

These adjustments are vital to sustaining competitiveness against rapidly advancing competitors such as Solana.

They aim to enhance network efficiency, facilitate more sophisticated wallet functionalities, and reduce transaction costs.

Still, despite the latest rally, Ether is still approximately 50% below its peak in November 2021, indicating persistent underperformance compared to Bitcoin and other leading digital assets.

As Bitcoin approached the $100,000 milestone on Thursday, investors liquidated about $1.1 billion in cryptocurrency bets at an extraordinary pace.

Data from Coinglass indicates that the short position liquidation hit $836 million on Wednesday, marking the highest level observed since at least November 10.

On the last day, unwinding negative positions against Ether generated $290 million.

As short sellers often act swiftly to buy back and settle their positions, these liquidations can lead to significant increases in prices.

Deribit, the premier cryptocurrency options exchange, indicates that most Bitcoin option trades are hedges.

The second-highest open interest is attributed to puts expiring on May 30 with a strike price of $65,000, while the highest open interest is associated with calls at a $100,000 expiration date.

There is a clear sense of optimism evident across contracts of varying maturities.

With Polymarket bets on Bitcoin’s chances of $105,000 already in play, the crypto betting site is likely to show further upside soon (this level was breached earlier this afternoon, though it has settled a touch below that).

Bitwise Asset Management’s chief investment officer, Matthew Hougan, predicted in a recent blog post and an interview that Bitcoin’s value will exceed $200,000 this year, among many other cryptocurrencies on track to hit new all-time highs.

Arthur Hayes, chief information officer at Maelstrom, and Geoff Kendrick, a senior expert at Standard Chartered, are among those forecasting that Bitcoin will hit $200,000 by the end of the year.

The latest increase in sentiment indicates a notable turnaround following Bitcoin’s significant drop to $74,500 just a few weeks ago.

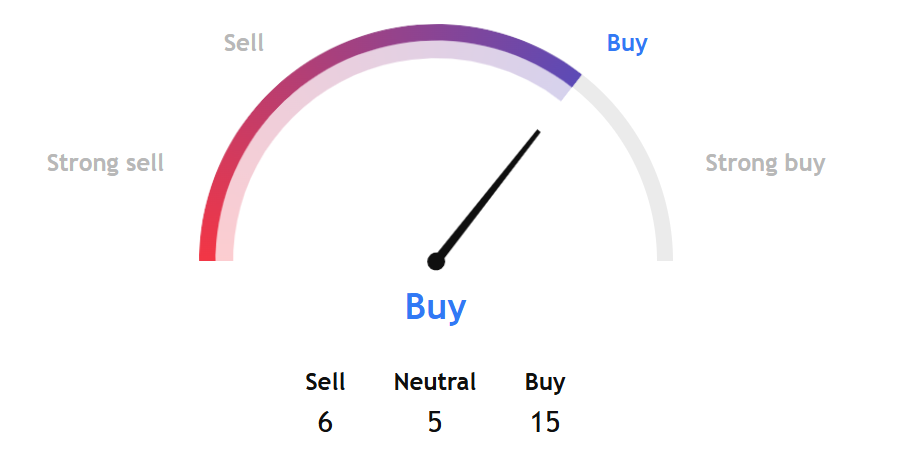

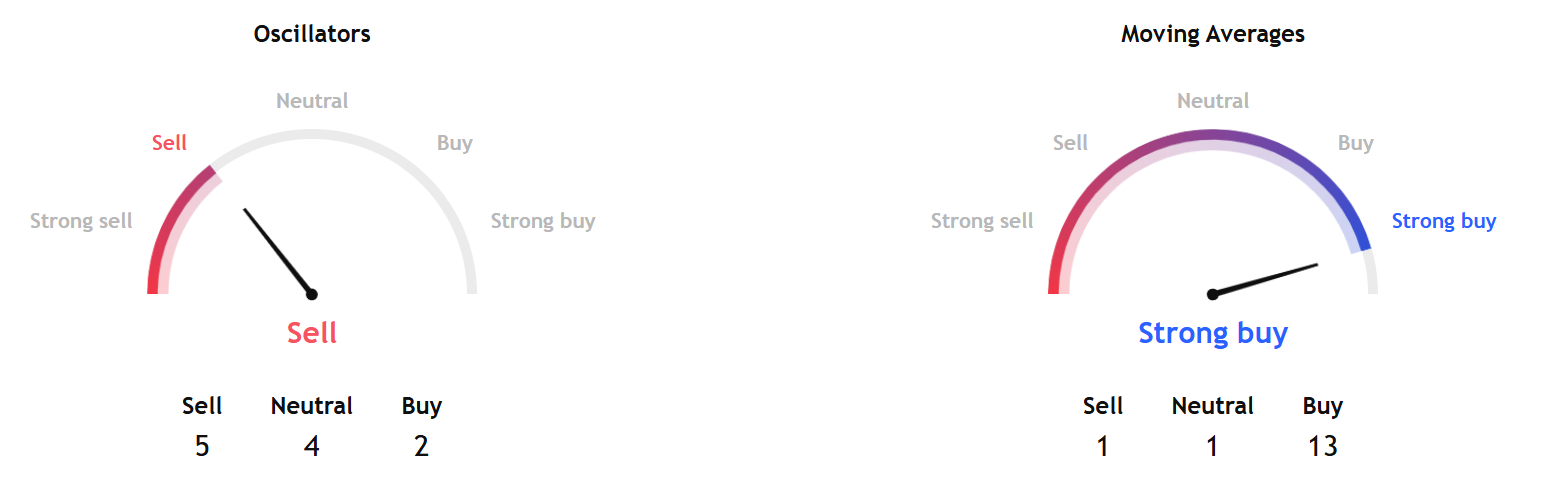

Technical indicators point to a buy signal.

While oscillators show a sell signal, moving averages overwhelmingly point to a strong buy.

Within the oscillator indicators, the RSI (14), Commodity Channel Index (20), Momentum (10), Stochastic RSI Fast (3, 3, 14, 14), and Williams Percent Range (14) indicated a sell signal.

However, the MACD Level (12, 26) and the Ultimate Oscillator (7, 14, 28) pointed to buy. The remaining showed a neutral reading.

Within the moving average indicators, almost all pointed to buying.

The Hull Moving Average (9) indicated a sell signal, whereas the Ichimoku Base Line (9, 26, 52, 26) suggested a neutral reading.

Elsewhere

Hedge Your Bets: New Long-Short ETFs Capitalize on Bitcoin-Gold Rivalry

“Wall Street is turning the philosophical battle between Bitcoin believers and gold bugs into a tradable asset, as Tidal Financial Group launches new ETFs allowing investors to directly bet on which safe haven will outperform the other.

The Stablecoin Two-Step

Stablecoin issuers are now deploying transparent but legally dubious “dual token” schemes to sidestep regulations and deliver yield to users—a strategy that might provide short-term profits but could spell disaster when regulators eventually crack down.

Taiwanese Lawmaker Proposes Bitcoin for National Reserve, Citing Rising Global Risk

According Dr. Ju-Chun Ko, Taiwan’s reserves are in the region of 423 metric tonnes of gold and $577 bn foreign currency in reserve, of which 92% is invested in U.S. Treasury bonds.

Staying the Course – ETH, SOL Overweights Continue to Pay Off Amid Breakout

Our ETH and SOL overweights paid off as both led the breakout sparked by regulatory catalysts. ETH saw its best daily move in over a year, and SOL rebounded strongly. While we started cautiously, our positioning captured the upside when it mattered most.

Blockcast

Unveiling Crypto’s Hidden Rates Market With Rho Protocol’s Alex Rvykin

Rho Protocol addresses a critical gap in the crypto ecosystem. While traditional finance boasts the largest asset class in rates, the crypto market has largely overlooked its own unique and volatile interest rate dynamics, particularly perpetual funding rates. Listen to founder Alex Rvykin on our latest episode.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama. Previous episodes of Blockcast can be found here, with guests like Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Consensus 2025, Toronto

We’re a media partner for Consensus 2025, held in Toronto, Canada on 14-16 May. Coinbase, BlackRock, Google & The White House Will Be There – Will You? Use the code BLOCKHEAD20 for 20% off tickets!