Market snapshot at close

- S&P/ASX 200: +0.17% to 7,761 points (close)

- Australian dollar: +0.49% to 63.56 US cents

- S&P 500: +0.8% to 5,405 points

- Nasdaq: +0.6% to 16,831 points

- EuroStoxx: +2.7% to 449 points

- FTSE 100: +2.1% to 8,134 points

- Spot gold: +0.56% to $US3,226/ounce

- Brent crude: +2.11% to US$67.84/barrel

- Iron ore: $US100.08/tonne

- Bitcoin: +0.71% to $US85,480

Prices current around 4:40pm AEST

Live updates on the major ASX indices:

That’s a wrap

That’s it for today. Thanks for joining us.

We’ll be back tomorrow morning to cover the major developments in markets overnight.

Until then, take care of yourselves.

Best and worst performers

Among the top performing stocks were Iluka Resources (up 18 cents, +5.23%, to $3.62), Clarity Pharmaceuticals (up 8 cents, +4.87%, to $1.83), and Eagers Automotive (up 48 cents, +2.78%, to $17.73).

Among the worst performers were Pinnacle Investment Management (down 84 cents, -4.99%, to $16.01), Super Retail Group (down 38 cents, -2.9%, to $12.72), and LendLease Group (down 14 cents, -2.57%, to $5.31).

Serenity now

Looking ahead to the new trading session in the US, the US futures are flat to slightly negative.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says sentiment is fragile on “bipolar announcements” from the US that are taking a toll on companies’ and investors’ ability to make decisions – except for China.

“China this week makes the decision of not reacting anymore (which I think is the best option because I myself deal with a 4 and a 6-year old everyday),” she says.

“Instead of responding to the US, China’s Xi Jinping visits Asian counterparts to convince them that whatever they will negotiate to avoid US tariffs – it won’t be stable enough than sealing a deal with China,” she says.

She also says the more the US is shaking the world with tariffs to get richer, the more the rest of the world is dumping the dollar.

“The greenback remains under a decent pressure on waning growth expectations.

“Growth expectations are pulled lower everywhere – even in Germany that will benefit from massive defense and infrastructure spending – but the pace of deterioration of the US expectations are faster.

“As such, the dollar index consolidates below the 100 level this morning – the lowest levels in three years,” she says.

ASX200 closes slightly higher

The S&P/ASX200 index has closed 13.1 points higher (+0.17%), at 7,761.7 points.

Stagflation, by executive order

Citi’s economics team has assessed the impact of the latest announcements by the Trump administration on Australia.

Its view is that growth, inflation and interest rates are now likely to be lower for Australia.

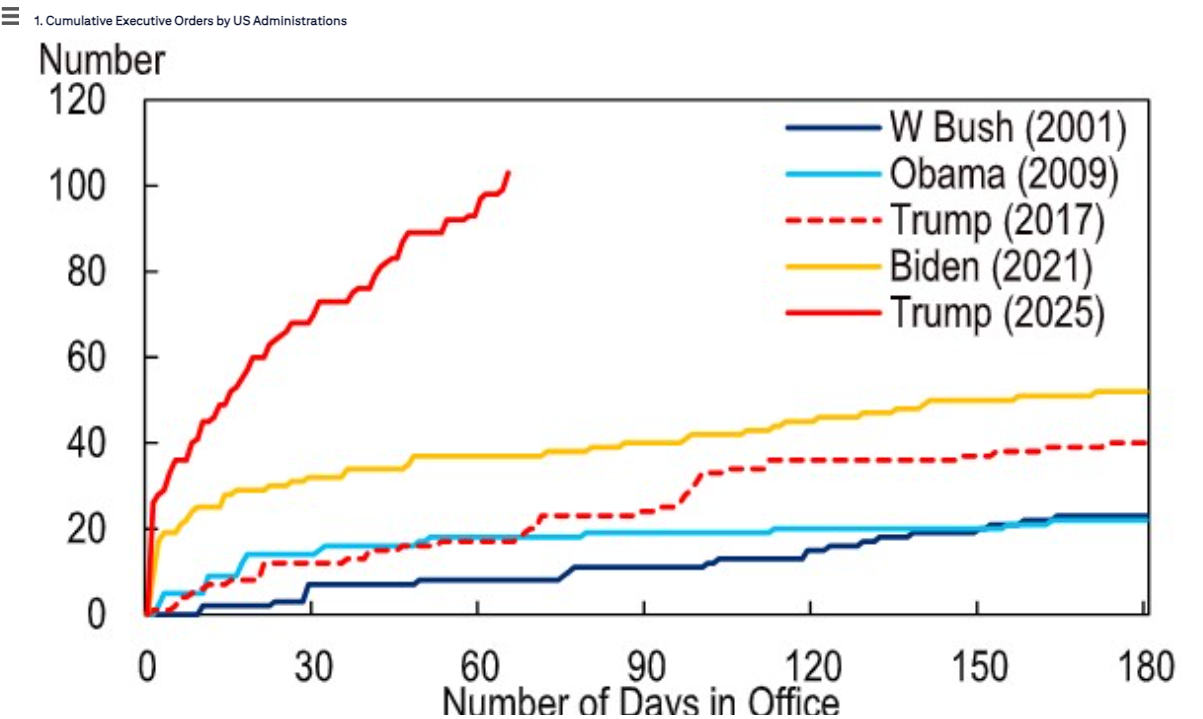

They say while previous US presidents have used executive orders (a non-congressional form of policy approval), in his first 60 days in office President Trump has exceeded the combined number of orders signed by all other presidents since 2001.

Only a handful of his orders relate to import tariffs, but one of the most recent orders (111) outlined his so-called ‘reciprocal’ tariffs on other nations.

Those tariffs will lead to lower US growth and higher inflation.

“The impact on the US economy is stagflationary,” they say.

But they will only be disinflationary for Australia (that’s a fancy way of saying the pace of inflation will slow down).

“The impact on inflation … is two-fold.

“First, there is a hit to domestic growth which implies lower aggregate demand and lower prices.

“Second, there is an impact through the trade channel where there is an excess supply of goods because trade needs to be redirected away from the US. Both scenarios see a dampening of inflationary pressures in Australia.

They say the majority of the hit to growth in Australia will come in 2026, which reflects the fact that supply-chains take time to adjust.

And they now see an RBA terminal rate of 3.1% now (in 2025), compared to 3.6% previously.

“A slightly lower inflation profile and higher uncertainty leads us to revise our previous view of terminal.

“We now see a year-end terminal rate of 3.1%, compared to 3.6% previously. We still see the RBA cutting by 25 basis points in May, followed by another 25bps each in August, September, and November.

“There is a risk of a 50bp cut in May, but we do not see this occurring because the RBA, much like the RBNZ, will want to wait-and-see the impact of trade wars.

“A cut in May would be seen as insurance and help boost confidence in the domestic recovery.

“Back-to-back cuts in May and July are the risk, but for now, we see the RBA opting to wait to see the hard data, after providing a boost to confidence in May.

“Thus, we do not see a cycle of front-loading rate cuts as the market is currently pricing,” they say.

Star Entertainment posts $300 million half-year loss after securing rescue funding

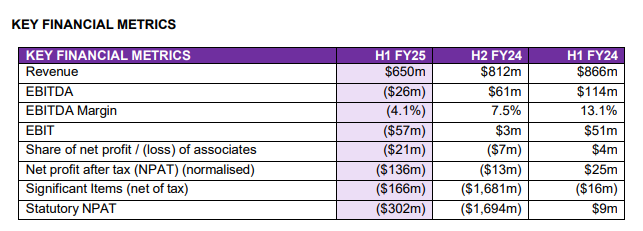

Troubled casino firm Star has reported a $302 million loss for the first half of the financial year, after pulling back from the brink of collapse.

Star Entertainment Group lodged its half year financial results with the stock exchange more than a month late, and its shares will return to trade on the ASX tomorrow, following suspension due to its failure to meet the reporting deadline.

My colleague Steph Chalmers has more details from Star’s investor and analyst meeting from today, in this story.

“Clearly our performance continues to be very challenged as we navigate through a very difficult trading environment,” Star chief executive Steve McCann told analysts and investors.

United States records sharpest drop in Australian visitors since COVID

Australian visitor numbers plummeted 7 per cent in March this year, compared to March 2024.

That’s the sharpest drop in Australian visitors the US has seen since March 2021, during the height of the COVID pandemic.

Lee Morgenbesser, an associate professor in comparative politics at Griffith University, says Australia hasn’t revised its US travel advice yet, but Australians should “reconsider their need to travel”.

Particularly academics, or anyone outspoken about the Trump administration on social media, he says.

“At least [take] precautions about some of the views you posted online,” he says.

“I’m not suggesting self-censoring, but I’m suggesting protection from searches … by the Trump government at the border.”

Should first home buyers be able to use their superannuation to buy a house?

My colleague Nadia Daly has asked a range of economists what they think of the idea of allowing people to access their superannuation to purchase a home.

Peter Tulip, former Reserve Bank economist, has an interesting take on the idea.

“It can be done well, or it can be done badly,” he says.

He says a solution to superannuation balances being run down would be to use the cash in retirement funds as collateral.

It would be similar to the so-called “Bank of Mum and Dad”, where parents act as guarantor with their existing assets, to bring down the required deposit people need to get a home loan without lenders’ mortgage insurance.

“Not everyone has wealthy parents that can do that: they could use their superannuation balance instead,” he says.

He says the super for housing scheme should also be expanded beyond first home buyers and be available to anyone wishing to purchase a home.

“There are a lot of people that want to buy a home that have substantial superannuation.

“The same reasons that you use it to apply for first home owners apply to other buyers.”

Take an early mark

We have ‘stale’ RBA minutes, Star casino still on the ropes, the Aussie dollar is pretty much back where it was and Trump is back in court. Oh, and the market goes nowhere. Very much a ‘meh’ kind of day. With only an hour or so’s more trading, I’m thinking a cool drink in the garden might be a good idea!😜

– Andrew

Mood.

CBA: a lot has changed since the RBA meeting two weeks ago

Commonwealth Bank economist Belinda Allen has taken a look at the minutes of the RBA Board ‘s recent monetary policy meeting.

Here’s what she’s thinking:

“It has felt longer than two weeks since the April RBA Board Meeting.

“The US trade war has escalated, financial markets have been extremely volatile and global growth fears have become more than a tail risk.

“Financial markets are pricing in more rate cuts locally with the chance of a 50bp rate cut priced in for May.

“The Minutes today must be seen through this dated lens.

“It seems the central bank at the time was caught between still viewing domestic risks as two sided, but downside risks to global growth risks were building with the meeting held two days prior to “Liberation Day”.

She says the data flow since the meeting has also been limited.

“Spending data has been subdued, consumer sentiment fell sharply in April due to the tariff war and as we noted at the time it does place a headwind on the forecast consumer recovery in 2025.

“This deterioration is significant given it is the only piece of data we currently have that reflects the escalation in the tariff war with the Minutes noting “Members nevertheless emphasised the importance of being alert to any signs of this changing.”

But the flow of official economic data coming out over the next few weeks, in its totality, will be enough to see the RBA cut the cash rate by 25 basis points in May.

“The deteriorating global outlook makes this even more likely despite Australia being in a relatively good position to weather the storm,” she says.

“The data flow ramps up in the weeks ahead.

“Next up will be March labour force data on Thursday. We expect some statistical payback this month with lift in employment of 45k, a rise in the participation rate to 66.9% which will push the unemployment rate higher to 4.2%.

“The March quarter CPI data will be the other key data to watch (due 30 April). Our forecast for the all‑important Q1 25 trimmed mean CPI is 0.6%/qtr.

“There will still be one more labour market print and Q1 25 wages data ahead of the next Board meeting due 20 May.

“As will further updates on the global trade war,” she says.

Star not planning any further asset sales

Star boss Steve McCann was asked if the group was considering selling off any further assets, particularly The Darling hotel at the Star in Sydney.

He said it’s not considering any further “non-core asset sales” at this point in time, under its deal with Bally’s.

Last month, chair of the American casino group, Soo Kim, told The Business it viewed the opportunity to get involved in Star as “most exciting” if the group was kept together.

“I think that there’s a lot of synergies for it to be one. If you start to split it up actually the operational turnaround becomes harder and so that’s why we decided to get involved,” he said.

Loading…

We need to work hard to regain market share: Star boss

Star chief executive Steve McCann says the casino group, which has secured a funding deal to bring it back from the brink of collapse, needs to work hard to regain customers.

“We need to also work very hard on regaining market share, reactivating customers who haven’t been coming to the Star in recent months, and those initiatives are all underway,” he said.

“There’s a lot to do. We’re very hopeful that with the Bally and Investment Holdings capital injections, that will provide us the time and breathing space to work on those revenue initiatives and turn this business around over the medium term.”

Mr McCann said there was a “very poor customer experience” as it implemented the rollout of carded pay, cash and time limits and increased customer due diligence.

“People have been impacted by the suddenness of the communications occurring, by the way that their play has had to change,” he noted.

“We are working hard on re-establishing those customer relationships and reactivating some customers who are not coming to the Star anymore because they don’t like that combination of impacts, they don’t experience that at the pubs and clubs. So there’s a lot of work going into that.”

Market snapshot

- S&P/ASX 200: +0.4% to 7,779 points

- Australian dollar: +0.33% to 63.45 US cents

- S&P 500: +0.8% to 5,405 points

- Nasdaq: +0.6% to 16,831 points

- EuroStoxx: +2.7% to 449 points

- FTSE 100: +2.1% to 8,134 points

- Spot gold: +0.48% to $US3,224/ounce

- Brent crude: +2.11% to US$67.84/barrel

- Iron ore: $US100.08/tonne

- Bitcoin: +0.5% to $US85,302

Prices current around 1:25pm AEST

Live updates on the major ASX indices:

Star shares to return to trade tomorrow

Star Entertainment Group chief executive Steve McCann is addressing investors after the release of the casino group’s results.

He confirms its shares will return to trade on the ASX tomorrow, after the recent suspension due to not being able to lodge its financial result on time.

“Clearly our performance continues to be very challenged as we navigate through a very difficult trading environment.

“We have been working very hard on establishing additional liquidity for the company to continue to trade through, which has led us to the Bally and Investment Holdings announcement…

“The ongoing impact of regulatory reforms, the impact of mandatory carded play, cash limits, time limits and our loss of market share across Sydney and Gold Coast properties has had a material impact on the business.”

Star Entertainment reports worse than expected first-half loss

Star Entertainment has reported a larger than expected first half loss in profits after being hit with more regulatory restrictions.

It has reported an underlying loss of $136 million (net profit after tax, before significant items) for the six months to December 31, and a statutory loss of $302 million (net profit after tax, after significant items).

It says its trading performance deteriorated again in the last six months of last year.

It says the introduction of mandatory carded play and cash limits at The Star Sydney and challenging conditions caused by casino operating reforms and market share loss at The Star Gold Coast hit the company hard.

It says group revenue was down 25% for the first half, reflecting challenging trading conditions due to the implementation of casino operating reforms (including mandatory carded play and cash limits at The Star Sydney).

Domestic gaming revenue was down 32%. Excluding the impact from the closure of Treasury Brisbane Casino, domestic gaming revenue was down 20% (private gaming rooms down 25%, main gaming floor down 16%), and non-gaming revenue was down 2%.

Australia’s dollar recovers from last week’s pummelling

During the chaos in global markets last week, the value of Australia’s dollar fell below 60 US cents, touching as low as 59.15 US cents.

But it’s staged a recovery over the last seven days and it’s currently trading around 63.47 US cents.

Here’s how it’s traded over the last six months compared to the US dollar:

RBA’s May meeting will be an ‘opportune time’ to reassess economy

In the minutes of the RBA’s recent Board meeting, it’s clear that the next two-day meeting on May 19-20 will be important.

That’s because, between now and then, the Bureau of Statistics will be publishing a range of important comprehensive data, we’ll have had more time to see how financial markets are responding to Donald Trump’s ever-changing tariffs plans, and the RBA will have prepared updates for its official forecasts (which it will release on May 20):

“Members observed that the May meeting would be an opportune time to revisit the monetary policy setting with the benefit of additional data about inflation, wages, the labour market and trends in economic activity, along with a fresh set of economic forecasts and further information about the likely evolution of global trade policies,” the minutes say.

“Collectively, this information would have a considerable bearing on their decision.”

Reserve Bank board meeting minutes

The minutes of the RBA Board’s monetary policy meeting from 31 March – 1 April have been published on the RBA website.

The minutes have some interesting tidbits.

They show RBA Board members discussed the “significant rise in uncertainty about global trade policy” since their last meeting, thanks to Donald Trump’s tariffs.

But the effect of that uncertainty on sentiment and economic developments for Australia was judged to be unclear at this stage, so members agreed that the outlook for inflation and the labour market set out in the February Statement on Monetary Policy was still the appropriate starting point for their policy deliberations.

And so far, they felt the economy still appeared to tracking in line with the RBA’s recent forecasts, which were for underlying inflation to return to the 2-3% target range from mid-2025 (which isn’t far away now).

They also think the labour market in Australia is tighter than they think is consistent with full employment, and the large fall in employment in February was more likely to be a “statistical aberration” than a turning point in labour demand.

Trump administration sued over tariffs in US Court of International Trade

Reuters has this report:

A legal advocacy group on Monday asked the US Court of International Trade to block President Donald Trump’s sweeping tariffs on foreign trading partners, arguing the president overstepped his authority.

The lawsuit was filed by the nonpartisan Liberty Justice Center on behalf of five small US businesses that import goods from countries targeted by the tariffs.

The businesses range from a New York wine and spirits importer to a Virginia-based maker of educational kits and musical instruments.

The lawsuit challenges Trump’s April 2 “Liberation Day” tariffs, as well as duties he separately levied against China.

“No one person should have the power to impose taxes that have such vast global economic consequences,” Liberty Justice Center senior counsel Jeffrey Schwab said in a statement.

“The constitution gives the power to set tax rates — including tariffs — to Congress, not the president.”

Representatives of the White House did not immediately respond to an email seeking comment.

The Trump administration faces a similar lawsuit in Florida federal court, where a small business owner has asked a judge to block tariffs imposed on China.

Trump imposed 10% tariffs on goods from all countries and higher tariffs for countries the administration says have high barriers to US imports, most of which he later paused for 90 days.

The president’s executive order invoked laws including the International Emergency Economic Powers Act, which gives presidents special powers to combat unusual or extraordinary threats to the US

In Monday’s lawsuit, the Liberty Justice Center said the law does not give presidents the authority to impose tariffs.

“There is no precedent for using IEEPA to impose tariffs. No other President has ever done so or ever claimed the power to do so,” the lawsuit said.

The lawsuit asks the court to block enforcement of the tariffs and declare Trump lacked the authority to impose them.

The New York-based Court of International Trade is a US federal court with broad jurisdiction over most trade-related matters.