Market snapshot

- ASX 200: +0.13% at 8,279 points (close)

- Australian dollar: +0.06% to 64.72 US cents

- Wall Street: Dow Jones (-0.6%), S&P 500 (+0.7%), Nasdaq (+1.6%)

- Europe: FTSE (flat), DAX (+0.1%), Stoxx 600 (+0.1%)

- Spot gold: -0.46% to $US3,232/ounce

- Brent crude: +1.54% to $US65.8/barrel

- Iron ore: $US99.51/tonne

- Bitcoin: -0.79% to $US103,790

Prices current around 4:30pm AEST

That’s it for today

We’ll wrap things up from here. Thanks for joining us today.

Tomorrow will be another important day for data, with the Bureau of Statistics releasing its labour force survey for April.

The unemployment rate is currently sitting at 4.1%, seasonally adjusted, so we’ll see if that moved anywhere last month.

Take care of yourselves.

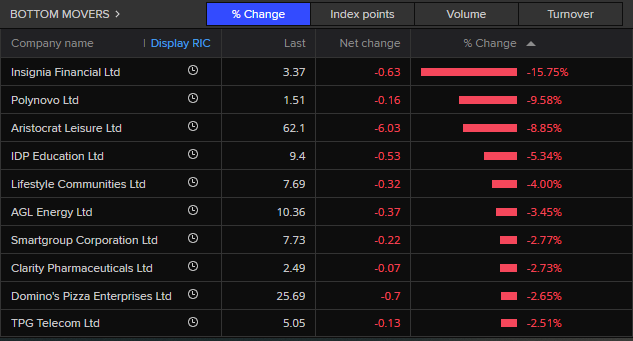

Best and worst performing stocks

Among the best performing stocks were Life360 (up $2.57, +9.46%, to $29.75), Neuren Pharmaceuticals (up 85 cents, +6.89%, to $13.18), and Block Inc (up $5.35, +6.3%, to $90.25).

Among the worst performers were Insignia Financial (down 63 cents, -15.75%, to $3.37), Polynovo Ltd (down 16 cents, -9.58%, to $1.51), and Aristocrat Leisure (down $6.03, -8.85%, to $62.1).

Why ASIC lost patience with Macquarie’s incompetence

Six years after the banking royal commission, what is going on at Macquarie Bank?

Last week, the corporate regulator slammed Macquarie’s management for breaching its reporting obligations for at least a decade and ignoring suspicious trades in the electricity futures market.

And now, the regulator is suing Macquarie’s broking arm, alleging it has misled the market by misreporting millions of short sales over more than a decade.

Our chief business correspondent Ian Verrender says a rejuvenated regulator appears to have run short of patience:

Administrator KordaMentha updates Whyalla steelworks creditors and workers

An update on the administration of the Whyalla steelworks in South Australia today has informed workers and creditors that $100 million has been spent by administrator KordaMentha so far.

The South Australian government forced the steelworks into administration in February after the business, owned by GFG Alliance, failed to pay tens of millions of dollars in royalty payments to the government and millions in unpaid bills to creditors.

KordaMentha partner Sebastian Hams said the $100 million had been spent on restoring inventory, sustaining capital expenditure and improving the site’s safety.

He said site visits from prospective buyers were underway.

Arj Ganesan and Viki Ntafillis with the story:

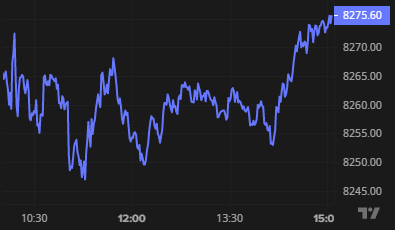

Australia’s market closes in positive territory (just)

Trading on the ASX has finished for the day, and the ASX200 index has gained 10.6 points (+0.13%) to close on 8,279 points.

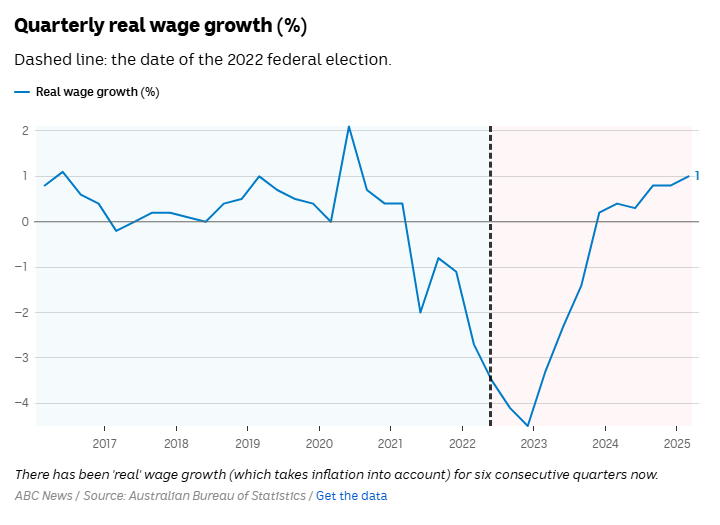

Real wage growth for six consecutive quarters

The ‘real’ value of our wages, which takes inflation into account, is very important.

It determines the purchasing power of our pay-packet.

If we’re experiencing real wage growth, it means wages are growing faster than inflation and we’re able to buy more goods and services for every dollar we’re earning.

And today’s wage data from the Bureau of Statistics showed real wages grew by 1% in the March quarter, which was the fastest pace in real wage growth in the post-COVID era.

It was also the sixth consecutive quarter of real wage growth.

It’s a big part of the story of the “cost of living crisis.”

Inflation is now back within the Reserve Bank’s 2-3% target range, but households will need to see real wage growth for many more quarters before they feel like they’re finally getting ahead again, after years of high and rising inflation.

EY Senior Economist Paula Gadsby says productivity growth will also be crucial from here:

“It is worth noting though that the Reserve Bank is counting on productivity growth improving to its long run average rate to ensure this level of wages growth does not create inflationary pressure moving forward,” she wrote in her note today.

RBA will only cut twice more this cycle: Capital Economics

Capital Economics has reiterated its view that the RBA will only cut rates twice more this cycle (including a 25 basis point cut next Tuesday).

“…the renewed acceleration in wage growth in [the first quarter] at first glance suggests that the labour market is once again a source of inflationary pressures,” Capital Economics’ head of Asia-Pacific Marcel Thieliant wrote in a note.

“However, the Bank did flag volatility from public sector pay hikes in its February Statement and the pick-up in wage growth wasn’t any stronger than the Bank had anticipated.

“Crucially, faster wage growth hasn’t prevented inflation from slowing further.

“Trimmed mean inflation fell from 3.2% to 2.9% last quarter, putting it back in the 2-3% target band for the first time since 2021.

“In [six month] annualised terms, trimmed mean inflation fell from 2.7% to 2.5%, suggesting that underlying momentum has genuinely softened.”

“…Nonetheless, we still think that the Bank will only deliver one more 25bp rate cut at its August meeting instead of two more as foreseen by the analyst consensus.

“While there’s still a risk that the truce between the US and China doesn’t last, our analysis suggests that the Australian economy is well positioned to weather the global trade storm.”

Sony expects profit to flatline on tariffs

Sony has forecast a flat profit result for the current financial year, factoring in a 100 billion yen ($1.05b) hit from the impact of Donald Trump’s trade war.

However, that forecast hasn’t taken account of this week’s truce between the US and China, so the actual impact could vary, the electronics and gaming giant said.

Sony shares are up 2 per cent in afternoon trade, after earlier falling 3 per cent.

The company reported a 16 per cent increase in annual profit, to 1.4 trillion yen ($14.7b).

Sony sold 2.8 million PlayStation 5 units in the fourth quarter, a 38 per cent drop compared to a year earlier.

Operating profit at the gaming unit fell by 12.5 per cent over the same period.

Sony raised PS5 prices in Europe and Britain last month, citing higher inflation and exchange rate fluctuations.

Sony expects profit at the games business to increase by 16 per cent this year due to higher sales of first-party games.

Reporting with Reuters.

ASIC chair Joe Longo says alleged Macquarie breaches ‘very serious’ but not ‘deliberate’

ASIC chair Joe Longo has been speaking with the ABC PM program’s business reporter David Taylor about Macquarie Bank’s breaches of short-selling reporting requirements.

“The inquiry had been unable to tell us exactly how many trades they failed to report, or inaccurately report, but we’ve been able to find evidence of many millions of trades that were not reported, so it’s a very serious matter,” he said.

However, Mr Longo said the lack of reporting does not appear to be a deliberate attempt to cover up trades or mislead the market or regulator.

“Now, now let me be very clear. There’s no suggestion in this case this was deliberate,” he explained.

“This was a consistent failure over many years of the systems, over the years where we got reassurances that their issues with their reporting were being fixed or had been fixed when in fact they hadn’t been.

“But we’re not alleging in this case that the conduct was deliberate.

“This really represents an underinvestment in their systems and processes, hubris, an arrogance that they thought they’d fixed the problem when in fact they hadn’t.”

ASIC chair Joe Longo is also speaking with Kirsten Aiken for The Business, which airs at 8:44pm AEST on ABC News Channel and anytime after 6:30pm AEST on iView.

For more details of ASIC’s case against Macquarie, you can read Stephanie Chalmers’ article.

ASX turns positive with an hour of trade left

We’re heading towards the close and after spending most of the session in the red, the ASX has edged above the flat line in afternoon trade — the ASX 200 is up 0.1 per cent, as is the All Ords.

Long time, no see

Kate hasn’t been on the blog for ages…🫤

– Natty

Well hello Natty! Hope you’ve been well.

I wish I could tell you I’ve been living it up on an overseas holiday, but instead I’ve been on more of a working holiday that’s taken me away from my buds here in business land.

I spent the election campaign (remember that?!) working with the team at 7.30, and I’m now spending a few weeks with the talented crew at Four Corners.

But I’ll be making like this cool pup and pulling back up to the blog soon — and as a self-confessed lurker, I’m never that far away! (You can take the girl out of blogging … etc.)

Mixed moves on Asian markets

Taking a look around the region, and there’s mixed moves for Asian markets today:

- Tokyo’s Nikkei 225 -0.7%

- Shanghai Composite +0.2%

- Shenzen Component -0.3%

- Seoul’s Kospi 200 +1.5%

- Hong Kong’s Hang Seng +1.4%

Super-sized RBA interest rate cut ‘extremely unlikely’: ANZ

ANZ has poured cold water on the idea of a super-sized interest rate cut next week.

It follows the release of the latest quarterly wages data from the Bureau of Statistics.

The Wage Price Index (WPI) rose 3.4 per cent over the 12 months to March.

“The latest wage growth number does not increase the likelihood that the Reserve Bank will move in May, but neither would it be a deal breaker,” ANZ senior economist Adelaide Timbrell says.

“The Wage price index is in line with the Reserve Bank’s forecast for mid this year, and given the uncertainty in the global backdrop, it’s still more likely that the Reserve Bank will cut.

“At this stage, a 50 basis point cut, I would say is extremely unlikely.

“We haven’t seen any outsized rate cuts from other central banks due to the global backdrop, nor is there anything in the domestic economy that would create a need for stimulus.

“A 25 basis point cut in May, given the global backdrop is appropriate without the global uncertainty, you could make an argument for no cuts in May, so I think A 50 basis point cut is very unlikely,” she said.

ANZ had already been forecasting a 25 basis point cut, with NAB the outlier among the major banks in forecasting a 50 basis point move next Tuesday.

The RBA hands down its interest rate decision on Tuesday May 20 at 2:30pm AEST.

📹 Is Trump following Australia’s lead on pharmaceuticals?

Earlier this week, Donald Trump signed executive orders aimed at speeding up drug approvals and another that promises to bring down the cost of medicines.

US drug companies were told to voluntarily lower their prices in the next 30 days to match prices in comparable countries, otherwise, the government may step in and impose the price.

Chief business correspondent Ian Verrender explains how the executive order on pharmaceuticals was received by the market, and what the tariff pause between the US and China means for businesses.

Watch his chat with Kirsten Aiken on The Business:

Loading…

Ian wrote about what is behind America’s decades-long fight to dismantle the Pharmaceutical Benefits Scheme a few months back, it’s a great read:

ASX consultation on potential job cuts underway

Stock exchange operator ASX has confirmed a consultation process is underway on job cuts, following media speculation.

The Australian Financial Review reported yesterday that the ASX had started cutting 100 jobs across the business, representing around an 8 per cent reduction in its workforce.

A spokesperson for the ASX would not comment on the reporting around specific numbers and said no final decisions had been made.

“Operating efficiently is an ongoing priority for ASX, and we continually look for ways to optimise, and this can sometimes include changes to our workforce,” the spokesperson said.

“There is a consultation process underway regarding proposed people changes.

“No decisions have been finalised at this time and our focus is on engaging transparently with our people and supporting them through this process.”

Half of households plan to spend $8k on energy upgrades

More than half of households plan to spend nearly $8,000 on average on energy upgrades, according to an REA Group and Origin Energy report.

But two out of five households could be left behind as they struggle to understand energy use and navigate the market.

The rising cost of living has resulted in most people surveyed changing their energy usage to lower bills.

The PropTrack Origin Australian Home Energy Report, commissioned by Origin Energy and compiled by REA Group, surveyed attitudes on transitioning households away from gas appliances and installing technologies including solar and battery systems.

REA Group senior economist Eleanor Creagh said the upgrades could result in more than $80 billion being spent by homeowners on energy improvements.

“It’s encouraging to see that there is a large number of Australians motivated to make these changes,” she said.

“Certainly in terms of reaching our long-term net zero goals and electrification, quite a bit more needs to be done in education, incentives and policy.”

The responses identified challenges that could slow down the transition of households towards sustainable energy technologies.

Two out of five people surveyed did not know how to improve the energy efficiency of their homes, with “renters and younger Australians facing the biggest knowledge gaps”.

There was little awareness of the Nationwide House Energy Rating Scheme (NatHERS) — the government’s system for rating the energy efficiency of new homes — as 71 per cent of people said they had no understanding of it.

“There’s also a lot of confusion around available government rebates or technologies,” Ms Creagh said.

“Many people see energy efficient upgrades as expenses and don’t recognise the long-term savings.

“Without better education, many households will continue to be locked out of those benefits.”

Read more from business reporter Tony Ibrahim:

What unions and business groups make of wage growth

It’s unlikely to surprise you, but here’s some of the commentary from both unions and business groups on today’s wage growth data.

The Australian Council of Trade Unions (ACTU) described it as “the clearest sign yet that working people’s incomes are finally being restored after years of going backwards”, with the sixth-consecutive quarter of real wage growth.

“Improved collective bargaining rights and fair pay won by union members under the Albanese government are delivering real results for nurses, teachers, early childhood educators and aged care workers,” ACTU president Michele O’Neil said.

“There’s still a way to go, but today’s data shows the importance of having more working people able to bargain over their wages and conditions.”

Meanwhile, peak employer association Australian Industry Group said increases in public sector wages, particularly state government agreements in Victoria, NSW and WA were putting upward pressure on wages, describing them as “excessive”.

“Public sector wage agreements have become increasingly out of touch with the realities of the Australian economy,” Ai Group chief executive Innes Willox said.

“Pressure from excessive state government wage deals puts further pressure on Australian private sector employers, who are already struggling with weak market conditions and declining profitability.”

📹 KPMG economist: ‘Solid’ real wage growth

The chief economist of KPMG says Australian workers are still seeing “solid” real wage growth, with the wage price index tracking above inflation.

Brendan Rynne says the latest wage growth figures show good strength within the Australian labour market, but wages are still well-contained.

Watch his interview with Emilia Terzon on ABC News Channel:

Loading…

Sony’s profit rises 16 per cent, beating expectations

Some news just hitting Japan’s market — electronics giant Sony has reported a 16 per cent increase in annual profit, to 1.4 trillion yen ($14.7b).

That was ahead of the previous year’s result and analyst expectations.

But the stock was down 3.2% at last check.