Market snapshot

- ASX 200: -0.4% to 8,514.2 points

- Australian dollar: 66 US cents

- Nikkei: +1.6% to 40,197 points

- Hang Seng: -0.1% to 24,310 points

- Shanghai: -0.2% to 3,441 points

- S&P 500: +0.8% to 6,141 points

- Nasdaq: +1% to 20,167 points

- FTSE: +0.2% to 8,735 points

- EuroStoxx: +0.1% to 537 points

- Spot gold: -1.2% to $US3,289/ounce

- Brent crude: +0.5% to $US68.09/barrel

- Iron ore: +0.1% to $US94.55/tonne

- Bitcoin: -0.3% to $US107,348.30

Price current around 4.45pm AEST

Live updates on the major ASX indices:

ASX closes lower

The Aussie stock market has closed 0.4 per cent lower at 8,514.2 points.

Mining giants BHP and Rinto Tinto saw big gains off the back of iron ore price hikes overnight (BHP closed up 3.9 per cent to $37.53, Rio Tinto was 4.6 per cent higher at $108.97) but big banks including CBA were in the red (down 2.8 per cent to $185.36).

AMP chief economist and head of investment strategy Shane Oliver said share market volatility is likely to remain high in the next few months given tariff uncertainties, concerns about US debt and likely weaker growth and profits.

“But with Trump likely to pivot towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year end,” he said.

“Shares have literally climbed a wall of worry over the last six months as Trump has tried to build a new world order and upset the global trading system with big tariff hikes and as conflict in the Middle East threatened to disrupt oil supplies,” he said.

“However, volatility is likely to remain high as: US and Australian shares are expensive; Trump’s tariff threat will likely increase again with the July 9 tariff deadline rapidly approaching and some countries likely to see hikes beyond 10 per cent tariffs.”

New super pay gap data released

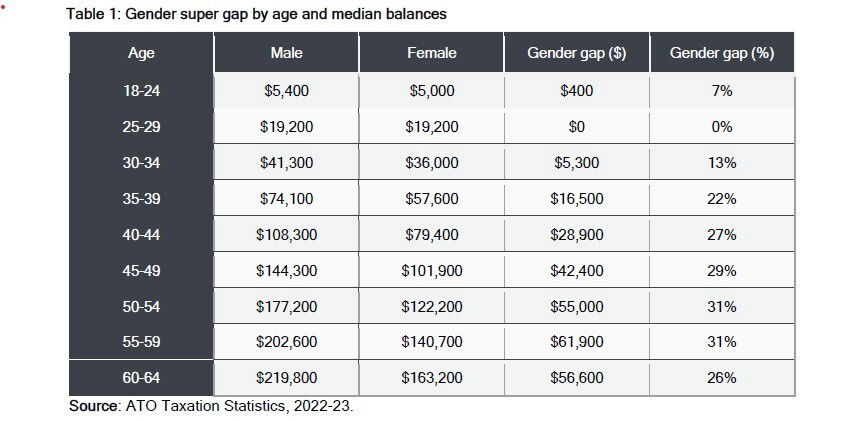

Women today are expected to retire earlier and live longer than men but currently retire with a third less super, according to the Super Members Council.

Its analysis of ATO data shows the gender super gap dramatically widens when women reach their 30s — the decade many women take time out of the paid workforce to raise children.

Until now, parental leave was the only type of paid leave that didn’t attract super — whether funded by employers or the government.

But Super Members Council CEO Misha Schubert said from July 1 super will be paid parental leave, calling it ” a historic achievement”.

“We’re not talking baby steps here — this is a huge stride forward to tackle women’s retirement inequity,” she said.

“It’s going to be transformative to help to tackle gender inequity in retirement.”

Read more on the ATO’s latest taxation statistics here:

Middle East oil crisis averted for now

The Middle East oil crisis has been averted for now, so the price of oil has fallen and shares are up to near record highs.

AMP’s chief economist Shane Oliver says while the past week started with uncertainty as to how Iran would retaliate against the US strike against its nuclear facilities, “things quickly settled down after Iran’s retaliation was seen as “merely symbolic and aimed at de-escalation which quickly saw President Trump verbally impose a ceasefire between Israel and Iran”.

This, Mr Oliver points out, saw the oil price plunge below levels seen before the war started and shares rebound to near record levels.

“Oil supply is key when it comes to conflict in the Middle East,” he said.

“This is all that investment markets are concerned about. When it became clear that any disruption to oil supplies was unlikely oil prices quickly fell back and shares rebounded.”

He notes the positive global lead saw the Australian share market rise by around 0.4 per cent for the week, with gains led by financials, material and discretionary stocks but with energy shares down sharply.

“Bond yields fell in the US and Australia with prospects for lower interest rates but rose in Germany, on the back of more defence related fiscal stimulus, and Japan,” he said.

“While oil prices plunged around 12 per cent and gold fell with less safe haven demand, metal prices rose but iron ore prices fell.”

As Mr Trump had announced on social media that he’d brokered a ceasefire between Israel and Iran, I was speaking to young Iranians about how they felt about it, and whether they think regime change in Iran to democratic system may be possible. You can read more on that here:

Net tax from companies rises

2.3 million Australians declared rental income in 22-23

The ATO’s taxation statistics released today show 2.3 million Australians declared rental income in 2022-23, with about 71 per cent of landlords owning only one investment property (just over 1.6 million).

About 19 per cent (423,000) own two properties, around 6 per cent (130,000) own three properties, while around 4 per cent of landlords (47,000) own four properties.

There are very few landlords (18,837) with five investment properties and a similarly small group with six or more (19,389).

Read more here:

Why is the US dollar diving?

Market analyst Chris Weston from Pepperstone says the US dollar is in a steep demise.

“The US dollar Index (DXY) put in a daily close below its June 12 low of 97.61, with price trading to a low of 97.01, the weakest level since March 2022. With the DXY −2.1% in June, this marks the fifth consecutive monthly decline for the USD index and the worst run of form since mid-2017,” he notes.

Why is the US currency performing so badly? Weston says it doesn’t have much going for it right now:

“As FX players move on from the Iran-Israel conflict and navigate further month-end flows, the price action in the USD and the failure of the USD to stage any meaningful counter-rally, with traders quick to sell into strength, speaks volumes—the reasons behind the disdain for the USD seem plentiful and easily explain the bear trend.

“Those that are front of mind include:

- “Equity–US dollar correlation. The 20-day rolling correlation between the S&P 500 and the DXY sits at –0.79. That’s as strong an inverse relationship as we’ve seen since January; under current dynamics, when the S&P 500 rallies, the dollar falls.

- “Fed leadership uncertainty. Media reports that Trump could make an earlier than expected announcement on his pick to replace Jerome Powell, whose tenure as Fed chair ends in May 2026. This approach reduces the perception of Fed independence and the freedom for the Fed chair to set policy without interference. Essentially, a “shadow” Fed chair undermines credibility of US monetary policy, and that does not sit well with foreign investors.

- “The U.S. becoming less ‘exceptional’ — U.S. growth and labour markets are facing increasing downside risks, notably in Q325 — and, while China and EU growth is hardly blowing the lights out; the greater concern for markets falls on the U.S. economy.

- “Foreign-capital hedging flows. With foreign investors racking up an incredible US$31 trillion in U.S. assets (across equity, fixed income, and credit)—a function of U.S. exceptionalism—this USD notional exposure has been called into question, with foreign investors either reducing their exposure to the U.S. or increasing USD hedging ratios. Trump’s unpredictable and erratic policy agenda is a major catalyst behind these flows.

- “Interest-rate differentials offering EUR tailwinds. EUR vs. U.S. 1-year forward swap differentials have risen from –172 bp in early June to –136 bp. This reflects shifting rate-cut expectations, with the market pricing in additional rate from the Fed later this year while paring back ECB-cut bets.

- “Fiscal dynamics. Upward revisions to China’s growth outlook from economists, plus the compelling 2026 fiscal plans from the German govt, contrast with ever-increasing U.S. public debt and U.S. deficits projected near 6% of GDP for years ahead.”

That is what I’d call a wall of worries.

Market snapshot

- ASX 200: -0.2% to 8,537 points

- Australian dollar: Flat at 65.44 US cents

- Nikkei: +1.6% to 40,197 points

- Hang Seng: -0.1% to 24,310 points

- Shanghai: -0.2% to 3,441 points

- S&P 500: +0.8% to 6,141 points

- Nasdaq: +1% to 20,167 points

- FTSE: +0.2% to 8,735 points

- EuroStoxx: +0.1% to 537 points

- Spot gold: -1% to $US3,295/ounce

- Brent crude: +0.6% to $US68.12/barrel

- Iron ore: +0.1% to $US94.55/tonne

- Bitcoin: -0.2% to $US107,615

Price current around 2:50pm AEST

Live updates on the major ASX indices:

Has the US government bond dam burst?

The pricing of US bonds yields suggests more money is leaving the world’s biggest economy.

The US 30-Year Treasury bond is trading at 4.812 per cent.

On May 7 it traded lower at 4.778 per cent.

But it was as low as 4.422 per cent in April.

The Financial Times is reporting investors are exiting out of long-term US bonds at the fastest rate since the height of the COVID-19 pandemic five years ago.

Net outflows, it says, from long-dated US bond funds spanning government and corporate debt have hit nearly $11 billion in the second quarter.

When investors sell bonds, their yields go up.

You know how the market’s been distracted by the Iran-Israel war and the potential for a spike in the price of oil?

Well now that the ceasefire appears to be holding, investors are turning their attention back to tariffs and, crucially, the US fiscal position.

Is it sustainable? Well, no.

Could the so-called One Big Beautiful Bill be the fiscal panacea for the US economy, along with sweeping tariffs?

It seems that traders are voting with their cash.

Treasurer issues first invitations to Productivity Roundtable

Jim Chalmers had warned that it will be a relatively small group who meet in August to discuss solutions for the nation’s lagging productivity growth.

Today we got the initial list of invitees:

- Danielle Wood, Chair, Productivity Commission

- Sally McManus, Secretary, Australian Council of Trade Unions

- Michele O’Neil, President, Australian Council of Trade Unions

- Bran Black, Chief Executive Officer, Business Council of Australia

- Andrew McKellar, Chief Executive Officer, Australian Chamber of Commerce and Industry

- Innes Willox, Chief Executive Officer, Australian Industry Group

- Matthew Addison, Chair, Council of Small Business Organisations of Australia

- Cassandra Goldie, Australian Council of Social Service

ACTU alternate delegates for the secretary and president if unavailable:

- Liam O’Brien, Assistant Secretary, Australian Council of Trade Unions

- Joseph Mitchell, Assistant Secretary, Australian Council of Trade Unions

No real surprises in this core group. A mix of worker representatives, employer representatives, one representative from the social services sector and the head of the government’s economic think tank.

The Treasurer says more invitations will be issued in tranches and in due course, as the agenda takes shape.

He also says additional stakeholders, experts and representative groups will be invited to the Roundtable, including for specific days, sessions and topics.

The public is also invited to make submissions for consideration by the Roundtable, with a deadline of July 25.

Submissions can be made via the Treasury website.

Aussie dollar at its highest level since November

The Australian dollar’s enjoying a nice tailwind … now at its highest level in 2025

The Australian dollar last traded this high against the greenback back in November 2024.

At 1:45pm AEST, the Aussie was trading at 65.55 US cents.

It reached 65.62 US cents earlier in Asian trade.

It traded 65.98 US cents in November 2024.

Much of the Australian dollar’s strength comes from US dollar weakness.

US president Donald Trump again, overnight, indicated his disdain for Federal Reserve chair Jerome Powell.

The suggestion there could soon be a new central bank boss favoured by the Trump administration led to US dollar weakness.

The link here is that markets see this as ushering in more interest rate cuts — which is US dollar negative.

The Australian dollar has also been buoyed by a rise in the price of iron ore — Australia’s largest export commodity.

ASX flat as bank falls offset mining gains

Australia’s economy is largely about houses and holes.

Recently, the houses have dominated, reflected most prominently in a record share price for the biggest home lender, CBA.

The holes have struggled a bit, with the big miners a reasonable way off record highs.

But that’s flipped on today’s market, where Rio Tinto (+4.5%) and BHP (+3.6%) are surging, along with many of the smaller miners.

Meanwhile, CBA is off 1.25%, while the other three mega banks are down about 0.6%.

Macquarie, however, is up 1.9%.

Overall, just past the middle of the trading day, the ASX 200 is up just 4 points at 8,554.

The Australian dollar is holding onto gains, at 65.57 US cents.

Peter Ryan interview

Hi team, Thank you to Michael Janda for the interview with retiring senior business journalist Peter Ryan on his ‘highs and lows from 45 years in journalism’. As a long-time listener/viewer/reader, your high quality journalism is much appreciated.

– Michael

Hi Michael, thanks for the kind words.

Peter’s journalism has been top notch for such a long period, and it was a real privilege to sit down and hear more about it directly from him.

What the audience doesn’t fully get to see and hear is what a kind and generous man Peter is, reflected in the hundreds of colleagues he has helped over the years, through mentoring, HR advice, or simply a kind word to someone having a tough time.

If you have 40 minutes to spare, I promise that it won’t be wasted watching this.

Loading…

Does the government do more now than it used to?

With new details on tax raised maybe a good time look back 30yrs at how much tax was raised in 1992-3. $117.7B raised, about $259.7B in todays money (adjusted for inflation). So $577B raised today is a 122% increase in tax revenue. Population has only grown 51% in that same period (23.7M vs 17.6M). Per person tax has grown 47% (~$22K today vs $15K in 1993 adjusted for inflation). Do the government really provide 47% more than they did 30yrs ago?

– CJ

Hi CJ, it’s a good question worth deep consideration — something well beyond the scope of a blog post.

However, whether governments provide 47% more, it is clear they do a lot more than they used to.

Since 1992-93, we’ve got a National Disability Insurance Scheme, Australia has spent a lot on defence, we subsidise childcare a lot more than before and require more staff per infant, there’s been some massive infrastructure projects (especially in urban transport, inland rail and renewable energy).

Above all that, the nation’s demographics have changed a lot and we now have a lot more older Australians in residential care and receiving expensive medical treatments in public or publicly subsidised healthcare facilities for a lot longer.

Sometimes, as an individual, we don’t see these increases in government services if we’re not using them ourselves.

That doesn’t mean others in society aren’t seeing a real benefit.

But, as I said at the top, it’s a good avenue for future inquiry.

Cost-of-living crisis over?

What happened to the cost of living topic after the federal election?

Hardly is mentioned anymore anywhere especially by the Liberal Party, it mustn’t exist? 😉– Russ D

Interesting question Russ D.

It doesn’t take an economist to figure out that Wednesday’s inflation reading of 2.1% for the year to May (2.4% excluding volatile price moves) is pretty tame given that the Reserve Bank’s target is 2-3% inflation.

Treasurer Jim Chalmers didn’t want to sound too triumphant in his press conference about the numbers on Wednesday.

“I’m reluctant to say it’s mission accomplished, but we are certainly making more progress than was expected,” he told reporters.

“This is the lowest that inflation has been for years. It’s the lowest headline inflation since the beginning of 2021. It’s the lowest underlying inflation since the end of 2021. And also means for the first time since these monthly records have been kept that we have seen six consecutive months now of inflation within the Reserve Bank’s target range.”

The problem is that a lot of the damage had already been done to standard of living during the end of the Morrison government and the first part of the Albanese government when real wages — that is wage growth minus inflation — were falling.

They’ve been growing again for a while now, but it’s probably going to take years for the typical Australian’s purchasing power to get back to where it was prior to the inflation outbreak.

Australian super funds breathe sigh of relief as Bessent pushes to drop ‘revenge tax’

News reported on this blog earlier this morning that US Treasury secretary Scott Bessent is pushing Congress to drop the proposed Section 899 tax on investments, colloquially dubbed the “revenge tax”, has been met with relief by big overseas investors, such as Australia’s huge super funds.

Australian Treasurer Jim Chalmers has also welcomed the news, as my Parliament House colleague Tom Crowley reports.

Australia Institute slams million-dollar-plus earners who pay no tax

Every year, progressive think tank The Australia Institute crunches some of the numbers released in the ATO’s Tax Stats data to find out how many people earned more than a million dollars but paid no tax.

In 2022-23, that number was 91, who claimed around $390 million in deductions to reduce their taxable incomes below the $18,200 tax-free threshold.

Many of these deductions would have related to philanthropic gifts to tax deductible charities.

However, the Australia Institute’s analysis found that, between them, they claimed $62.8m in deductions for paying accountants and lawyers to manage their tax affairs, at an average of $690,815 each.

TAI found that 24,350 Australians earned more than $1m in 2022/23. Of those, 24,211 paid net tax, leaving 139 who paid zero net tax, with many being able to offset past losses against current tax liabilities.

“It should not be possible for someone who has earned more than $1m in a year to be able to avoid paying any tax,” said Greg Jericho, chief economist at The Australia Institute.

“At a time when we are debating changes to superannuation taxation for the small number of people with balances over $3m, these figures show just how the rich abuse the tax system to avoid paying their fair share.

“The government does not need to raise income tax to fund essential services like education, health and the NDIS. It needs to crack down on the ability of super wealthy people who pay high-priced tax lawyers and accountants to help them avoid paying tax.

“People earning ten or twenty times the average annual income paying no tax just doesn’t pass the pub test. It reinforces the idea that if you have the money, you can work the system to your advantage in ways not possible for the rest of us.”

Read more here:

Are surgeons earning too much money?

When doctors are earning such high salaries, it’s hard to accept pay rises sought through industrial action. In SA they are citing the pay scales of interstate colleagues. It seems that this profession has become a money making one instead of being a service oriented profession. Teachers and Nurses on the other hand paid much lower wages, while also being of equal importance to the society.

– Celosia

It’s an interesting question.

Many surgeons would argue that their high pay now is fair compensation for the many years of unpaid studies and relatively low-paid training roles and long hours they work in order to get to where they are.

Teachers and nurses don’t have to spend nearly as long at uni and in work placements before being fully qualified.

On the other hand, teachers and nurses don’t get to decide how many new entrants are permitted to join their profession each year, which is a closed-shop privilege the medical specialties have retained.

“The Royal Australasian College of Surgeons (RACS) is the only body in Australia which is eligible to grant Fellowship in nine surgical specialties. Whilst training courses and exams are conducted by RACS, the administration and management of the training programs is conducted by the responsible specialist societies such as the General Surgeons Australia, Australian Orthopaedic Association, and the Neurosurgical Society of Australasia,” Sydney University notes in its advice for prospective medical students.

“Applications for the training program are competitive and places are limited, so you may need to apply multiple times before gaining admission.”

While law societies in Australia perform a similar role admitting new practitioners, to my knowledge, they do not set a limit on how many graduates who have completed their degrees and practical legal training can be admitted as solicitors in any given year.

In other words, if you pass your degree, complete your PLT and meet the character test, you’re in. I studied law in NSW, and I have never heard of anyone being knocked back from admission because of any sort of quota.

On the other hand, in medical specialties, you can pass your degree, successfully undertake residencies in your chosen field and still be rejected from the final stage of training to become a surgeon because there are not enough places available.

The surgeons would argue that this is because there is a limited pool of people who can conduct the necessary specialist training and supervision.

But there is also an argument that the supply of specialists may be being artificially constrained, which would reduce patient choice, increase waiting times and prop up the fees that can be charged.

It is certainly an area worth further investigation, and I’d love to hear from people involved in the medical specialties to see what their take is — drop me an email: [email protected]

‘No near-term path to profitability’: Analyst welcomes MyDeal closure by Woolworths

Steph reported earlier that Woolworths is planning to shut down its MyDeal online marketplace.

The closure is expected to cost $90-100 million in cash, plus a writedown of MyDeal’s assets, leading to an approximately $45 million impairment charge in Woolworths’ results, due to be released in August.

The company bought a majority stake (around 80%) in MyDeal back in 2022.

RBC Capital Markets analyst Michael Toner welcomes the move, saying MyDeal was simply bleeding cash for the supermarket giant.

“We view this as a positive, albeit incremental, step towards portfolio simplification as MyDeal had no near-term path to profitability,” he writes.

“Woolworths has flagged a ‘meaningful reduction in Woolworths MarketPlus operating losses once completed.’

“On the basis of restated accounts provided at the 1H25 result, we estimate that MyDeal lost roughly ~$20m EBIT in FY24 on a backward-looking basis, though this has likely accelerated since that point in time as WOW has called out contracting GMV/ deteriorating performance for MyDeal.”

So Woolies is taking some upfront pain now, to stop bleeding cash over the longer-term.

Trump’s Big, Beautiful Bill still faces challenges to pass Congress

US Treasury secretary Scott Bessent on Thursday asked Republicans in Congress to remove a “retaliatory tax” proposal that targets foreign investors from their sweeping budget legislation, as lawmakers struggled to find a path forward on the bill.

The retaliatory tax proposal has stirred alarm on Wall Street, as fund managers, venture capital firms and others have warned it could disrupt financial markets, which have already been spooked by President Donald Trump’s push to impose steep tariffs on top US trading partners.

Known as “Section 899,” the proposal would give Trump new authority to impose taxes up to 20% on investors from countries that are found to impose “unfair” taxes on US companies.

At the White House, Trump pushed lawmakers to pass the yet-to-be finalized bill, which would extend his 2017 tax cuts, authorise more spending on border security and the military and add about $US3 trillion to the federal government’s $US36.2 trillion debt.

“This is the ultimate codification of our agenda,” Trump said of the bill at an event where he was surrounded by truck drivers, firefighters, ranchers and other workers who the administration says would benefit from the bill.

Asked if he believed Congress could finish its work before the July 4 Independence Day holiday, which Trump has sought for weeks, he replied, “We hope so.”

Senate Republicans have yet to produce their version of their legislation ahead of a possible weekend vote, and the overall shape of the bill appeared more uncertain after a nonpartisan referee ruled that several healthcare provisions violated the complex process Republicans are invoking to bypass Democratic opposition.

Reuters