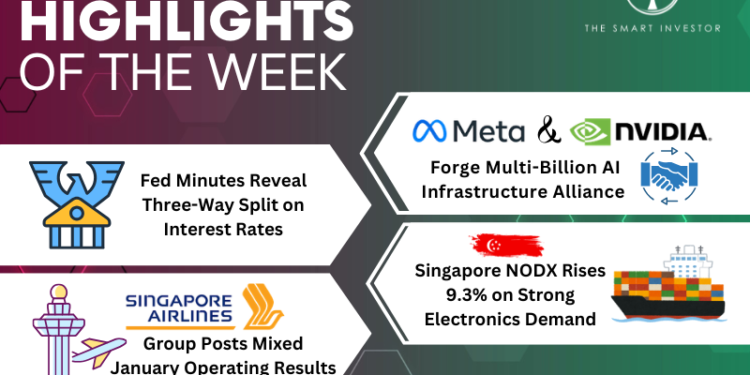

This week saw major developments spanning global technology and monetary policy through to Singapore’s trade performance.

A landmark AI infrastructure deal reinforced the ongoing boom in AI-related spending, whilst minutes from the US Federal Reserve’s latest meeting revealed a more fractious debate over interest rates than anticipated.

Closer to home, Singapore’s export figures pointed to resilient electronics demand, and the SIA Group released its January 2026 operating statistics.

Meta Platforms (NASDAQ: META) and Nvidia (NASDAQ: NVDA) announced a sweeping multiyear partnership this week to build hyperscale AI data centres, a deal analysts estimate could be worth tens of billions of dollars.

The agreement covers millions of Nvidia’s current Blackwell and upcoming Rubin GPUs, alongside Spectrum-X Ethernet networking equipment.

Notably, Meta will be the first to deploy Nvidia’s Grace CPUs as standalone chips in large-scale production.

These CPUs are designed to run AI inference and agentic workloads more efficiently, offering a twofold performance improvement per watt over earlier solutions.

This comes as Meta commits up to US$135 billion to AI infrastructure in 2026 for its Meta Superintelligence Labs.

Nvidia CEO Jensen Huang highlighted the deep co-design across hardware and software, cementing Nvidia’s dominance.

While Meta and Nvidia shares rose, rival Advanced Micro Devices (NASDAQ: AMD) fell 4% as investors interpreted the alliance as a barrier to competitors.

Minutes from the 27-28 January 2026 FOMC meeting revealed a central bank more divided than markets expected.

While the benchmark rate held steady at 3.5% to 3.75%, officials are now split into three camps.

One group supports further cuts if inflation declines, another prefers holding steady, and a third “hawkish” group suggested rate hikes remain on the table if inflation persists above the 2% target.

Currently, the Fed’s preferred PCE gauge remains roughly 1% above target.

Two governors, Christopher Waller and Stephen Miran, dissented in favour of an immediate cut due to labour market concerns.

Adding to the uncertainty, Trump-nominee Kevin Warsh has publicly backed lower rates, though markets do not price in a cut until June at the earliest.

Singapore’s non-oil domestic exports (NODX) grew 9.3% year on year (YoY) in January 2026.

While positive, this fell short of the 12.1% growth forecast by analysts.