- Lagarde signals intent to finish ECB term, amid politically sensitive succession chatter.

- Westpac warns Australia’s unemployment rate masks soft demand and falling participation

- FX INTERVENTION: Reports the Reserve Bank of India is selling USD/INR to support the rupee

- Goldman: Gold to grind higher to $5,400/oz by end-2026 on strong demand

- NZD, AUD fall as RBNZ says inflation returning to target, no preset path

- El-Erian flags private credit ‘canary in the coal mine’ as fund freezes redemptions

- USD gains on strong US data unlikely to last; policy uncertainty, political risks to cap

- Supreme Court tariff ruling nears; JPM maps S&P 500 swings across four scenarios

- Japan flash PMIs rise in February; composite hits 53.8, exports surge

- Japan inflation slows to 1.5% in January, core measures ease. What will the BoJ think?

- Japan January 2026 Core CPI 2.0%, slowest since Jan 2024 (vs. 2.0% expected & 2.4% prior)

- Iran warns of decisive response if attacked as Trump weighs strike option

- Fed’s Daly says policy ‘in a good place’ as inflation cools & AI productivity impact looms

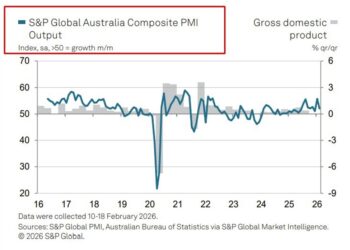

- Australia flash PMIs cool in February: composite 52.0 vs 55.7 as price pressures intensify

- New Zealand January 2026 trade data, exports and imports not as large as in December

- Trump considers limited strike on Iran to force nuclear deal, Wall Street Journal reports

- investingLive Americas market news wrap: Rising US trade deficit dims GDP forecast

At a glance:

-

Fed’s Daly: Policy “in a good place” after 75bps of cuts; tone steady-to-mildly dovish.

-

RBNZ: Inflation seen back inside target in Q1; no “trigger happy” hikes; NZD and AUD softer.

-

ECB’s Lagarde (WSJ): Baseline is to complete term through 2027; declined to address FT exit report.

-

RBI: Traders say central bank likely sold USD/INR to defend the 91 level pre-open.

-

Japan CPI: Headline 1.5% y/y (2.1% prior), lowest since Mar 2022; core 2.0% (2.4% prior), lowest since Jan 2024.

-

Japan PMIs: February flash composite strongest since May 2023.

-

USD/JPY: Rangebound; Japan long weekend ahead (markets closed Monday).

Plenty of central bank commentary today!

San Francisco Fed President Mary Daly said monetary policy is “in a good place” following last year’s cumulative 75 basis points of rate cuts. Daly argued the labour market has stabilised and inflation should resume its downward path as tariff effects fade. The tone was steady-to-mildly dovish, reinforcing the view that the Fed is comfortable with current settings and not under pressure to move quickly in either direction.

From New Zealand, RBNZ Governor Anna Breman said the path back to 2% inflation has been “bumpy,” but added inflation is expected to already be back within the target range in the first quarter of this year. She reiterated confidence that inflation will return to the 2% midpoint over the next 12 months. Chief Economist Paul Conway reinforced that policy is not on a preset path and that the Bank “won’t be trigger happy” with rate hikes. The tone weighed on the New Zealand dollar, with the Australian dollar slipping alongside.

In Europe, ECB President Christine Lagarde, in an interview with the Wall Street Journal, said her baseline is to complete her term through October 2027. She declined to comment directly on a Financial Times report suggesting she could step down early.

Staying with central banks, traders said the Reserve Bank of India likely sold USD/INR before the local spot open to prevent a cleaner break above the 91-per-dollar level.

On the data front, Japan’s January CPI showed a marked cooling in inflation. Headline CPI rose 1.5% y/y (2.1% prior, 1.6% expected), the lowest since March 2022 and ending a 45-month run above the Bank of Japan’s 2% target. Core CPI (ex fresh food) slowed to 2.0% (2.4% prior), its lowest since January 2024. The core-core measure (ex fresh food and energy) eased to 2.6% from 2.9%.

That softer inflation print was followed by solidly improving February flash PMIs, with the composite index posting its strongest growth since May 2023.

USD/JPY remained rangebound through the session, with traders keenly awaiting the upcoming long weekend in Japan. Markets are closed on Monday. US PCE tonight also keenly awaited, of course 😉 .

As a ps., China is back next week after being away on holiday this week. Asian markets should get back to normal!