Details:

- New orders 5.8 vs 6.6 prior

- Shipments -1.0 vs 16.3 prior

- Employment 4.0 vs -9.0 prior

- Average employee workweek 2.1 versus -5.4 prior

- Prices paid 49.1 vs 42.8 prior

- Prices received 22.2 vs 14.4 prior

- Unfilled orders 9.1 vs -8.2 prior

- Delivery times 4.0 vs 0.0 prior

- Inventories 7.1 vs -2.1 prior

- Supply availability -1.0 vs -4.1 prior

The big story here is on the price side — prices paid jumped to 49.1 from 42.8 and prices received rose to 22.2 from 14.4. That’s a notable acceleration and could feed into the inflation narrative. On the forward-looking side, expected prices paid rose to 57.6 from 52.6, suggesting firms see more cost pressures ahead. The employment picture flipped positive after last month’s decline, and the capital expenditures index hitting a multi-year high at 18.2 is a constructive signal. The shipments drop is the weak spot but unfilled orders surging suggests demand is there — just backed up.

The agency said: “Manufacturing activity increased in New York State, according to the February survey. The general business conditions index held steady at 7.1, suggesting activity expanded modestly for a second consecutive month. The new orders index came in at 5.8, pointing to an ongoing increase in orders, while the shipments index dropped seventeen points to -1.0, indicating shipments were flat. The unfilled orders index rose seventeen points to 9.1, and delivery times were slightly longer. Inventories rose. The supply availability index came in at -1.0, suggesting supply availability was little changed from last month.”

Six-month outlook:

- General business conditions 34.7 vs 30.3 prior

- New orders 34.9 vs 33.3 prior

- Shipments 33.4 vs 34.9 prior

- Number of employees 26.1 vs 14.9 prior

- Average employee workweek 15.2 vs 17.5 prior

- Prices paid 57.6 vs 52.6 prior

- Prices received 40.3 vs 36.5 prior

- Capital expenditures 18.2 vs 10.3 prior

- Unfilled orders 18.2 vs 10.3 prior

The agency said: “Firms continued to be optimistic about the outlook. The index for future business conditions rose four points to 34.7. New orders and shipments are expected to increase, and employment is expected to grow. The capital expenditures index rose eight points to 18.2, a multi-year high, indicating a strengthening in capital spending plans.”

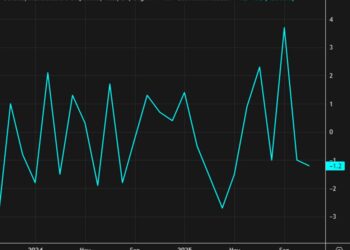

The New York Fed Manufacturing Index (officially known as the Empire State Manufacturing Survey) is a monthly economic indicator that gauges the health of the manufacturing sector in New York State.