The stock market is offering rare deals on a few companies.

The recent weakness in the stock market has opened up some buying opportunities in a few key areas. Some stocks have reached the lowest levels seen in years, and savvy investors can scoop up shares for cheap.

Three stocks that I’ve been eyeing recently are Microsoft (MSFT 0.16%), The Trade Desk (TTD 1.34%), and Nvidia (NVDA 2.21%). I think all three of these are bargain stocks, and by investing now, they could help set you up for life based on the market-beating returns they can produce.

The market could reassess these stocks on any day, so investors shouldn’t wait for a better price for this trio; now is the time to act.

Image source: Getty Images.

Microsoft

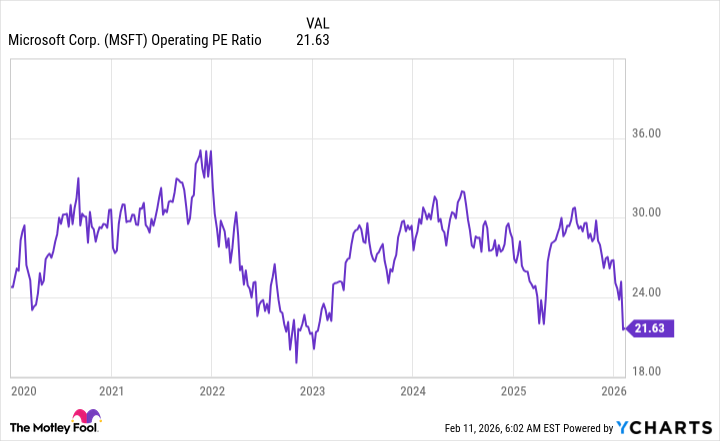

Microsoft has had a premium valuation in the tech space since about 2020. However, that premium has been erased over the past few months with general weakness in the tech sector and a poorly received earnings report. I prefer to value Microsoft’s stock using operating profits, as it doesn’t include the effects of its investment in OpenAI, which has caused its net income to soar over the past few quarters. From that measure, Microsoft is nearly at the cheapest level it has reached outside of the 2023 sell-off.

MSFT Operating PE Ratio data by YCharts

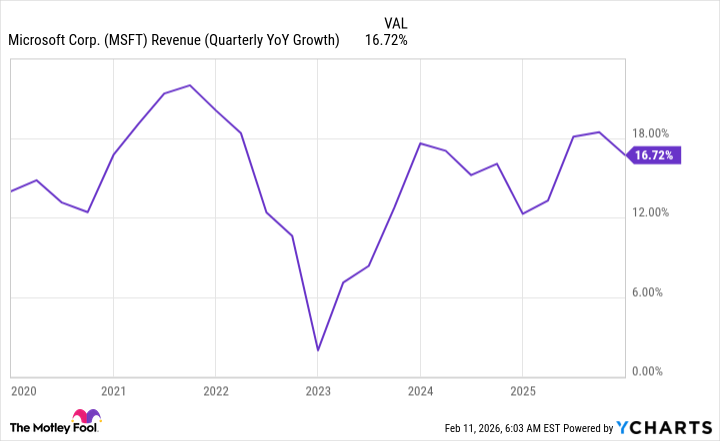

What has changed over the past few months? Nothing. Microsoft is still in a dominant position in its industry and just delivered one of its better quarters in terms of growth over that timeframe. It’s rare to get an opportunity like this to buy Microsoft stock, and investors shouldn’t squander it.

MSFT Revenue (Quarterly YOY Growth) data by YCharts

The Trade Desk

The Trade Desk isn’t all green flags like Microsoft is. It has some challenges it’s facing with its ad platform, although it’s still producing strong results. In Q3, The Trade Desk reported 18% year-over-year growth. While this is slower than in previous quarters, it’s still an impressive growth rate. Additionally, its previous year was boosted by Q3 political ad spending, so The Trade Desk had some headwinds it was dealing with now.

Today’s Change

(-1.34%) $-0.35

Current Price

$25.79

Key Data Points

Market Cap

$12B

Day’s Range

$25.65 – $26.82

52wk Range

$25.64 – $91.45

Volume

444K

Avg Vol

13M

Gross Margin

78.81%

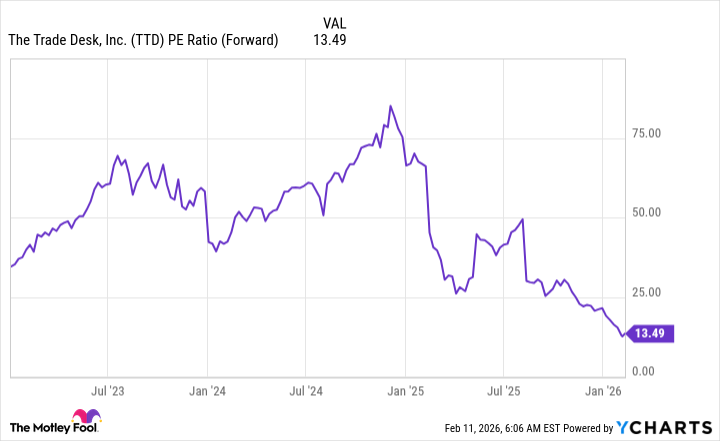

For 2026, Wall Street expects 17% revenue growth, so it’s not like The Trade Desk’s entire growth thesis is in the trash. Despite this, The Trade Desk stock is valued at an unbelievably low level. For a mere 13 times forward earnings, you can own a stock growing in the high teens. That’s an absolute bargain, and I think investors can confidently take a position in the stock at this price.

TTD PE Ratio (Forward) data by YCharts

Nvidia

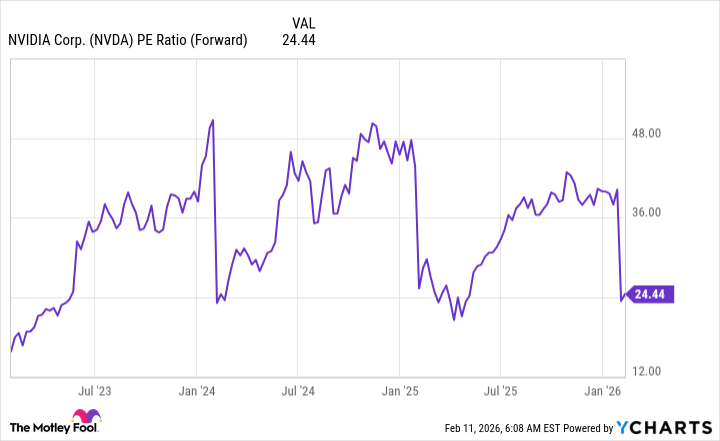

Last is Nvidia, a stock that’s not usually associated with the word “bargain.” However, I think that’s exactly what Nvidia is, and investors should take advantage of this opportunity. Despite many of its largest clients announcing jaw-dropping capital expenditure figures, Nvidia’s stock has barely budged. It now trades for a mere 24 times forward earnings, despite being projected to grow at a 64% pace in FY 2027 (ending January 2027).

NVDA PE Ratio (Forward) data by YCharts

That’s not that much of a premium over the broader market, as measured by the S&P 500. With the S&P 500 trading for 21.8 times forward earnings, Nvidia’s stock is almost too cheap to ignore at this point. Additionally, 2026 won’t be the end of elevated generative AI spending (outside of an event that causes all AI spending to cease). Nvidia believes that global data center capital expenditures could reach $3 trillion to $4 trillion by 2030, which would result in massive gains for Nvidia and its peers.

Today’s Change

(-2.21%) $-4.13

Current Price

$182.81

Key Data Points

Market Cap

$4.4T

Day’s Range

$181.59 – $187.50

52wk Range

$86.62 – $212.19

Volume

162M

Avg Vol

180M

Gross Margin

70.05%

Dividend Yield

0.02%

I’m not sure if we’ll reach those levels, but I am confident that AI spending is set to increase over the next few years, making Nvidia a no-brainer stock to buy now.