Image source: Getty Images

The wealth-building power of the stock market has been proven over many decades. Share prices can swing when economic challenges spring up and company earnings stumble. Over the long term, though, the market has always trended updwards, and investors can experience capital gains and dividend income.

The Dow Jones Industrial Average hit new peaks above 50,000 points just this month. The FTSE 100 in the UK and Japan’s Nikkei 225 indexes have also surged to fresh highs in February. As you can see, patient investors tend to be rewarded over time.

I’m convinced that share investing is a great way to consider building wealth for retirement. Want to know how just £500 a month could provide a comfortable lifestyle?

Stock market returns

Over the long-term, the global stock market has delivered an average return of between 8% and 10%. No other major asset class has performed as impressively over a number of decades.

Bonds have returned somewhere between 3% and 5%, while real estate’s produced returns of roughly 3% and 5%. Cash accounts have provided a terrible return of 1% to 2%.

Given the stock market’s exceptional performance — and the massive range of options investors have to fill their portfolios — why settle for less? If one invests in a tax-efficient Stocks and Shares ISA, too, the returns can be truly life changing.

A £43k+ passive income

The average Stocks and Shares ISA has delivered an average return of 9.64% over the last decade. That’s according to Moneyfacts.

At this rate, someone investing £500 a month could make an astonishing £624,104 after 25 years. That’s assuming the reinvestment of dividends to boost compound gains over time.

With a portfolio of this size, an investor could withdraw a percentage each year for passive income. They could also purchase an annuity. My own plan is to purchase dividend stocks that deliver income as well as scope for further portfolio growth.

If applied to the £624k ISA we calculated above, this approach could deliver a £43,687 yearly second income. That’s if it was invested in 7%-yielding dividend shares.

A FTSE dividend hero

Pleasingly, the UK stock market’s packed with excellent dividend payers that could make this reality. To my mind, Legal & General (LSE:LGEN) is one of the best, which is why it’s the single largest share holding in my portfolio.

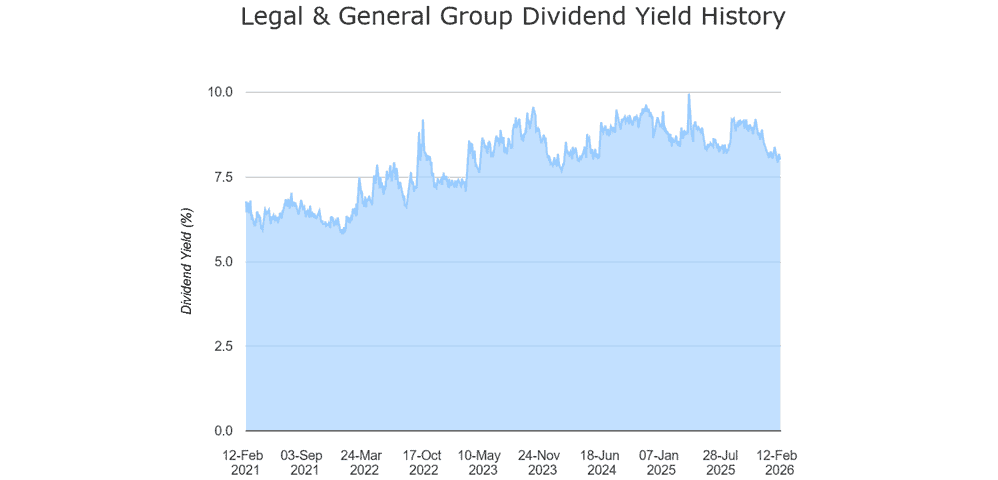

What makes it so great? As you can see, it’s long offered a dividend yield that smashes the FTSE 100 long-term average of 3% to 4%.

It’s a record City analysts expect to continue, with yields of 8.1% and 8.3% for 2026 and 2027 respectively. Predicted payouts are supported by Legal & General’s cash-rich balance sheet.

What’s more, the FTSE company has an excellent history of lifting annual dividends. By consistently raising them for the last 14 years (bar pandemic-hit 2020), Legal & General shares have proven a great way to protect investors from inflation.

Intense industry competition could threaten future cash flows and dividends. Still, I’m confident this market leader will keep pumping out passive income as the financial services sector grows.