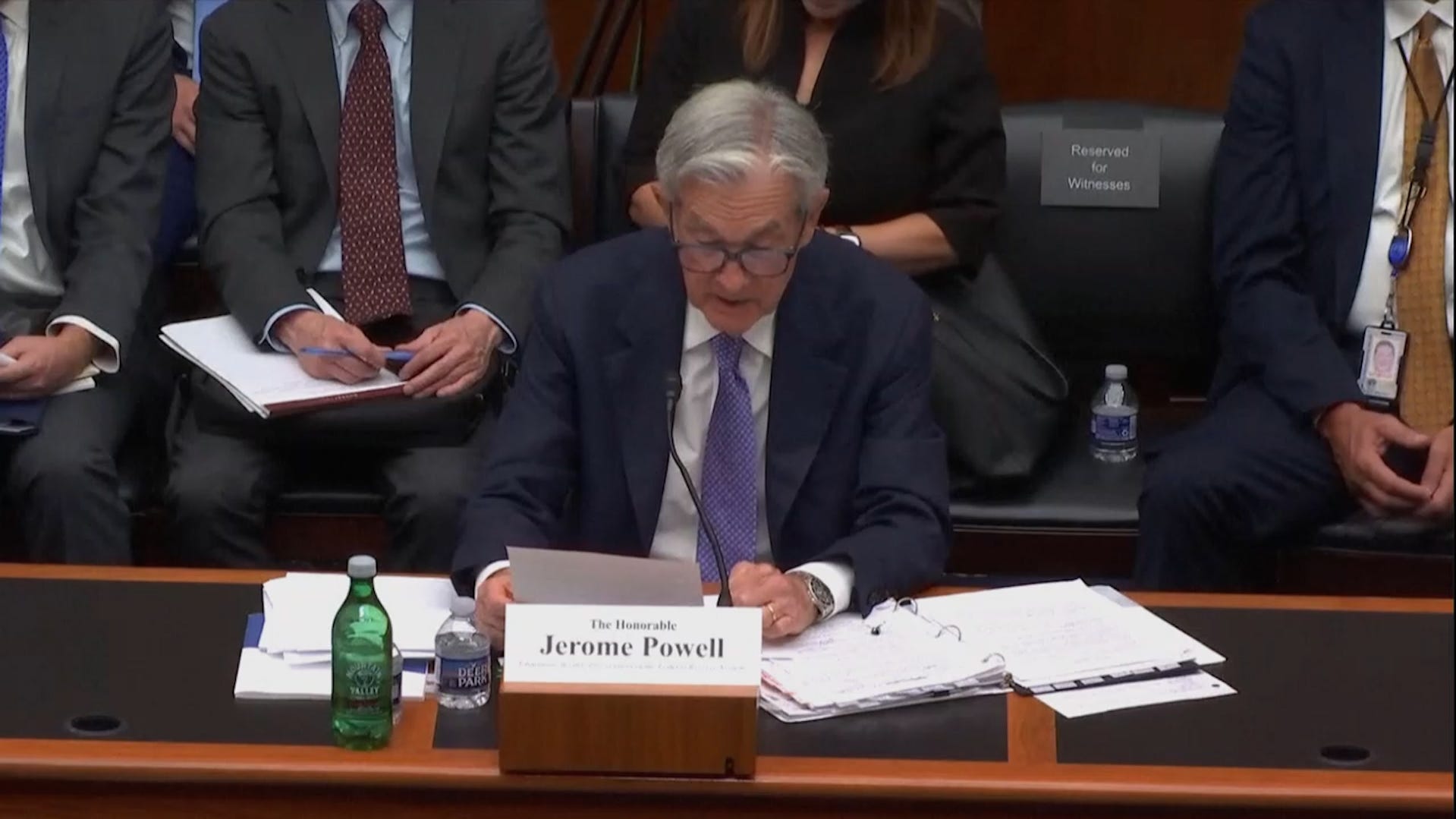

Fed chair Powell says no Trump pressure to lowering interest rates

President Donald Trump has put pressure on the Federal Reserve to lower interest rates and Jerome Powell is still saying no.

Stocks gave back some gains Wednesday midday after opening higher.

The Dow Jones Industrial Average lost 80 points to trade near 43,009, while the tech-heavy Nasdaq Composite was up 42 points, or 0.2%, near 19,955. The S&P 500 was up 1 point near 6,093, within striking distance of its February all-time high.

Oil’s slide ended, with prices last up about 2% at just over $66 per barrel. Prices dropped two days in a row as it looked like Middle East oil supplies would remain intact.

Stocks advanced Tuesday after Israel and Iran agreed on a ceasefire. Though fragile — both sides accused each other of having broken the pact within hours of it becoming effective — investors seem to believe it will hold, or at least help keep the conflict contained and keep global oil supplies intact.

With Mideast tensions easing, investors will turn their attention to the second day of Federal Reserve Chairman Jerome Powell’s testimony to Congress. In his first appearance, he stayed on script, repeating his “wait-and-see” approach to rate cuts. Powell said the economy was stable enough now to see how tariffs affect inflation before deciding on any rate cuts.

The benchmark 10-year U.S. Treasury note was up about 2 basis points to 4.31% around noon New York time.

Corporate news

- FedEx’s results topped analysts’ estimates in the last three months of its fiscal year, but its current quarter outlook was weaker than expected. The stock was down 1.6% at midday.

- Worthington Enterprises’ fiscal fourth-quarter results came in better than forecasts. Shares jumped in the morning, but by midday were flat.

- Tesla sold just 13,863 vehicles in Europe last month, down 28% from a year earlier, the worst-performing major manufacturer in Europe through May, according to sales data from the local association of car manufacturers, ACEA. The stock fell more than 4%.

- QuantumScape announced a breakthrough in its process for making solid-state batteries. Shares soared 36%.

- BlackBerry raised its annual sales guidance after reporting better-than-expected quarterly results. The stock was nearly 16% higher in midday trade.

Cryptocurrency

The New York Stock Exchange filed for a rule change to allow it to list the Truth Social Bitcoin and Ethereum ETF.

Bitcoin was last up 2% at $107,399.