Posted June 18, 2025 at 2:23 pm EST.

Dozens of crypto treasury companies have been announced since the beginning of the year. However, none may be as controversial as Nasdaq-listed SRM Entertainment (SRM), which is transitioning into a Tron (TRX) treasury company via a reverse merger and a $210 million injection of capital.

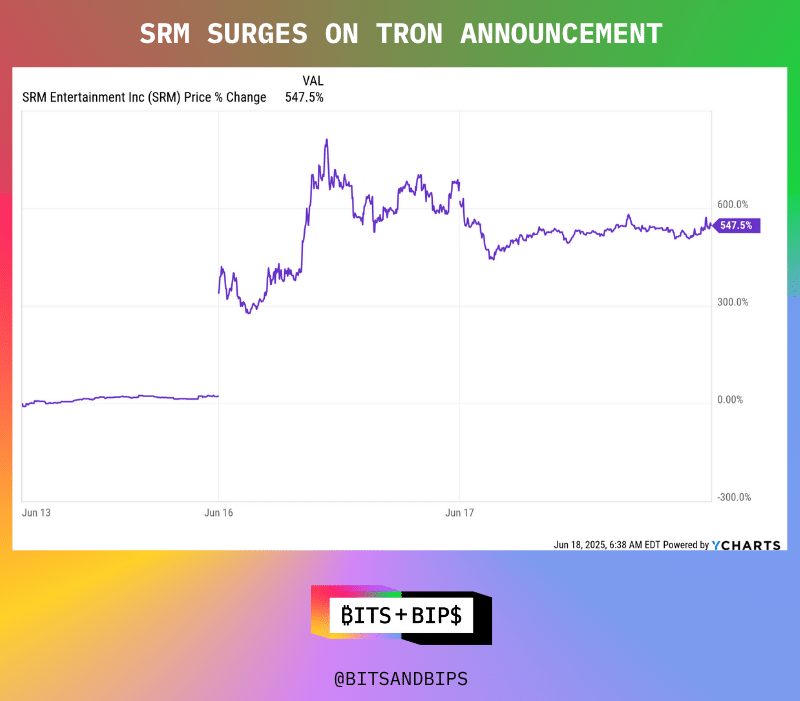

The market reaction to the announcement was swift. Shares in SRM, which will change its name to Tron Inc., are up 547.5% as of Wednesday morning.

Tron’s billionaire founder Justin Sun, who is investing $100 million into the deal and is becoming an advisor to the company, tweeted after the news broke, “This time the big one is finally here.”

But not all is as positive as it seems. Though Tron and Sun himself have always been controversial figures in the crypto community, many begrudgingly admit that Tron has found real-world adoption. However, unbeknownst to the industry, Tron’s most-praised qualities have recently become less defensible. On the flip side, Sun has strengthened his connections to the Trump family — and thus, potentially shielded himself from any downside.

These are the critical factors that potential investors need to consider before buying into Tron Inc. Here’s what you need to know.

Tether’s Back Door?

I can’t tell you how many investors wish that they had had a chance to invest in Tether, the dominant player of the $251.7 billion stablecoin market that made $13 billion in profit last year. But alas, it is a private company.

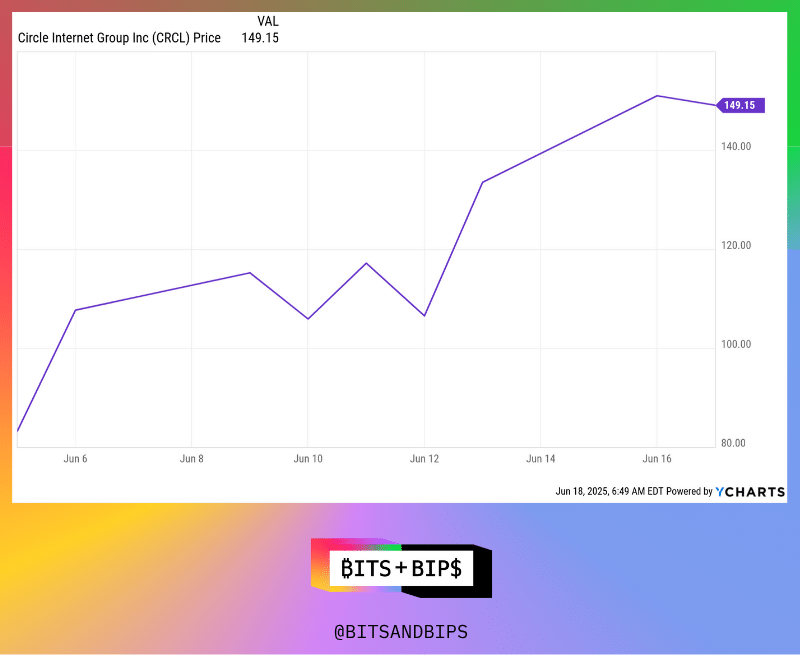

A nice consolation prize was Circle, the primary issuer of the $61.4 billion USD Coin, which went public on June 5 and is currently valued at $36.38 billion. Excitement over stablecoins, which is expected to get legislation signed into law by President Trump before the August recess, has caused stock in the company to surge by almost 150% since its debut on the New York Stock Exchange.

Despite this impressive growth, questions remain about Circle. For instance, it only made $156 million in profit last year. More concerning? It paid almost $1 billion in distribution costs to Coinbase, a key onramp for the digital asset. Circle executives have been quiet about the massive disparity between Circle and Tether’s profitability, but at some point I wonder if investors will start caring.

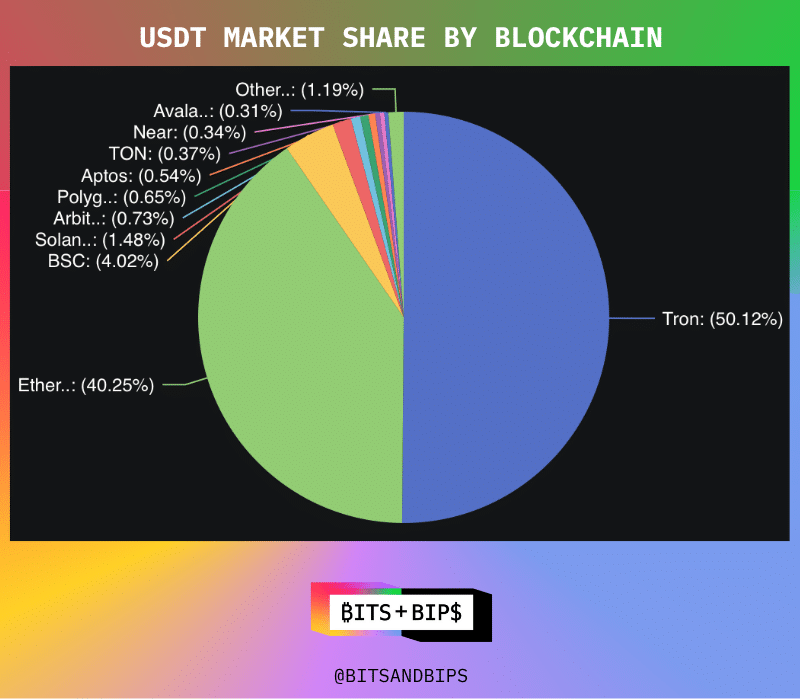

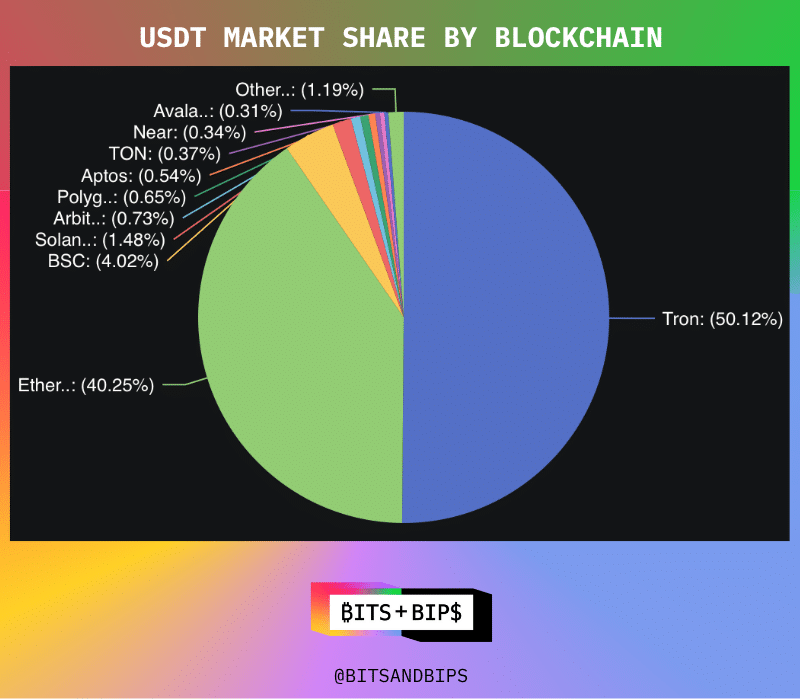

What does this have to do with Tron? Well, it is the primary distribution platform for USDT, Tether’s $156.3 billion stablecoin. In fact, slightly more than 50% of all USDT resides on Tron. For all the talk of it being a multipurpose blockchain akin to Ethereum or Solana, people in the industry consider it to be a stablecoin chain.

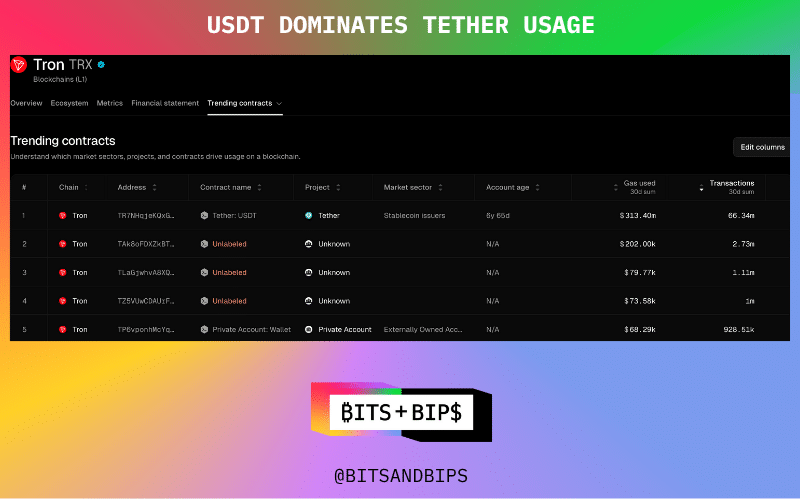

Need more proof? Look at the following chart from Token Terminal that breaks down the blockchain’s most popular smart contracts. Tron’s USDT contract is the most widely used by a large margin.

So it seems pretty clear that buying into TRX or Tron Inc. can be seen as a proxy investment into Tether. But what about its financials? There are a couple of interesting data points to consider here.

For starters, Circle’s price-to-sales ratio (P/S ratio), which is essentially a proxy for how much each investor values a dollar of future revenue for the company, is 31.65. The P/S ratio for the industry-wide KBW Banking Index is 1.71. Interestingly, Tron falls in the middle, with a P/S ratio in 2024 of 6.4.

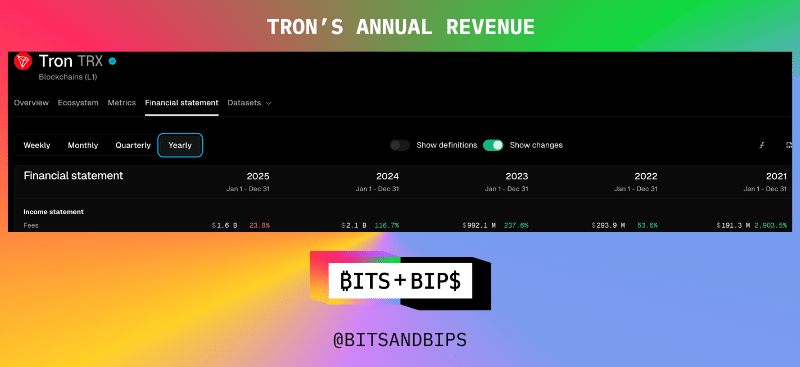

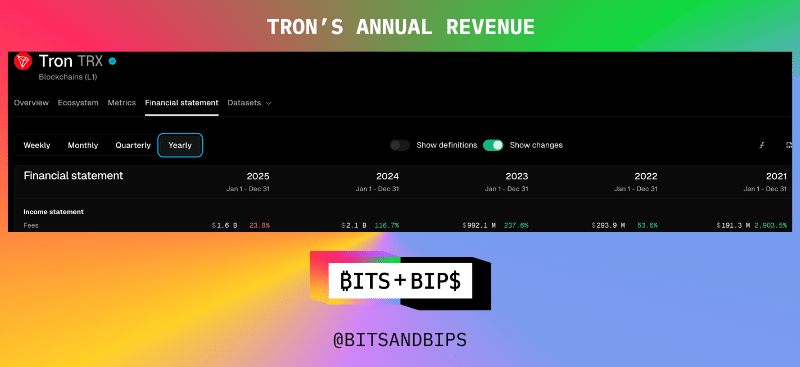

Additionally, Tron generates sizable revenue, as it has averaged $1.6 billion in revenue over the past three years. But as noted earlier, its comparatively appealing financials are largely due to Tether.

But Tron Is Getting More Expensive for Stablecoins

The main reason analysts view Tron positively is that, in comparison, Ethereum seems too expensive for ordinary transactions. That is easy to see as average fees can spike as high as $70 and for a long time, they were consistently higher than $1, though they have dropped below that threshold in recent months. These costs matter to stablecoin users, especially those from emerging markets. “You’re talking about some of the most cost-sensitive markets on Earth,” Chris Maurice, chief executive officer of African focused crypto exchange YellowCard, said to Forbes when I profiled Justin Sun back in March. “In some of these countries people will spend eight hours of their day to save a couple of bucks, and $50 versus a few cents is a pretty tremendous difference.”

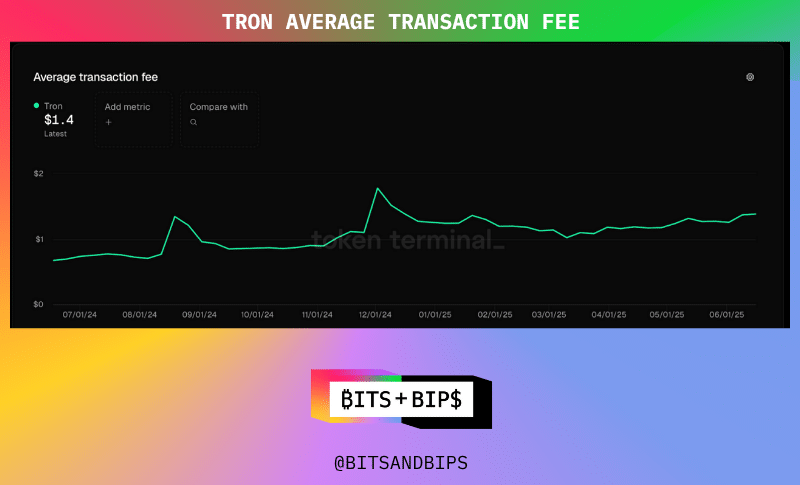

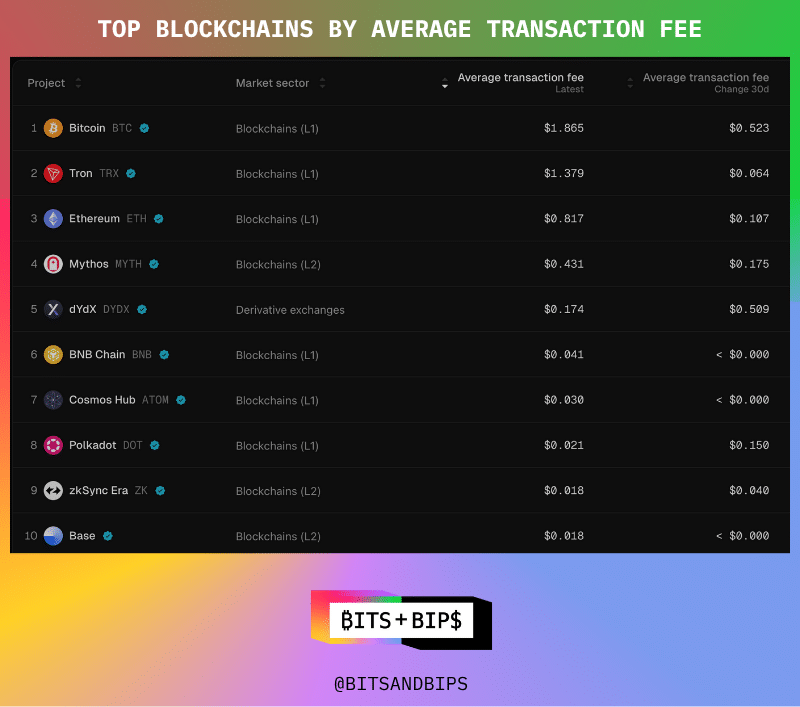

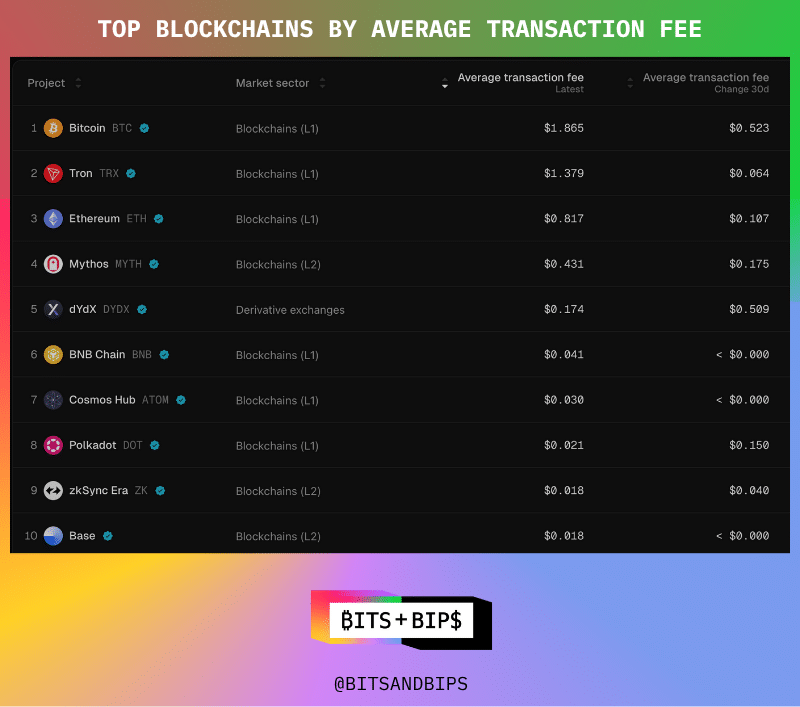

However, though Tron has long had a reputation for being an ultra-cheap blockchain like Solana, in recent months, it has quietly gotten more expensive. In fact, its average transaction fee has also been creeping up over $1, and it is even higher than that of Ethereum over the past 30 days.

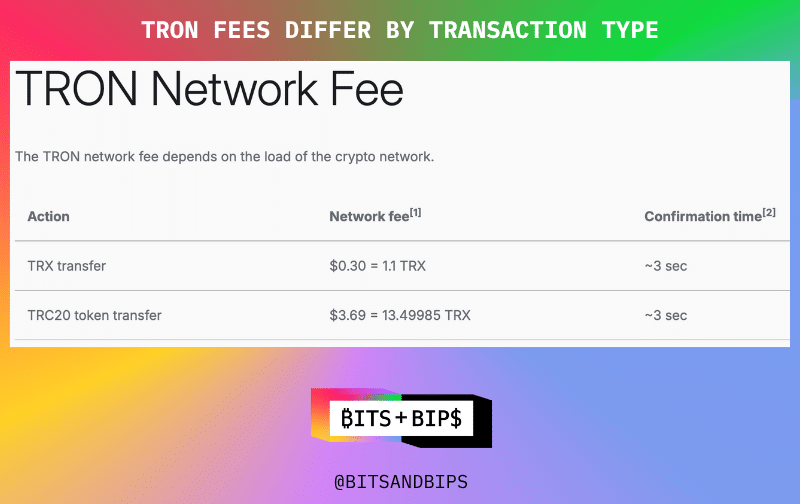

But behind these numbers is an even more surprising fact: Tron does not treat every transaction equally. In fact, the network charges different gas fees based on the type of transaction. What does this mean in practice? Well, it might only cost a fraction of a dollar to send TRX from one address to another. However, if you want to use a smart contract to do something more complex — for instance, sending a non-native token, such as the stablecoin USDT, things are much more expensive. In fact, as of Wednesday morning, it costs just 30 cents to send TRX over Tron, while sending USDT is $3.69 on average, according to data from Coin Wallet, which separates out fees on transfers of TRX token vs. TRC-20 tokens, which is what USDT on Tron is.

This has practical implications since, again, Tron and USDT serve lower-income customers. The leader of one stablecoin company that works with Tron, who insisted on anonymity, laid out the stakes pretty clearly in an interview with Unchained. “We’re exploring turning off Tron for any small transaction because the fees have gotten pretty ridiculous. I mean, we’re paying upwards of $4 for transactions now. That is fine if you’re doing a million-dollar transaction, but if you have hundred-dollar payments coming in, it’s not feasible. And if you’re doing remittance payments out and things like that, it’s just not feasible.”

The question then becomes whether stablecoin usage, in particular that of USDT, will ever migrate from Tron in a sizable number. There is no shortage of competitors. Coinbase’s layer 2 blockchain Base has an average fee of $0.18 (see above), which is making a major play for stablecoins. Another buzzy project is Plasma, an EVM-compatible Bitcoin sidechain focused on stablecoins in which Tether CEO Paolo Ardoino is an investor. Most critically, it will offer zero-fee USDT transactions. Demand for the project has been intense. Just last week, its planned $50 million fundraise for its XPL token became 10x oversubscribed in minutes.

So whether or not Tron loses market share in its most widely used application will be an important factor to watch. But two considerations remain in Tron’s favor.

First, all of the news about banks like JPMorgan and Bank of America getting into stablecoins would appear to be much more threatening for Circle and USDC, which primarily services the U.S. market and high-end consumers, than USDT and Tron, which are primarily focused on the rest of the world.

Second, an old adage in markets says liquidity begets liquidity, and the same can hold true for stablecoins. Tron has achieved massive distribution, and those linkages are not easily severed. Even the stablecoin executive admitted as much, even if he issued a warning for Tron down the line if they don’t make fees more affordable.

“It’s one of those things where everybody built this infrastructure on Tron for stablecoins, and now everybody has to deal with things like, ‘Oh wait, the fees suck.’ Usage is certainly dropping, and I think that if they don’t do anything with the fees, you will see usage continue to drop because other low cost chains will cannibalize it,” said the executive.

A Trump Tron Put?

Of all the crypto treasury companies that have been spawned in recent months, Tron Inc. will be the most closely associated with the White House, besides Trump Media Group’s own bitcoin treasury. It is hard to overstate how closely Sun and Trump have become in recent months.

When I interviewed Justin last winter for the Forbes story, he told me that he had never met the president and had only spent some time with his sons Donald Jr. and Eric. Things have since changed. Here is a list of their current business entanglements:

- At a time when no one else had invested, Sun put $75 million into Trump’s decentralized finance product World Liberty Financial (WLFI) and is an advisor to the company. WLFI currently holds $11 million worth of TRX in its treasury. WLFI will also be expanding onto the Tron blockchain.

- Sun was revealed to be the largest individual holder of the $TRUMP memecoin and was a guest at Trump’s private dinner for token holders on May 22.

- On June 10, the Tron blockchain officially began minting President Trump’s new stablecoin USD1.

- The Tron-SRM merger was brokered by a company called Dominari Securities, which resides in a Trump building in Manhattan and counts both sons as shareholders. The FT even reported that Eric would be taking a formal role in the company, but he dispelled them on X by saying that he would have no “public” position.

- And perhaps most importantly, the Securities and Exchange Commission under Donald Trump has agreed to pause an enforcement action filed against Sun and the Tron Foundation for the unregistered sale of securities in the U.S. and fraudulent market manipulation concerning TRX.

All of this makes you wonder if the White House might take special interest in seeing any TRX-related product succeed. After all, Sun’s initial $30 million investment in WLFI essentially saved the project last year when its initial fundraising efforts proved lackluster.

Time will tell, but as of now, the White House has cleared the way for the SRM-TRX launch via its drawdown at the SEC and rolled out the red carpet to investors of this project by using a placement agent with direct ties to the Trump family.