Market snapshot

- ASX 200: +0.8% to 8,534 points

- All Ords: +0.8% to 8,760 points

- Australian dollar: Flat at 64.52 US cents

- S&P 500: +0.6% to 5,970 points

- Nasdaq: flat at 21,663 points

- FTSE: +0.2% to 8,787 points

- EuroStoxx: +0.2% to 566 points

- Spot gold: -0.1% to $US3,349/ounce

- Brent crude: -0.5% to $US65.32/barrel

- Iron ore: -0.9% to $US94.40 a tonne

- Bitcoin: -0.4% to $US105,419

Price current around 15.45pm AEST

ICYMI: Alan Kohler’s Finance Report last night

Deadline looms for ‘best offer’ submissions to avoid Trump tariffs

Today is the deadline for U.S. trading partners to submit their “best offer” to avoid punishing import tax rates.

According to Reuters, only Britain has struck a preliminary trade agreement with the U.S. during the 90-day pause.

The pause is set to expire in about five weeks, with investors worried about the lack of progress in hashing out deals.

Japanese Chief Cabinet Secretary Yoshimasa Hayashi has said Tokyo has not even received a letter from Washington asking for its best proposals on trade talks.

Global economic uncertainty have left investors fleeing U.S. assets and looking for safer alternatives, including gold.

If investors continue to flee U.S. assets, then many are asking where the money that usually flowed into U.S. assets will end up going..

“While Europe may be the obvious destination, relative value metrics may favour emerging Asia,” says Manishi Raychaudhuri, the founder and CEO of Emmer Capital Partners Ltd.

Asian markets rose today, boosted by tech stocks as traders hope a deal could still be possible if and when U.S. President Donald Trump and Chinese leader Xi Jinping talk this week.

Higher tariffs on metals kick in

The U.S. tariff rate on most imported steel and aluminum has doubled as President Donald Trump amps up global trade wars.

According to Reuters it comes the same day he expects trading partners to deliver their “best offer” in bids to avoid punishing import tax rates on other goods.

Last week, Trump announced he was taking the tariffs on steel and aluminum imports from 25% up to 50%.

“We started at 25 and then after studying the data more, realized that it was a big help, but more help is needed. And so that is why the 50 is starting tomorrow,” White House economic adviser Kevin Hassett said in explaining the move at a steel industry conference in Washington on Tuesday.

The increase applies to all trading partners except Britain, the only country so far that has struck a preliminary trade agreement with the U.S. during a 90-day pause on a wider array of Trump tariffs.

Further analysis from the experts

Market analyst Tony Sycamore says despite Australia’s fourteenth consecutive quarter of economic growth, today’s GDP results reaffirm the “economy continues to muddle along at a rate significantly below the 2.5%-3% growth rate we grew accustomed to before the COVID shock”.

“It also suggests the economy will fall short of the RBA’s recently revised lower forecasts of 1.8% for June 2025 and 2.1% for December 2025.”

Mr Sycamore says the slow growth reinforces the case for the RBA to continue easing its restrictive monetary policy settings.

“We expect the RBA to cut rates by 25 basis points at its meeting in July, bringing it to 3.60%, and to deliver another 25 basis point cut in August.”

Economist says business investment is “crucial” to lifting Australia’s productivity and sustainability growth

Soft business investment growth indicates an ongoing lack of spark in private sector activity, according to Stephen Smith, partner at Deloitte Access Economics.

He says it is important to ensure policy settings are optimised now for future economic growth.

“With Parliament not resuming until late July, policymakers and legislators should be thinking about how to hit the ground running to execute a policy agenda that prioritises lifting productivity and economic growth in a sustainable way that does not reignite inflation,” he says.

But he says the private sector must also step up.

“Business also has to be willing to reignite its sense of entrepreneurialism and innovation to invest in state-of-the-art technology, skills, and new markets.”

Economist says GDP results reflect “softness” in economic demand and repercussions from weather events

According to RSM Australia Economist Devika Shivadekar, today’s GDP results reflect an economy that has been heavily disrupted both locally and nationally.

“These disruptions not only impacted household consumption and business investment but also contributed to a sharp detraction in public spending—the largest since 2017—and a hit to exports across key sectors like mining, tourism, and shipping,” she said.

Despite household spending increasing by 0.4%, Ms Shivadekar said “this was driven largely by non-discretionary items such as food, rent, and energy costs”.

“On a per capita basis, GDP slipped 0.2%, and while the household saving ratio rose to 5.2%, thanks to higher incomes and emergency support—highlighting the cautious stance households are still taking.”

Ms Shivadekar said today’s results mean the Reserve Bank of Australia will remain “cautious”, with the next interest rate cut expected in August.

“Ongoing global uncertainty, muted household spending, and the aftershocks of recent climate-related disruptions all contribute to a more dovish near-term stance.”

She said the latest business indicators data revealed Australian businesses were in trouble:

“Manufacturing is stuck in a deep rut with sales down for the fifth straight quarter, pointing to longer-term structural problems rather than a short-term dip.

“Mining profits are under pressure as global commodity prices soften and inventories swell, while retailers are also feeling the pinch with consumer hesitancy seeing them resort to heavier discounting to clear stock.

“Construction activity is also cooling despite population-driven demand for housing, with rising costs and persistent labour shortages acting as constraints.”

However, she said professional services are growing especially in fields tied to energy transition and artificial intelligence.

“The picture is clear — Australia’s economy is moving through a period of transition and there is a clear need to maintain the balance by providing targeted support to industries under strain, while supporting the momentum in sectors at the forefront of change.”

Consumers are saving rather than spending

Consumers are prioritising rebuilding their savings rather than spending, says Westpac senior economist Pat Bustamante.

The saving-to-income ratio increased to 5.2% from 3.9% in the December quarter.

You can see the full chat with finance presenter Alicia Barry here:

Loading…

A good question…

Is a slowing GDP good news for our market ? It seems so.

– Craig

Hi Craig,

Thanks for your question.

Interestingly, the markets barely moved when the GDP results were dropped (despite the tepid growth).

I’ve been watching the local markets on my screen and they have been steadily climbing since the open.

Investors seem to be more influenced by the US trade talks and higher oil prices at this stage.

And now the market is within 0.4% off its best ever close.

Interesting!

What’s happening on markets now?

Local markets are having a solid day, hitting a new 50-day high.

The ASX 200 is up almost 0.8 per cent in the middle of the trading day, to 8,532 points (at 12:40pm AEST).

The broader All Ordinaries index is up 0.8 per cent to 8,759 points.

Nine of the eleven sectors are higher, with just technology and consumer non-cyclicals in the red.

Markets were largely unchanged after the GDP results were released and the dollar fell just 0.1%.

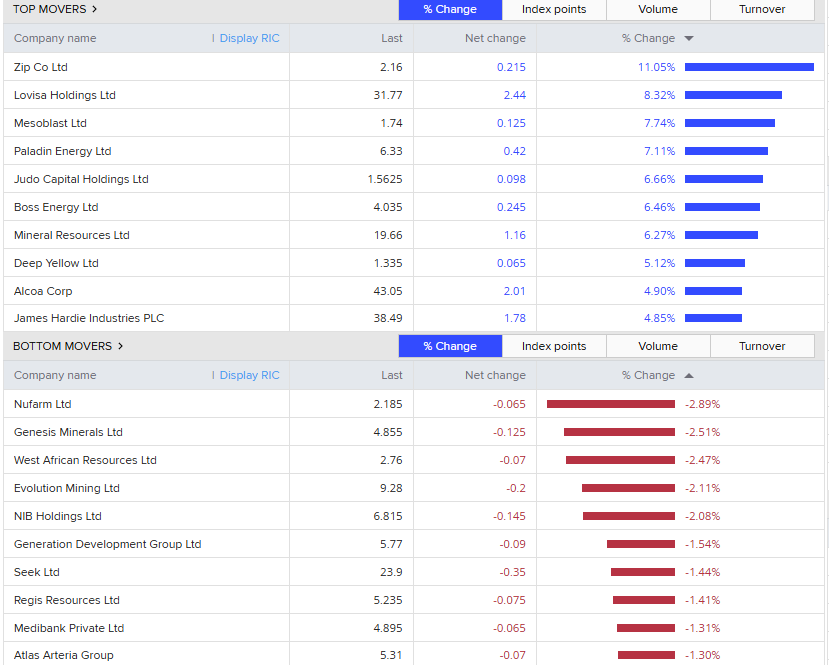

Zip Co and Lovisa Holdings are the top performing individual stocks up almost 11% and 8% respectively.

Lovisa is up on the news Mark McInnes has been appointed as the Deputy Chairman.

Nufarm is leading the worst-performing stocks, down -2.9%.

Union questions what Virgin float means for workers

The Transport Workers’ Union wants clarity on what the public float will mean for workers.

Virgin Australia has announced a $685 million initial public offering, at $2.90 a share.

It will reduce Bain Capital’s stake from 70% to around 40%, while Qatar Airways will retain a 23% stake.

The union’s national assistant secretary Emily McMillan says the airline was on the brink of devastation and is now back to making record profits, with workers making this result possible.

“There are still question marks around this public float as well as Qatar’s stake in the airline, and what this means for workers,” she said.

“While an IPO has the potential to further grow the airline and increase opportunities for workers and the travelling public, we must see Virgin make clear that it will continue to consult closely with its workforce.”

Virgin announced this week that employees would receive $3000 worth of share rights as part of the IPO.

RBA may opt to cut rates in July

Economists say the RBA may cut rates again in July after economic growth was weaker than expected.

Australia’s GDP rose just 0.2% in the March quarter, down from 0.6% in the December quarter.

Ben Udy, lead economist for Oxford Economics Australia, said:

“Looking ahead, the increase in global uncertainty was only just getting warmed up in Q1.

“While it’s still too soon to know for sure, early signs point to an even larger drag from confidence on consumption and investment in Q1.”

He says the RBA will be watching closely for further signs that the weakness in the March quarter extends into the June quarter.

“If that evidence continues to rack up, the RBA may opt to cut rates again in July, a little sooner than our current forecasts suggest.”

The Reserve Bank had forecast annual GDP growth of 1.8% by the end of the June quarter.

The economy has grown 1.3% for the year to March.

Economic growth slowed by reduced public spending

GDP growth was hampered by reduced public sector spending as well as extreme weather events, according to the ABS.

“Extreme weather events reduced domestic final demand and exports. Weather impacts were particularly evident in mining, tourism and shipping,” Katherine Keenan, ABS head of national accounts, said.

There was no growth in government final consumption expenditure in the March quarter, as state and local governments spent less on social benefits to households for energy bill relief.

Housing spending was up 0.4%, driven by essentials such as food and rent.

“Growth was relatively slow across most household spending categories following stronger than usual spending during December quarter’s retail sales events,” Ms Keenan said.

Australian households saved more, with the saving-to-income ratio increasing to 5.2% from 3.9% in the December quarter.

“The 1.3 percentage points rise in the household savings ratio this quarter included higher income support from government and insurance claims linked to severe weather events in Queensland,” she said.

“There was also a small rise in small business income, while mortgage interest payments dropped following the Reserve Bank of Australia cash rate in February 2025.”

Private investment rose 0.7% in the March quarter, led by investment in dwellings, new buildings and new engineering construction.

In its latest economic statement, the Reserve Bank had forecast annual GDP growth of 1.8% by the end of the June quarter.

The economy will need to grow noticeably in the June quarter to meet that target.

Australian economy soft in March quarter

Australia’s gross domestic product (GDP) rose 0.2% in the March quarter.

The Australian Bureau of Statics figures show the economy grew 1.3% in the year to March.

Katherine Keenan, ABS head of national accounts, said:

“Economic growth was soft in the March quarter.

“Public spending recorded the largest detraction from growth since the September quarter 2017.”

Everyone’s buying an SUV

SUVs continue to be the most popular vehicle in the Australian market, according to monthly figures released by the Federal Chamber of Automotive Industries.

More than 105,000 vehicles were sold in May, up from almost 91,000 in April, but that’s down on the same time last year.

“While down 5.2% compared to the same month in 2024, the results reflect a market that remains resilient and competitive by historic standards. The fundamentals of the market remain robust, with strong competition and consumer interest across range of vehicle types,” said the chamber’s CEO Tony Weber.

In the year to May, SUVs grew to 60% of all new vehicles sold in Australia, compared to 56% in 2024.

The biggest-selling brand was Toyota (with almost 24,000 sales in May), followed by Ford (8,500 sales) and Mazda (7,800 sales).

ICYMI: RBA official says weaker outlook for Australia’s economy

Donald Trump’s tariffs will contribute to a weaker outlook for Australia’s economy, a Reserve Bank official says.

Assistant governor Sarah Hunter said Australia was unlikely to face direct negative impacts.

But the uncertainty sparked by the tariffs would hurt our economy in indirect ways.

She explained why the RBA revised its official forecasts recently to anticipate weaker growth, lower inflation and a slightly higher unemployment rate over the next 12 months.

“Global uncertainty may weigh substantially on domestic activity if uncertainty remains elevated,” she warned.

The latest quarterly GDP figures will be released by the Australian Bureau of Statistics at 11.30am AEST.

You can read more about Sarah Hunter’s comments here:

ICYMI: Telstra fined for disruption to emergency call service

Australia’s largest telecommunications provider failed to provide an emergency service for a period of time in 2024 during a software upgrade, an ACMA investigation found.

Telstra mistakenly disconnected from the emergency call relay service, utilised by Australians with hearing and speech impairments, for nearly 13 hours in July 2024.

You can read about it here:

Morning market snapshot

- ASX 200: +0.6% to 8,518 points

- All Ords: +0.6% to 8,743 points

- Australian dollar: Flat at 64.56 US cents

- S&P 500: +0.6% to 5,970 points

- Nasdaq: +0.8% to 19,398 points

- FTSE: +0.2% to 8,787 points

- EuroStoxx: +0.2% to 566 points

- Spot gold: +0.1% to $US3,356/ounce

- Brent crude: -0.2% to $US65.48/barrel

- Iron ore: -0.9% to $US94.40 a tonne

- Bitcoin: -0.3% to $US105,462

Price current around 10.25am AEST

Live updates on the major ASX indices:

Here’s what’s happening on local markets

Hello,

It’s Emily Stewart here, I’m jumping on the blog to let you know what’s happening on financial markets.

As expected, the ASX opened higher this morning, as investor sentiment improved due to the ongoing US tariff talks.

The All Ordinaries is up 0.6 per cent to 8,744 points and the ASX 200 is also up 0.6 per cent to 8,517 points (as at 10:20am AEST).

The markets have reached a new 50-day high.

The top stocks are Tabcorp Holdings up 5.8 per cent and Judo Capital Holdings up 5.8 per cent.

Over the last five days the index has gained 1.37 per cent.

Virgin Australia looks to raise $685 million

Virgin Australia has announced an initial public offering, as it flies towards relisting on the ASX.

Virgin will sell 236 million shares to value the company at $2.32 billion, according to the term sheet.

The $685 million IPO is worth 30% of the airline’s total issued capital.

Bain Capital bought Virgin for $3.5 billion five years ago after the airline was placed in voluntary administration.

The float will reduce Bain’s stake in the airline from around 70% to 40%.

Qatar Airways will retain a 23% stake in the company.

The initial public offering has been set at $2.90 per share.

Shares are due to start trading on the ASX on June 24.

-With Reuters