15h05 ▪

4

min read ▪ by

Ethereum is making a notable comeback to the forefront of the crypto scene. With 163 million dollars injected into its ETFs in a few days, technical and fundamental signals are aligning. The market wonders: will the 2,900 dollar threshold be surpassed? An explosive momentum seems to be emerging, driven by institutional investors.

In brief

- Ethereum ETFs record 163 million $ inflows, with BlackRock leading.

- On-chain and technical indicators show bullish signals, with an RSI at 70.47 and a critical threshold at 2,720 $.

- Peter Brandt forecasts an ETH at 4,000 $, reigniting the debate on a new bullish cycle.

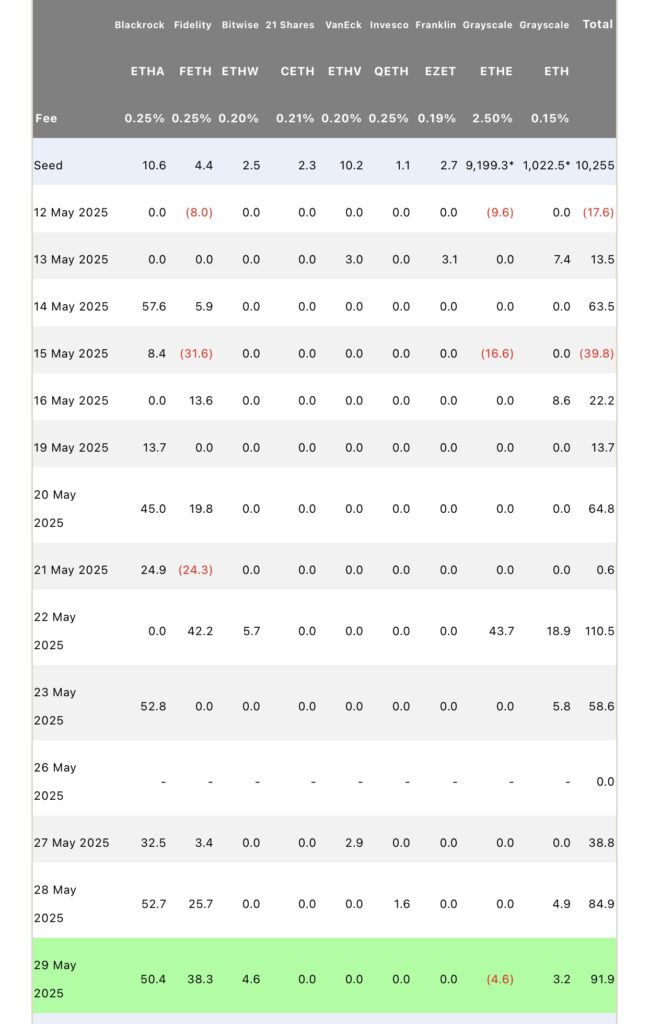

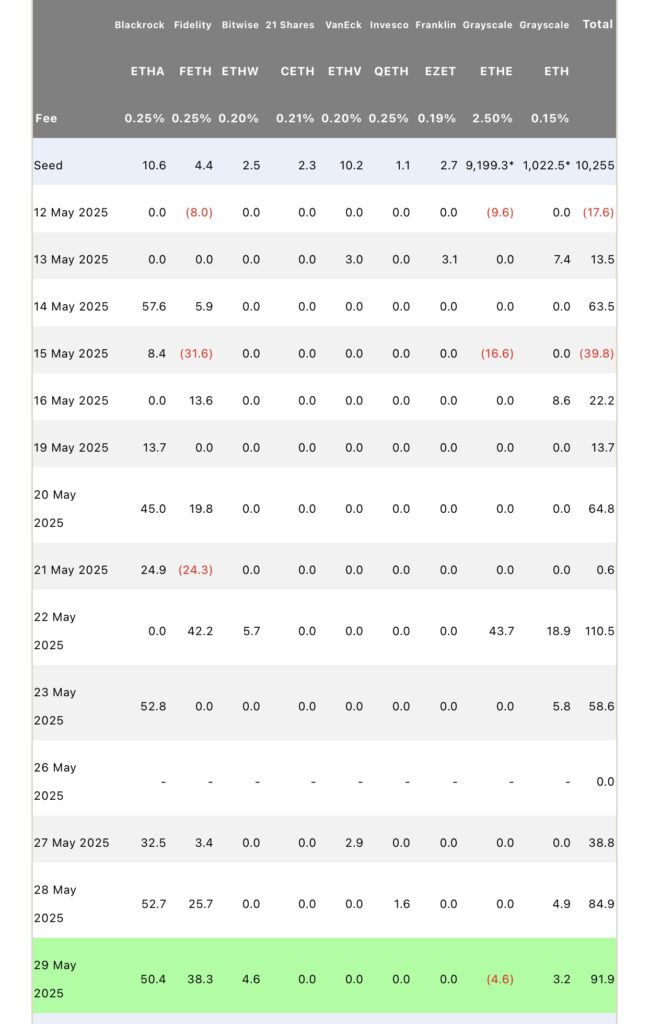

Why Ethereum ETFs are attracting big investors again

The crypto market has recorded a strong signal: Ethereum ETFs recently attracted 163 million dollars, including 71.3 million over one week and 92 million in a single day, May 29. On that date, BlackRock stood out by capturing 50 million on its own, confirming its role as a catalyst for the return of institutional liquidity. This massive capital injection reflects a renewed perception of the potential of ETH, despite persistent regulatory uncertainties.

This renewed appetite could trigger a lasting bullish momentum for ethereum if the momentum establishes. ETFs thus become a barometer of macroeconomic confidence in cryptos, beyond mere speculative enthusiasm.

Crypto: these on-chain signals confirm ethereum’s strong comeback

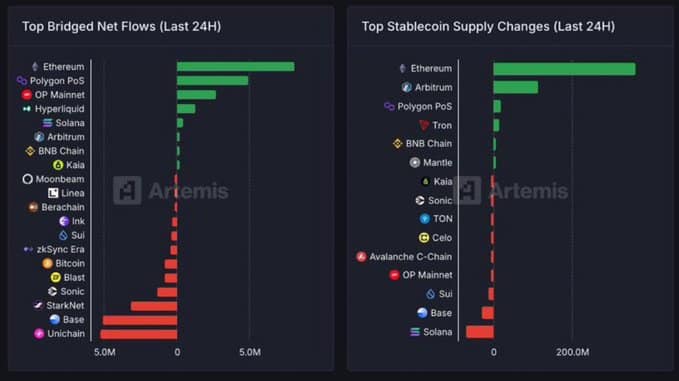

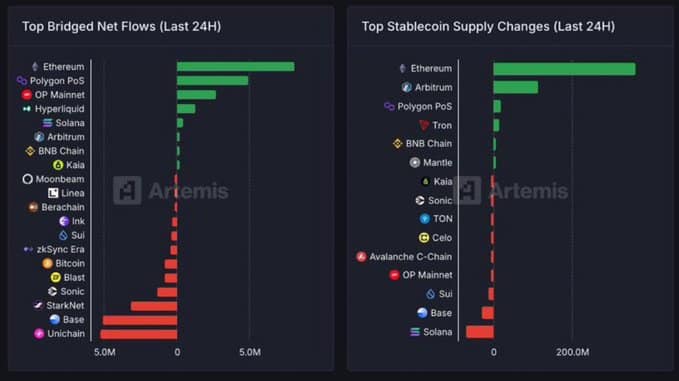

Beyond flows to ETFs, on-chain indicators confirm that the Ethereum network is expanding:

- Increase in net cross-chain flows: Ethereum surpasses its direct competitors with intensified interactions via bridges;

- Growth of the stablecoin supply: +4.1% over the last two weeks;

- Increase in active wallet activity: +12% in 7 days.

These elements indicate a strong structural dynamic, well beyond the 71 million dollars of inflows into Ethereum ETFs in one week. As a result, ETH is once again attracting developers, crypto users, and capital in a market where bitcoin is also experiencing decisive movements. This combination could justify a higher valuation in the weeks to come.

Imminent breakout? Technical indicators are rallying for ETH

Ethereum’s chart analysis shows signals aligned with bullish fundamentals:

- RSI at 70.47: close to the overbought zone, indicating strong buying pressure;

- CMF at 0.15: indicating net capital inflows over several consecutive sessions.

The market is therefore at a crossroads: the bullish breakout or the exhaustion. The coming days will be decisive.

The current enthusiasm around ethereum could intensify if technical resistances yield. However, volatility remains high, and the post-ETF euphoria could quickly fade. In this context, the bold prediction by Peter Brandt, envisioning an ethereum at 4,000 dollars, draws interest. This turnaround from a historically skeptical analyst raises a crucial question: is this just a rebound or the start of a new bullish cycle for ETH?

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.