Ethereum has surged above $2,600, with 69 million ETH turning profitable as bulls eye the $3,000 mark amid rising inflows.

With an intraday gain of 3.36%, Ethereum has surpassed the $2,600 level. Starting the week strong, ETH continues its bullish momentum as Bitcoin holds above the $105K mark.

Boosting broader market sentiment, the US-China trade deal has fueled an extended rally this week. Amid these conditions, will Ethereum manage to reach the $3,000 milestone?

Ethereum Price Analysis: Eyes Set on $3,000

Ethereum has risen to the $2,600 level with an intraday surge of nearly 3.5%. The ongoing rally has produced four consecutive bullish candles over the past five days, contributing to a nearly 45% price increase.

This recent rally follows a breakout from a falling channel and a key supply zone near $1,850. Additionally, the uptrend has broken through the 38.20% Fibonacci level and crossed the 200-day EMA, near the critical $2,400 psychological level.

Ethereum now aims to test the 50% Fibonacci level near $2,700. The sudden spike in buying pressure has driven the Money Flow Index to 83. As inflows increase, the uptrend is likely to clear overhead resistance levels. Furthermore, bullish alignment of the 50-day and 100-day EMAs hints at a potential positive crossover.

A breakout above the 50% Fibonacci level could significantly increase the chances of Ethereum testing the $3,000 psychological mark this week. On the downside, crucial support lies at the 100-day EMA near $2,145, just below the 38.20% Fibonacci level at $2,400.

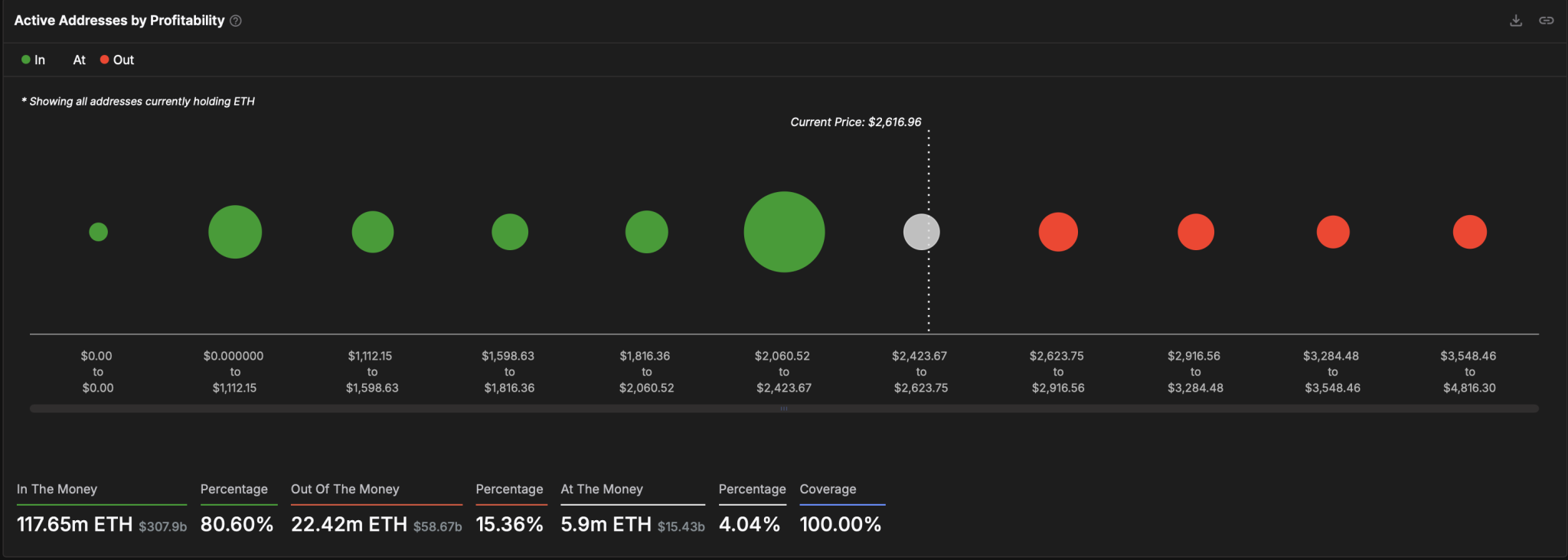

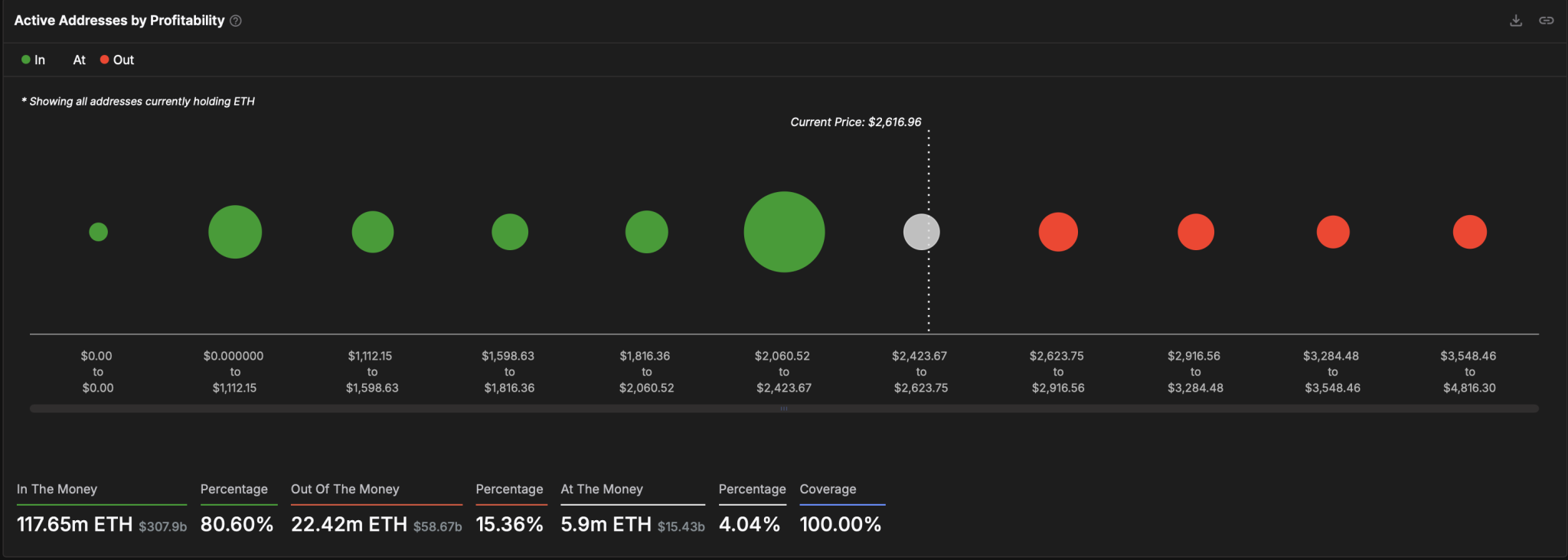

On-Chain Data: 69M ETH Turns Profitable

With Ethereum trading near the $2,600 mark, data from IntoTheBlock shows that 10 million investors have become profitable. These investors hold a combined volume of 69 million ETH, acquired at an average price of $2,259 and a maximum of $2,423.

Ethereum’s ongoing recovery is set to challenge a key resistance zone, where 8.09 million investors hold approximately 8 million ETH at an average cost of $2,740. If Ethereum breaks through this zone, a smooth climb to $3,000 seems likely.

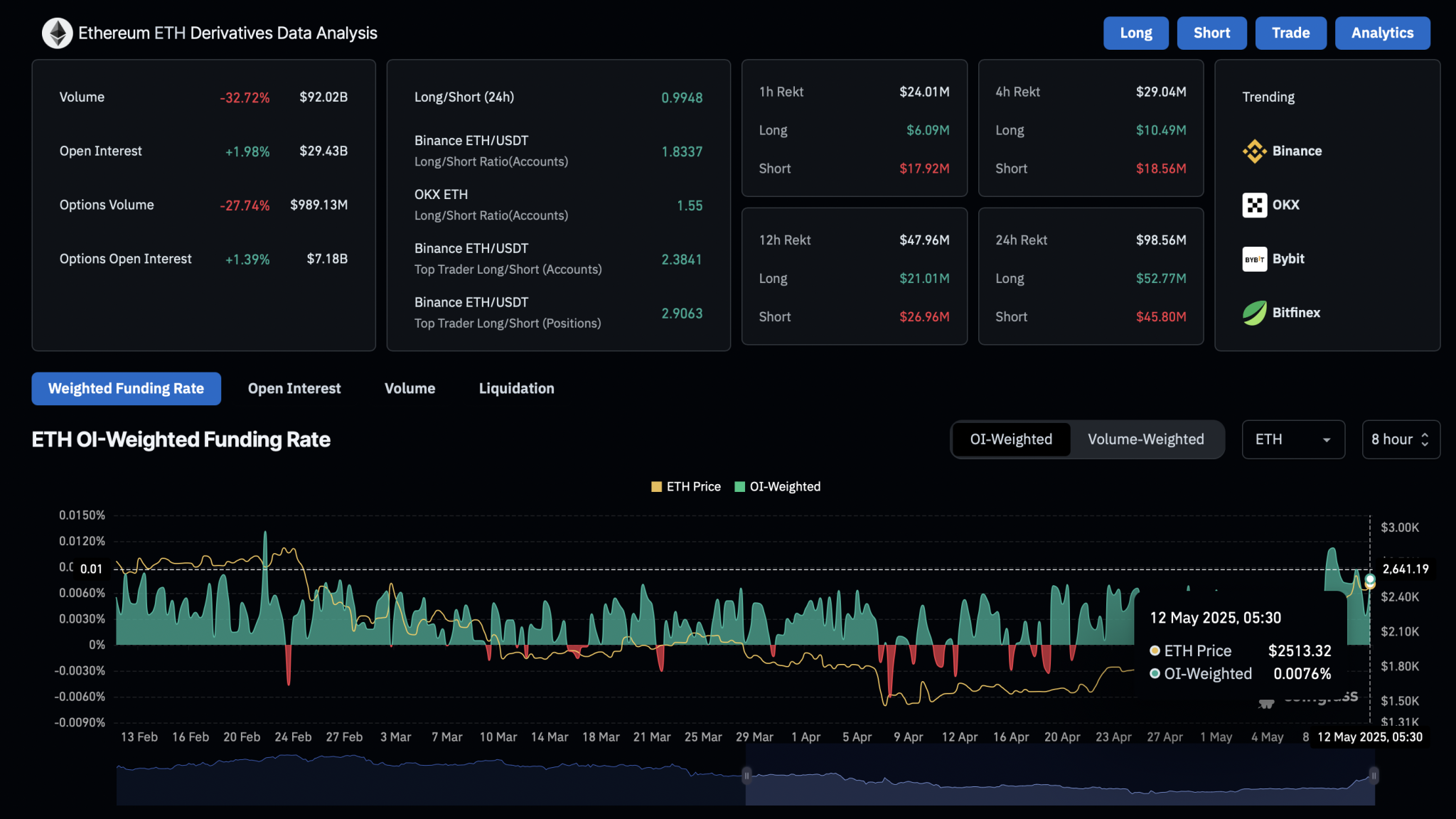

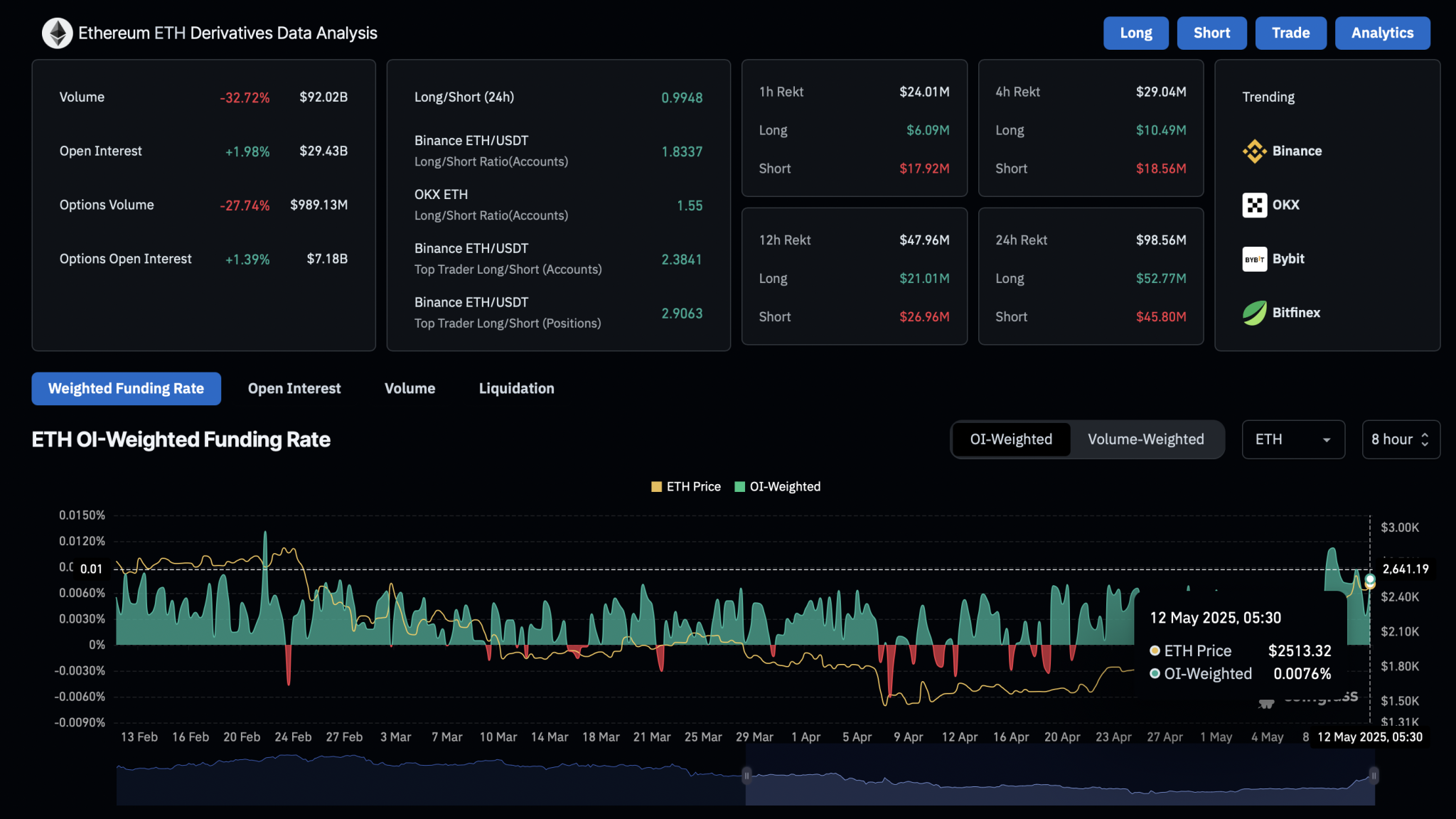

Ethereum Price Rally Liquidates $18.56M in Bearish Positions

As Ethereum’s rally gathers momentum, derivatives data shows an increase in trading activity. ETH open interest has jumped by nearly 2% to $29.43 billion, while the funding rate reflects growing bullish sentiment at 0.0076%.

Interestingly, liquidation data shows that $18.56 million worth of bearish positions have been wiped out. This has given a psychological boost to Ethereum’s rally as the week begins.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.