Market snapshot at the open

- ASX 200: Flat at 8,157 points

- All Ords: Flat at 8,374 points

- Australian dollar: -0.1% to 64.57 US cents

- S&P 500: -0.6% to 5,650 points

- Nasdaq: -0.7% to 17,844 points

- FTSE: +1.2% to 8,596 points

- EuroStoxx 600: +0.2% to 537 points

- Spot gold: Flat at $US3,331/ounce

- Brent crude: -1.6% $US60.33/barrel

- Iron ore: -0.3% to $US97.35/tonne

- Bitcoin: +0.4% to $94,700

Prices current around 10:15am AEST

ASX website down

If you’ve been trying to check the ASX website today, you might be having trouble.

This is the message I have been seeing at various times today.

Fortunately, the ABC also uses a piece of financial software to see what’s happening on financial markets, so we will continue to keep you informed!

Petrol lifts 0.1 cents in a week

Hi team,

Just jumping in with the new data on pump prices.

(In tabloid parlance, this is PETROL PAIN or BOWSER BITE)

Well it would be except that crude oil prices have fallen substantially this year, leading to cheaper prices for refined products like unleaded.

The national average price of a litre of unleaded petrol inched +0.1 cents to 178.2 cents in the week to Sunday.

Weekly data from the Australian Institute of Petroleum details the movement, which still puts the average below the 12-month average figure of 183.8 cents and on current trends seemingly set to go lower.

WiseTech shares fall

Shares in logistics software giant WiseTech Global have fallen -3.6 per cent after the company provided an overview of its business and strategy at the Macquarie Australia Conference.

In published reference materials, WiseTech says global uncertainty and macroeconomic conditions relating to US trade tariffs, may be a headwind for the remainder of the financial year.

Global container volumes are projected to fall 1 per cent in 2025 (in contrast to the 5 per cent growth in 2024).

It’s been a tumultuous year so far for the company.

Four independent directors stepped down from the board in February, citing differing views around the role of CEO Richard White.

Mr White, who founded the company, stepped down as CEO, however returned earlier this year as the executive chairman.

Today, the company confirmed a shortlist of candidates for the CEO role is being finalised, with an appointment expected prior to the AGM in November.

The board is also interviewing additional directors.

Two weeks until the RBA’s interest rate decision

The Reserve Bank’s monetary policy board will hand down its next interest rate decision in a fortnight’s time, at 2:30pm AEST on May 20.

Market pricing is pointing to a 25 basis points cut to the cash rate in May as a near-certainty, but one of the major bank economics teams is still expecting a 50 basis points cut.

Here’s where their forecasts stand:

NAB: 50bps cut in May, followed by 25bps cuts in July, August, November and February 2026

ANZ: 25bps cuts in May, July and August

CBA: three more 25bps cuts in 2025, one each quarter

Westpac: 25bps cut in May, two more “pencilled in” for August and November

Morning markets

Local markets have opened pretty much flat.

The ASX200 is down -0.04 per cent to 8,157 points and the broader All Ordinaries is down the same to 8,374 points (as at 10:18am AEST).

Futures were trading down this morning, after Wall Street’s major indexes closed in the red.

The US Federal Reserve is expected to keep interest rates on hold when it meets this week.

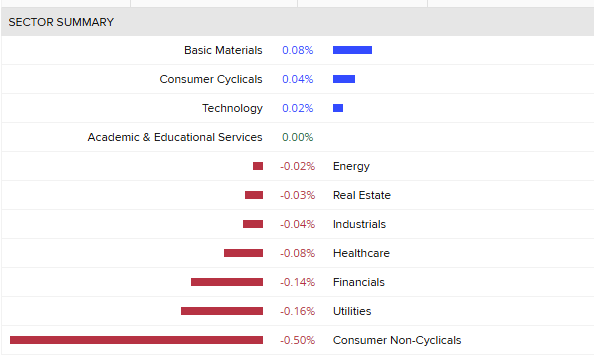

Back to Australian markets, this is what the sectors are doing:

So far the top performing stocks have been Clarity Pharmaceuticals and DigiCo Infrastructure.

The worst performing stocks are Endeavour Group and A2 Milk Company.

An update on Australia’s Future Fund

Australia’s sovereign wealth fund, called the Future Fund, has released its results for the past year.

Key information includes:

- Investment returns of 7.9% for the past 12 months to 31 March 2025

- $17.8 billion added to the value of the fund in the past year

- Total funds under management has grown to $307.6 billion

- 10-year return of 7.5 %, exceeds mandated target of 6.9% per annum

“This was a strong result that reflects the work we have been doing for the past four years to ensure the portfolio is resilient and flexible to a range of scenarios,” said Dr Raphael Arndt, Future Fund CEO.

The Future Fund was established in 2006 in order to invest for the benefit of future generations of Australians.

It’s the country’s single largest financial asset.

Chief investment Officer Ben Samild said there were strong contributions to performance from the Alternatives, Credit, Infrastructure and Timberland asset classes.

“Returns also benefited from changes to our currency mix and exposure to commodities, including gold.”

Despite difficult market conditions, Dr Arndt said the portfolio has behaved in line with expectations.

“We are seeing consequential changes in geopolitical, economic and market environments at the moment and that is causing volatility and uncertainty for investors,” said Dr Arndt.

“Our expectation is that these conditions will lead to higher inflation and bond yields for an extended period.”

Can you maximise your offset account by using a credit card?

Most people who utilise an offset account with their mortgage aim to reduce the interest they pay on their home loan by parking as much cash as possible in the offset.

In order to do this, some use a credit card to pay all their regular expenses.

So how does it work and is it a good idea?

You can read more here:

Buying a second-hand electric vehicle?

Electric vehicles are growing in popularity, fuelled by government subsidies and fleet sales.

As new car sales grow, it means more EVs are starting to filter through to the used-car market.

So, what should prospective buyers consider before they make a purchase?

Battery quality is usually the biggest concern.

You can read more about it here:

📹 ICYMI: Westpac delivers disappointing half-year results

In case you missed it, Westpac yesterday reported a 1 per cent drop in profit to $3.5 billion for the first half of the financial year.

The company’s cash profit, its preferred measure which strips out one-off issues, was $3.3 billion, slightly lower than consensus estimates.

Shares dropped 3 per cent on Monday, alongside falls of a lesser magnitude for its peers.

Montgomery Investment Management’s Roger Montgomery told The Business Westpac’s disappointing results came from pressure on net interest margins, with most of that pressure coming from competition from other banks.

Catch up on the interview with Kirsten Aiken:

Loading…

NAB will report its half-year results tomorrow, followed by ANZ on Thursday, and a quarterly update from CBA on Wednesday next week.

Seven to buy remaining Southern Cross TV assets

A bit of media deal news hitting the ASX this morning, with Seven West Media to buy Southern Cross Media’s remaining television assets.

Seven will acquire the television licences and associated operations in Tasmania, Spencer Gulf, Broken Hill, Mt Isa, Darwin and “Remote, Central and Eastern Australia'”

Seven currently broadcasts on these licences under an affiliate deal.

“The acquisition largely completes SWM’s national broadcast network and opens new markets to Seven where the powerful offering of digital television — both live and [Video on Demand] — on 7plus complements the Seven broadcast signal,” Seven West Media said in a statement.

It will pay $3.75 million cash and the deal is expected to be completed by June 30.

Southern Cross had previously proposed a sale of the TV assets to Australian Digital Holdings, but negotiations fell through.

The sale to Seven will see Southern Cross completely out of television and focused on audio.

A choice between Beijing or Washington looms for Australia

A thumping electoral victory just as the domestic economic indicators have begun to head in all the right directions.

That’s the kind of scenario politicians universally, and certainly prime ministers, can only dream of, writes chief business correspondent Ian Verrender.

As early as Sunday morning, just hours after the polls had closed, business leaders and politicians already had turned their gaze on how best to revive flagging productivity and narrowing the federal deficit.

But deeper threats are likely to dominate and define the next three years of the Albanese government as the Trump administration attempts to unwind 80 years of an economic, trade and diplomatic world order.

Read the full analysis here:

Hungry Jack’s fined by ACCC over button battery failures

Fast food giant Hungry Jack’s has paid penalties totalling $150,240 for eight breaches of button battery information requirements.

The penalties imposed by the Australian Competition and Consumer Commission relate to Garfield toys distributed as part of a promotion last year.

Between May 20 and May 30 last year, Hungry Jack’s supplied 27,850 of the Garfield toys with its children’s meals.

The ACCC said, while the Garfield toy complied with the button battery safety standard, the chain did not advise consumers that it contained button batteries, nor provide relevant warnings about the potentially fatal hazards these pose, or advice about what to do if a child ingested one.

Hungry Jack’s agreed to a court enforceable undertaking admitting the toy likely failed to meet the button battery information standard.

Hungry Jack’s has recalled the toys, which can be swapped for a non-battery replacement at the fast food chain’s outlets, the ACCC said.

“Button batteries are extremely dangerous for young children and tragically, children have been seriously injured or died from swallowing or ingesting them,” ACCC deputy chair Catriona Lowe said in a statement.

If swallowed, button batteries can become lodged in a child’s throat, with resulting chemical burns resulting in serious injuries or even death within as little as a couple of hours.

The ACCC says three child deaths have been recorded in Australia as the result of button batteries, while more than one child a month is injured.

Alison Branley and Michael Atkin from the ABC’s Specialist Reporting Team had this detailed report last year on the dangers of button batteries.

The Taiwan dollar is surging. Here’s why

There’s been a lot of speculation in the Taiwan dollar over the past couple of days, pushing it up more than 7% to a three-year high.

It’s unusual for a developed economy’s currency to move so dramatically.

NAB’s senior markets economist Taylor Nugent says it appears the speculation has been based on, well, speculation.

“A confluence of rising hopes of a trade deal with China, speculation that a stronger TWD could be part of trade discussions with the US, and chatter around a rush to reduce exposures by local exporters in Taiwan and life insurers (which tend to be under-hedged on their US debt holdings),” he writes.

“Bloomberg reports that Taiwan’s monetary authority hadn’t been seen aggressively intervening in the market Monday to limit the TWD’s strength, though it typically does so to smooth out volatility.

“Officials pushed back on the currency being part of trade talks. President Lai said the currency would “naturally not be mentioned in the negotiations between Taiwan and the United States,” the central bank urged against speculation, and the office of trade negotiations said that it had wrapped up a first round of tariff-reduction negotiations with the US and that the talks did not touch upon the issue of foreign exchange policy.”

The Australian dollar also has gained against the greenback, but far less spectacularly.

It was up around half a cent overnight to 64.67 US cents.

When is the next RBA meeting? Not today

It’s the first Tuesday of the month, so you could be forgiven for thinking it’s a Reserve Bank interest rate decision day, after years of conditioning.

But with the RBA monetary policy board now meeting less frequently, the next meeting doesn’t kick off until Monday May 19.

The RBA will deliver its interest rate decision on Tuesday May 20 at 2:30pm AEST — so two weeks to go.

Markets are currently pricing in a 97 per cent chance of a 25 basis point cut, according to LSEG.

Here’s the schedule for the rest of the year:

Watch: the economic challenges facing re-elected Labor government

Fears of a US recession and a global slowdown caused by Donald Trump’s tariffs and trade war with China are hitting business confidence, hiring and investment plans.

It sets a challenging economic backdrop for the re-elected Albanese government and is a major priority, with the Treasurer receiving a briefing on the trade war over the weekend.

Business reporter Rhiana Whitson spoke to economists and business groups about how the uncertainty is already having an impact.

Watch the report from The Business:

Loading…

Oil slumps as production hikes continue

ASX to slip as Wall Street’s 9-session winning streak ends

Good morning, Steph Chalmers here to take you through the morning on markets.

Futures are pointing to local stocks slipping at the start of trade, after the S&P 500 snapped a nine-session streak of gains on Wall Street.

Donald Trump’s 100 per cent tariff on films produced outside America was one of the factors hitting sentiment, while traders are also awaiting the Federal Reserve’s two-day meeting this week.

Locally, the Australian dollar continued to push higher against the greenback.

Stick with us through the day!

Market snapshot

- ASX futures: -0.3% to 8,152 points

- Australian dollar: +0.1% to 64.64 US cents

- S&P 500: -0.6% to 5,650 points

- Nasdaq: -0.7% to 17,844 points

- FTSE: +1.2% to 8,596 points

- EuroStoxx 600: +0.2% to 537 points

- Spot gold: +2.9% to $US3,333/ounce

- Brent crude: -1.6% $US60.33/barrel

- Iron ore: -0.3% to $US97.35/tonne

- Bitcoin: +0.3% to $94,522

Prices current around 7:10am AEST