In boardrooms across the financial district, the conversation about blockchain has evolved from “Should we care?” to “How quickly can we adapt?”

Yet for many corporate leaders outside the Web3 ecosystem, distinguishing between meaningful innovation and market hype remains challenging.

Ethereum’s upcoming Pectra (Prague/Electra) upgrade, scheduled for 7 May 2025, aims to improve the efficiency, security, and scalability of the network.

Beyond the Cryptocurrency Narrative

Despite the numerous scams, rug pulls, and overall FUD (fear, uncertainty, doubt) that have plagued the crypto space. Ethereum (and perhaps other and other permissionless chains) have established its staying power through institutional adoption.

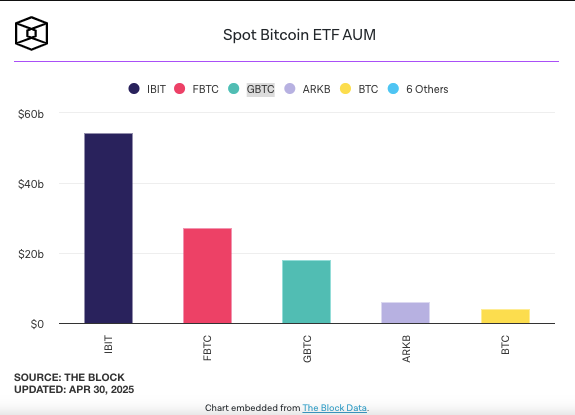

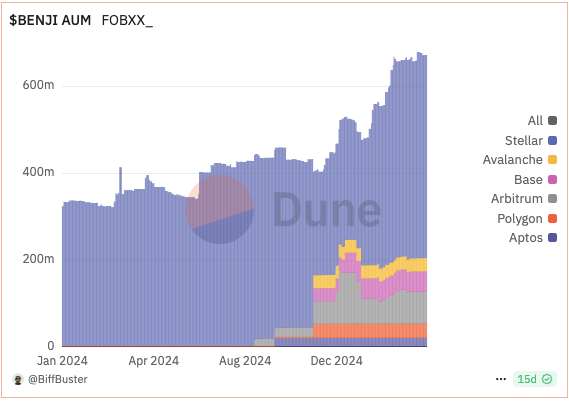

Major financial players who have show commitment, just to name a few include:

The Institutional Mindset Shift

This institutional evolution is captured in Alex Manson’s “Nothing Ventured, Nothing Gained: Rewiring the DNA in Banking.” As CEO of SC Ventures, Standard Chartered’s innovation arm, Manson articulates why traditional financial institutions must fundamentally transform their approach to blockchain technology.

The book’s central thesis is that financial institutions must rewire their operational DNA to remain relevant. This illustrates why companies like Standard Chartered are moving beyond viewing blockchain as merely speculative technology. Instead, they see permissionless networks as critical infrastructure for the future of global commerce.

For corporate stakeholders, this signals a critical inflection point. Retail investors and companies alike can now observe tangible evidence that Ethereum is evolving beyond speculation. The platform has matured into enterprise-grade infrastructure powering real business applications. This transformation extends Ethereum’s capabilities far beyond digital currencies into practical business solutions with measurable ROI.

The Pectra Upgrade: Practical Implications

Pectra solves some of the real-world problems that may have kept businesses from fully embracing blockchain technology:

- EOA Superpowers: EIP-7702 transforms standard Ethereum accounts (EOAs) by enabling them to execute code from any existing smart contract. This supports JPMorgan’s vision of “bank-side programmability,” allowing clients to deploy custom logic directly in the bank’s system.

- Capital Efficiency: EIP-7251 dramatically improves institutional staking by increasing validator capacity from 32 ETH to 2,048 ETH, a 64x improvement. This enhancement allows staking providers to manage larger capital pools with significantly reduced operational overhead.

Core Protocol Upgrades Powering These Benefits

Pectra includes several specific Ethereum Improvement Proposals (EIPs) that directly address enterprise needs:

EIP-7251. Validator Super-Sizing

What it does: Validators can now stake up to 2,048 ETH instead of just 32 ETH.

Why you should care: This dramatically reduces operational overhead for institutional staking. Your organization can deploy significant capital with fewer validator instances to manage.

This means lower infrastructure costs and simplified operations. For enterprises managing client funds in staking pools, this enables more capital-efficient products with streamlined backend requirements.

Bottom line: If you’re running multiple validators, you’ll soon be able to consolidate them. This means fewer nodes, lower costs, and easier management.

EIP-7702. Account Abstraction

What it does: User accounts can now function like smart contracts without sacrificing security.

Why you should care: This enables game-changing UX improvements for your customers. Your applications can now offer features like gasless transactions, batch transactions, and alternative payment options.

Users no longer need to handle complex gas payments. You can subsidize transaction costs or allow payment in your application’s native token.

Bottom line: Your product teams can create substantially more user-friendly blockchain experiences. This removes major friction points that have historically prevented mainstream adoption.

EIP-7742. Dynamic Blob Capacity

What it does: Ethereum can now automatically adjust how much transaction data it processes in each block.

Why you should care: Your L2 solutions will operate more efficiently and cost-effectively. Data availability, a critical component for rollups and other L2 solutions, becomes more responsive to market demand.

This means more predictable costs for your enterprise applications, particularly during usage spikes.

Bottom line: If your organization relies on L2 scaling solutions, you’ll see more consistent performance and lower operational costs.

EIP-6110. On-Chain Validator Processing

What it does: New validators can join the network faster and more securely.

Why you should care: If your organization operates validators or staking services, onboarding becomes significantly more efficient. The security improvements reduce systemic risk for all institutional participants.

The reduced waiting period improves capital efficiency for staking operations.

Bottom line: Faster validator onboarding means quicker time-to-revenue for staking operations and improved liquidity for staking capital.

EIP-7002. Smart Contract-Controlled Withdrawals

What it does: Smart contracts can now directly manage validator withdrawals.

Why you should care: This enables sophisticated automation for institutional staking operations. Your staking pools can implement programmable withdrawals with custom logic and improved security.

This creates opportunities for new financial products built around flexible staking operations.

Bottom line: Your staking infrastructure can now incorporate advanced features like automatic rebalancing, conditional withdrawals, and sophisticated risk management.

EIP-7691. Blob Scaling

What it does: Doubles the amount of data Ethereum can process per block.

Why you should care: Transaction costs for your operations will become lower and more predictable. This particularly benefits data-intensive operations like settlements, supply chain tracking, and asset tokenization.

Your Layer 2 solutions will experience dramatically improved performance and cost structures.

Bottom line: The cost of operating on Ethereum drops significantly, enabling more use cases to become economically viable for your enterprise applications.

Business Relevance: Why This Matters to Your Organization

The strategic implications extend across multiple business functions:

- Financial services transformation. Settlement processes, cross-border payments, and treasury operations are being reimagined through this technology. Your competitors are likely already developing capabilities in this space.

- Digital asset infrastructure. As tokenization of real-world assets accelerates, Ethereum provides the foundational layer for representing everything from carbon credits to real estate onchain.

- Supply chain visibility. Immutable record-keeping with granular permission structures solves longstanding challenges in multi-party business processes.

- Talent acquisition. Technical professionals increasingly view blockchain literacy as essential. Organizations demonstrating competence in this domain have recruiting advantages.

- First-mover competitive advantage. The organizations establishing standards and operational protocols today will shape industry dynamics for years to come.

Strategic Positioning for the Future

We’re witnessing a technological inflection point comparable to cloud computing’s emergence in the early 2010s. Organizations that approached cloud as merely an IT cost-saving initiative missed its transformative business potential.

Viewing Ethereum, the Pectra upgrade, and future protocol enhancements as merely technical improvements underestimates their true strategic significance.

Based on this Forbes article, the prediction is that stablecoins and tokenization are fundamentally reshaping global finance. Ethereum is becoming easier to use and implement. The business reasons to use Ethereum are becoming more compelling.

The Path Forward

In my personal opinion, the organizations that thrived during previous technological transitions shared a common approach. They balanced pragmatic experimentation with strategic vision.

I believe Ethereum’s Pectra upgrade represents practical improvements and a signal of institutional maturity for blockchain technology. For corporate leaders, the appropriate response isn’t blind enthusiasm or continued skepticism. It is informed engagement with a technology rapidly entering its enterprise era.

Understanding these developments isn’t merely technical due diligence. I see it as essential market intelligence for forward-thinking organizations.

The Pectra upgrade is only a single step in Ethereum’s long-term development goals. Learn more about the protocol roadmap and previous upgrades.