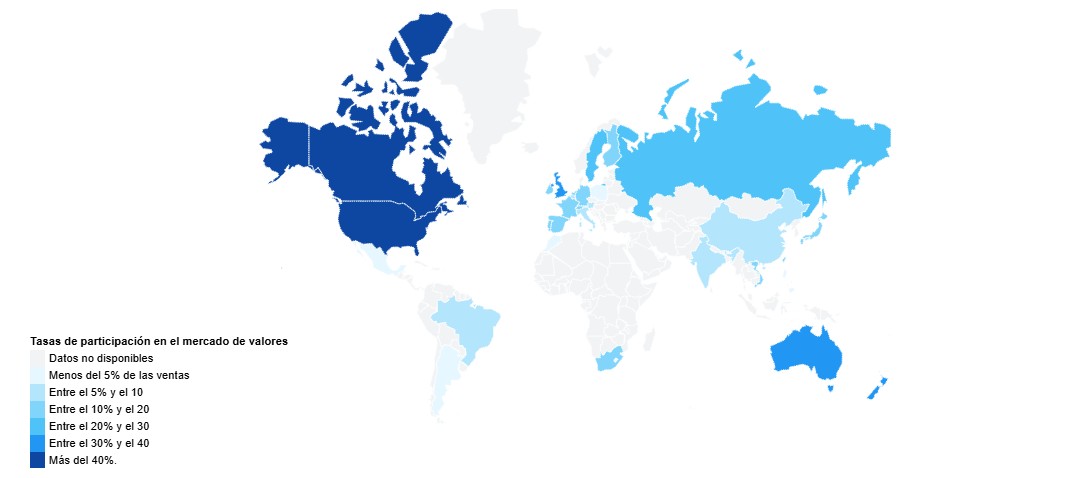

To understand the results of this report, it is necessary to take into account that the data presented on this map are the most recent available, and correspond to 2023 and 2024. “As there are no official statistics on the matter, there is a margin of error between 5% and 10% due to fluctuations in stock asset ownership and the difficulty of estimating the number of such owners. The figures include investors who directly own a stock portfolio, but also people who invest indirectly in stock assets through various financial vehicles (such as life insurance, for example),” clarify the authors of the report before we delve into its conclusions.

The analysis of stock ownership rates reveals marked disparities between continents since in North America, households have the highest rates, with 55% in the United States and 49% in Canada, reflecting a strong investment culture. Oceania follows this trend, with 37% in Australia and 31% in New Zealand. In Europe, there are significant differences as Nordic countries like Sweden (22%) and Finland (18.7%) are ahead of large economies like France (15.1%) and Germany (14.2%).

In Asia, rates remain globally modest, despite the dynamism of financial centers such as Hong Kong (13.8%) and Japan (15.2%). Lastly, emerging countries in Latin America and Africa, such as Brazil (8%) and Morocco (0.5%), present much lower levels, illustrating still-developing financial markets.

Pauline Laurore, finance expert at HelloSafe, explained: “The difference in stock market participation between countries can be explained by a combination of structural factors. In countries like the United States and Canada, investment in equities is deeply integrated into retirement savings plans —through pension funds— and supported by strong tax incentives. The financial culture there is more developed, and access to markets is facilitated by low-cost platforms and favorable regulation. In contrast, in many emerging countries, financial infrastructures are less mature, investment products are not widespread, and savings are still mainly channeled into real estate or low-risk assets. Even in highly populated countries like India and China, the low level of stock market penetration (6–7%) shows that there is considerable growth potential, provided educational, technological, and institutional obstacles are overcome.”

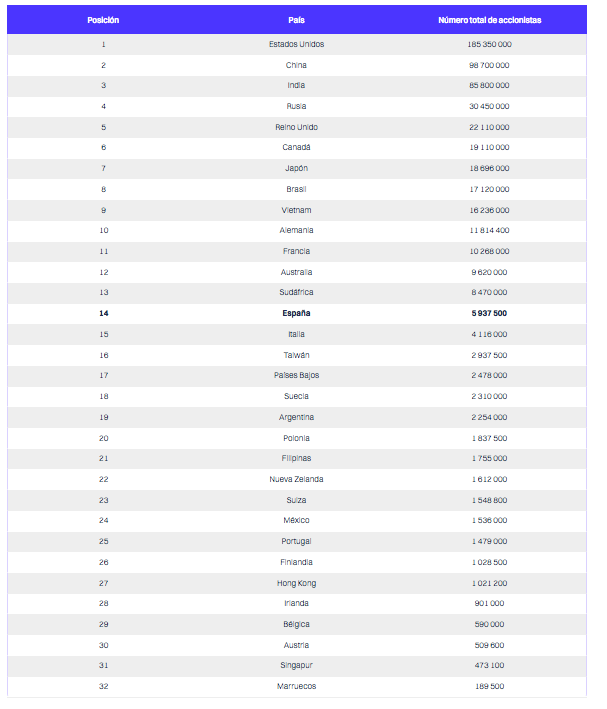

The analysis of the absolute number of shareholders reveals significant differences between countries in terms of demographics and economic development. In North America, the United States dominates with more than 185 million investors, far ahead of Canada, with 19 million. In Asia, although the proportion of investors is lower, the volume is impressive due to population: China (98.7 million) and India (85.8 million) rank among the global leaders.

In Europe, the figures are more modest despite advanced economies: the United Kingdom (22 million) and Germany (11.8 million) stand out, while France has 10.2 million holders. In Latin America, Brazil stands out with 17.1 million investors, far ahead of its neighbors. Finally, in Africa, South Africa leads the list with 8.47 million investors, which contrasts with much lower figures in Morocco (189,500). These figures reveal the combined influence of standard of living, investment culture, and demographic weight.