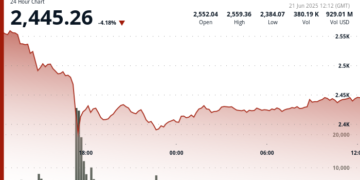

The “Sell America” day yesterday, transitioned to “Buy America” today with US stocks erasing all the declines from yesterday (-2.5% or more). Today, the major indices closed up over 2.5% with the:

- Dow up 2.66%

- S&P up 2.51%, and the

- Nasdaq up 2.71%.

Although yields along the yield curve were mixed with the 2 year up 6.9 baiss point to 3.82%, the 10 year was marginally lower by -0.4 basis points and the 30 year was down -2.6 basis points.

The 2-year note auction was sloppy with a positive tail of 0.6 basis points over the WI level at the time of the auction. The bid-to-cover was less than the 6 month average, with domestic demand surging to give support from what was a plunge in international buying (56% vs 73% average). It is worth monitoring for signs of less international demand in US debt, which could force yields higher. Tomorrow the US treasury will auction 10 year notes at 1 PM ET.

Helping the better tone in stocks and a move back into the USD today, were reports from a JPMorgan Private investor conference where Treas. Sec. Bessent reportedly said that he sees de-escalation with China in the very near future. The traders Pavlovian reaction was to take stocks higher and with it the USD. Later, it was clarified that an Imminent agreement overstated what he said. Instead, he meant that there is room for talks and de-escalation but much also depends on China’s willingness to compromise on trade as well.

Whoops.

Later it was reported that,

- Bessent & Co were actively working to secure trade agreements with key U.S. allies including India, South Korea, Japan, and Australia, though sources indicate that no deals are imminent. They called the imminent deals with India and Japan to be a “memorandum of understanding” with the “thorny details to be hashed out at a later date”. In other words, there is no deal per se.

- VP Vance was reportedly taken on a leading role as a “major executor” of trade negotiations, aiming to expedite progress with these partners.

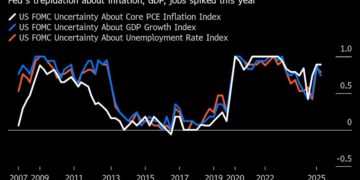

In Fed speak today, Federal Reserve officials offered cautious remarks on inflation and monetary policy today, with a shared concern about the stability of inflation expectations. Richmond Fed President Tom Barkin hinted at a possible shift, noting that inflation expectations may have loosened—a subtle but notable change in tone.

Minneapolis Fed President Neel Kashkari echoed similar concerns, warning that the backdrop of high inflation raises the risk of unanchoring inflation expectations. While he acknowledged that tariffs typically create a one-time rise in prices, the combination of persistent inflation and new trade barriers could destabilize expectations. Kashkari emphasized that policymakers cannot allow expectations to become unanchored, even though, so far, long-term inflation expectations remain relatively stable.

He also noted that tariffs are both inflationary and growth-dampening, and reiterated his belief that independent monetary policy produces better long-term outcomes. While he didn’t offer a clear stance on the path of interest rates, he said it was too soon to judge, which pushes back on current market pricing that shows a 65% chance of a rate cut in June.

Overall, today’s commentary suggests Fed officials remain cautious and unconvinced by market optimism for near-term easing, especially amid renewed inflationary pressures from tariffs.

Looking at the currency markets, the US dollar moved higher today, reversing some of the sharp declines seen yesterdy. :

- EURUSD. The EURUSD fell back below its rising 100-hour moving average at 1.14323. There is a modest tilt to the downside technically at least in the short term. Stay below in the new trading day and work through the 200-hour moving average of 1.13797 (and moving higher) would add to the bearish bias. The last time the price traded below its 200-hour moving averages back on April 2.

- GBPUSD: The GBPUSD also moved lower but is closing above its rising 100-hour moving average of 1.3311. The current prices trading at 1.3329. Like the EURUSD it would take a move below its 100-hour moving average to give the sellers more confidence. The high price from last week’s trading at 1.3292 be a another target on the downside followed by the rising 200-hour moving average of 1.3228.

- USDJPY: The theme of the 100-hour MA continues with the USDJPY. It is testing near its falling 100-hour moving average at 141.61. Move above and the falling 200-hour moving average of 142.406 would be targeted. The last time the price traded above its 200 hour moving average was back on April 9.

- USDCHF: The USDCHF was the first of the major currency pairs to have the price correction move through both its 100-hour moving average (at 0.81398), and its 200-hour moving average (currently at 0.81609). The USDCHF bottomed yesterday at 0.80412 after trading as high as 0.8874 on March 31. That is a fall of over 800 pips. The room to roam on the topside with swing highs from last week at 0.8230, 0.8239, and 0.82695 as the next targets.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.