Market snapshot

- ASX 200: +0.4% at 7993

- Australian dollar: -0.2% to 63.58 US cents

- Wall Street: Dow -1.7% S&P -2.2% Nasdaq -3.1%

- Europe: Stoxx600 -0.2% DAX +0.3%

- Spot gold: -0.2% % to $US3,337/ounce

- Brent crude: +0.7% to $US66.25/barrel

- Iron ore: -0.7% at $US98.05/tonne

- Bitcoin: +0.7% to $US84,647

Prices current around 12:30pm AEST.

Live updates on the major ASX indices:

ASX maintains gains in mid afternoon trade

The Australian share market has extended its gains, with the ASX 200 and the All Ordinaries up 0.6% at 2:50pm AEST.

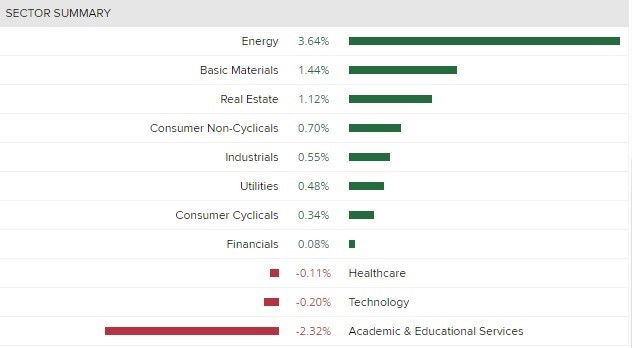

Gold miners and energy companies were among the biggest gainers, with the energy sector the best performing and academic the worst sector:

Tariffs will have more influence on rates than jobs data: HSBC

Data from today indicates the job market may be tightening, says Paul Bloxham, HSBC’s Chief Economist for Australia, NZ + Global commodities:

“There would be nothing in this report to suggest the jobs market would be a reason why the RBA should be cutting its cash rate further.

However, local events are being overtaken by global ones. The global trade policy shock has seen our economics team downgrade its global growth forecasts. We have also nudged our growth forecasts lower for Australia and expect GDP growth of 1.6% in 2025 and 2.0% in 2026.

For monetary policy though, we see the bigger effect as whatever the likely impact on local inflation will be from these developments. On this, we see the global slowdown as likely to be disinflationary and expect that Australia will also see lower imported goods prices due to trade diversion. If China is unable to export as many manufactured goods to the US, we expect some these to head towards Australia’s market, putting downward pressure on imports goods prices.

This disinflationary effect should allow the RBA to cut its cash rate further, despite the economy operating at close to full employment and many domestic price pressures persisting. However, these domestic price pressures are why we expect the RBA to take a cautious approach to easing.

Our central case sees the RBA lowering its cash rate by 25bp in May and by another 75bp by Q1 2026, taking the cash rate to 3.10% by early 2026 (we revised our cash rate view just after the US ‘liberation day’ tariffs announcements).”

With the high cost of housing, the appeal of co-ops grows

With the affordability of housing a major financial stress point for many, some people are looking at alternative models.

One of them is housing co-operatives: a community-led form of affordable housing run by the people who live in them.

Residents can be renters or they can have a stake in the co-operative’s equity, and advocates say they could be part of the solution to Australia’s rental crisis.

Read more by Danielle Pope:

The mystery of the missing workforce

Employment growth has slowed over the past year, so why hasn’t Australia’s unemployment rate increased?

Our resident data expert Gareth Hutchens answers this question and more in this comprehensive article on today’s figures:

Global uncertainty already affecting hiring: recruiter

While Australia’s jobs market remained broadly steady last month, recruiters have told The Business the global uncertainty spurred by the Trump administration’s trade war is starting to have an impact on hiring.

“The uncertainty that’s happening globally is affecting people willing to invest in new jobs and new hires,” Kris Viner from recruitment agency Robert Walters said.

“With the news cycle and the unpredictability around tariffs kind of changing every week, you’d be very brave to make large-scale hiring investments until you really understand how that’s going to affect you.”

You can catch a report on the jobs market and the hiring environment from Rhiana Whitson on The Business tonight at 8:45pm AEST on ABC News Channel and anytime on iView.

While employment increased by 32,000 in the month of March, economists say Australia’s job market has cooled down noticeably in recent months, with far fewer jobs being added compared to this time last year.

Read more here from business reporter Gareth Hutchens:

Jobs data sets us up for a rate cut: AMP economist

Today’s unemployment figures were a solid set of numbers that shows the labour market is holding up well, according to AMP’s Chief Economist Diana Mousina.

Ms Mousina said although the rise in employment was slightly below economist expectations, volatility in the figures means it could still be considered a good outcome.

She also noted that hours worked fell by 0.4% because of more people than usual reducing hours in the wake of bad weather in NSW and QLD thanks to Cyclone Alfred.

What does it mean for interest rates?

While there has been different commentary around this today, Diana Mousina reckons it’s fairly positive, with the labour market in good shape:

“The unemployment is likely to increase a tad further, peaking at around 4.3% which should ease the pace of wages growth further. The RBA see the unemployment rate reaching 4.25% by June and remaining at that level”

“From an interest rate point of view, this is the perfect set-up for the RBA – lower inflation but the labour market holding up. While the unemployment rate remains low, the slowing in wages (and therefore inflation) makes us confident that the strength in the labour market should not deter further rate cuts. We see another 0.25% rate cut in May, after the March quarter inflation data which should show a quarterly trimmed mean of 0.6% (lower than RBA forecasts of 0.7%). And then we expect another 0.25% cut in August. Our view has not changed since the new US tariff announcements because the impact on Australia is unclear. Exports to the US may slow but they only account for <5% of total goods exports.”

She concludes by saying:

“So, there is certainly no need for the RBA to press the panic button right now with a large interest rate cut at the next Board meeting”

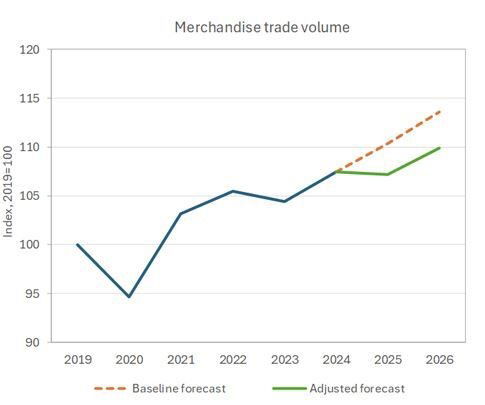

WTO sees world trade -0.2% this year, with a US export slump

Hi team,

Just jumping in with a deeper look at something flagged earlier on the blog, the World Trade Organisation’s ‘Global Trade Outlook and Statistics‘.

Aware that, with that title, it’s not exactly a new Jack Reacher novel, but it’s still worth your time.

Here are the key points:

- Under current conditions, the volume of world merchandise trade is likely to fall by -0.2% in 2025. The decline is expected to be particularly steep in North America, where exports are forecasted to drop by -12.6%.

- However, severe downside risks exist, including the application of “reciprocal” tariffs and broader spillover of policy uncertainty, which could lead to an even sharper decline of -1.5% in global goods trade and hurt export-oriented least-developed countries.

- The report contains for the first time a forecast for services trade to complement its projections for merchandise trade. The volume of services trade is forecasted to grow by +4.0% in 2025, around 1 percentage point less than expected.

Markets pare back bets of a super-sized rate cut

A quick check in on what’s happened to interest rate cut expectations following the jobs figures.

Market pricing for a 50 basis point cut in May has pared back — from 30 per cent earlier, to around 22 per cent, according to LSEG Refinitiv.

But consensus remains that there will be a decrease in the cash rate of some size when the RBA board next meets.

Unemployment would be 4.7 per cent if participation hadn’t declined

Some interesting observations, as usual, from job website Indeed’s Asia-Pacific economist Callam Pickering:

“While employment rose by 32,200 people in March, that followed a decline of 57,500 people in February. In fact, over the first three months of the year, Australian employment has increased by just 6,500 people. That’s a fair slowdown from last year when the job market was regularly adding 100,000 people or more a quarter.

“Given that, it’s perhaps surprising that Australia’s unemployment rate hasn’t increased. The reason though is quite simple: Australia’s participation rate has declined by 0.5 percentage points over the past two months, effectively absorbing the impact of low employment growth. If the participation rate had held steady, at its record high from January, Australia’s unemployment rate would have jumped to 4.7%.”

The big decline in the participation rate came in last month’s February data release, and the ABS mostly attributed it to a larger cohort of people retiring.

ASX higher after steady jobs data

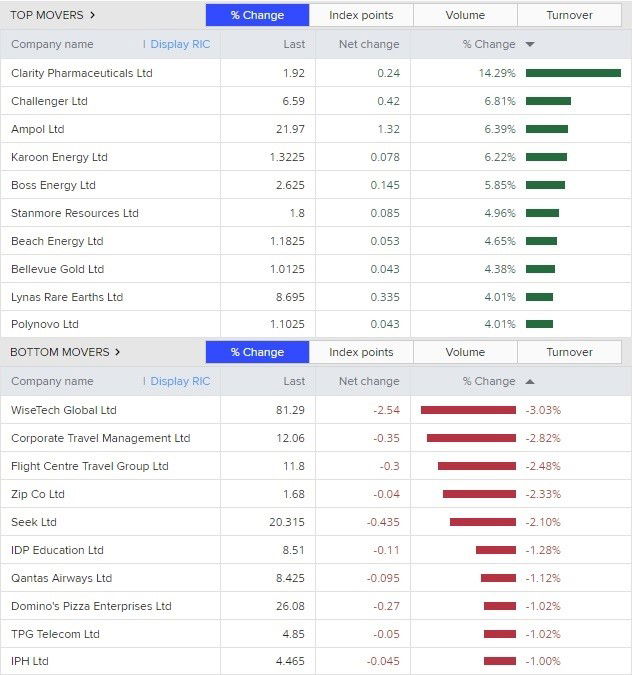

The Australian share market is trading a little higher at lunch time, driven by mining and energy stocks.

The All Ords are 0.43% higher to 7996 points, while the ASX200 is up 0.48% to 7795 at 12:20pm AEST.

The top movers are mostly energy and resources companies, except for Clarity Pharmaceuticals which is leading the way after it announced it was signing a commercial-scale supply agreement for copper-64 isotopes – something used in cancer diagnosis and therapy.

WiseTech is leading the losses, along with some travel and tech stocks.

The Australian dollar is down to 63.56 US cents.

Update

Why all 4 big banks cutting rates when they know that with Volatility in stocks and unemployment no at 4.1% Reserve will not cut as unfair during elections one party gets undue advantage

– Abbas

Hi Abbas, the banks cut rates following the RBA’s decision in February to do so. The central bank did not cut rates at its last meeting earlier this month. Its next meeting in late May will fall after the federal election. It remains to be seen what they will do then, but markets are predicting they will cut rates then

Labour market ‘resilient’: NAB economist

The jobs data shows the labour market is still strong thanks to population growth and “healthy” labour demand.

That’s according to NAB economist Gareth Spence, who spoke to Finance presenter Sam Yang a few minutes ago:

Loading…

Hours worked fell amid ex-Tropical Cyclone Alfred

Hours worked over the month of March decreased by 0.3 per cent, according to the ABS data.

It’s the second monthly decline in a row, even though employment increased in March.

“A higher than usual number of people reported working reduced hours this month due to bad weather, coinciding with ex-Tropical Cyclone Alfred and other major weather events in New South Wales and Queensland,” ABS head of labour statistics Sean Crick noted.

More people in the jobs market amid cost-of-living pressures

Let’s take a closer look at the jobs data, which has just been released by the bureau of statistics.

The unemployment rate ticked up slightly to 4.1%, the number of employed people grew (by 13,900), as did the number of unemployed people (by 1,500).

Why is that? It is likely down to population growth, and the rise in the participation rate (from 66.7% to 66.8%) — meaning more people are in the jobs market, looking for work.

Unemployment rate rises to 4.1%

The jobless rate has risen to 4.1% in March

The month prior the rate was 4% (previously the ABS had said it was 4.1% but they revised it down in today’s release)

We’ll sift through the data now and bring you more analysis shortly

Could the RBA cut 0.35 of a percentage point?

Could the RBA go for a middle ground cut by 0.35% and get the rate back to “round” numbers?

– Moomy

Many of us would like it to Moomy, but I don’t think the RBA is in a hurry to ‘normalise’ the cash rate back to more round quarter-percentage-point increments.

For those who don’t know the background behind this discussion, the cash rate currently sits at 4.1%, after the RBA cut it to a low of 0.1% during the pandemic.

Normally, the RBA moves in increments of 0.25 percentage points, sometimes 0.5 and very occasionally by a full percentage point (such as during the global financial crisis).

However, it did not take the chance while raising rates to even up the ledger, and former governor Philip Lowe dismissed as somewhat ridiculous suggestions that it should.

I’m not sure Michele Bullock has a different attitude.

Also, while the cash rate target is a slightly weird number, the interest rate on exchange settlement balances is an even 4%.

The two rates used to be set at the same level, but after COVID the RBA decided a lower exchange settlement rate was better to effectively implement monetary policy.

“The Reserve Bank currently pays an interest rate on ES balances that is 0.1 percentage points below the cash rate target. Banks have an incentive to deposit as little as possible at this rate, and instead prefer to earn the higher cash rate by lending out their balances,” the RBA notes in this explainer.

“The Reserve Bank is also willing to lend ES balances to banks if this is required. The interest rate on these loans is 0.25 percentage points above the cash rate target. Banks have an incentive to borrow as little as possible at this rate, and instead prefer to borrow at the lower cash rate in the market.”

In short, I think we may have to keep getting our heads around a slightly odd cash rate number for a bit longer.

Another Australian retail chain goes bust

In case you missed it last night, shoe store Wittner is the latest retailer to go into administration.

This spate of fashion chain insolvencies in recent times has already led to the loss of thousands of retail jobs nationally.

Read more:

Our software remains safer after Trump backs down on funding cut

The foundation stone of the world’s cybersecurity defences won an eleventh-hour reprieve overnight, after news of an imminent US government funding cut triggered international outcry.

The Common Vulnerabilities and Exposures program (CVE) was expected to grind to a halt today after more than 25 years when core funding from the US Department of Homeland Security lapsed, with no plans to renew it.

The CVE system, run by non-profit organisation MITRE, identifies and catalogues every new vulnerability in the software of globally significant companies such as Microsoft, Google and Adobe.

It assigns each flaw a unique number so that cyber security teams can defend their organisations from attackers seeking to exploit it.

Somewhere between 100 and 200 new CVEs are registered every day, and more than 40,000 new flaws were catalogued in 2024 alone.

Yesterday, MITRE warned there could be a “break in service” from today, meaning the program could go dark, sending cyber defenders around the world into a panic for more than 12 hours.

Experts are describing the episode as wake-up call, and warn the demise of MITRE’s CVE program remains as “a single point of failure” in a crucial global system, which would cause chaos were it to fail.

For now, its funding has been renewed for another 11 months.

Trump closes off ‘de minimis’ loophole to enforce tariffs

Hi Guys, have you seen or heard predominantly on TikTok that Chinese warehouses are now shipping the manufactured goods straight to the consumer instead of going through the brand due to the tariffs imposed by Trump.

– Noah

Hi Noah,

If this is happening now, it won’t be for long.

As flagged by our own Kate Ainsworth (see story link below), Donald Trump has announced the end of the so-called “de minimis” exemption to tariffs and duties for goods coming from China and Hong Kong.

You can read the White House fact sheet about the US president’s executive order here.

This will mean that all goods shipped from China to the US valued at less than $US800 will still be subject to the full tariffs (upwards of 145%) imposed by the Trump administration.

That is unless they come via post, when they will be subject to a duty of 30% of their value or $US25 (rising to $50 from June 1) in lieu of other duties.

The end of the de minimis exemption for China and Hong Kong commences from 12:01am US EDT on May 2, 2025 — unless Donald Trump changes his mind in the meantime.

This could be colloquially dubbed the Temu and Shein killer tariff.

This week, the two companies urged US shoppers to buy now in order to beat price rises.

It basically makes totally uneconomic the trade in ultra cheap consumer goods from sellers like this, and could also be a huge headache for Amazon.

The change affects “covered goods from the People’s Republic of China (PRC) and Hong Kong”, so it seems like that would include items made in China but posted from other nearby countries, such as Vietnam.

If not, then I can foresee a lot of Chinese-owned warehouses springing up in northern Vietnam.