The US dollar moved sharply to the downside with the dollar index (DXY) down -1.83%. That was its largest one-day decline going back to November 2022.. The US dollar was the weakest versus the Swiss franc at -3.94%. The USDCHF fell to the lowest level since 2011.

The greenback also fell -2.26% versus the EUR and -2.06% versus the JPY. The decline vs the CAD of -0.77% was the smallest decline for the greenback vs a major currency today.

Helping the downside, was lower CPI inflation which saw the core measure come in at 0.1% versus 0.3% estimate. The headline number came in at -0.1% versus 0.1% expected. The year-on-year for the headline was 2.4% versus 2.8% last month, while the core fell to 2.8% from 3.1% last month.

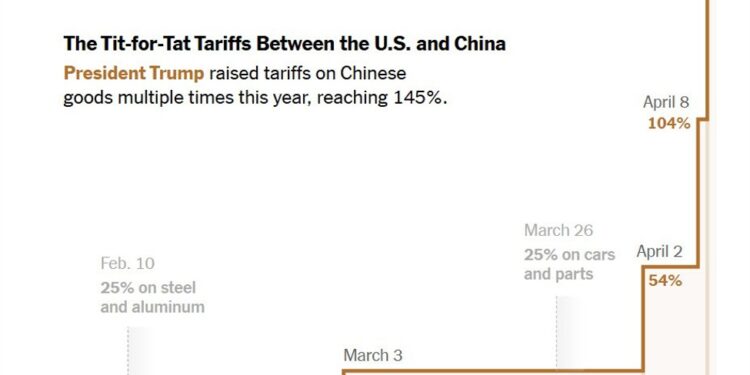

Although inflation came down, the markets are still worried about the impact of tariffs. Although Pres. Trump delayed tariffs for most countries by 90 days, the tariff rate on China imports increased to 145%. With China a major exporter to the US that shuts down any direct exporting to the US (however, there will likely be indirect movement of goods from other countries) until there is a resolution..

After oversized gains yesterday in the US stock markets, the equity market traders rethought the current tariffs and retraced some of the gains from yesterday’s trading today. Yesterday the::

- Nasdaq gained 1857.06 points or 12.16% today.

- S&P soared by 434.13 points or 9.52% .

- Dow industrial average rose 2962.86 points or 7.87% to 40,608.45.

- Small-cap Russell index gained 152.45 points or 8.66% to 1913.16.

Today, the

- NASDAQ index fell -737.66 points or -4.31% at 16387.33

- S&P index fell -189.08 points or -3.46% at 5267.83.

- Dow industrial average index fell -1015.01 points or -2.50% at 39593.66.

- Russell 2000 index fell -81.76 points or -4.27% at 1831.39

Going into the final day of the trading week, the major indices are trading higher:

- Dow industrial average +3.34%

- S&P index, +3.82%

- NASDAQ index 5.13%

Yields today saw the yield curve steepen despite another strong auction in the 30-year sector:

- 2 year 3.845%, -10.5 basis points. For the week, the yield is up 20.3 basis points

- 5 year 4.031%, -6.7 basis points. For the week, the yield is up 33.5 basis points

- 10 year yield 4.399%, +0.3 basis points. For the week the yield is up 40.5 basis points.

- 30 year yield 4.868%, +7.6 basis points. For the week the yield is up 44.7 basis points

There were a number of Fed speakers today,:

- Dallas Fed Pres. Lorie Logan stated that the current stance of Fed policy is appropriately positioned for now. She warned that higher-than-expected tariffs could lead to a troubling combination of rising unemployment and inflation. Logan emphasized the importance of preventing tariff-related price increases from fueling broader inflation pressures. She noted that inflation persistence will depend on how rapidly businesses pass on higher costs and whether long-term inflation expectations stay well anchored. A sustained surge in inflation could risk unmooring those expectations.

- Kansas City Fed President Jeff Schmid expressed concern over the inflationary impact of recent tariff announcements, stating that they have heightened economic uncertainty. He rejected the notion that tariffs would result in only a temporary, one-off price increase, emphasizing that the Fed cannot risk its credibility on inflation. Schmid noted that the tariff news has coincided with falling consumer sentiment and a rise in short-term inflation expectations. He stressed the need to stay focused on inflation control, though his remarks do not account for the latest CPI report or the recent partial pause on tariffs.

- Fed Governor Michelle Bowman noted that while economic growth remains solid, there are signs of slowing. She acknowledged the recent CPI report showing inflation has declined and emphasized the importance of monitoring how evolving policies impact the broader economy. Bowman said the effects of tariffs remain uncertain, both in terms of their overall economic impact and how they may influence specific industries.

Fed’s Goolsbee – never at a loss for words – weighed in on a number of different topics today:

- Interest Rates and Monetary Policy

Fed’s Goolsbee emphasized that all policy options should remain on the table and reiterated that the Fed’s decision-making timetable is distinct from market expectations. He advocated for a patient, data-driven approach, urging against premature conclusions. Given current uncertainties, he believes now is the time for the Fed to wait and observe, rather than act. Goolsbee also noted that he would not speculate on how the Fed might respond to potential market stress, reinforcing the importance of flexibility. - Market Conditions and Financial Stability

Goolsbee addressed broader market dynamics, noting that recent bond market volatility has been global, not just confined to the U.S. He acknowledged that current tariffs are already higher than most previous scenarios, but believes short-run tariffs are unlikely to shift the broader economic trajectory. A strong 10-year Treasury auction helped ease concerns, and long-term Treasuries still appear to be the safest global asset. However, he cautioned that financial conditions indexes can be hard to interpret and should be considered carefully. - Economic and Inflation Outlook

Goolsbee described the current state of the U.S. economy as solid, with hard data remaining strong and unemployment hovering near full employment. The economy had been moving toward a “golden path,” though fears of a return to pandemic-era disruptions and stagflation risks still linger. He stressed the increasing importance of timely soft data and warned that a loss of confidence could trigger broader issues. Inflation appears to be trending down, and while short-term inflation expectations are mixed, long-term expectations remain well anchored — a key focus for the Fed. He also emphasized that the full impact of current policy rates may take 12–18 months to materialize. - Structural and Productivity Trends

From a structural standpoint, Goolsbee highlighted that the U.S. retains a robust manufacturing base, albeit with a complicated supply chain. Additionally, he noted that recent gains in productivity could be tied to advances in artificial intelligence. He also mentioned that he has not heard widespread concerns from business contacts regarding layoffs, reinforcing his view that the labor market remains resilient.

Finally late in the day,

- Boston Fed President Susan Collins stated that current interest rate policy is appropriately positioned, and for now, holding steady is the best approach. However, she warned that newly imposed tariffs are likely to push inflation higher while simultaneously slowing economic growth. Core inflation could rise “well above” 3% this year, which may delay the timing of any potential rate cuts, though there is still room for cuts later in the year if conditions allow.Collins emphasized that monetary policy faces difficult trade-offs and must remain flexible amid high uncertainty. She highlighted the importance of keeping inflation expectations anchored and acknowledged risks remain skewed toward higher inflation and weaker growth. Tighter financial conditions may also help restrain activity, and although the short-term outlook is clouded, Collins expects inflation pressures to ease over the longer term.

In other markets today:

- Gold is closing at a record level. Use currently trading up $88.51 or 2.87% at $3170.46. The high price today reached $3176.40.

- Crude oil fell sharply. The current price is trading down $-2.26 at $60.06..

- Bitcoin is trading down $2876 and $79,719.