Bitcoin took a sharp dive to $81,000 after hitting highs of $88,000 during President Donald Trump’s latest tariff announcement. The market initially reacted positively to the news of a 10% baseline tariff on all imports, as it was lower than many had anticipated. However, just minutes later, Trump revealed additional higher tariffs on specific countries, causing markets—including Bitcoin—to reverse sharply.

Don’t Miss:

Trump on Wednesday announced sweeping reciprocal tariffs, branding the move as “Liberation Day.” The policy imposes a 10% baseline tariff on all imports to the U.S., but many nations will face significantly higher rates based on how they tax U.S. goods.

For instance:

-

China will face a 34% tariff under the new policy.

-

Vietnam (46%), Taiwan (32%), Switzerland (31%), and India (26%) will all see much higher import duties.

-

Some of the steepest tariffs are hitting Cambodia (49%), Bangladesh (37%), and South Africa (30%).

Trump justified the move as a way to erase America’s trade deficit and protect U.S. manufacturers. However, economists warn that the policy could lead to inflation and a global trade war, as other nations are likely to retaliate with tariffs on American goods. Moody’s Analytics chief economist Mark Zandi cautioned that extended tariffs could push both the U.S. and its trading partners into recessions.

Trending: Have $200K saved? Here’s how to turn it into lasting wealth

When Trump first announced the 10% across-the-board tariff, markets breathed a sigh of relief, as many expected harsher measures. This initial reaction pushed Bitcoin to $88,000. However, as Trump unveiled additional tariffs with higher rates on major trade partners, concerns over inflation and economic uncertainty sent risk assets tumbling—dragging Bitcoin down to $81,000.

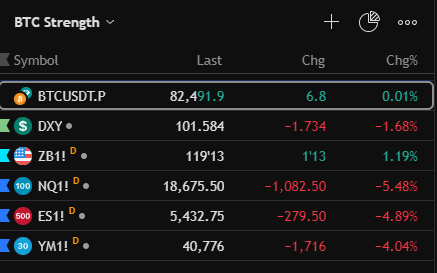

As discussed in a previous article, Bitcoin has been showing relative strength compared to the stock market.