Australian shares suffered their worst week since June 2022, as nearly $70 billion was wiped off the All Ordinaries index on Friday.

Fears of a recession in the US roiled global markets, with the biggest one-day falls Wall Street has seen since the pandemic setting the stage for early losses on the ASX.

The Australian dollar also took a tumble, falling back to 62.4 US cents on Friday afternoon.

The ASX 200 closed 2.4 per cent lower for the day, taking the weekly fall to 3.9 per cent — the worst five-day drop in more than two-and-a-half years.

Energy was the worst-performing sector on the local market, while consumer stocks, including the supermarkets, and gold miners among the few dozen stocks to rise.

The ASX 200 has now fallen 11 per cent from the all-time high it closed at in mid-February, which means it has entered a ‘technical correction’.

Driving the fear on Wall Street, across Asian markets and in Australia is rising concerns that the world’s biggest economy is heading towards a recession.

“The good news is that we may be getting close to the top on US tariffs, which may help settle markets down,” AMP’s head of investment strategy and chief economist Shane Oliver said.

“Given the even bigger threat to global growth flowing from Trump’s latest round of tariffs it looks like share markets will have a further leg down.“

In individual company news, Insignia Financial shares dropped 5.3 per cent, as the company confirmed it had been affected by cyber attacks targeting some of Australia’s biggest superannuation funds.

Insignia, which is behind the brands MLC, super and investment platform Expand, IOOF and Plum, said it had found evidence of a “malicious third party undertaking an activity known as credential stuffing”.

“At this stage, it appears from Insignia Financial’s investigations that the activity involved an unusual number of login attempts targeted at the Expand Platform,” it said in a statement.

It confirmed that around 100 customer accounts had suspicious activity but there had been no financial impact on Insignia customers.

Members of Australia’s biggest super fund, AustralianSuper, did lose money, with four members losing $500,000 between them.

Amotiv, a company that sells vehicle parts and accessories, suffered the worst percentage fall on the benchmark index, despite saying it did not expect a “material impact” from the US tariffs announced by Donald Trump.

In a statement to the ASX, Amotiv said it now expected marginal revenue growth and a small decline in its underlying earnings for the financial year, citing “muted demand” in Australia and weak vehicle sales.

The company said it was now “assessing a range of tactical and strategic actions to manage the risks and realise the opportunities of these changes”, including finding new sources of goods, changing prices and finding alternative manufacturing and supply locations.

Take a look back at how the session unfolded, including the day’s financial news and insights from our specialist business reporters on our blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

Market snapshot

- ASX 200: -2.4% to 7,847 points

- Australian dollar: -1.3% to 62.44 US cents

- S&P 500: -4.8% to 5,396 points

- Nasdaq: -6% to 16,550 points

- FTSE: -1.6% to 8,474 points

- EuroStoxx: -2.6% to 523 points

- Spot gold: -0.3% to $US3,104/ounce

- Brent crude: -1% to $US69.46/barrel

- Iron ore: -0.6% to $US102.30/tonne

- Bitcoin: +0.8% to $US83,028

Prices current around 4:30pm AEDT

Close of Business

That’s all from our live markets coverage today but there is plenty more where that came from across ABC News all weekend.

If you particularly want to relive the market turbulence, tune into Close of Business with Alicia Barry on ABC News Channel tonight and over the weekend, or anytime on iView.

We’ll be back live blogging markets first thing Monday with my esteemed colleague Stephen Letts at the desk.

Until then, have a good weekend and don’t panic.

Tokyo’s Nikkei in a bear market

We’re in a technical correction on the ASX, but spare a thought for investors in Japan.

Tokyo’s Nikkei is now down 20 per cent from its July peak, otherwise known as a bear market.

Loading

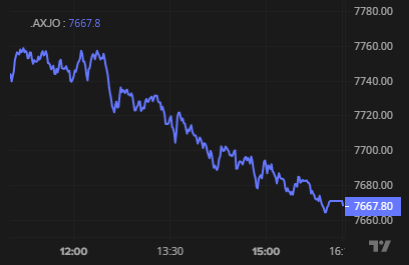

Worst week for the ASX 200 since 2022

Things went from bad to worse for markets today and that left the ASX 200 3.9 per cent down for the week — its worst week since June 2022.

Here’s how the session looked:

“The RBA must be thinking cuts now. The only conclusion you can draw from this war on trade is that it is bad for everyone”, said Henry Jennings, senior market analyst at Marcus Today, told Reuters.

We’ll have to wait and see what plays out on Wall Street tonight, currently US futures are pointing to modest falls.

Best and worst performing stocks

Here were the biggest individual stock moves for the Friday session on the ASX 200.

The worst % falls were for:

- Amotiv (-16.7%)

- Zip (-13.8%)

- Karoon Energy (-12.2%)

- Breville (-12%)

- Corporate Travel Mgmt (-11.7%)

And some of the rare bright spots, the biggest % gains:

- Capricorn Metals (+5.2%)

- Coles (+4.1%)

- Lynas Rare Earths (+3.4%)

- Endeavour Group (+3.1%)

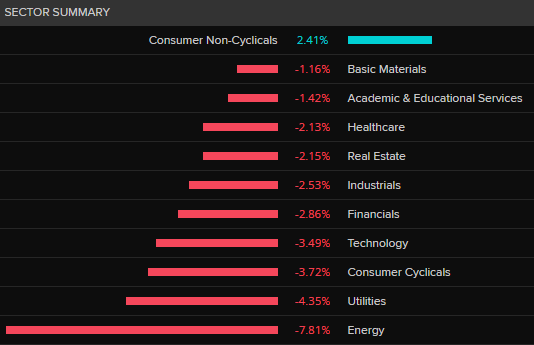

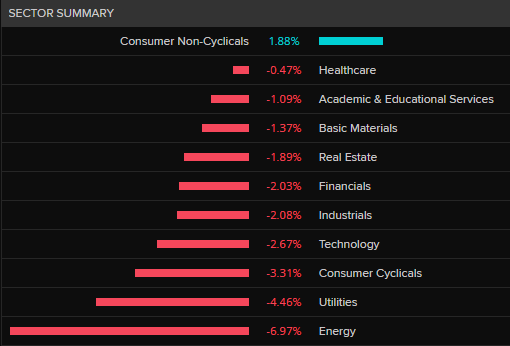

The major fall in oil prices weighed on energy, making it the worst performing sector of the session:

ASX 200 down 11 per cent from all-time high

As we reported earlier, the benchmark ASX 200 index is now in a ‘technical correction’ — that is it’s lost more than 10 per cent from its recent peak, which was the all-time high set in mid-February.

At the close, it’s lost 11 per cent since then.

Nearly $70 billion in value wiped off the All Ords

The All Ordinaries index started the session with a market capitalisation of $2.72 trillion.

With close to 2.6 per cent wiped off through today’s session, that’s $69.4 billion in losses.

ASX extends falls into the close, All Ords drops 2.6%

The heavy selling only got worse as the session progressed, leaving the ASX 200 down 2.4%, while the All Ordinaries dropped 2.6%.

That leaves the benchmark index 3.9 per cent lower for the week.

We’ll bring you a full breakdown of the stocks and sectors hardest hit shortly.

Does your super fund have two-factor authentication?

I’m amazed if super funds don’t have at least two factor authentication. I mean MyGov has had it for years. Email , password and answer one of a number of secret questions. Why haven’t companies with huge resources done it?

– Phillip

Aussie dollar slides 1.5% against greenback

The Australian dollar has been steadily falling over the last few hours — here’s a look at the chart:

What is credential stuffing?

We’ve just heard from Insignia that they’ve found evidence of “credential stuffing” when investigating the cyber attack on super funds.

What exactly is credential stuffing?

The Australian Cyber Security Centre defines credential stuffing as a cyber attack where “cybercriminals use previously stolen passwords from one website and try to reuse them elsewhere so they can gain access to more accounts”.

In other words, when hackers breach a website and steal our email address and password combinations, they will then use that information to try and log in to as many accounts as possible on other websites using that information.

That’s because hackers know many of us use our same email address and password combinations for multiple online accounts.

Essentially, hackers use stolen login credentials and “stuff” it into as many websites as possible — and when they are able to log in, they can access our accounts without the website or the real account holder knowing.

There’s a full breakdown here from Kate Ainsworth:

MLC owner Insignia responds to ‘malicious’ cyber incident

Insignia Financial has issued a statement to the ASX on the cyber incident affecting Australian superannuation funds:

“At Insignia Financial, based on the investigations undertaken to date, the attack appears to involve a malicious third party undertaking an activity known as credential stuffing.

“At this stage, it appears from Insignia Financial’s investigations that the activity involved an unusual number of login attempts targeted at the Expand Platform.

“Although investigations are continuing, Insignia Financial has not observed similar activity impacting other customer facing platforms.”

Insignia shares are down 5.8 per cent.

Insignia is the financial services company behind the brands MLC, super and investment platform Expand, IOOF and Plum.

Heavy falls in Asia with Japan’s Nikkei down 3.5%

It’s not just the local stock market feeling the pressure — the falls are being seen across Asian markets too.

Tokyo’s Nikkei 225 is currently down 3.5 per cent, and its banking index has slid 11 per cent.

The Shanghai Composite and the Hang Seng are closed for a holiday.

Australian market in ‘correction’ as US recession fears mount

The benchmark Australian stock market index, the S&P/ASX 200 has entered a technical correction.

A technical correction is generally accepted as being a 10 per cent or greater fall in the index from its recent peak (closing high).

The ASX 200 reached all all-time intraday high of 8,615 index points in February 2025.

Its closing high on that day was 8,555 index points.

At 2:45pm AEDT, the index was trading down 165 points, or 2.1 per cent, to 7,694.

From its peak, the stock market is now down 10 per cent.

The energy sector has been the hardest hit, but banks and miners are also under intense selling pressure.

The fear in global financial markets centres around the Trump administration’s tariffs, and whether or not they are set in stone or a negotiation tactic.

In addition, there’s uncertainty around how countries like China may respond, and whether there will be an escalation in the trade war.

There is now a material risk, economists say, the world’s biggest economy is headed toward a recession.

“The risk of recession has gone up again,” AMP’s head of investment strategy Shane Oliver said.

“The good news is that we may be getting close to the top on US tariffs, which may help settle markets down.

“The bad news is that the US may still do more with sectoral tariffs, much depends on retaliation from other countries and how the US in turn responds to a trade war and the risk to the global growth outlook has increased substantially so weaker economic data and profits lie ahead.

“The risk of a US recession was already rising with US households having run down their pandemic savings buffers and thanks to a further blow from the latest tariffs — which amount to a roughly $US600bn or 2% of GDP tax hike which is the biggest tax hike since 1968 — to confidence and supply chain disruptions is probably now around 45%.

“A rough estimate is that the hit to US growth will be at least 1%, with a similar amount added to US inflation.

“For Australia, the 10% US tariff on our exports is bad news for the industries affected and there is likely more to come for pharmaceuticals (worth $2bn a year).

“Given the even bigger threat to global growth flowing from Trump’s latest round of tariffs it looks like share markets will have a further leg down,” Dr Oliver warned.

All eyes now on the US futures market.

AustralianSuper says funds secure even if you see $0

AustralianSuper has issued a statement, addressing concerns from members unable to login or seeing their account balance as zero:

“We are experiencing a high volume of traffic to our call centre, member online accounts and mobile app that is causing intermittent outages.

“Even though you may not be able to see your account, or you are seeing a $0 balance, your account is secure.

“This is a temporary situation and we’re working hard to resolve it as quickly as possible.

“We apologise for any inconvenience.”

Super account access issues across numerous funds

We’re hearing from readers, not just from AustralianSuper, experiencing issues logging in or seeing $0 account balances.

TW: Hostplus member: I can’t access my account. Being served with the ‘down for scheduled maintenance’ message. That is some quick scheduling!

Josh: Can’t login to CBUS Super account either.

Emma: I’m with Australian Retirement Trust. The website and app have gone down, but I logged in earlier today and my balance was unaffected.

Joe: My balance with AustralianSuper is showing $0. I am nearing retirement. What has happened to my balance? Im angry 😠

Websites and apps are clearly being flooded with login attempts as members try to check their funds.

Business reporter Emilia Terzon is putting questions to the funds and we’re updating this story:

Markets in 60 seconds

Friend of the blog David Taylor has this handy summary of what exactly is happening on markets right now:

DT told us this was markets in 60 seconds, but I’m counting 67 seconds — will take it up with him offline.

Statement from National Cyber Security Coordinator

The Department of Home Affairs has issued a statement from the National Cyber Security Coordinator, Lieutenant General Michelle McGuinness CSC about the cyber attacks against several Australian superannuation funds:

“I am aware cyber criminals are targeting individual account holders of a number of superannuation funds.

“I am coordinating engagement across the Australian government, including with the financial system regulators, and with industry stakeholders to provide cyber security advice.

“If you have been impacted or are concerned you may have been impacted, follow the advice provided by your super fund.”

ASX down 1.8%, All Ords off 1.9%

The local share market is moving back towards its session lows as we move into the afternoon.

At the moment the ASX 200 is down 1.8 per cent.

To give you an idea of why, if we look at the 20 biggest stocks, just four are higher (Woolworths, Coles, Transurban and CSL).

Energy stocks, including Santos (-8.3%) and Woodside (-8.2%) have been hit heavily by the steep drop in crude oil prices overnight.

Financials are also down sharply, including Macquarie (-6%), ANZ (-2%) and Westpac (-1.8%).

The major miners including BHP (-0.8%) and Fortescue (-0.6%) are faring slightly better than the index overall.

Other than consumer stocks, gold miners remain some of the few bright spots, including Capricorn Metals, Gold Road Resources, De Grey Mining and Northern Star.

Here’s how the sectors are faring on the benchmark index:

AustralianSuper members say they can’t access accounts

Some of our readers have reported difficulties accessing their AustralianSuper accounts, although other members have told ABC News they are now regaining access.

Here are just some of the messages we’ve received:

Tess: I have been trying & failing to log into the Aus Super app since the cyber attack news landed. All well and good for them to “urge” millions of users to check our balances, are their networks ready for everyone to try and do this at once? Perhaps not

Ria: I’ve been trying to log in to my AS account since this notification through but it won’t let me in

Daniel: AustraliaSuper’s app and website are running at snail pace.

Caroline: There’s no way to check Aus Super balances as their app has crashed. Frustrating that we remain anxious about our retirement savings

Stefan: Seems like the AustralianSuper app is down because everyone’s checking! I’ve still got another 50 years to till I retire but it’s still a worry to lose a chunk of your savings.